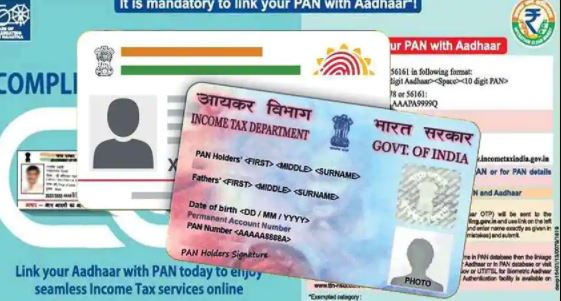

PAN Aadhaar Linking Deadline: There is vital information for PAN card holders. The government has given a caution to interface PAN and Aadhaar. In the event that you have not yet connected PAN and Aadhaar, then, at that point, you might need to experience a major misfortune.

As a matter of fact, the last date for connecting PAN-Aadhaar was 31 March 2022, yet PAN-Aadhaar connecting should be possible till 30 June with punishment. f you don’t accomplish this work by June 30, then you should suffer double the consequence.

As a matter of fact, Aadhar card and PAN card are the main records in India. You can connect it till 31 March 2023, yet after 30 June 2022 you should suffer double the consequence for connecting PAN-Aadhaar. All things considered, from first April 2022, a punishment of Rs 500 must be paid for linking Aadhaar with PAN number. Yet, if you don’t connect by 30 June 2022, you should suffer a consequence of Rs 1,000 from 1 July.

PAN will be invalid

f you don’t connect it, then, at that point, your PAN will be invalid under Section-139AA of the Income Tax Act. In such a circumstance, you can likewise not file ITR on the web. In this your expense discount can be halted. Aside from this, you can not involve PAN in any monetary exchange. Tell us how to connect PAN card with Aadhar card.

Link online like this

- Go to the Income, most importantly, Tax site.

- Enter the name, PAN number and Aadhaar number as given in the Aadhar card.

- Tick the square if the time of birth is given in the Aadhar card.

- Presently enter the given manual human test code.

- Presently click on the Link Aadhaar button.

- Your PAN will be linked with Aadhaar.

PAN card will become pointless assuming that it is dropped

After the crossing out of the PAN card, it very well may be made usable once more. In any case, remember that on the off chance that somebody utilized a dropped PAN card meanwhile, it would be viewed as an infringement of segment 272B under the Income Tax Act. In such a circumstance, the PAN holder should pay a fine of Rs 10000. Furthermore, not just this, on the off chance that the dropped PAN card is utilized again some place, the punishment can likewise be expanded.