Also in the letter:

■ IT firms eye prix fixe deals to improve margins

■ LTIMindtree Q1 profit rises 4% to Rs 1,151 crore

■ Online B2B marketplaces a $200 billion opportunity by 2030

Dunzo asks Reliance Retail for more cash

Hi, this is Digbijay here in Bengaluru. This morning my colleague Soumyajit Saha and I are bringing you another important story on Dunzo. It has held fresh talks with its largest investor Reliance Retail for at least $20 million amid a cash crunch at the firm.

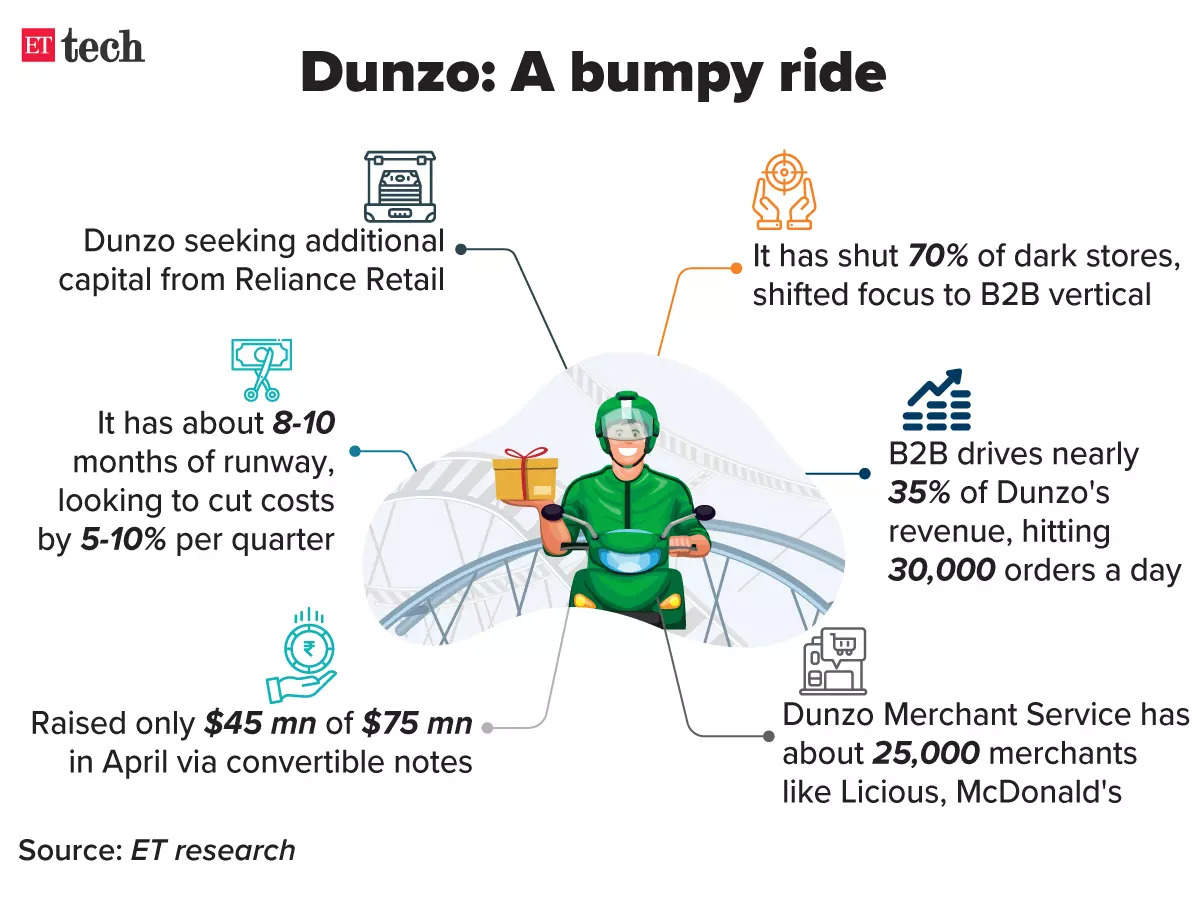

Driving the news: Dunzo is looking at Reliance Retail for more capital to extend its runway, even as it continues to cut costs in its consumer business Dunzo Daily, and is doubling down on its B2B offering — Dunzo Merchant Services.

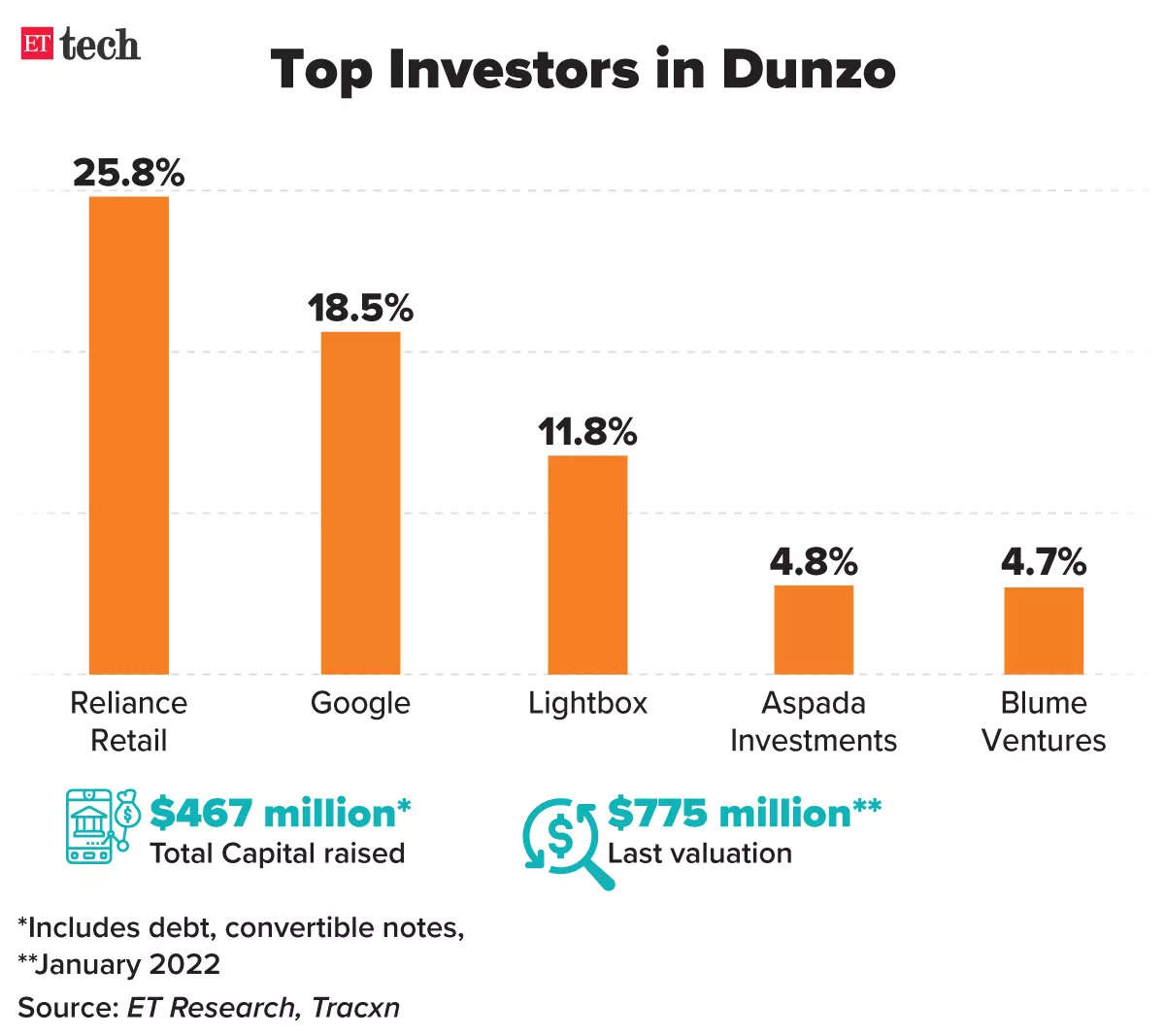

Why but? Dunzo has been in the news for delaying salaries owing to a cash flow issue. Dunzo CEO Kabeer Biswas even briefed his staff about the same. We are told that of the $75 million the company tried to raise through convertible notes in April, only about $45 million came through. So now it needs money to sustain its operations, and it is talking to its largest investor — who is also a strategic investor — for the same.

Deeper cuts: We had reported that Dunzo has decided to shut about 50% of its dark stores in April. That number has now grown to about 70%. It will continue to serve the remaining locations through third-party merchants via its marketplace. While shifting focus to its B2B unit — Dunzo Merchant Services (DMS) — it will continue to cut costs, which would be in the range of 5-7% or more per quarter, sources told us.

To B2B, or not to B2B: Dunzo’s B2B business does more than 30,000 orders a day, mostly last-mile delivery services, in seven cities, and brings in roughly 35% of Dunzo’s revenues. It serves over 25,000 merchants. About 65-70% of these are in the food business, including McDonald’s, Licious, and Theobroma. The core team at DMS is about 20 people, under cofounder Dalvir Suri and vice president of sales C Sumit Anand. But will B2B carry the day for Dunzo?

Jargon buster: A convertible note is a form of short-term debt that converts into equity, typically during a future financing round, or an IPO. It doesn’t ascribe a valuation to the company at the time of the fundraise, and has been used widely by Indian startups over the last few years. Dunzo was last valued at $775 million in January 2022.

Also read | Late-stage startups tap alternative funding routes amid softening valuations

OneCard, Wint Wealth aspiring for NBFC licence

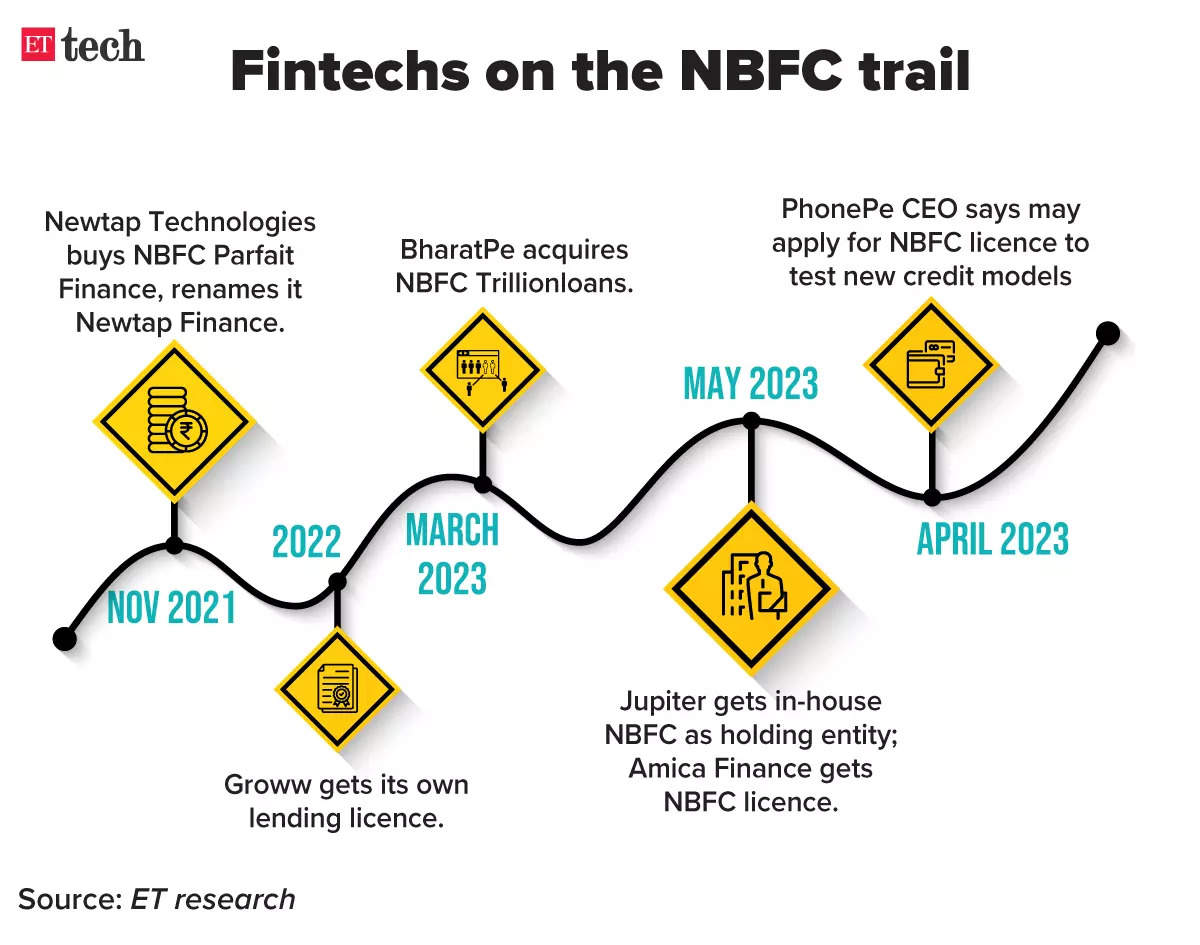

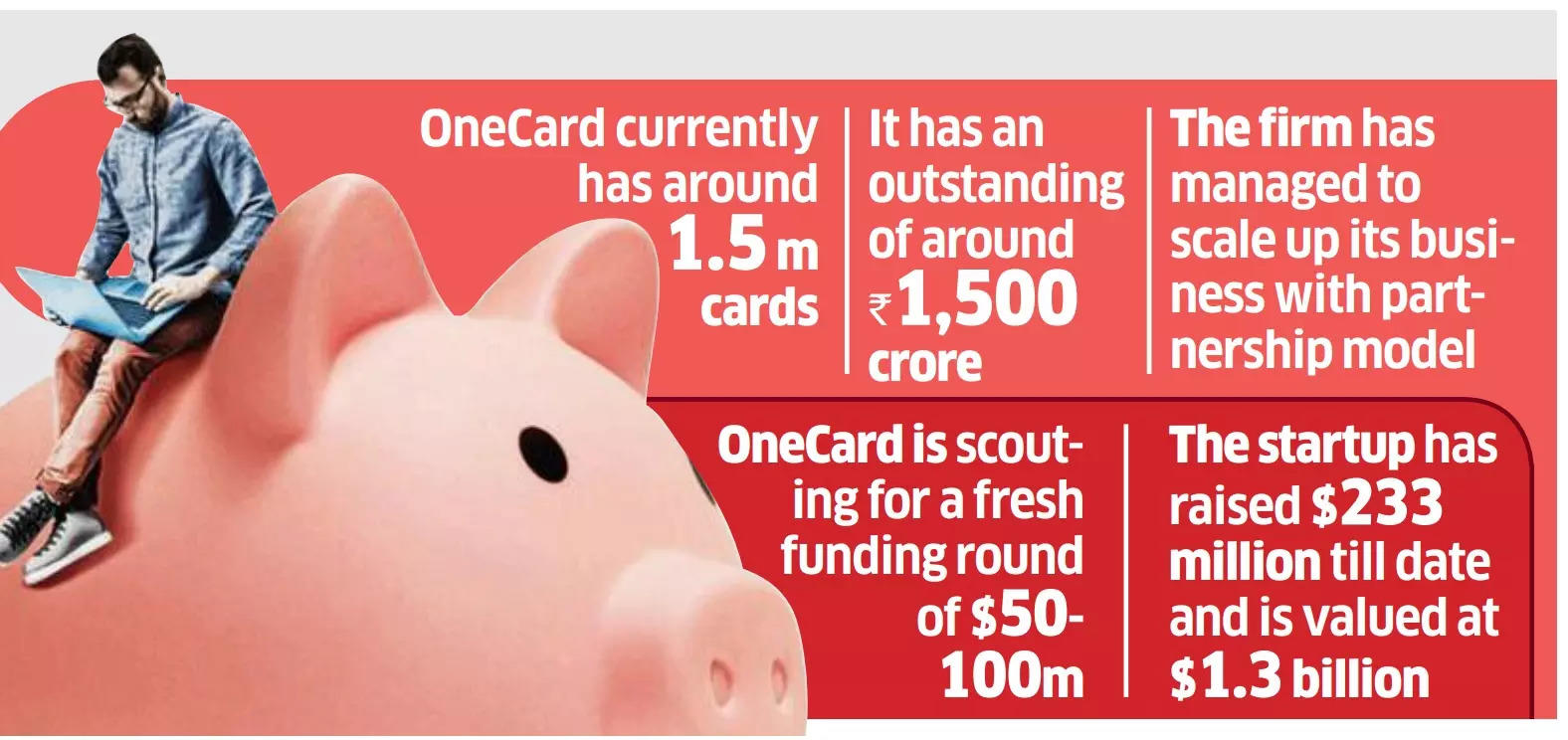

More and more fintechs are hoping to play the credit game to ensure their users remain sticky and they can enrich their rosters with credit-worthy customers. The newest players hoping to hop on to the non-banking finance corporation (NBFC) bandwagon are OneCard and Wint Wealth.

Lending licence: Pune-based credit card unicorn OneCard and Bengaluru-based startup WintWealth, which enables retail investors to buy company bonds, have applied for an NBFC licence, two people in the know told ET. These firms intend to join the likes of Cred, Groww, and Jupiter, who have recently bagged their own lending licences.

Loansome alley: OneCard offers premium credit cards to deserving customers on behalf of mid-sized lenders like Federal Bank, South Indian Bank, and CSB Bank. Getting its own NBFC licence would mean that OneCard will build its exposure in personal loans and other products. It also offers other retail lending products like checkout finance or buy-now-pay-later options. In checkout finance, the customer gets the option to convert the amount into EMIs when making the payment.

WintWealth, a platform where retail customers can pick up bonds issued by large companies, hopes to offer loans to customers against their holdings and generate value.

Regulatory oversight: After the Reserve Bank of India came out with digital lending licences, large fintechs have been taking steps towards getting more regulated.

“With regulations, fintechs will have to be cautious about their experimental approach. Fintechs plan to issue both credit cards and personal loans on their platform,” a fintech founder told ETtech on condition of anonymity.

Growing credit play: ET had reported that stock investing platform Upstox is also looking to enter the credit domain. Even Cred aims to use its in-house NBFC Newtap Finance to expand its revenue sources. Cred has grabbed a large customer base but needs to monetise them better.

IT firms eye fixed price deals to improve margins

Indian technology companies are pitching for more ‘fixed-price contracts’ instead of ‘time and material’ deals premised on variable resource deployment, in order to improve margins in an environment where global clients have turned abstemious with outsourcing budgets.

What’s happening? Fixed-price projects allow better cost control and a greater ability to introduce automation in projects and expand margins. By contrast, ‘time and material’ projects are directly linked to the number of people deployed on billable projects.

Why it matters: Software bellwethers Tata Consultancy Services (TCS) and Wipro, which announced earnings last week, said that the pricing environment has not significantly improved during the first quarter of the fiscal, and that companies have maintained margins thanks to higher utilisation. Deal momentum, though slow, remained strong.

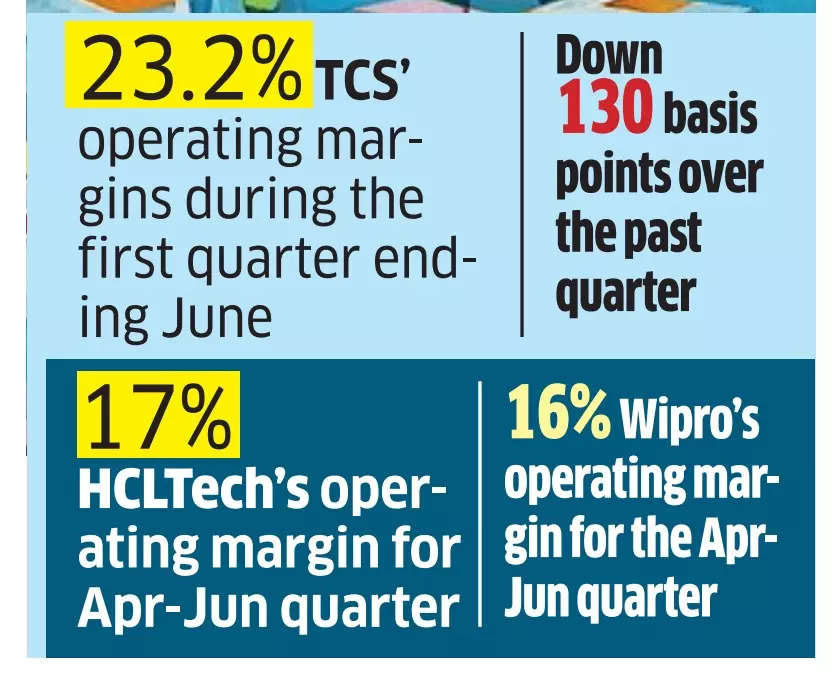

Shrinking margins: The first quarter has been tough on margins. TCS reported an operating margin of 23.2% in the June quarter, down 130 basis points over the previous quarter. HCLTech’s operating margin for the same quarter stood at 17%, down 110 basis points sequentially and flat on-year. Wipro’s operating margin stood at 16%, down 30 basis points sequentially but up 1% from a year ago.

LTIMindtree Q1 Results: PAT rises 4% YoY to Rs 1,151 crore; revenue rises 14%

Debashis Chatterjee, CEO and MD, LTIMindtree

As the earnings season continues, LTIMindtree, the fifth largest IT company in India, reported a consolidated net profit of Rs 1,151 crore for the quarter ended June, which is 4% higher on-year.

Financials: The company has posted an EBITDA (earnings before interest, tax, depreciation and amortisation) of Rs 1,635 crore in the June quarter, which is up 9% on-year. Meanwhile, EBITDA margins shrunk to 18.8% for the quarter under review as against 19.5% in the year-ago period. In constant currency (CC) terms, the company’s revenue grew 8% YoY. The headcount during the quarter dropped to 82,738, against 84,546 in the preceding March quarter.

IT majors report earnings: In the previous week, IT companies TCS, HCLTech and Wipro announced their first quarter results. Analysts said that based on the results and demand commentary, companies aren’t seeing any immediate demand revival in the second quarter, and any visibility on recovery in the second half of the current fiscal is limited at this stage.

Online B2B marketplaces a $200 billion opportunity by 2030, says report

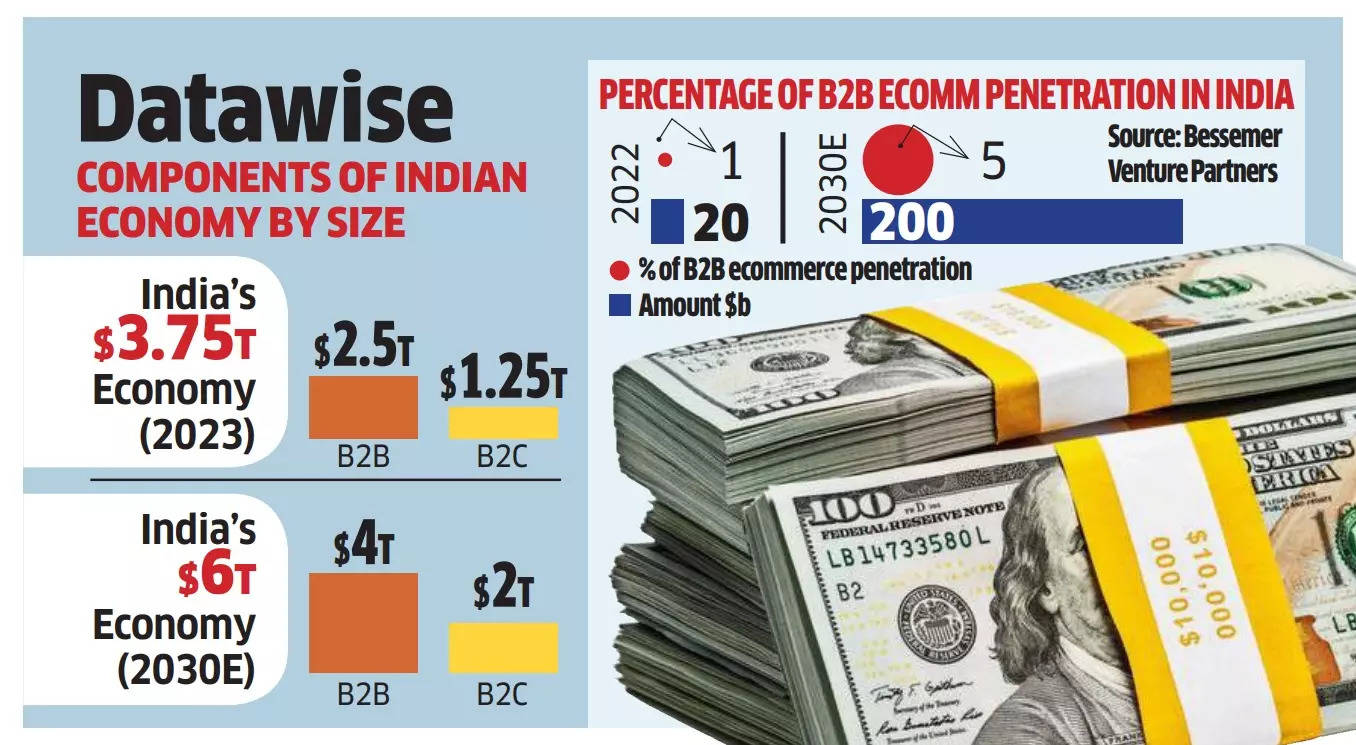

Online-first and technology-enabled business-to-business (B2B) marketplaces are set to be a $200 billion market opportunity by 2030, according to an estimate by Bessemer Venture Partners (BVP).

Details: The sector’s growth is enabled by four factors — increased digital adoption, mature digital infrastructure, favourable regulatory policies, and a conducive cross-border environment, the Bengaluru-based venture capital firm said in a report.

Growth drivers: According to the report, the key drivers for growth are ecommerce and logistics players, payments systems such as the Unified Payments Interface (UPI), the Open Network for Digital Commerce (ONDC), account aggregators, and the Open Credit Enablement Network (OCEN).

Word-for-word: “Any business that functions as an agency today and is serving other businesses is an opportunity to create an internet- and online-led B2B marketplace,” Anant Vidur Puri, partner, BVP, told ET in an interaction.

Other Top Stories By Our Reporters

(From left) Factors. ai founders Srikrishna Swaminathan, Aravind Murthy, and Praveen Dass

Factors.ai raises $3.6 mn led by Stellaris Venture Partners: Factors.ai, the provider of analytics software for business-to-business marketing teams, on Tuesday said it has raised $3.6 million in a pre-series A funding round led by Stellaris Venture Partners. Returning investors in the round included Elevation Capital and Emergent Ventures.

Fashion brand Styched acquires Shark Tank-fame sneaker startup Flatheads: The deal, structured as an all-equity transaction, marks the entry of Bengaluru-based Styched into the footwear segment.

Karnataka offers 100 acres to Foxconn subsidiary: Karnataka has offered a 100-acre plot to Foxconn Industrial Internet (FII), a subsidiary of the world’s largest contract manufacturer Foxconn, at the Japanese industrial park (JIP) in Tumakuru district.

Global Picks We Are Reading

■ US tech: dwindling funding rounds will create a bonfire of the start-ups (Financial Times)

■ Sustainable smartphones calling? Eco-friendly new design rules to extend the life of your handset (The Guardian)

■ AI’s “tech tsunami” is coming for call centre workers (Rest of World)