Also in this letter:

■ EarlySalary in talks to raise around $100 million from TPG, Norwest

■ Paytm stock sheds 4.66% after IIAS advises against CEO’s reappointment

■ Over 7% of Indians held crypto in 2021, says UN trade body

ED attaches crypto assets held in Vauld’s India entity

The Enforcement Directorate (ED) said on Friday it has attached Rs 370 crore in assets of a Bengaluru-based company linked to the instant loan app case. The assets were parked in bank and payment gateway balances and crypto wallets on Flipvolt, the Indian arm of Singaporean crypto exchange Vauld.

Details: The ED said it had conducted searches at several premises linked to the company, Yellow Tune Technologies Pvt Ltd, over three days starting August 8.

Vauld, suspended all deposits and withdrawals on its platform in June, following the collapse of the terraUSD stablecoin and its sister token Luna. In July, Vauld signed an indicative term sheet to be fully acquired by another Nexo, another crypto lender, pending due diligence.

Shell company? The ED said its probe revealed Yellow Tune was a shell company with Chinese nationals on its board, and that funds to the tune of Rs 370 crore were deposited by 23 entities including accused non-banking financial companies (NBFC) and their fintech arms into Yellow Tune’s Indian rupee wallets.

“By encouraging obscurity and having lax anti-money-laundering norms, [Flipvolt] has actively assisted Yellow Tune in laundering the proceeds of crime worth Rs 370 crore using the crypto route. Therefore, equivalent movable assets to the extent of Rs 367.67 crore lying with Flipvolt in the form of bank and payment gateway balances worth Rs 164.4 crore and crypto assets lying in their pool accounts worth Rs 203.26 crore, are frozen,” the ED said.

Strike two: This is the second time this month the ED has frozen the bank assets of a crypto exchange. Last Friday it said it had recently conducted searches against a director of Zanmai Labs, which owns the popular crypto exchange WazirX, and issued an order to freeze its bank assets totalling Rs 64.67 crore.

The agency is probing at least 10 cryptocurrency exchanges for allegedly laundering more than Rs 1,000 crore identified as proceeds of crime from firms accused in the instant loan apps case, as we reported on Thursday.

EarlySalary in talks to raise around $100 million from TPG, Norwest

Digital lending fintech EarlySalary is in the process of closing a $100 million financing round led by private equity fund TPG and Norwest Venture Partners, several sources told us.

The round is expected to be announced in the next few days and will value EarlySalary at roughly $300 million, said another person.

What it does: Founded in 2015 by Ashish Goyal and Akshay Mehrotra, Pune-based EarlySalary provides instant loans of up to Rs 5 lakh directly to salaried individuals.

It also partners with companies to help employees receive salary advances in their bank accounts for emergencies.

Fintech in flux: EarlySalary’s latest funding comes soon after the Reserve Bank of India (RBI) released its first set of digital lending guidelines. The new rules put the focus back on regulated entities, giving fintechs with an active NBFC (non-banking financial company) licence an advantage over others.

EarlySalary owns an NBFC licence, through which it also co-lends to its customers and partners.

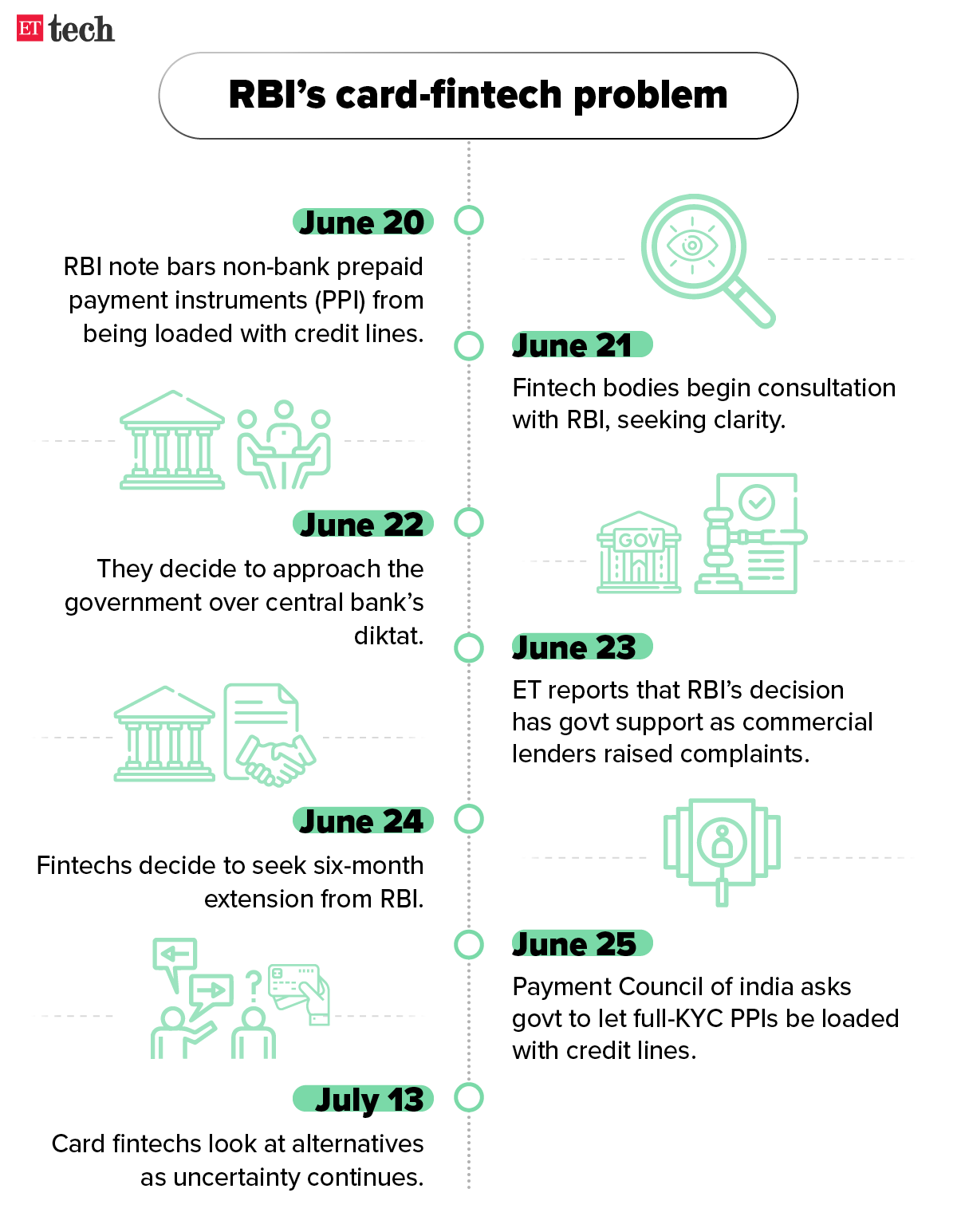

In June, the RBI had sent fintech firms into a tizzy after it banned prepaid payment instruments (PPIs) from being loaded through credit lines, directly affecting the operations of challenger card startups including Slice and Uni.

EarlySalary was also affected, and stopped customers from making any transactions on their prepaid cards. However, sources say that the card product wasn’t a significant part of the company’s loan disbursements.

Paytm stock sheds 4.66% after IIAS advises against CEO’s reappointment

Shares of Paytm parent One 97 Communications closed the day 4.66% down after proxy advisory firm Institutional Investor Advisory Services (IIAS) advised its shareholders to vote against the reappointment of Vijay Shekhar Sharma as its chief executive.

At one point the stock was 6.2% down on the day.

IIAS said Sharma had made several commitments in the past to make the company profitable, but these had not played out.

Statement: “The board must consider professionalising the management,” IIAS said ahead of Paytm’s annual general meeting on August 19. It also advised shareholders to vote against Shekhar’s remuneration, saying it was higher than that of CEOs of companies on the Sensex, most of which are profitable.

Losses: One97 Communications Ltd, backed by China’s Alibaba Group Holding and its affiliate Ant Group, posted a loss of Rs 644 crore for the June quarter last week, but said it was on track to achieve operational profitability by September 2023.

Tweet of the day

ETtech Deals Digest

■ Ronnie Screwvala-led UpGrad picked up $210 million in a funding round at a $2.5 billion valuation. Many prominent investors participated in the round, including existing backers Temasek, IFC and IIFL. The funding comes amidst a challenging period for edtech startups, with many like Byju’s and Unacademy cutting their headcount to navigate the gloomy economic environment.

■ Customer engagement and user retention software platform Clevertap raised $105 million in a Series D funding round led by global investment group CDPQ. IIFL AMC’s tech fund and existing investors Tiger Global and Sequoia India also participated in the round. ET had reported on August 9 that the company was looking to raise $75 million. Clevertap aims to use the fresh funds for expansion and strengthening its team.

■ One-year-old wealth management startup Dezerv raised $21 million in a funding round led by Accel, with existing investors like Whiteboard Capital and Elevation Capital also participating. Founded by Sandeep Jethwani, Sahil Contractor and Vaibhav Porwal, Dezerv offers a tech-driven financial platform for working professionals to manage their money. So far, it has seen close to Rs 800 crore invested through its platform and plans to use the fresh capital to add new investment opportunities.

Here is a list of all startups that raised funds this week.

Over 7% of Indians held crypto in 2021, says UN trade body

The United Nations Trade and Development Body (UNCTAD) has said in a report that over 7% of Indians owned crypto last year as the adoption of these digital assets spiked among developing nations.

According to the report, Ukraine topped the list, with about 12.7% of its population holding crypto, while India ranked seventh.

“Recent digital currency shocks in the market suggest that there are privacy risks to holding crypto, but if the central bank steps in to protect financial stability, then the problem becomes a public one,” it said.

RBI governor Shaktikanta Das termed crypto a “clear danger” to the financial system earlier this year as India seeks to tightly regulate the volatile assets.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.