Also in this letter:

- IT firms to petition govt over exceptions in data bill

- Key takeaways from Boat’s draft IPO prospectus

- Twitter responds to Rahul Gandhi’s allegations

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Future Retail directors acting at behest of promoters, Amazon says

Amazon has sent another letter to Future Retail’s three independent directors, questioning their motives in turning down its offer of financial help to the struggling retailer.

In its letter sent on Thursday evening, Amazon said the attempt by the independent directors to question private equity firm Samara Capital’s term sheet “reveals that the statements are being made at the behest of Future’s promoters” and to protect their “mala fide action”. ET has reviewed a copy of the letter.

Catch up quick: In its previous letter to the independent directors, sent on January 23, Amazon wrote that Samara Capital had reiterated that it remained committed to the term sheet signed on June 15, 2020, which proposed a “purchase consideration” of Rs 7,000 crore for the retailer. But it said Future Retail would have to hand over its financial details to Samara for due diligence before any deal could go ahead.

The independent directors decided to not accept Amazon’s offer. One of them, Ravindra Dhariwal, described the offer as a “smokescreen”, and said it was untenable.

Second attempt: Amazon wrote in its latest letter, “We once again call upon you to consider our offer of assistance and provide access to FRL’s records for conducting the due diligence exercise as expeditiously as possible. We call upon you once again to share any such report(s) by tomorrow, ie, January 28, 2022.”

FRL in Supreme Court: On Thursday, the Supreme Court agreed to hear Future Retail’s petition filed on Tuesday, to prevent its lenders from declaring the firm a non-performing asset for missing its payments.

The court also wanted to hear Amazon in the case, but senior counsel for Future Group Mukul Rohatgi told the court that the matter was not related to Amazon.

IT firms to petition govt over exceptions in data bill

The IT sector will petition the government on broad exemptions lawmakers are seeking in the proposed data protection bill.

These exemptions have left regulators and corporations worried and would adversely affect India’s $190 billion IT-BPM business in Europe, according to Rama Vedashree, CEO of Data Security Council of India (DSCI), an affiliate of industry body Nasscom.

She added that such exemptions would dilute an otherwise comprehensive data privacy regime, and could make it difficult to get adequacy status from the European Union, which facilitates business between EU and other countries. The industry grouping will send a representation to the central government as early as next week, she added.

Other issues: Apart from opposing the wide-ranging access to personal data being sought by the government, the industry representation will also highlight:

- The inclusion of non-personal data in the bill.

- The absence of timelines for government agencies to be compliant with its provisions.

- Its lack of applicability to personal data in the physical format.

Continental Europe broadly accounts for 11% of overall business for the country’s IT sector while the US and the UK constitute as its largest markets with a share of 62% and 17%, respectively. Nasscom estimates that offshoring prospects from Europe are expected to increase in the coming years.

A recent report commissioned by the European Data Protection Board (EDPB) also called out India’s proposed data law—specifically the exemptions that the government has sought for itself.

Survey: Meanwhile, about 70% of C-suite leaders view the data protection bill as an opportunity to build trust, according to the EY Data Privacy Survey of 150 C-suite leaders across healthcare, retail, IT/ITes, BFSI and manufacturing.

Nearly two-thirds of them are concerned about their personal data being handled by social media companies and the government, and about 93% of enterprises are prioritising privacy in their digital transformation journey, the survey found.

Tweet of the day

Key takeaways from Boat’s draft IPO prospectus

Imagine Marketing, the parent company of D2C audio brand Boat, filed its draft red herring prospectus for an initial public offering on Thursday.

The company is looking to hit the capital markets by the first quarter of the next financial year and is expected to seek a valuation of around $1.5-$2 billion in the offering, as we had previously reported. Founded in 2016, the company was last valued at around Rs 2,200 crore when it raised Rs 50 crore from Qualcomm Ventures in April last year.

Here are the key takeaways from the DRHP.

Issue size: The company said it is looking to raise Rs 2,000 crore, including Rs 900 crore by issuing new shares. The remaining Rs 1,100 crore will be raised through an offer for sale, in which existing investors will sell some of their shares.

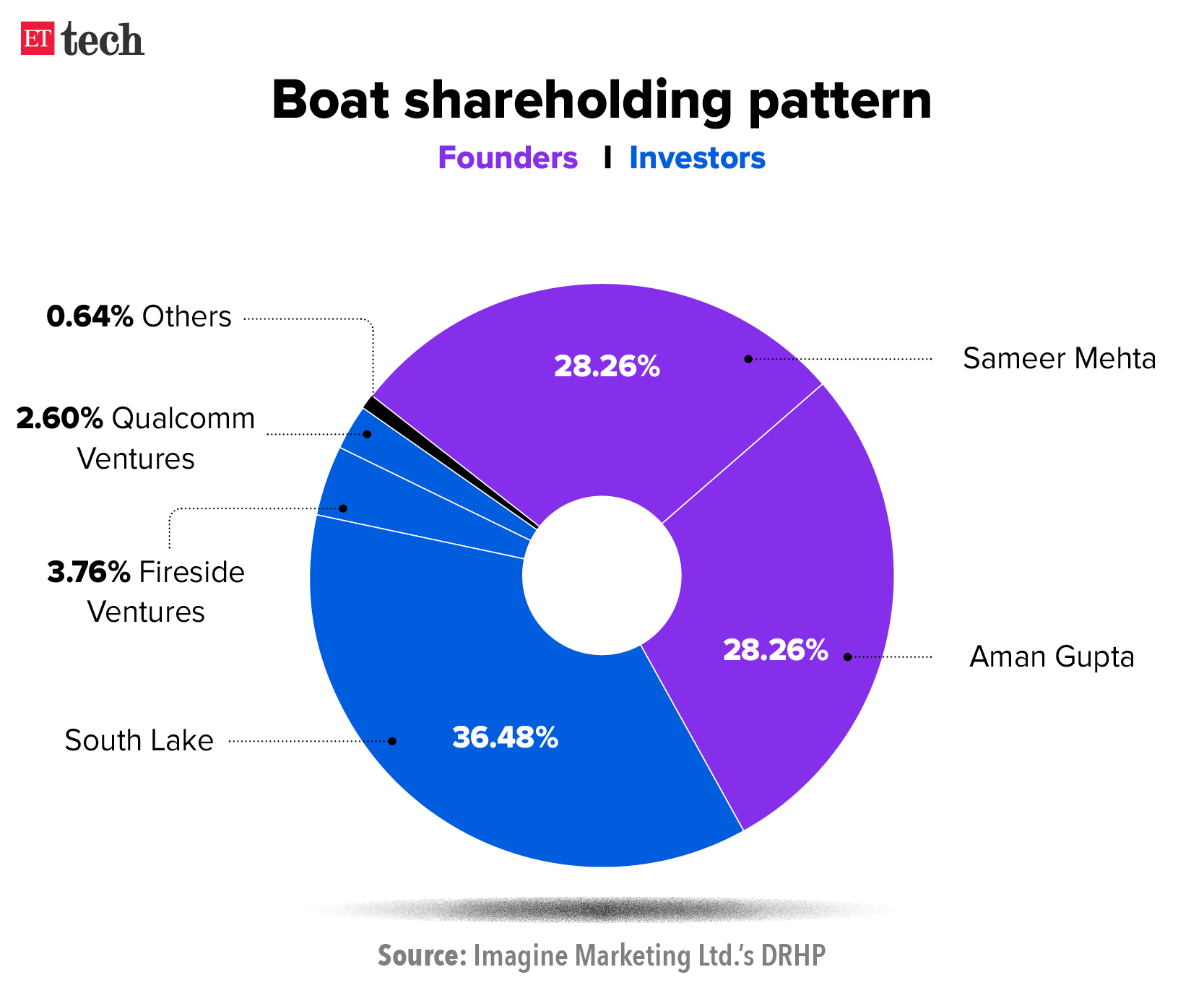

Shareholding: Boat’s founders Aman Gupta and Sameer Mehta have a combined 56% stake in the company. That’s higher than any new-age Indian company that has listed on the domestic stock markets or is looking to do so. Nykaa’s Falguni Nayar is a close second with a 52.56% stake in her company. Private equity major Warburg Pincus is the single largest shareholder in Boat with around 36% in the company.

Offloading stakes: South Lake Investment, a vehicle of Warburg Pincus, will sell shares worth up to Rs 800 crore in the IPO. Gupta and Mehta are expected to sell a small number of shares.

What will the funds be used for? Repay or prepay debt.

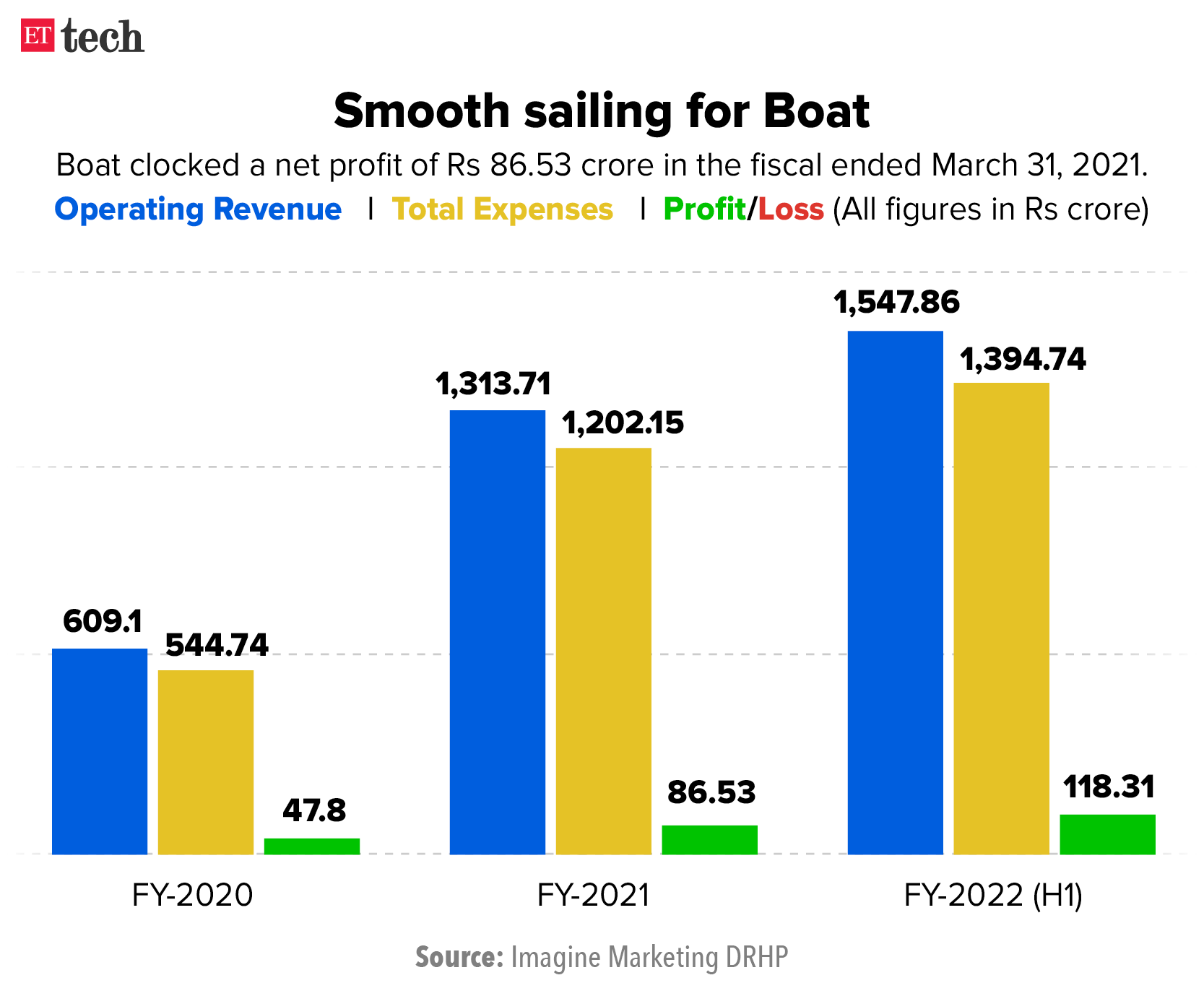

Financials: For the six months ended September 2021, Boat’s operating revenues have surpassed FY21 figures and stand close to Rs 1,550 crore, with net profit surging to Rs 118 crore.

Pre-IPO placement: The company may consider a pre-IPO round. It is in consultation with book running lead managers and is likely to raise upto Rs 180 crore before the offering.

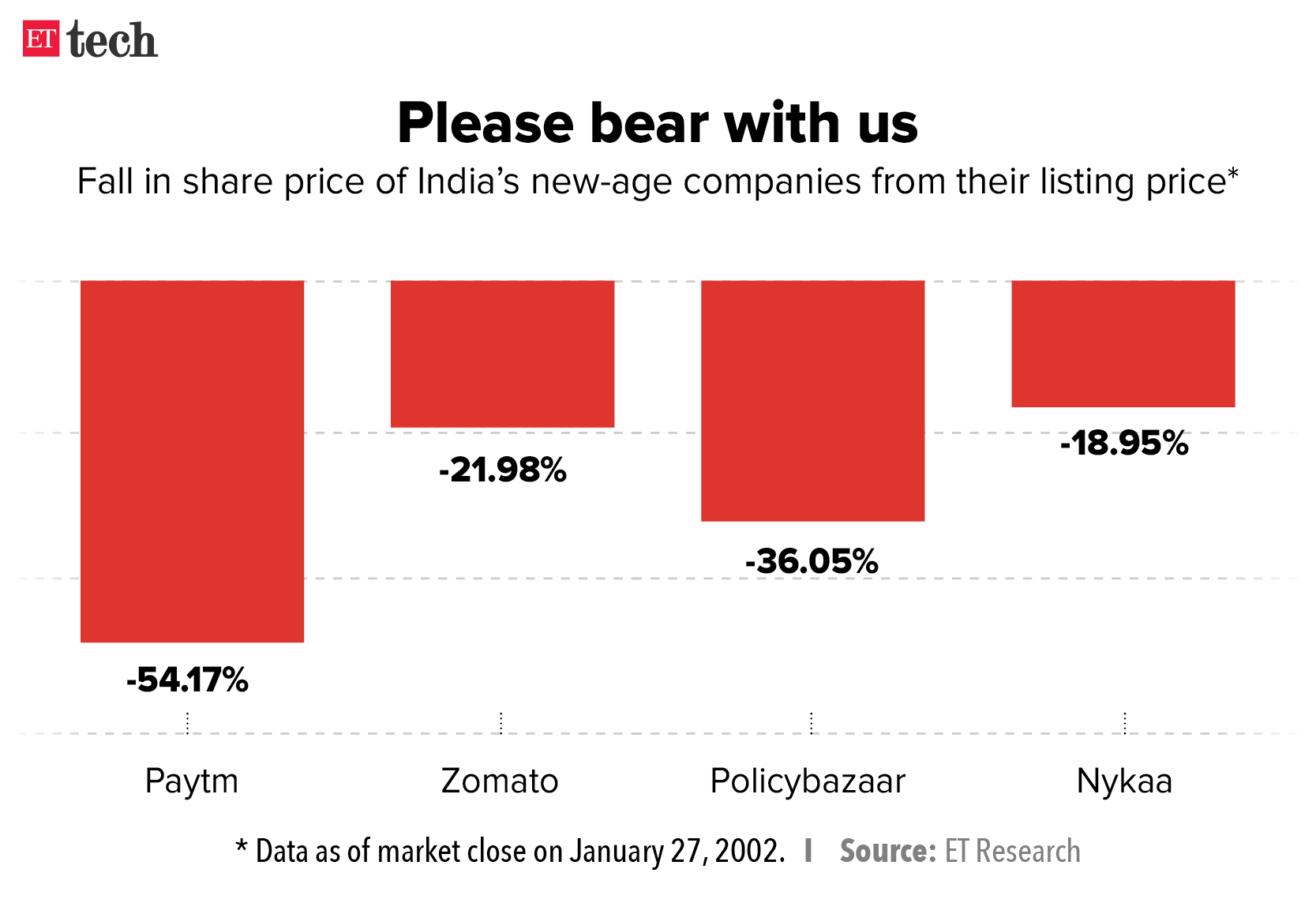

IPO parade continues: By filing for an IPO, Boat joins the growing number of Indian startups looking to tap the public markets. 2021 was a signal year for tech startup IPOs in India, with the likes of Zomato, Nykaa, Paytm, Policybazaar listing on the bourses.

But these companies’ share prices have taken a beating in 2022, thanks in part to a huge sell-off in US tech stocks as investors anticipate interest rate hikes.

Twitter says follower count can fluctuate after Rahul Gandhi writes to CEO

Congress leader Rahul Gandhi.

Twitter has said that follower counts on its platform “can and do fluctuate” as it removes millions of accounts each week for violating its policies, platform manipulation or spam. The company was responding to allegations by Congress leader Rahul Gandhi.

Driving the news: Gandhi wrote a letter to newly appointed Twitter CEO Parag Agrawal on Dec. 27, alleging that his follower count had frozen since his account was briefly blocked last August. He alleged that the social media company was working under pressure from the Modi government.

Twitter’s response: The company said it removes millions of accounts each week for violating its policies on platform manipulation and spam. It said that while some accounts notice a minor difference, in certain cases the number could be higher.

Infographic Insight

ETtech Done Deals

■ Curefoods has merged with rival Maverix, in a deal that’s said to peg the valuation of the Ankit Nagori-led cloud kitchen at $280 million. Curefoods will now have 125 kitchens across 12 cities, making it one of the largest cloud kitchen players in the country.

■ Lee Fixel’s Addition has led a $14 million funding round in professional services automation startup, SuperOps.ai, along with Tanglin Venture Partners.

■ Growth School, a community-led live learning platform, has raised $5 million in a seed funding round led by Sequoia Capital India and Owl Ventures.

■ Agritech startup MoooFarm has raised $2.4 million in a seed round led by Accel India with participation from Rockstart’s AgriFood fund and Navus Ventures.

■ Snacks brand TagZ Foods has raised an undisclosed amount from BharatPe’s Ashneer Grover and Namita Thapar, executive director of Emcure Pharmaceuticals.

Ranveer Singh, Jacqueline Fernandez violate ASCI’s influencer norms

Bollywood actors Ranveer Singh and Jacqueline Fernandez

Actors Ranveer Singh and Jacqueline Fernandez are among more than two dozen digital creators who are in breach of the Advertising Standards Council of India’s (ASCI) guidelines for influencer advertising in digital media.

What happened? These celebrities failed to include disclosure labels with their paid posts on the first instance and on subsequent routine checks. They represent brands and businesses including Myntra, Nykaa, Manyavar, Kama Ayurveda.

ASCI said its complaints team contacted the influencers and companies and asked them to follow the guidelines.

Quote: “We hope this signals to the industry that we are serious about consumer protection and pushing the agenda around misleading ads,” said Manisha Kapoor, general secretary, ASCI.

Regulating the space: Last June, ASCI made it mandatory for influencers to label their promotional posts to ensure transparency and safeguard the interests of consumers.

In July-December 2021, about 5,000 posts, stories and feeds from influencers’ handles were screened for complaints, including those from consumers.

Other Top Stories By Our Reporters

Karan Mohla joins B Capital: The Chiratae Ventures old timer has been brought on board to help B Capital identify early-stage startups in India and Southeast Asia. B Capital’s portfolio in India includes Byju’s, Meesho, Khatabook and Dailyhunt. (read more)

13 IoT, hardware startups to receive Rs 7.5 lakh each: Thirteen Indian startups in the hardware and Internet of Things sectors selected for Digital India’s Scale Up programme will receive a grant of Rs 7.5 lakh each from the Ministry of Electronics and Information Technology.

Wipro appoints Badrinath Srinivasan as MD, Southeast Asia: He will strengthen the key markets of Southeast Asia focusing on large deals and strategic transformational engagements as part of his mandate, the company said in a statement. (read more)

Global Picks We Are Reading

■ Why online stars are mad at Apple (NYT)

■ WhatsApp gets EU ultimatum after new terms spark backlash (Bloomberg)

■ Elon Musk talks up Tesla bots after production woes hit cars (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.