Also in this letter:

■ Unacademy lays off around 1,000 employees

■ Sezzle to exit India amid global restructuring of ops

■ Crypto exchanges turn to investors big and small as volumes crash

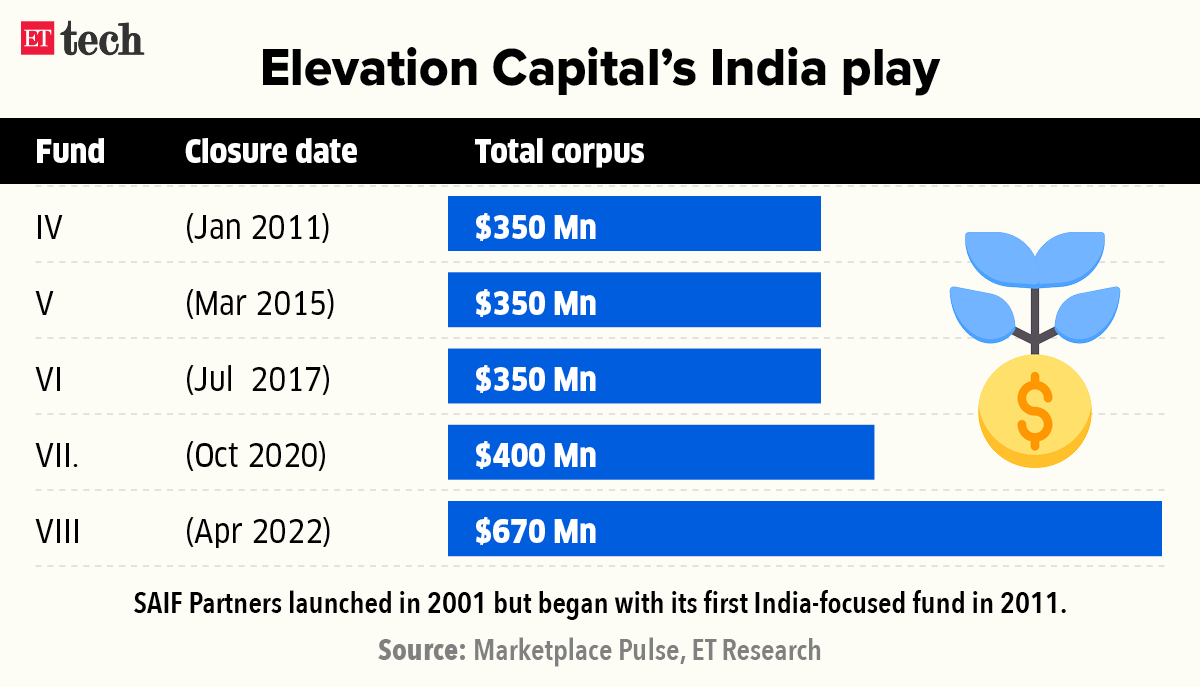

Elevation Capital raises its largest India fund at $670 million

Elevation Capital, the early-stage investor that has backed startups such as Swiggy, Paytm, Urban Company and Meesho, has closed its eighth India-dedicated fund at $670 million, its largest ever corpus.

This comes amid signs of a funding slowdown and overall macro headwinds hurting technology investments and valuations globally.

In October 2020, the firm had raised $400 million as part of its India-focussed Fund VII, which coincided with an unprecedented boom in funding for Indian startups.

But as the pace of funding starts to slow, Elevation said it will look to deploy the fresh capital over a three-year time frame. That’s unlike the previous fund, which was distributed among more than 30 startups last year.

What’s the plan? Elevation, known for having kept its fund at the $300-400 million mark even as peers raised much bigger funds over the last few years, said it was now at an inflection point. It will continue to only invest in India, even as most of the bigger VC funds have diversified into Southeast Asia.

It closed around 30 deals last year and will continue to write cheques of $2 million to $5 million during the early stages with capital commitments going all the way up to $25 million during the lifecycle of a startup.

New focus areas will include software-as-a-service (SaaS), web3 and crypto firms.

Competitors: Last month, Accel, one of the most prominent venture funds in India, announced the close of its seventh fund at $650 million.

Its Silicon Valley counterpart Sequoia Capital is on track to rack up $2.8 billion for its latest India and Southeast Asia fund, according to sources in the know.

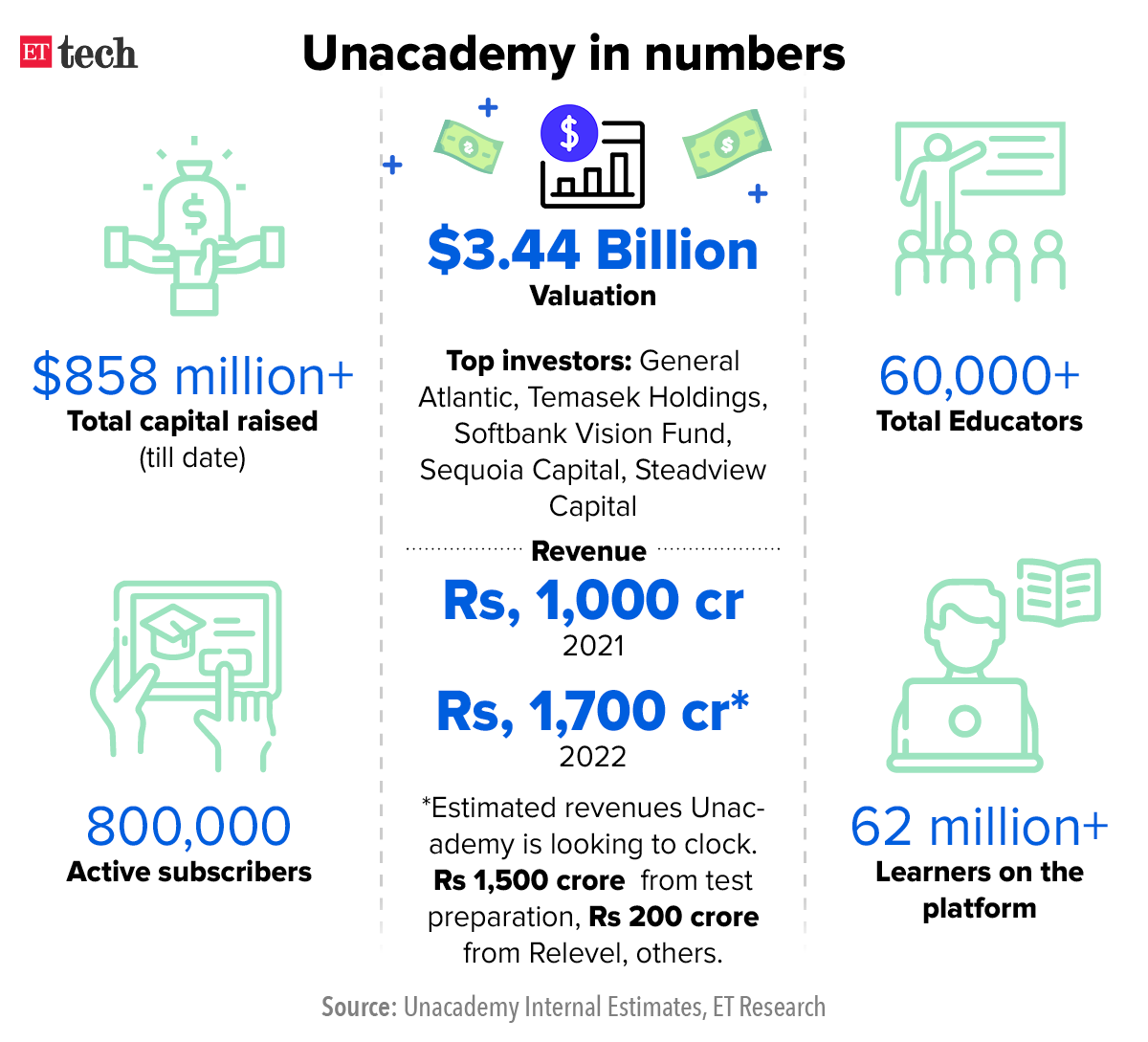

Unacademy lays off around 1,000 employees in huge cost-cutting exercise

Edtech startup Unacademy, which is backed by the likes of SoftBank, has laid off around 1,000 employees in the past few weeks, multiple sources told us. These include its on-roll staff and teachers on contract.

Why? Around 600 were asked to leave last week as the Bengaluru firm looks to cut costs amid an impending slowdown in venture funding and tightening of the economy.

“They are looking to bring down their cash burn from each cost centre and have therefore undertaken this move,” one of the sources said.

Unacademy was valued at $3.4 billion last August, when it raised $440 million led by Singapore’s Temasek.

Details: According to our sources, about 300 of the 1,000 were educators on contracts, while the rest were in sales, business and other functions.

Most were in the content sales and business development teams for Unacademy’s core test preparation product.

Unacademy’s response: “Based on the outcome of several assessments, a small subset of employee, contractor, and educator roles were re-evaluated due to role redundancy and performance, as is common for any organisation of our size and scale. The company has in good faith ensured they receive certain additional benefits and a generous severance,” a company spokesperson said in a statement.

Employees cry foul: Around half a dozen sacked employees we spoke to said that they were kept unaware of the entire exercise and that they had received no feedback about their allegedly poor ratings or performance.

Others said they were sacked before they could complete their roughly two-month probation period.

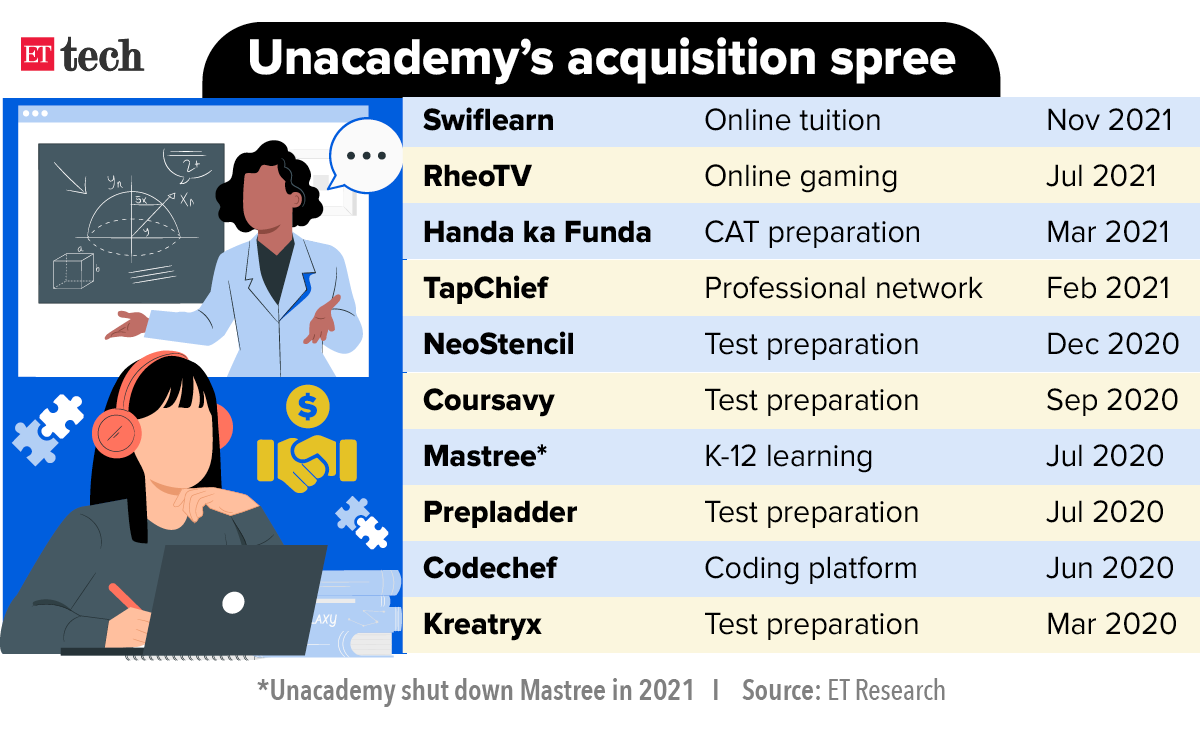

What’s next? Unacademy’s cost-cutting exercise is aimed at increasing the focus on its core businesses. It has therefore decided to shut Mastree, a skills programme for kids, and its kindergarten to grade 12 (K-12) businesses.

Sources briefed on the company plans said it would now largely focus on two products — its core test preparation business and the job-tech vertical of Relevel.

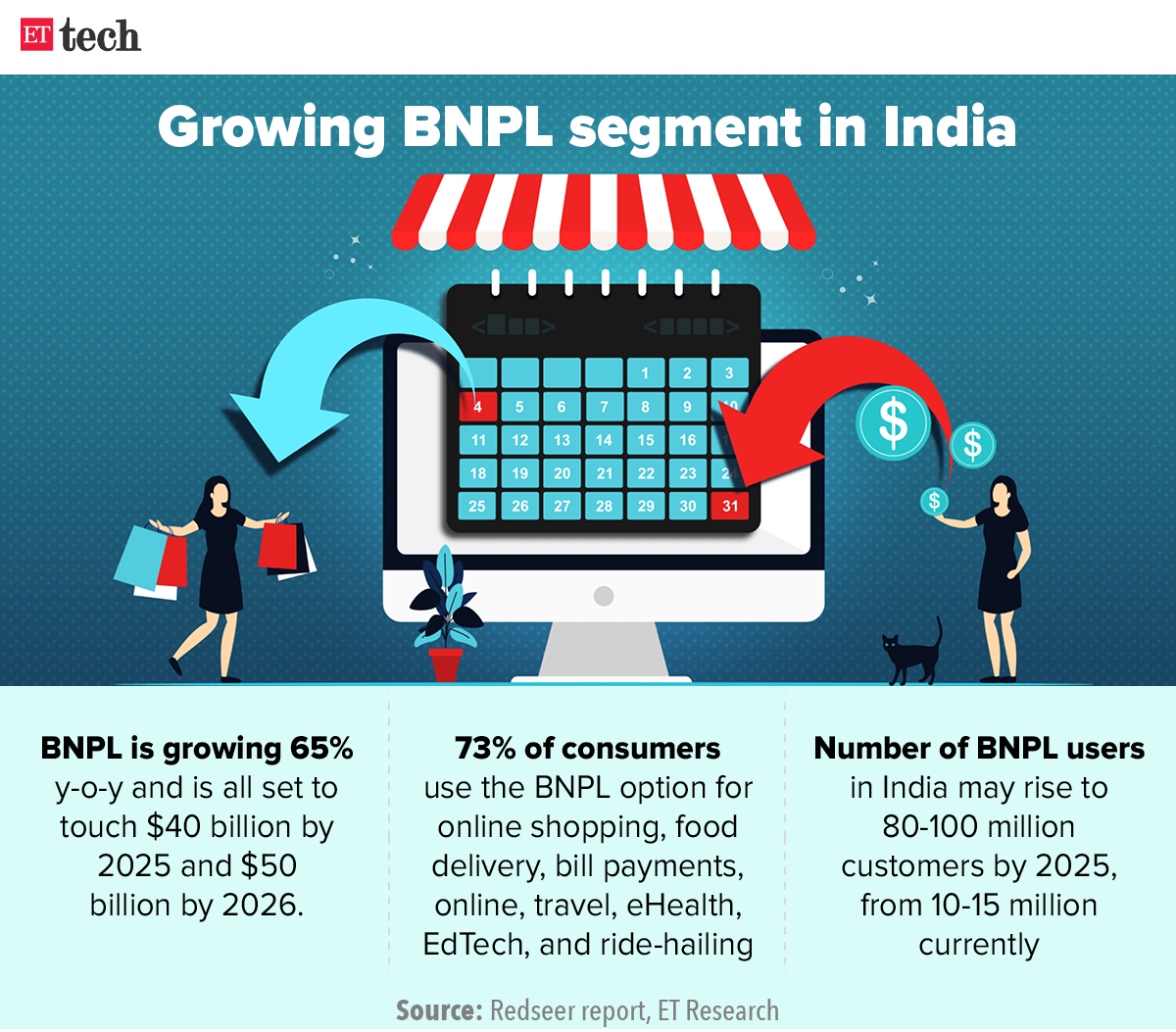

Sezzle to exit India amid global restructuring of ops

US-based buy-now-pay-later (BNPL) firm Sezzle is shutting down its India operations from April 9 as part of a restructuring exercise at its parent company. The fintech firm informed merchants of its decision on Wednesday and asked them to remove the service from their websites at the earliest.

However, Sezzle told clients that it would continue to provide support to shoppers and merchants until May 9.

In February, Australian BNPL firm Zip signed a definitive agreement to acquire Sezzle, valuing it at around $491 million. The deal is expected to close by the end of October. Zip is also an investor in Indian BNPL startup ZestMoney.

The move to shut its local business is surprising as Sezzle had ambitious plans for India. The company’s country head for India, Vandhan Parkavi, had told ET in November that it planned to add more merchants to its platform.

Sezzle’s move follows Singapore-based ecommerce firm Shopee’s abrupt exit from India late last month.

TWEET OF THE DAY

Crypto exchanges look to institutional investors, college students as volumes fall

Crypto exchanges are hoping to rope in everyone from large institutional investors to college students to stem the drastic drop in daily trading volumes after India introduced taxes on virtual digital assets.

Many investors and traders are shunning crypto assets as profits will attract a 30% tax from April 1, with no deductions allowed. Exchanges are grappling with how exactly to compute the 1% tax deducted at source (TDS) on each transaction.

All exchanges in India have seen a drop of at least 50% in the past few days compared to trading volumes last year.

They now hope that institutional investors will be more open to investing in crypto assets as taxing crypto assets gives them some legitimacy.

We reported on Thursday that the order books of cryptocurrency players were under renewed stress and investors were finding it hard to buy or sell such assets as liquidity providers, deterred by tax complications, have decided to stay away.

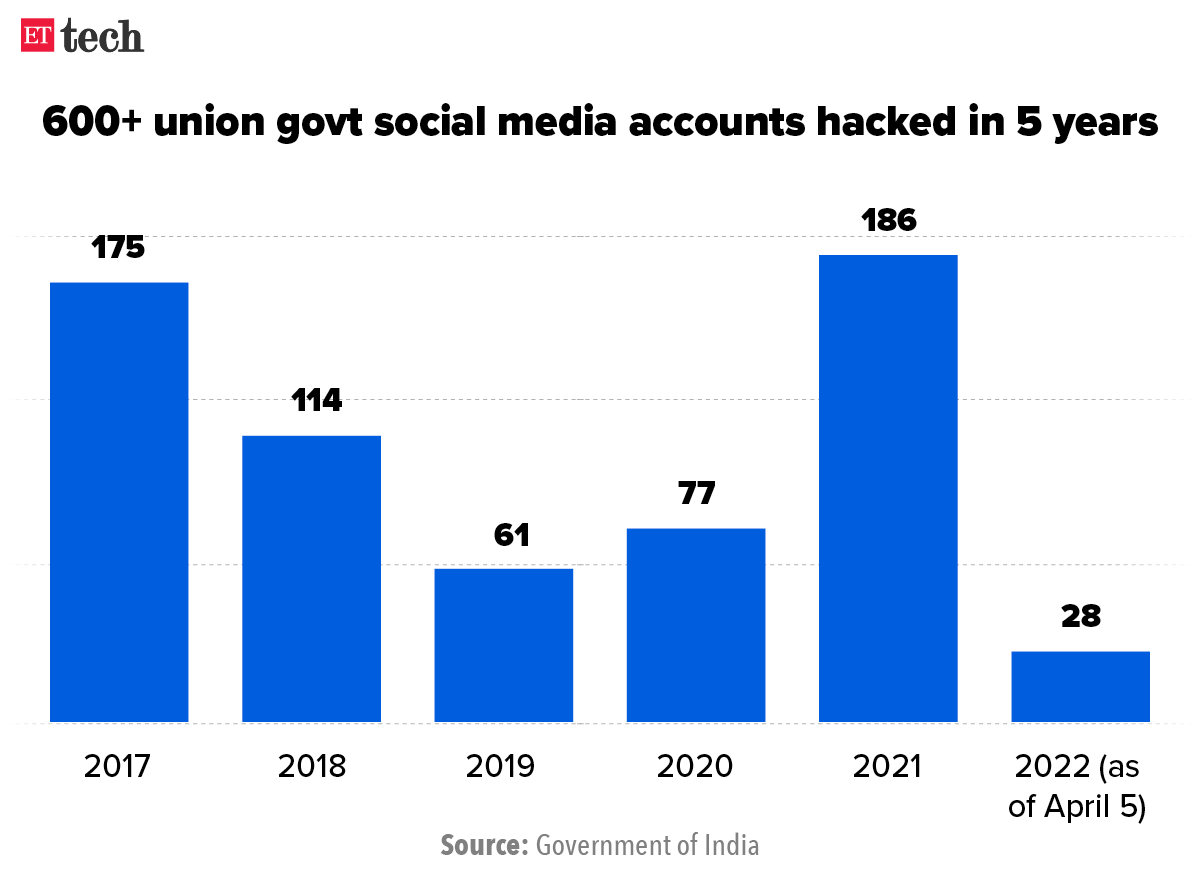

Infographic Insight

BharatPe CEO says Grover “stole money” as saga continues on LinkedIn

It’s been more than a month since Ashneer Grover resigned from BharatPe, but scuffles between the company and its cofounder continue unabated on social media. On April 7, Grover got into another social media spat with BharatPe’s management, this time over alleged non-payment of salaries to some employees.

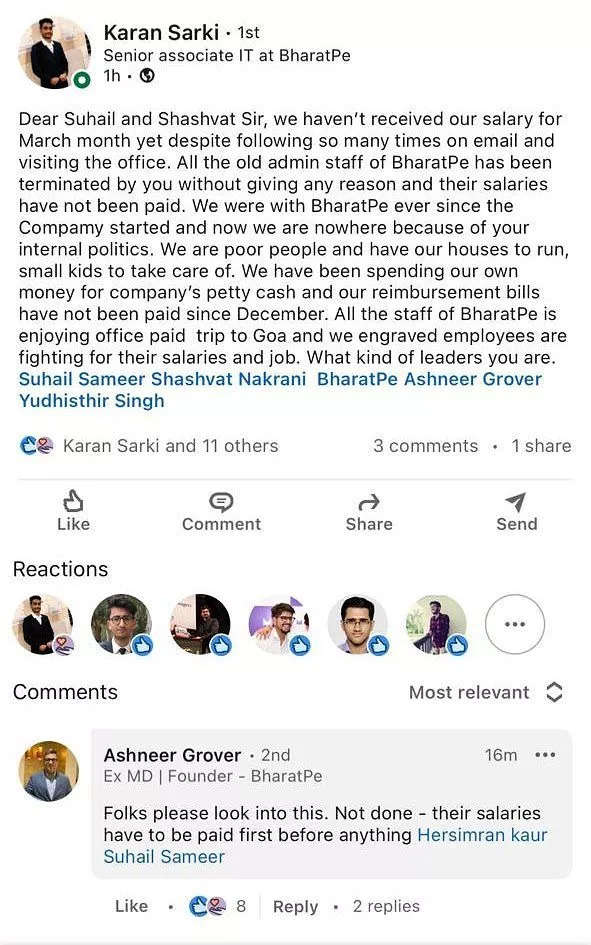

What now? On Wednesday, an IT associate at BharatPe wrote on LinkedIn that he and other staffers had not received their salaries for March.

“We were with BharatPe ever since the company started and now we are nowhere because of your internal politics,” Karan Saraki wrote, tagging BharatPe CEO Suhail Sameer and cofounders Ashneer Grover and Shashvat Nakrani.

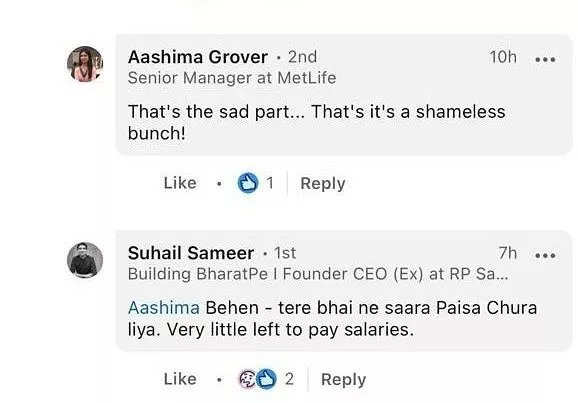

Fuel for a fire: Responding to the post, Grover wrote, “Folks please look into this. Not done — their salaries have to be paid first before anything,” tagging head of financial control at BharatPe Hersimran Kaur and Sameer. His sister Aashima Grover also joined in, describing BharatPe’s top management as a “shameless bunch”.

To this, Sameer responded, “Tere bhai ne saara paisa chura liya (your brother stole all the money). Very little left to pay salaries.” The comment drew an immediate backlash and Sameer later apologised for the message.

“Friends – I apologise to have irked many of you. In hindsight, it was out of line. We are already working on past employees’ full and final [settlements] being paid out. My comment was a reaction to a particular statement, not the post. But I accept the mistake. I request you to also have patience, and refrain from building a story based on false narrative,” he wrote.

Other Top Stories By Our Reporters

Tata Digital unveils super app at last: After several delays, Tata Group finally launched its much-awaited super app Tata Neu for the public on Thursday. We had first reported on March 15 that Tata Neu would be launched on April 7.

Coinbase in India for the long haul, says CEO: Coinbase announced the launch of its crypto trading services in India at an event in Bengaluru on Thursday. Cofounder and CEO Brian Armstrong said he didn’t expect anything to happen in India overnight. He said the company would make long-term investments in the country and was committed to working with bank partners, lawmakers and regulators.

Global Picks We Are Reading

■ Will Elon Musk bring Trump back to Twitter? (The Washington Post)

■ Facial Recognition Goes to War (NYT)

■ Investors are buying virtual land in a metaverse ghost town (Rest of World)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.