Also in this letter:

■ PhonePe among top fintechs with $1.3 trillion TPV: Walmart

■ Meta, Google may lock horns over age-gating, consent norms

■ Over 63% of Indian taxpayers stick to old regime, says report

Dunzo survival hinges on Reliance Retail’s commitment to funds

Dunzo CEO Kabeer Biswas, Reliance Industries chairman and MD Mukesh Ambani

Dunzo’s future hangs by a thread as its largest investor Reliance Retail—promoted by Asia’s richest man Mukesh Ambani—is yet to commit to a capital infusion in the cash-strapped startup. What does this mean for Dunzo?

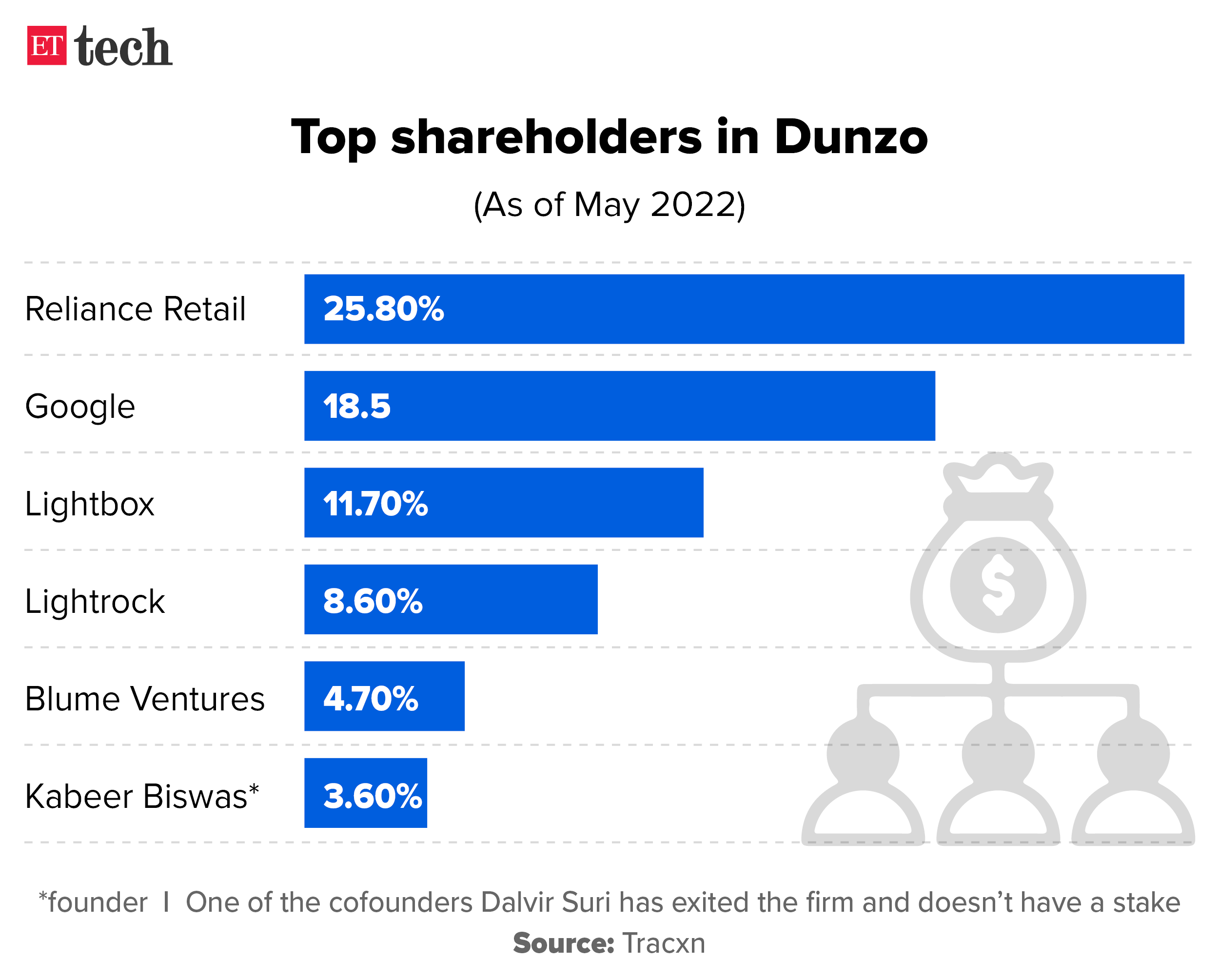

Survival at stake: Reliance Retail is yet to agree to invest in Dunzo’s planned rights issue. An impasse after several rounds of talks between the two has left Dunzo’s other investors increasingly sceptical about its chances of survival in the absence of fresh funding, said multiple people briefed on the situation.

Reliance’s rights: While Dunzo chief executive Kabeer Biswas has been trying to stitch together a fresh round of financing for months, Reliance Retail’s participation and its clearance for the cash infusion will be critical.

Also read | Dunzo’s downfall: from startup star to sinking ship?

Salary delayed, again: Salary delays are an indicator of the severe crisis Dunzo is facing. The company told its remaining staff—after multiple rounds of layoffs this year—that November salaries should be deposited ‘in a few days’ based on ‘assurance’ from investors, even as it tries to close the bigger funding round. It still has bills to clear to former staffers as well as vendors.

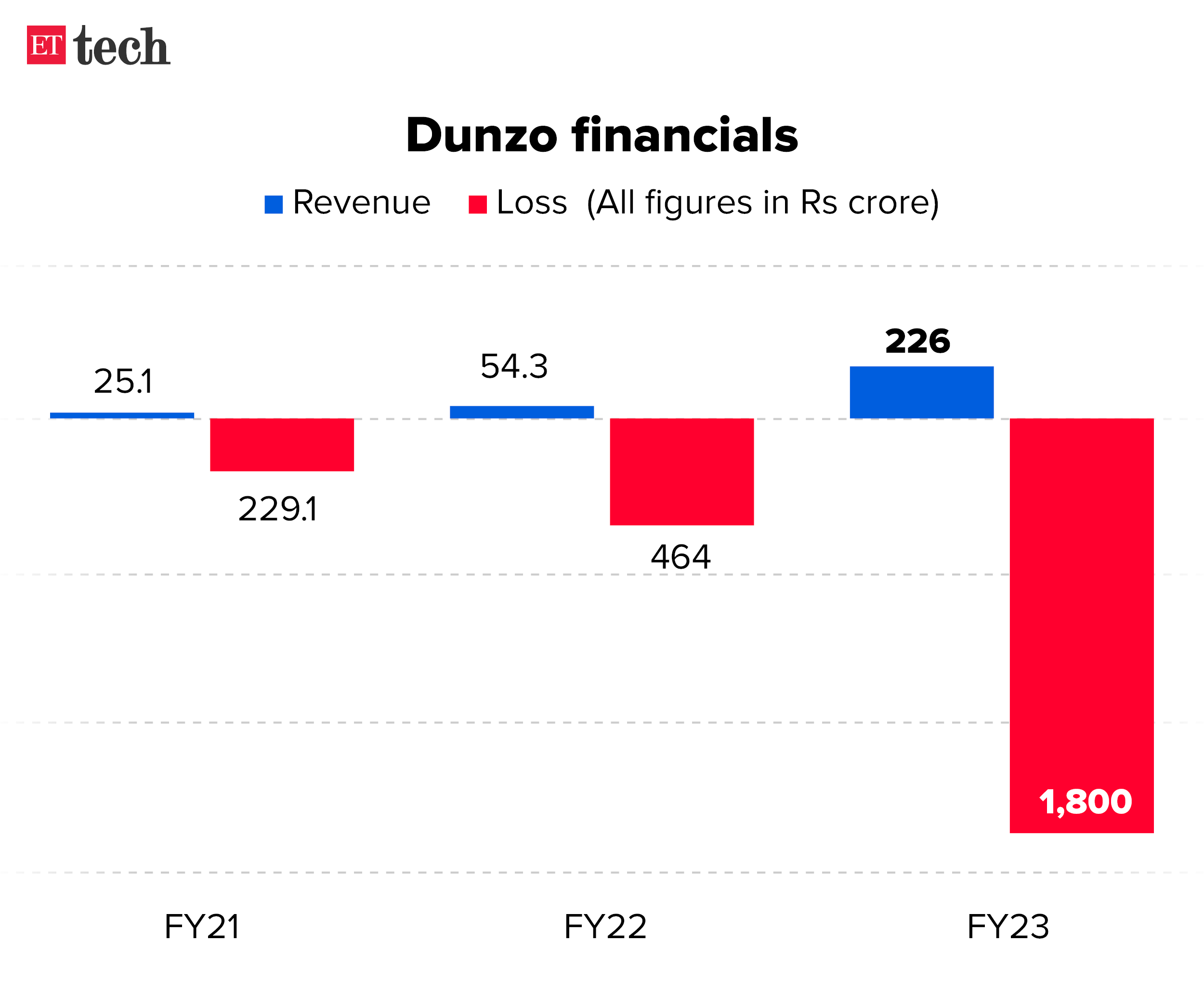

Also read | Dunzo FY23 loss widens to Rs 1,800 crore, revenue jumps 4x to Rs 226 crore

Here are ETtech’s top stories on the Dunzo crisis:

Didn’t want my legacy to be defined by one company: Apoorva Mehta on Instacart exit

.jpg)

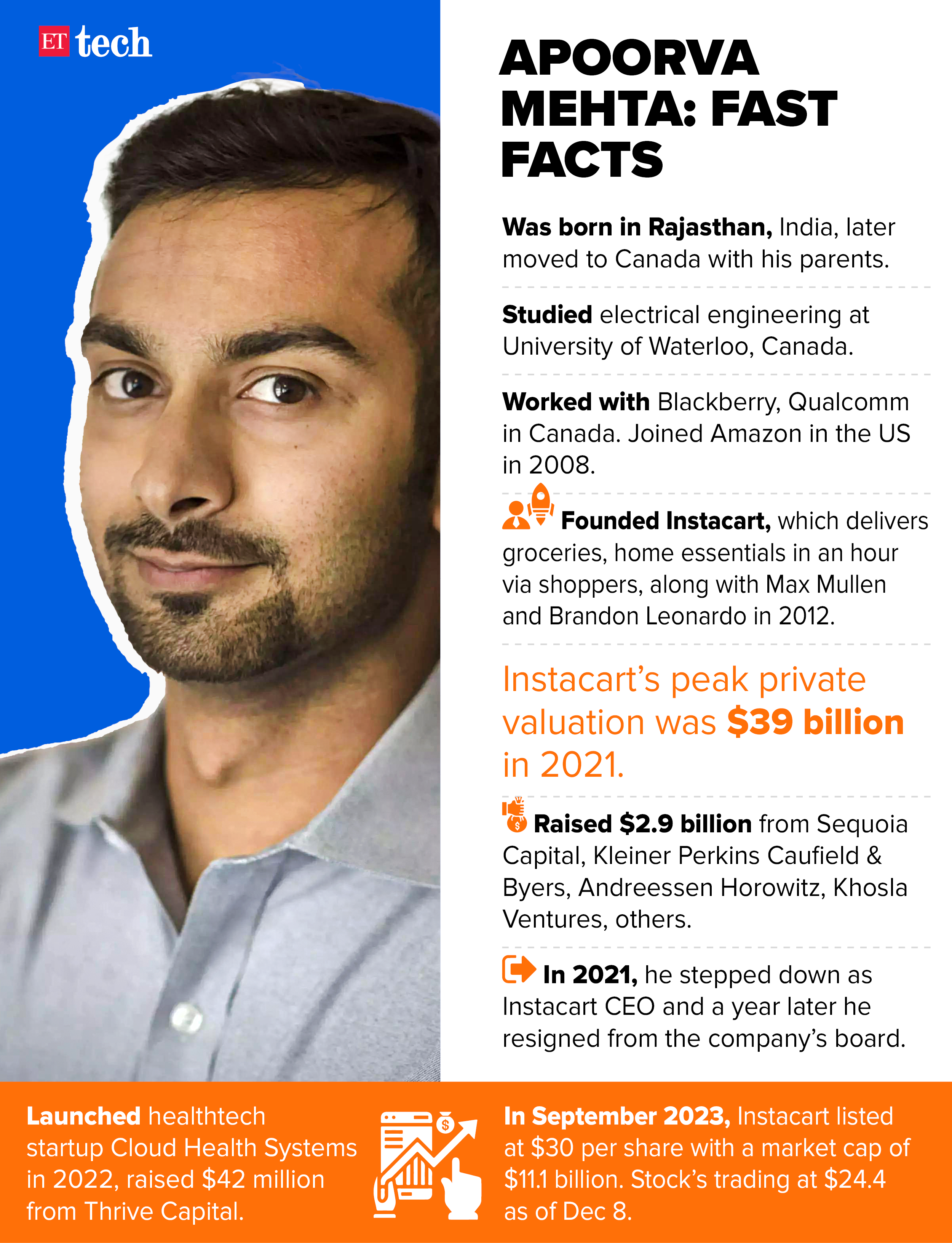

Apoorva Mehta, cofounder of grocery delivery startup, is now focussing on his healthtech startup Cloud Health Systems. He spoke to ETtech’s editor Samidha Sharma in San Francisco about building Instacart, fighting Amazon in the grocery business, and picking healthcare for his latest venture. Edited excerpts.

On IPO timing: Instacart’s financials have been pretty strong for some period of time. When I stepped down as CEO, we had five quarters of positive cash flows while driving growth. The company clocked over $500 million in ad sales and had over $2 billion on the balance sheet. The primary reason to go public was to make sure that employees and early investors receive liquidity. It had always been our intention to be publicly listed at some point. It’s a testament to the financial stability of the company that allows it to go public at a time when there was no window.

Also read | Instacart’s public market debut: top stories on the grocery delivery company’s IPO

On leaving Instacart: I just didn’t want my legacy to be defined by one company. Also, I wanted to focus on my new startup fully. I did what I came to do at Instacart. No one believed that online grocery shopping was going to be possible, scalable and make any money. We invented a completely new model, which resonated not only with customers but also people who picked and delivered the groceries. The whole ecosystem adopted the model that we created.

Also read | Instacart founder Apoorva Mehta exits with $1.1 billion fortune after IPO

Fight with Amazon: People thought that full vertical integration, which was Amazon’s model, where you would have your own warehouses, was the way to go. We thought, not only does that model not scale, it will never make any sense economically. And that was the contrarian idea behind Instacart. It took us many years to prove that was the case. The proof point is showing up in our financials.

On his new venture CloudHealth: I cannot get into too many details as we are still operating in stealth. Our team is about 35 people. What is really interesting to me is that healthcare is an incredibly large market. Grocery was $1 trillion, this is $4.7 trillion, and roughly 5% of the world’s GDP is spent on American healthcare. I wanted to take on something that would impact society in a positive way while creating a very sizeable business.

PhonePe among top fintech companies with $1.3 trillion total payment value: Walmart

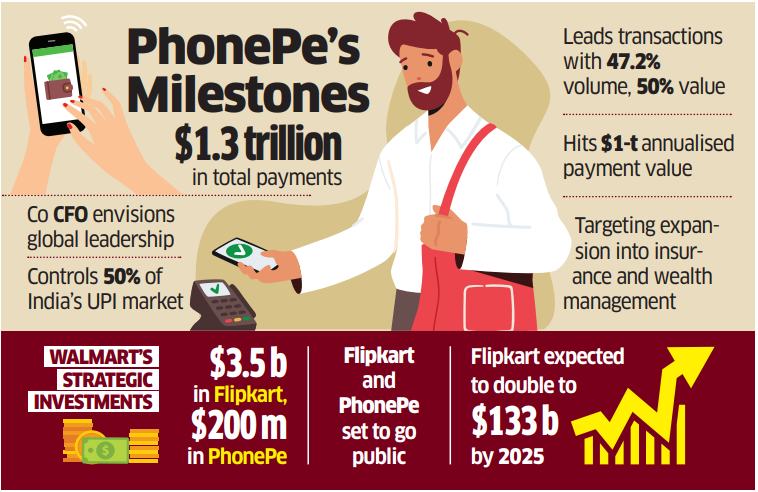

US retail giant Walmart said its digital payments subsidiary PhonePe has achieved a total payment value (TPV) of $1.3 trillion, putting it on par with some of the largest fintech players in the US. This highlights the market capitalisation potential of the Indian firm as it considers an initial public offering (IPO).

Potential to be global leader: PhonePe’s $1.3 trillion TPV is at the same scale as the largest fintech players in the US, having market capitalisations of more than $100 billion in some cases, Walmart’s chief financial officer John David Rainey said at the Morgan Stanley Global Consumer and Retail Conference. “PhonePe could be one of the leading payment companies in the world, certainly outside of China in the near future,” he added.

Also read | PhonePe is set to launch consumer lending by January 2024

Likely to be IPO-ready: Rainey indicated that both Flipkart and PhonePe are on a trajectory for launching IPOs. He expects improvements in profitability as they approach IPOs, emphasising that the individual market capitalisations of Flipkart and PhonePe could be highly attractive.

Also read | PhonePe FY23 revenues rise 77% to Rs 2,914 crore; payments business eyes operating profit

UPI leader in India: PhonePe has a 47.2% share of UPI transactions in volume terms and 50% in value, according to the National Payments Corporation of India (NPCI). In March this year, it hit $1 trillion in annualised total payment value run rate.

Also read | PhonePe separation official; online payments firm to be India-domiciled now

Meta, Google may lock horns over age-gating, consent norms

Tech biggies Google and Meta are headed for a clash in India over the issue of age verification and consent management for internet users below 18 years of age.

Meta’s proposal: Meta is likely to propose that the best solution to implement age-gating and subsequent consent management architecture for the parents of users aged below 18 is an app-store-level check, vice president of global policy Joel Kaplan told ET.

Quote, unquote: “The right place to collect this information is at the app store level. That way, people only have to do it one time and then the app can notify them. We suggested that it is a good approach for the US to look at. In our conversations with policymakers here (in India), we have suggested that as a possibility (also),” Kaplan said during his visit to India earlier this month.

Also read | Age-gating rules apply to all firms under data law

Google’s opposition: Google is opposed to Meta’s plan and believes that while companies will need more than one option to implement age-gating and consent management as prescribed under the Digital Personal Data Protection Act, an app-store-level solution is an “excuse”.

Jargon Buster: Age-gating is the process of restricting access to age-inappropriate content, services or products by online platforms.

Also read | Only kids-focused sites may gain from age-gating tweak in data bill

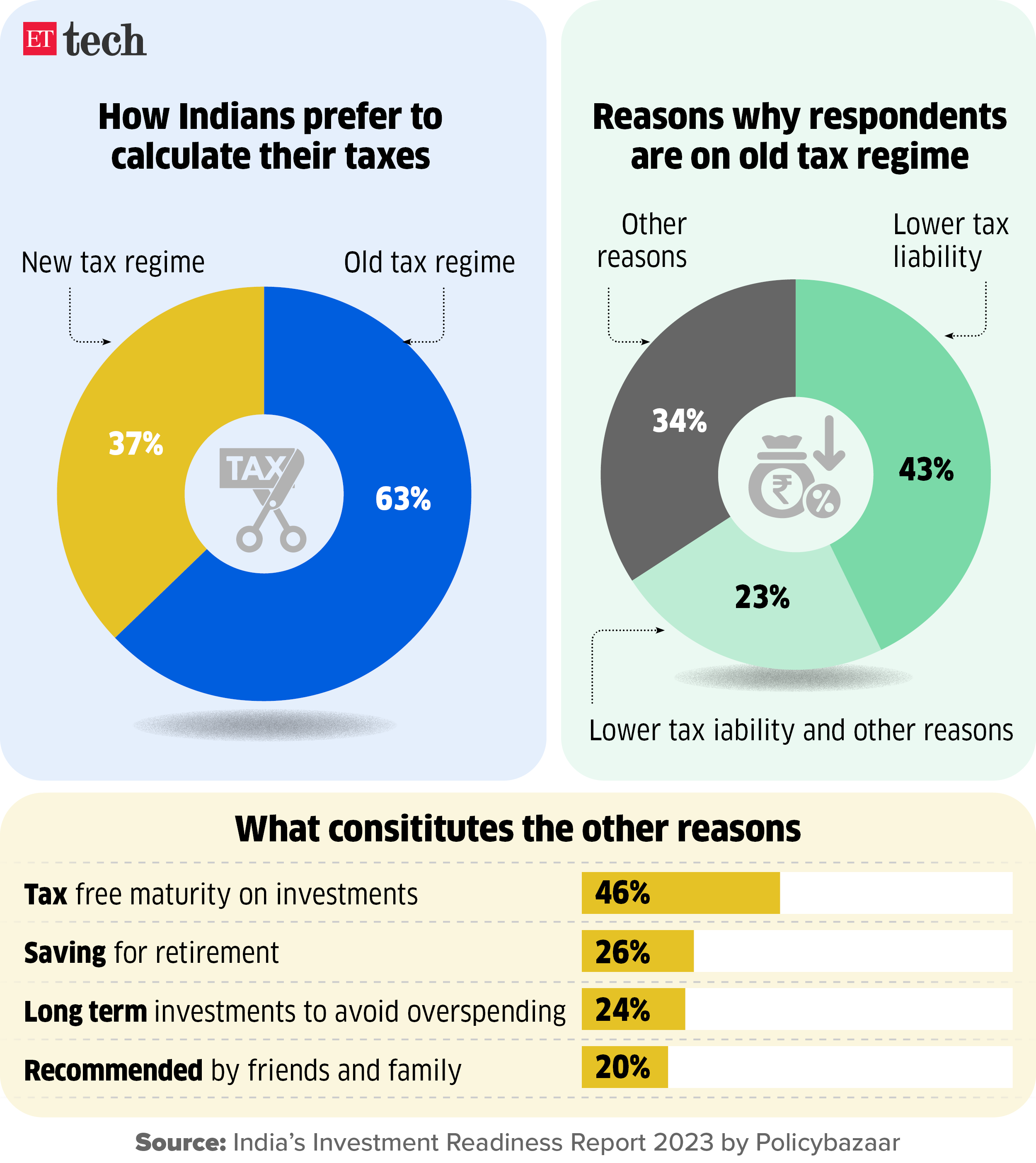

Over 63% of Indian taxpayers stick to old regime, says report

Over 63% of income tax-paying Indians are still in the old tax regime, while the rest have moved to the new one, as per a survey conducted by PB Fintech, the parent company of insurance marketplace Policybazaar.

Hard calculations: The survey, covering 1,263 respondents across 350 cities, found out women were more particular about choosing the tax regime, with 74% of them having picked the tax regime through hard calculations compared to 71% among men.

Details: Also, 67% of the salaried section stuck to the old tax regime while the new tax regime was favoured by 49% of businesspersons, the highest among all categories.

Popular saving instruments: Among those choosing long-term investment plans and sticking to the old regime, provident fund investments continue to be the most popular, followed by life insurance and life insurance instruments.

Other Top Stories By Our Reporters

How sustainability is becoming part of Indian tech firms: Several tech companies with a presence in India are getting increasingly conscious, of not just their top line and bottom lines, but also the green line — their environmental impact. Sustainability is now part of the corporate agenda for these firms. So, apart from their products, the likes of Intel and SAP Labs have also invested in green campuses.

Amazon, Microsoft lead efforts to tackle inherent biases in GenAI: Generative artificial intelligence (AI) chatbots are not free of inherent biases, and several ongoing projects from the likes of Amazon and Microsoft are working towards reducing these biases linked to large language models (LLMs).

Global Picks We Are Reading

■ Google finally gives ChatGPT some competition (The Verge)

■ The EU just passed sweeping new rules to regulate AI (Wired)

■ Mexican politicians are harnessing Swiftie fandom on TikTok (Rest of world)