In today’s dynamic financial landscape, securing a loan is a crucial step towards realizing one’s aspirations. However, a common question that plagues many individuals is whether having a good salary is sufficient to qualify for a loan when their CIBIL score is less than ideal.

This conundrum between a strong income and a weak credit history poses a challenge for many. We delve into this complex issue to uncover the intricacies of loan eligibility and how you can improve your CIBIL score to enhance your chances of obtaining financial assistance.

The Good Salary vs. CIBIL Score Dilemma

For those with a robust monthly income, the prospect of securing a loan may seem promising. A high salary indicates the capacity to repay the loan, which is a key criterion for lenders. However, even with a good salary, having a low CIBIL score can hinder your loan approval prospects.

The Importance of a Healthy CIBIL Score

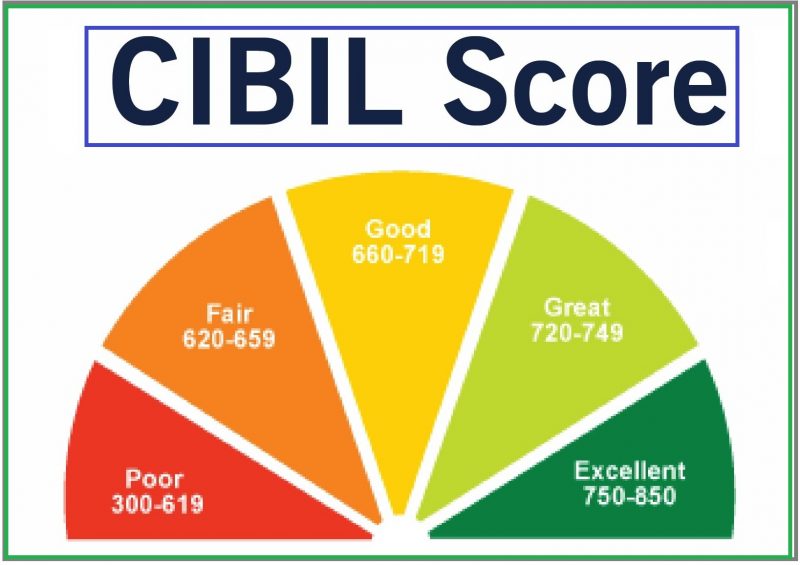

The CIBIL score, or Credit Information Bureau India Limited score, plays a pivotal role in determining your creditworthiness. It reflects your credit history, repayment behavior, and credit utilization patterns. Lenders use this score to assess the risk associated with lending money to an individual.

How to Improve Your CIBIL Score

Improving your CIBIL score is essential to enhance your eligibility for loans. There are several steps you can take to boost your credit score:

- Timely Repayments: Ensure that you pay your bills, EMIs, and credit card dues on time. Late payments negatively impact your credit score.

- Reduce Outstanding Debt: Aim to lower your outstanding debt and credit utilization. High credit card balances can adversely affect your credit score.

- Maintain a Mix of Credit: A diverse credit portfolio, including a mix of secured (like home loans) and unsecured (like credit cards) loans, can positively influence your credit score.

- Monitor Your Credit Report: Regularly review your credit report for errors and discrepancies. Dispute any inaccuracies to maintain an accurate credit profile.

- Use Credit Wisely: Avoid applying for multiple loans or credit cards within a short span, as it can make you appear credit-hungry.

The Role of Fixed Deposits and Credit Cards

Fixed Deposits (FDs) and Credit Cards can be instrumental in improving your CIBIL score. By responsibly managing these financial instruments, you can demonstrate your creditworthiness to potential lenders.

- Fixed Deposits (FDs): By placing a substantial sum in an FD, you can use it as collateral to secure a loan. This minimizes the lender’s risk and increases your chances of loan approval.

- Credit Cards: Responsible use of credit cards, with timely payments and low credit utilization, can positively impact your CIBIL score. It showcases your ability to manage revolving credit.

Securing a Loan with a Low CIBIL Score

If you have a good salary but a low CIBIL score, there are still options available to secure a loan:

- Collateral-based Loans: Lenders may offer secured loans against assets like property or fixed deposits, as these reduce the risk associated with lending.

- Co-signer or Guarantor: You can ask a family member or friend with a strong credit history to co-sign the loan, vouching for your creditworthiness.

- Specialized Lenders: Some financial institutions specialize in offering loans to individuals with low credit scores. While the interest rates may be higher, it can be a viable option.

In conclusion, having a good salary is undoubtedly an advantage when seeking a loan, but a healthy CIBIL score is equally important. By diligently improving your credit score and exploring alternative options, you can navigate the intricate world of loan eligibility and achieve your financial goals. Remember, financial discipline and responsible credit management are the keys to success in the world of loans and credit cards.