Two months into his chaotic reign, the early indications are that those concerns were justified.

Move fast and break things

Last Sunday, Twitter announced new rules under which it would suspend accounts that posted links to other social media platforms such as Facebook and Instagram with the main purpose of promoting content on these platforms. It also said tweets promoting accounts on those platforms could be removed if users urged their Twitter followers to join them there.

The move sparked an instant backlash from Twitter users, some of whom pointed out that the new rules were illegal under US antitrust law and the European Union’s Digital Markets Act.

Twitter quickly deleted the tweets and the web page announcing the new policy and Musk tweeted hours later, “Going forward, there will be a vote for major policy changes. My apologies. Won’t happen again.”

He then tweeted a poll asking Twitter users if he should step down as head of the company, adding, “I will abide by the results of this poll.”

Sure enough, almost 60% of the 17 million Twitter users who participated in the poll voted ‘yes’.

It’s hard to imagine Musk expecting anything but this result when he tweeted the poll.

When asked afterwards whether he would in fact step down, he replied, “I will resign as CEO as soon as I find someone foolish enough to take the job! After that, I will just run the software & servers teams.”

This seat-of-the-pants management style has come to typify Musk’s approach to running Twitter and has raised concerns about his other ventures.

Turmoil at Tesla

On Wednesday, news website Electrek reported, citing a source, that there will be another wave of layoffs at Tesla in the next quarter and that the electric vehicle maker will also freeze hiring. Musk had said in June the company would reduce its salaried workforce by roughly 10% over the next three months.

In October, the company said it would miss its 2022 delivery targets because of slowing growth and supply-chain disruptions.

And as of this week, Tesla is offering a rare year-end discount of $7,500 to US customers on the Model 3 and Model Y as it looks to stoke demand. These, incidentally, are its least expensive models and comprise the bulk of orders.

Tesla analysts have also cut their price targets on the stock, worried that weakness in demand from China will weigh on deliveries next year.

The company’s shares have already been battered in 2022, down 60% and on course for their worst year ever. Since they make up the lion’s share of their CEO’s net worth, Musk is no longer the world’s richest person as of this week.

There are more than enough reasons for Musk to return his focus to Tesla and the growing concerns of its shareholders, and his latest Twitter poll suggests he agrees. The only question is, how quickly can he find someone foolish enough to be the next Chief Twit?

Written by Zaheer Merchant in Mumbai

Top stories by our reporters

Flipkart-PhonePe Separation

PhonePe separates from Flipkart: Ecommerce major Flipkart, which acquired online payments platform PhonePe in 2016, has officially separated its business operations from the company. The hive-off also completes a move begun earlier this year to make PhonePe a fully India-domiciled company. US-based retailer Walmart which had acquired a 77% stake in Flipkart in 2018, will remain the majority shareholder in both entities.

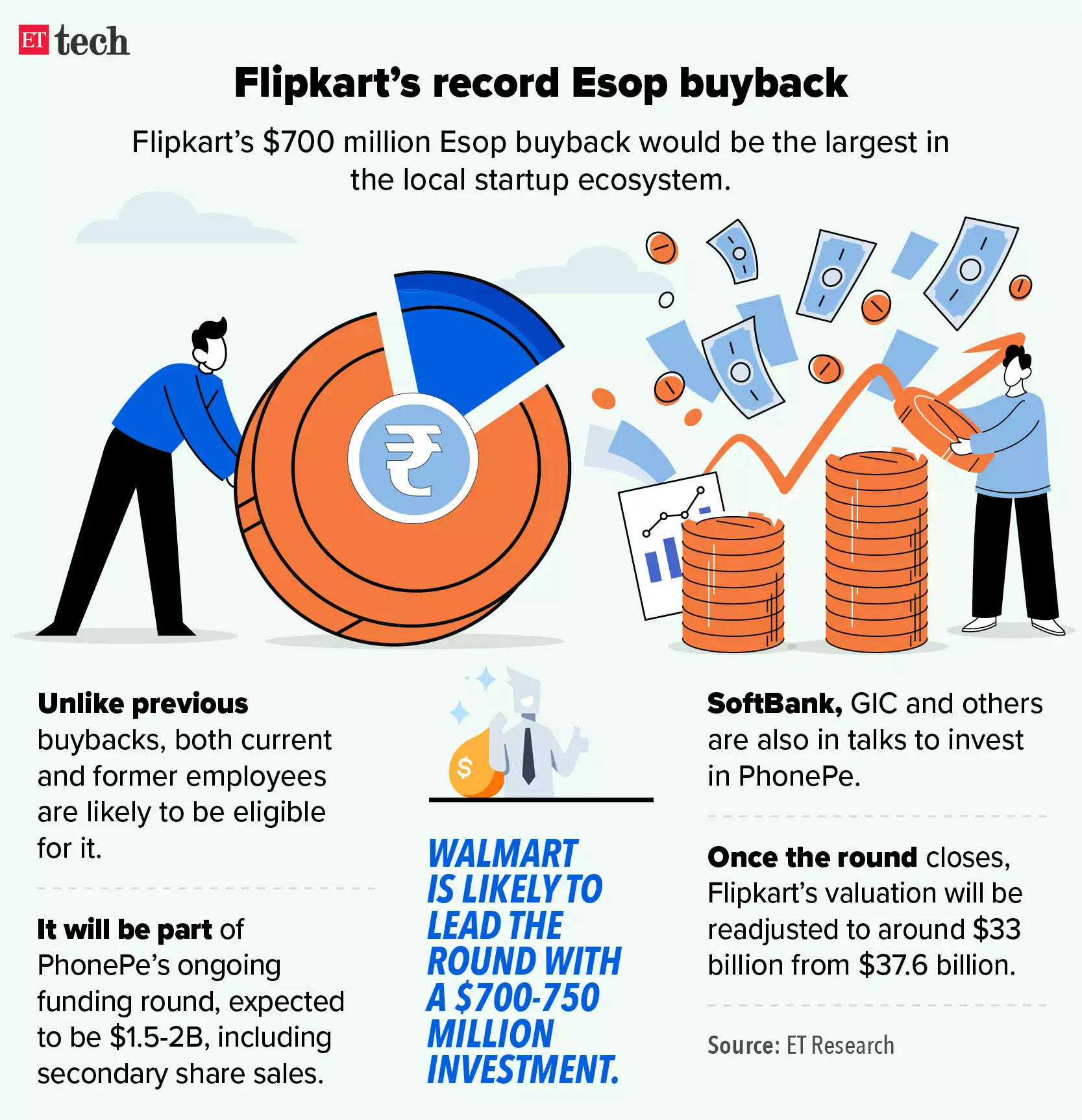

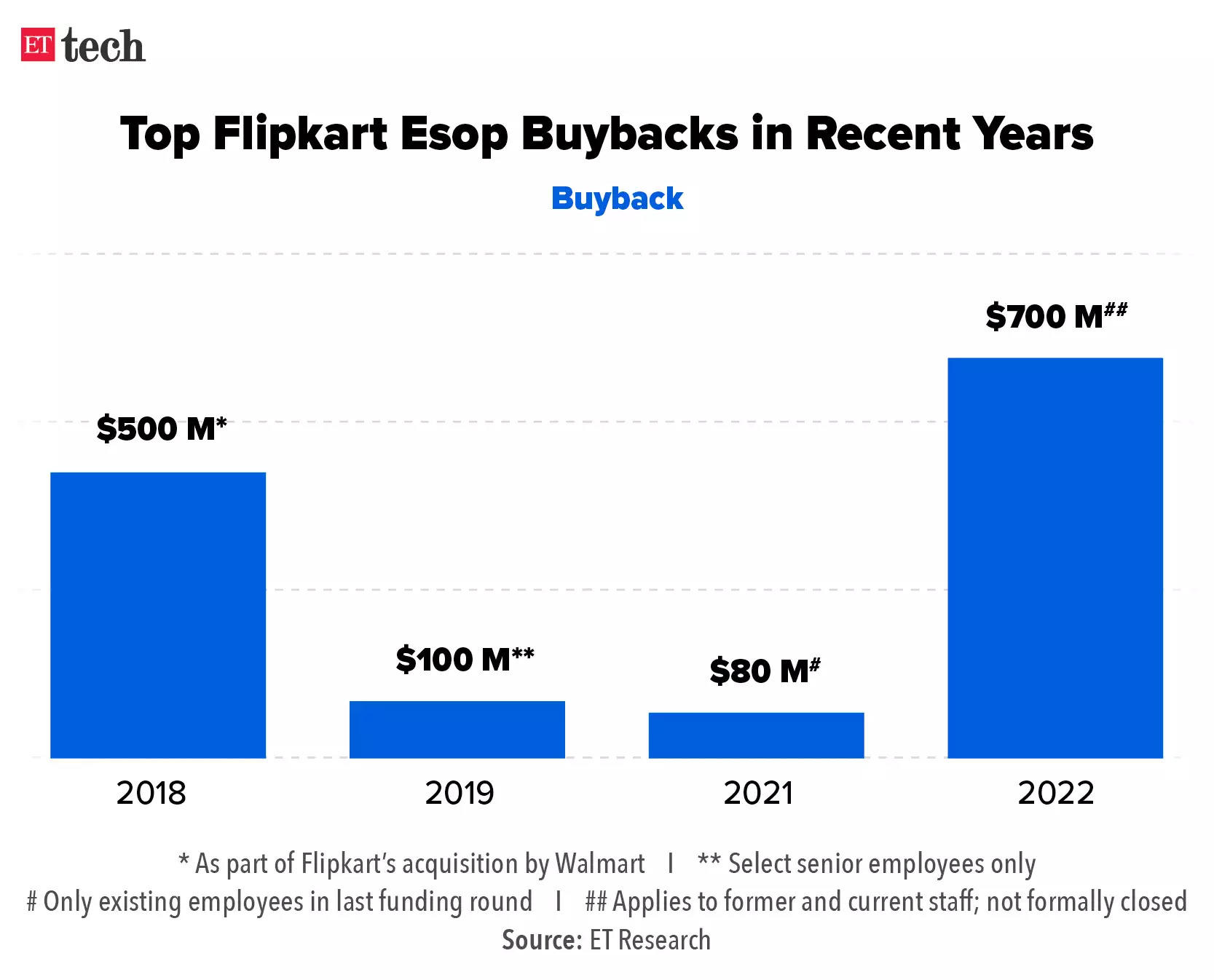

Nearly $700 million cash payout in store for Flipkart employees: After the PhonePe hive-off, Flipkart Group CEO Kalyan Krishnamurthy sent an email to his employees informing them about a one-off payout as a part of the transaction.

“This payout represents the value of the PhonePe holding within those Flipkart options…. [It] will present an event for wealth creation for our employees,” Krishnamurthy wrote. ET had first reported that Flipkart was planning an Employee stock ownership plan (ESOP) buyback of $700 million in what would be the largest share buyback in the Indian startup ecosystem.

M&As, deals & fundraising

BigBasket raises $200 million from Tata Digital, others: BigBasket raised $200 million in new funding that has boosted the valuation of the Tata Digital-owned e-grocer to $3.2 billion, a top executive told us. In addition to Tata Digital, which owns 64% in the Bengaluru-based company, other investors in the firm have also participated in the funding round.

Mensa Brands acquires MensXP and iDiva: Ecommerce brand aggregator Mensa Brands, in partnership with India Lifestyle Network, acquired online lifestyle publications MensXP, iDiva, and influencer marketing management firm Hypp from Times Internet. Post the deal, all three platforms will continue to operate as independent brands and destinations in their respective segments.

Tatas pump Rs 1,600 crore into Tata Cliq: The Tata Group has infused Rs 1600 crore into its omni-commerce entity Tata UniStore, which owns and operates the Tata Cliq platform, as per the regulatory filings. With this, the group has pumped over Rs 5,000 crore into the e-commerce business this fiscal.

Tech policy updates

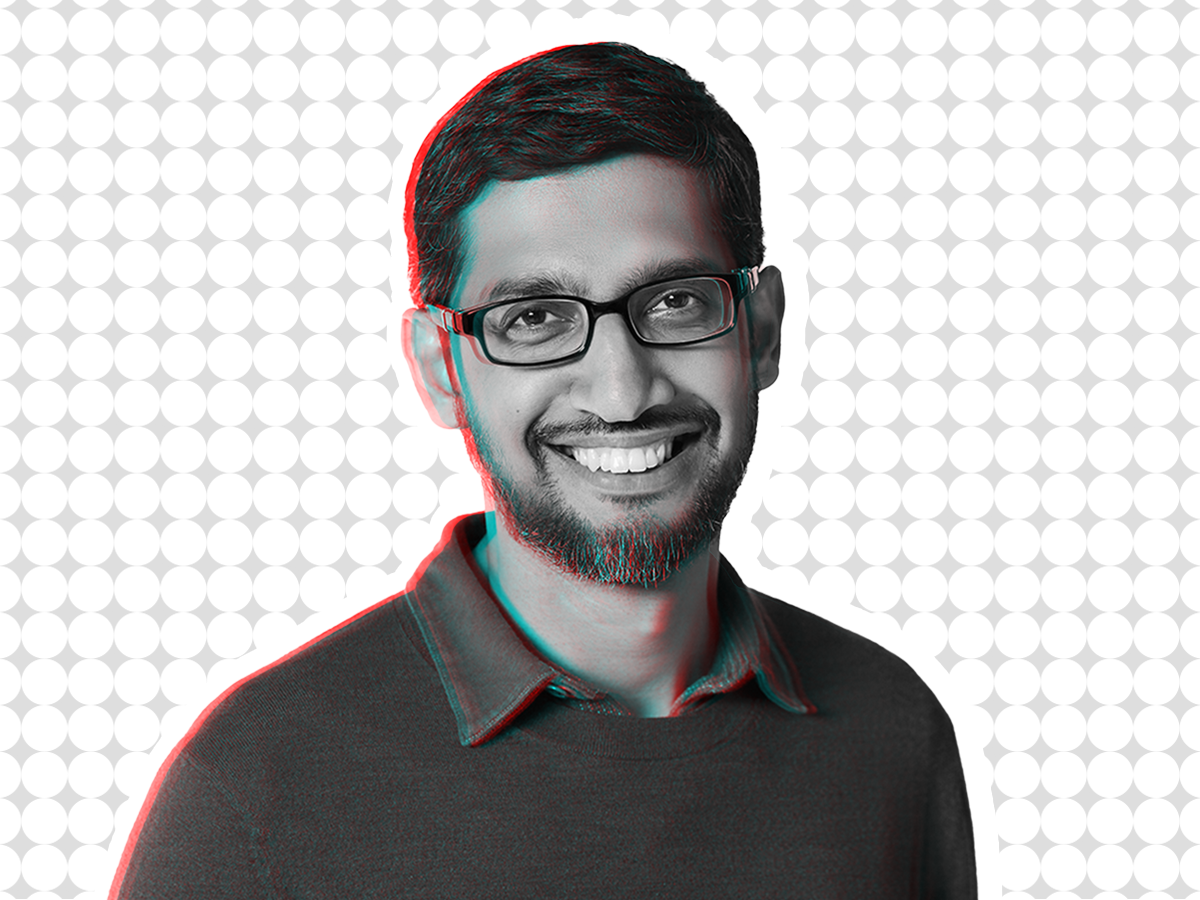

Google appeals CCI verdict on Android in NCLAT: Google appealed Competition Commission of India’s (CCI) order regarding unfair business practices in the Android mobile device ecosystem in the National Company Law Appellate Tribunal (NCLAT). The appeal comes days after CEO Sundar Pichai, who was in India for the Google For India event earlier this week, spoke of the need for ‘responsible regulation’ and said India could take the lead in this sphere.

House panel finds Big Tech’s ad business a ‘monopolistic threat’: A parliamentary panel called Big Tech’s ad business “a monopolist threat” and asked the government to act early and head off anti-competitive behaviour in digital markets. Pointing out that leaders tend to emerge quickly in digital markets, the standing committee on finance said, “Competition behaviour needs to be evaluated ex ante before markets end up monopolised instead of the ex post evaluation being carried out at present,” proposing a framework for systemically important digital intermediaries (SIDIs).

Karnataka policy targets 10,000 new startups in five years: The Karnataka Cabinet on Thursday approved a new startup policy aimed at adding about 10,000 more startups over the next five years. According to Karnataka’s IT/BT Minister CN Ashwath Narayan, the broad goal is to help the growth of about 25,000 startups over five years with a special focus on multiplying the number of high-growth ones.

IT ministry pushes deadline for public feedback on data bill to Jan 2: Last Saturday, MeitY extended the last date for public consultation on the draft Digital Personal Data Protection Bill (DPDPB), 2022, to January 2, 2023. The ministry said it was extending the timeline “in response to the requests received from several stakeholders”. The draft was first published on November 18.

ETtech interviews

India can be a ‘shining example’, says Pichai: In an exclusive interview, Sundar Pichai, CEO of Alphabet and Google, told us that innovations such as UPI, Aadhaar and India Stack combined with responsible regulation can make India a “shining example” to the world. He also expressed concerns about the Indian competition watchdog’s twin rulings against Google in October, saying they could set back user privacy and security.

Google’s Sanjay Gupta on India growth, revenue & more: Google’s India advertisement revenue is likely to continue to see strong growth, country head Sanjay Gupta told us. “I think India will explode in terms of revenues because the ad-to-GDP (gross domestic product) ratio in India is still very low. It’s 0.4%,” Gupta added.

TCS’ Rajesh Gopinathan’s outlook for 2023: Tata Consultancy Services (TCS) is on its path to double its revenues to $50 billion by 2030, its CEO & MD Rajesh Gopinathan said. The company, however, foresees an impact of a combination of the interest rate tightening by the US Federal Reserve and a volatile geopolitical scenario in 2023.

In an exclusive interview, he said the long-term growth story is, however, intact and 2023 will be a balanced year after two years of very strong growth.

IT corner

IT firms’ clients focus on smaller deals amid cautious environment: Clients of IT services companies are focusing on lower-sized deals because of the cautious macroeconomic environment across major geographies like the US and Europe. The share of large awards above the $100 million (Rs 800 crore) annualised contract value (ACV) range has reached its lowest point in five years, comprising just 10% of deal activity in the July-September quarter, said a report by ISG.

IT firms expect operating margins to jump as attrition falls: The operating margin of Indian IT majors is expected to get better as attrition is registering a significant drop as the demand cycle is expected to moderate and industry wide layoffs have cooled off the “job market”. According to experts, the attrition or number of employees leaving in the last 12 months has come down in the range of 17-18% across the tech industry.

2022 Year in Review

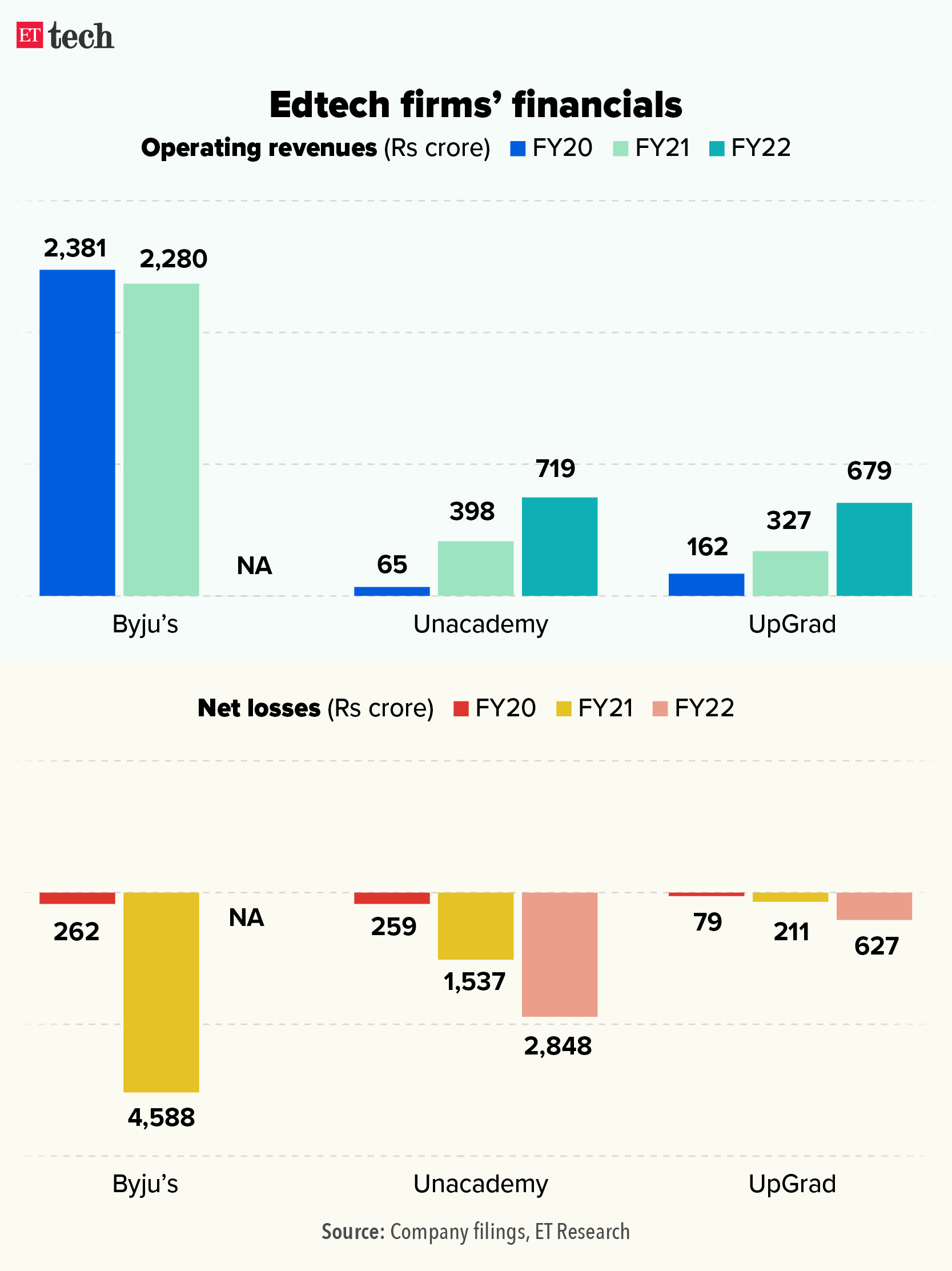

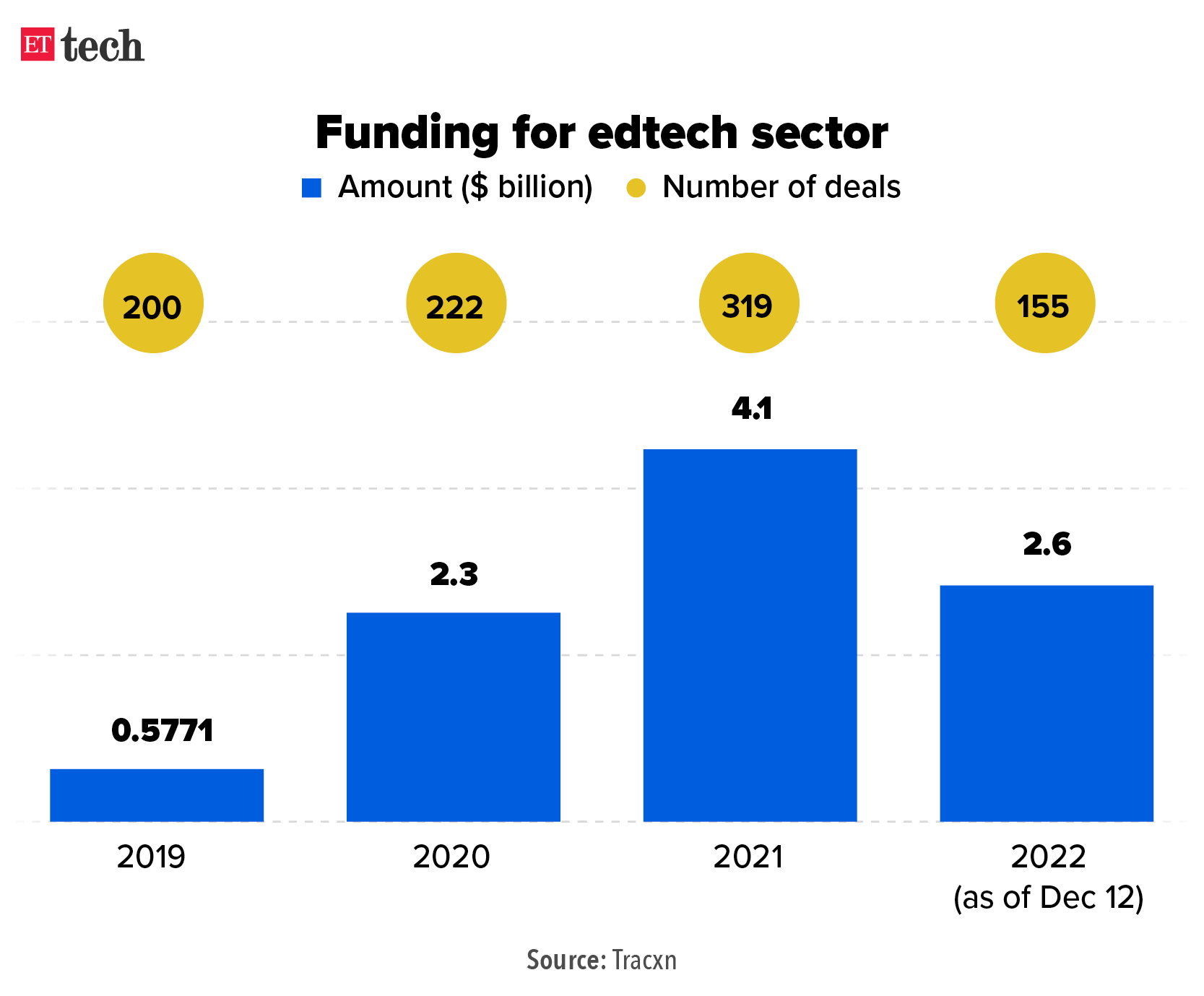

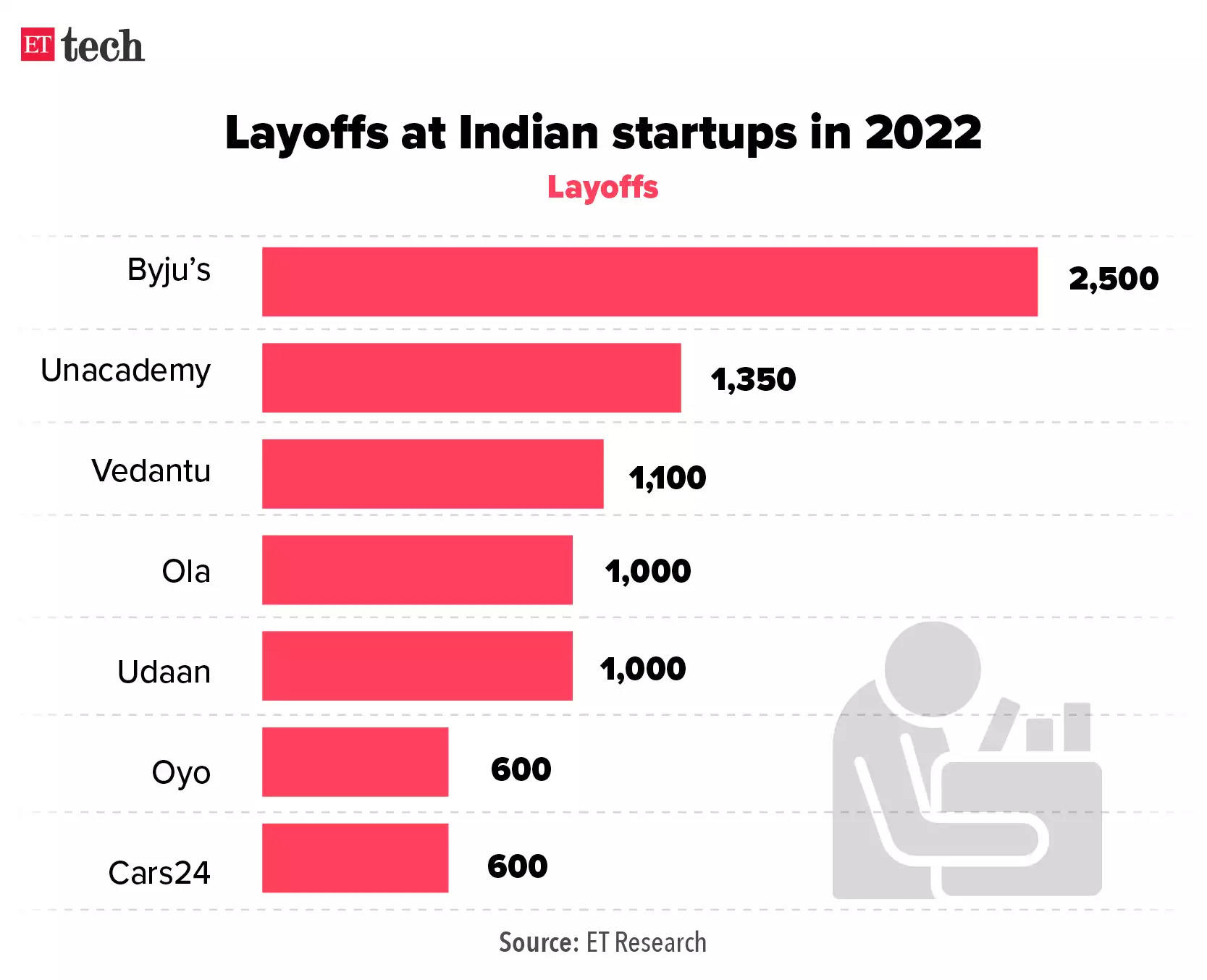

As the pandemic bubble bursts, edtechs go back to class: The pandemic-driven boom has ended and tech funding has dried up. And this has forced edtech ventures to cut costs further and seek sustainable offline models with profit-generating revenue streams, say entrepreneurs and investors.

Edtechs are expected to move away from the K-12 business model in the coming year and focus on priorities such as a bigger offline play, tapping international markets with higher disposable incomes, and digitising the existing school system.

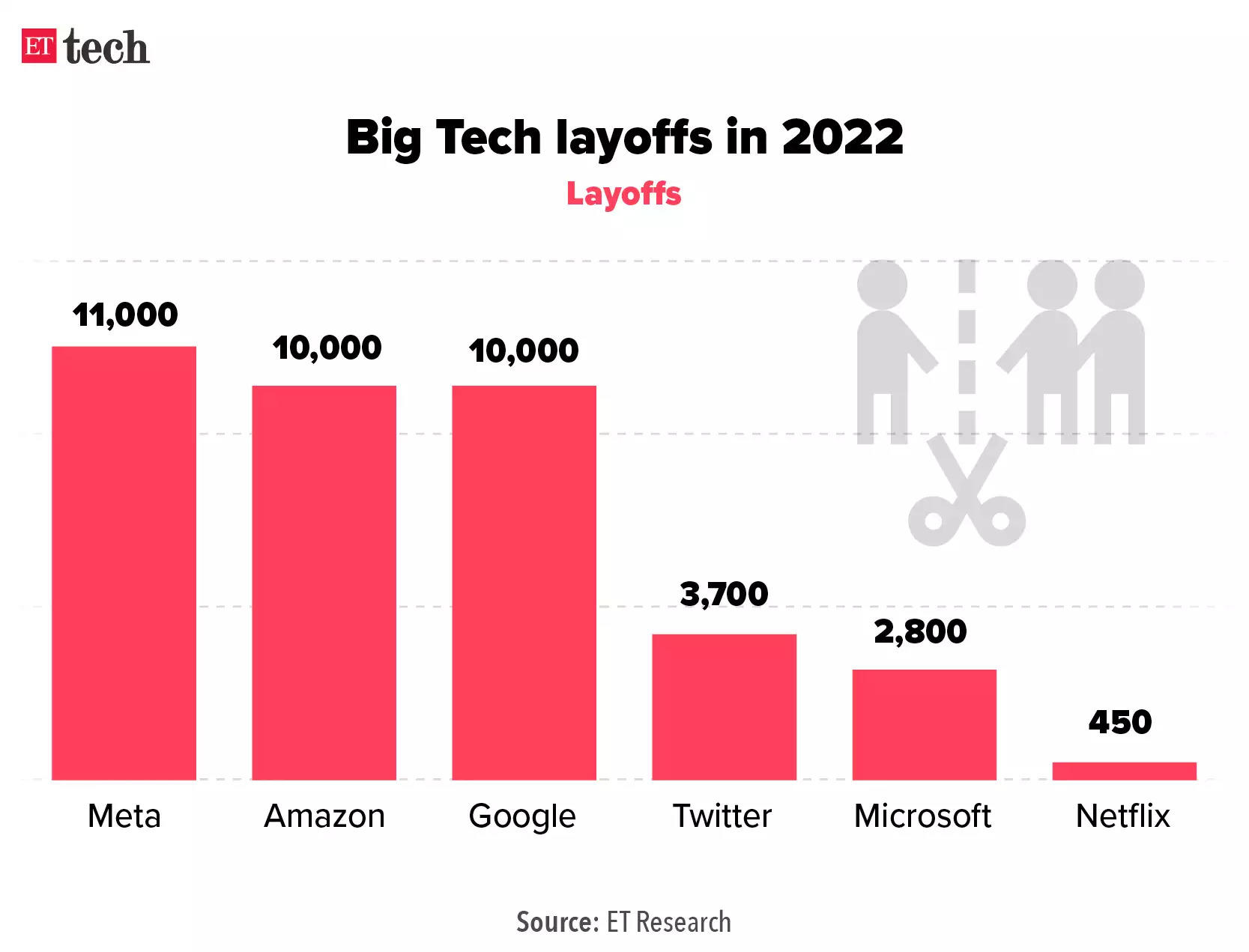

Tech firms embrace layoffs as recession fears build: The geopolitical volatility in Europe, triggered by Russia’s invasion of Ukraine, had drastic effects on the post-pandemic global economy.

After two years of staggering growth during the pandemic, online businesses were caught out when Covid began to fade. Russia’s invasion proved the final straw. Suddenly, tech companies found themselves with far too many employees, and proceeded to conduct layoffs for the rest of the year.

In other news

Ex-WhatsApp Pay India head looks to join Tata Digital: Vinay Choletti, the former head of WhatsApp Pay in India, who quit Meta within four months of taking over the role, is in advanced stages of talks to join Tata Digital in its payments business, multiple sources aware of the discussions said. Cholleti spent a little over a year at WhatsApp, where he was head of merchant payments before being elevated to head of WhatsApp Pay.

Next financial crisis will come from crypto, says RBI governor: According to Reserve Bank of India (RBI) Governor Shaktikanta Das, the next financial crisis will occur due to private cryptocurrencies. He said that he still holds the view that cryptocurrencies should be prohibited as they have no underlying value and pose risks for macroeconomic and financial stability.