Also in the letter:

■ Titan may buy Rs 350-crore ESOP from CaratLane staff

■ IT midcaps keep hiring momentum going

■ Prosus shuffles top deck with new heads for edtech, food

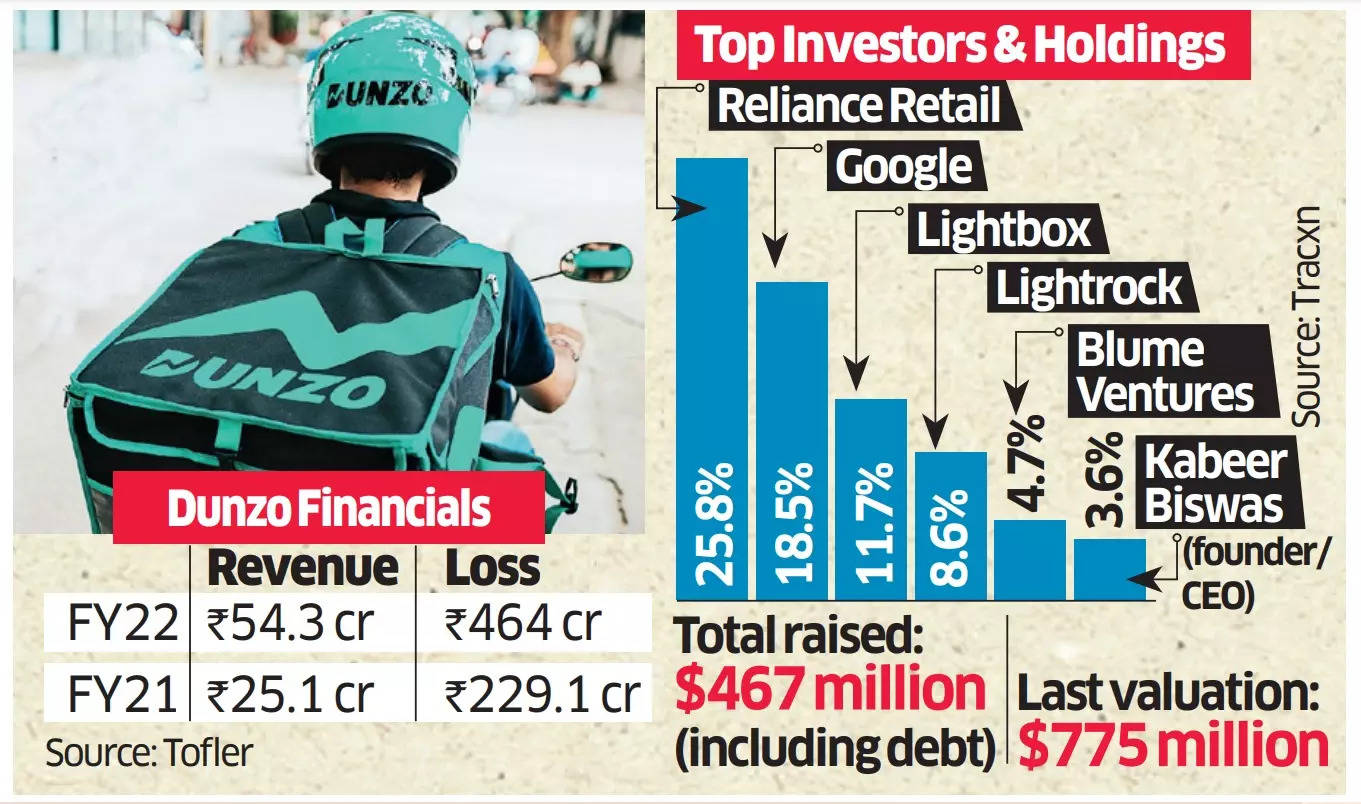

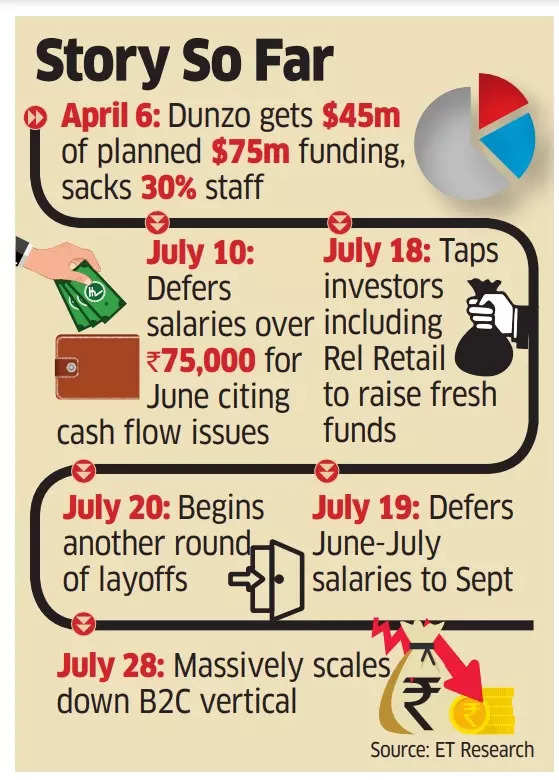

Markdown slows infusion of fresh funds in Dunzo

For what it’s worth: A set of Dunzo’s existing investors have been in talks to line up new funds at about a 50% discount to the startup’s last valuation of nearly $800 million. However, Reliance Retail, the largest investor in the company who had cut a cheque of $200 million in January 2022, is not in favour of such a steep cut. Reliance had invested in the now-troubled startup in a $240 million round.

Casting a wide net: In recent weeks, Dunzo reached out to multiple family offices like Premji Invest, Kiran Mazumdar Shaw of Biocon, and others to infuse capital into the company. Multiple sources said Dunzo has tried to close a new funding arrangement even with a big markdown as it is racing against time to pay off pending salaries and vendors’ dues.

Continuous crisis: Over the past few weeks, the cash flow crisis at Dunzo has only exacerbated. Last week, the firm was struggling to keep its dark stores in Bengaluru running amid a delay in payments to pickers, i.e., dark store workers, multiple people aware of the state of affairs said. Besides, ET found that in many parts of Bengaluru, Dunzo was only making deliveries that took over 75 minutes to service.

“They (Dunzo) have been rotating the operation of dark stores. We keep shutting some when others are open, with delivery workers stepping in to help run stores”, a person in the know of the matter said.

Read our detailed coverage on Dunzo:

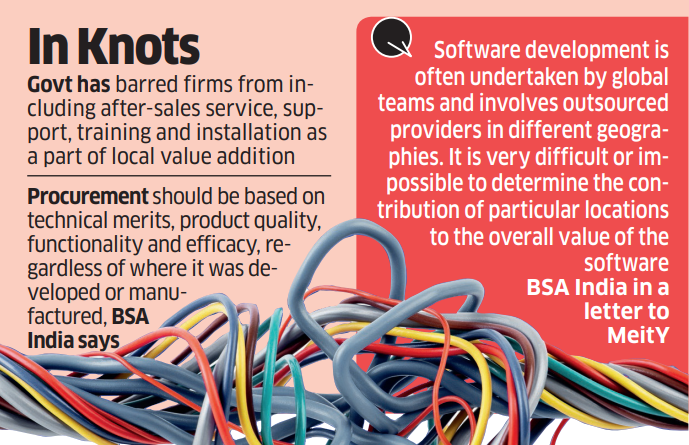

Global tech companies seek change in local value addition norms

Global software companies including Microsoft, Oracle, and Adobe are pushing for change in local value addition norms for software. The companies say they are unable to bid for government contracts due to lack of standards in determining software localisation.

The issue at hand: BSA India, the Indian branch of a software alliance that includes Amazon Web Services, Cisco, Salesforce, Autodesk, Slack, and others, has raised concerns in a letter to the Ministry of Electronics and Information Technology (MeitY). The letter, dated July, highlights difficulties faced by these companies in bidding for orders on the government’s GEM portal due to the challenge in defining local value addition.

With software development often spanning global teams and outsourced providers in various regions, BSA India emphasised the complexity of attributing the contribution of specific locations to the software’s overall value.

Denying ‘reasonable opportunity’: The letter says that government norms on software and service procurement do not consider the nature of how software and related services are developed. This oversight, according to the companies, deprives them of a ‘reasonable opportunity’ to vie for state-run projects and procurement.

Moreover, the government’s directive of excluding after-sales service, support, training, and installation from value addition calculations is posing a challenge, making it difficult for software firms to meet the minimum localisation value required by the Department of Promotion of Industry and Internal Trade (DPIIT).

Cab aggregators, drivers stare at potential disruption

Cab aggregator platforms, fleet operators, and taxi drivers are staring at a potential disruption as the Supreme Court hears a matter that could possibly result in thousands of drivers across the country being rendered “unworkable and inoperative”.

Past forward: in 2017, a division bench of the Supreme Court ruled that drivers with a light motor vehicle (LMV) licence could operate transport vehicles in that category, essentially allowing drivers without a commercial transport licence to operate taxis. This decision was appealed last year, and is currently being heard by the constitution bench.

The impact: Fleet operators believe almost 70% of the drivers working with cab aggregators like Ola and Uber are without a transport licence, and are driving only with an LMV licence. Per the Motor Vehicles Act, LMV is a vehicle that has a maximum unladen weight of 7,500 kg. Cab aggregators are worried that the impact on drivers could lead to a short-term supply crunch for platforms.

What next: The Supreme Court will conduct the final hearing in this matter on September 13, and the court has asked the Ministry of Road Transport and Highways to submit its stance on this. Ladsariya said that irrespective of the ruling, Everest Fleet will start pushing its drivers to apply for a transport licence, which is currently not mandatory for cab drivers.

Titan to buy CaratLane employees’ ESOPs for around Rs 350 crore

Mithun Sacheti, founder, Caratlane

Tata group company Titan is expected to buy employee stock options (ESOPs) held by CaratLane employees for around Rs 340-350 crore, or approximately $42 million, days after it sealed a Rs 4,621-crore deal to purchase founder Mithun Sacheti’s stake in the omnichannel jewellery retailer.

Details: Following the purchase of Sacheti’s 27.18% stake in CaratLane, Titan will hold a 98.28% stake in the company. CaratLane has around 1,700 employees and its ESOP pool holds around 1.5% stake. The remaining stake is held by current and former employees of CaratLane, and senior management officials of Titan, according to information sourced from Tracxn.

Titan’s purchase of ESOPs from CaratLane employees is in addition to Sacheti’s payout.

Recap: Titan’s acquisition of Sacheti’s stake in CaratLane, reported on Saturday, valued the company at Rs 17,000 crore, or around $2 billion.

In an exclusive interaction with ETtech on Sunday, Sacheti spoke about his entrepreneurial journey and CaratLane’s growth. “In 2018, we raised Rs 99 crore from Titan. While we had done well for ourselves, we were still loss-making. CK Venkataraman, the current MD of Titan, was extremely helpful in making the business profitable,” he said.

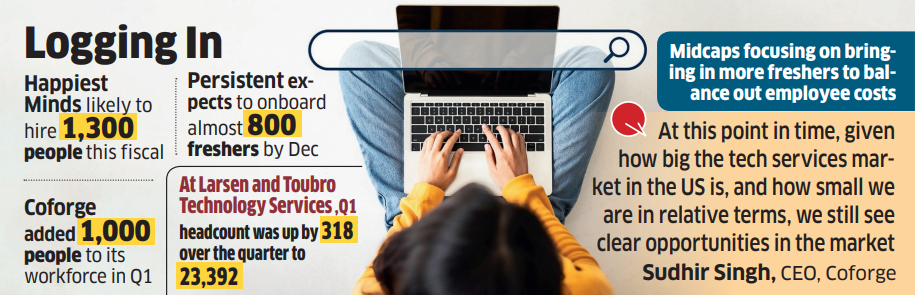

IT midcaps keep hiring momentum going

Midcap IT companies are expected to add to their headcount as they reported positive revenue growth in the last quarter, despite macroeconomic challenges.

Which companies? Companies such as Persistent, LTTS, Coforge, and Happiest Minds are among those expecting to add more people on their payroll, focusing on bringing in freshers to balance out employee costs.

Also read | Headcount at big 4 Indian IT companies dips in Q1

How many additions?

- Happiest Minds plans to add 1,300 to its workforce during this fiscal year.

- Persistent expects to onboard almost 800 freshers by December.

- Coforge management during its recent earnings call said out of the 1,000 people added during the first quarter, 200 were graduate engineer trainees.

- Larsen and Toubro Technology Services (LTTS) expects to add 750 employees next during the ongoing second quarter.

Prosus shuffles top deck with new heads for edtech, food

Gautam Thakar, chief executive of Olx Autos

In an internal organisational revamp, Prosus, the Dutch-listed arm of South African technology investor Naspers, has separated its edtech and food-delivery segments, with a dedicated leadership for each. The move was communicated to its teams last week.

Gautam Thakar to lead edtech: Larry Illg, chief executive of the combined segment, will be stepping down as part of the reorganisation. Roger Rabalais, previously the chief financial officer of the food-delivery and edtech segments, will now be the chief executive officer of the food segment. Gautam Thakar, chief executive of Olx Autos, will take over as CEO of the edtech vertical. Both Thakar and Rabalais will report directly to Prosus CEO Bob van Dijk.

Other Top Stories By Our Reporters

Rahul Yadav, founder, 4B Networks

Mumbai Police files FIR, issues lookout notice against 4B Networks founder Rahul Yadav: The Economic Offenses Wing (EOW) of the Mumbai Police has registered a first information report against 4B Networks, its founder Rahul Yadav and senior official Sanjay Saini for allegedly cheating advertising firm Interspace Communication Pvt Ltd of Rs 10 crore.

Crypto plunge gives Indian investors the jitters: In the past week, Bitcoin declined 11.5%, hitting $26,023.33 according to data at 5.30 PM on Monday. Similarly, significant alternative cryptocurrencies like Ethereum fell 9.7%, Ripple’s lost 16.9%, Solana crashed 13.3%, and memecoins such as Dogecoin and Shiba Inu declined by nearly 16%.

Global Picks We Are Reading

■ Why China remains hungry for AI chips despite US restrictions (Financial Times)

■ The fastest-growing shopping app in the world (Rest of World)

■ Revealed: The authors whose pirated books are powering generative AI (The Atlantic)