Credit: Giphy

Also in this letter:

■ Tiger Global slashes portfolio amid losses

■ Beauty & personal care continue to drive India ecomm growth: report

■ Uber hikes prices by 5% in the UK to attract more drivers

Digit Insurance files draft IPO papers with Sebi

Prem Watsa & Digit founder Kamesh Goyal

Digit Insurance, which is backed by Canadian billionaire Prem Watsa’s Fairfax Group, has filed for an initial public offering, papers submitted to the markets regulator showed.

Details: The insurance company plans to raise up to Rs 1,250 crore by issuing new shares and put up 109,445,561 shares in the offer-for-sale component.

- The total IPO is likely to be worth Rs 5,000 crore, a source told us.

- The company said it may sell shares worth around Rs 250 crore in a pre-IPO placement. If this happens, the final issue size will be lower.

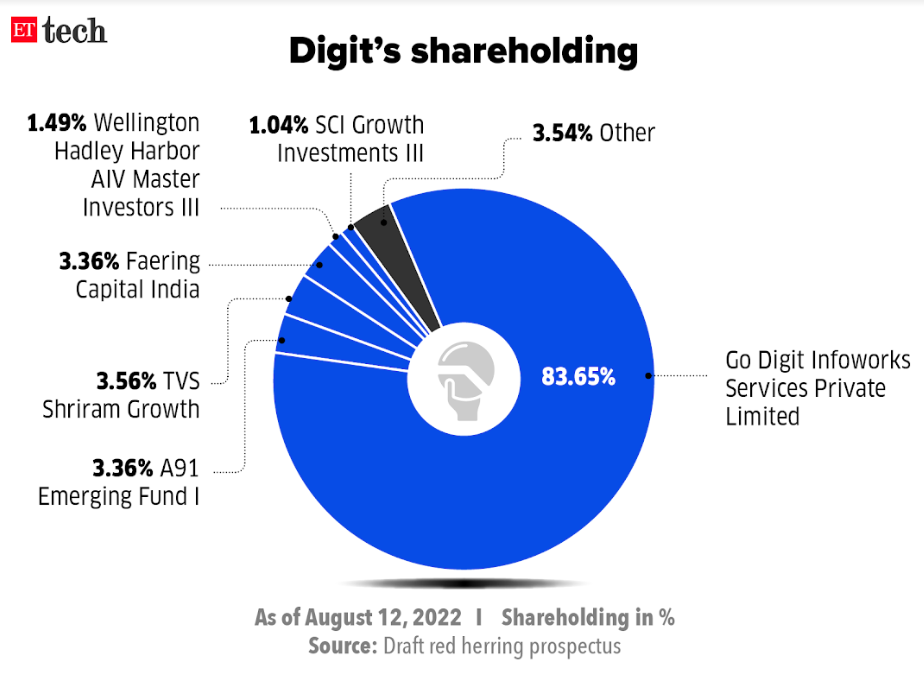

- The company’s promoters are Kamesh Goyal, Go Digit Infoworks Services Private Limited, Oben Ventures LLP and FAL Corporation, which is part of Fairfax holdings.

Who’s selling? As per the DRHP, investors that will sell shares the offer for sale include

- Go Digit Infoworks Services (up to 109,434,783 shares)

- Nikita Mihir Vakharia and Mihir Atul Vakharia (up to 4,000 shares)

- Nikunj Hirendra Shah and Sohag Hirendra Shah (up to 3,778 shares)

- Subramaniam Vasudevan and Shanti Subramaniam (up to 3,000 shares)

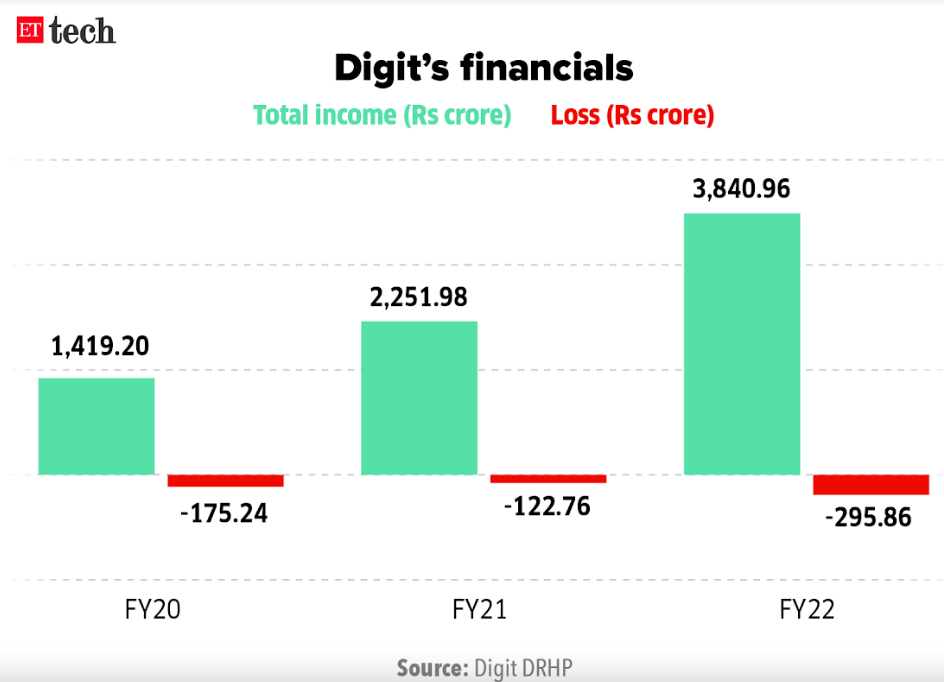

Loss-making: Among the risk factors the company listed in its DRHP was its lack of profitability – an issue common to most Indian tech startups that have gone public so far.

“We have a track record of reporting losses, and we may not achieve profitability in the future,” Go Digit wrote in its DRHP. “We incurred a loss after tax of Rs 295.86 crore in fiscal 2022, Rs 122.76 crore in fiscal 2021 and Rs 1,75.24 crore in fiscal 2020. We expect to continue to make significant investments to further develop and expand our business.”

Tiger Global slashes portfolio amid losses

Chase Coleman III, founder, Tiger Global

Investment firm Tiger Global Management, which lost billions of dollars in this year’s technology meltdown, has slashed or completely exited most of its holdings in the second quarter, potentially cutting its exposure to a recent stock rally, according to a filing released on Monday.

Details: The companies in which Tiger reduced positions include online used-car seller Carvana, cyber company Crowdstrike Holdings, software maker Snowflake, payments company Nu Holdings, retailer JD.com, food delivery app Doordash, cryptocurrency exchange Coinbase and Microsoft.

It also dissolved its investments in Robinhood, Zoom and Docusign.

Battered: Chase Coleman’s hedge fund saw its flagship fund fall 50% in the first half of the year, as worries over the Federal Reserve’s tightening monetary policy and surging inflation slammed many of the growth and technology stocks it held. It is unclear, however, what its strategy has been since then.

Elliott sells remaining SoftBank stake: Activist investor Elliott Management has sold almost all its remaining shares in SoftBank after previously investing as much as $2.5 billion, the Financial Times said on Tuesday, citing unidentified sources.

Elliott had already cut back its stake as SoftBank’s shares appreciated, supported by a record buyback programme. SoftBank’s portfolio has subsequently been hit by a collapse in tech valuations.

Investors trim Ant’s valuation: Meanwhile, Chinese fintech giant Ant Group’s valuation was trimmed again by global investors who bought private shares ahead of its suspended initial public offering.

Fidelity Investments cut its estimate for Ant to $70 billion at the end of May, according to Bloomberg calculations based on filings. That’s down from $78 billion in June last year, and $235 billion just before Ant’s IPO was torpedoed by regulators in November 2020.

Tencent to sell Meituan stake: Tencent plans to sell all or a bulk of its $24 billion stake in food delivery firm Meituan to placate domestic regulators and monetise an eight-year-old investment, four sources with knowledge of the matter told Reuters.

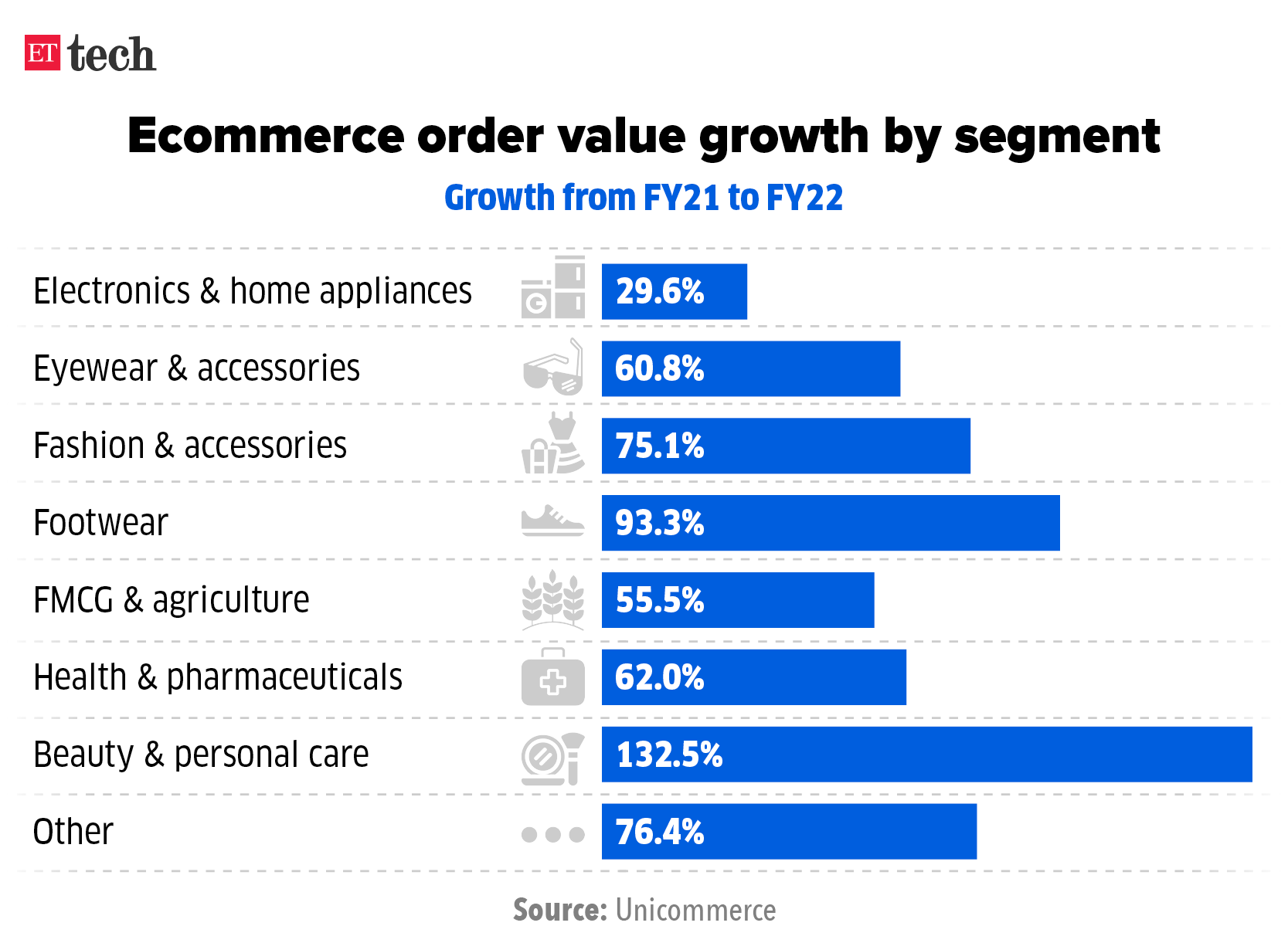

Beauty & personal care continue to drive India ecomm growth: report

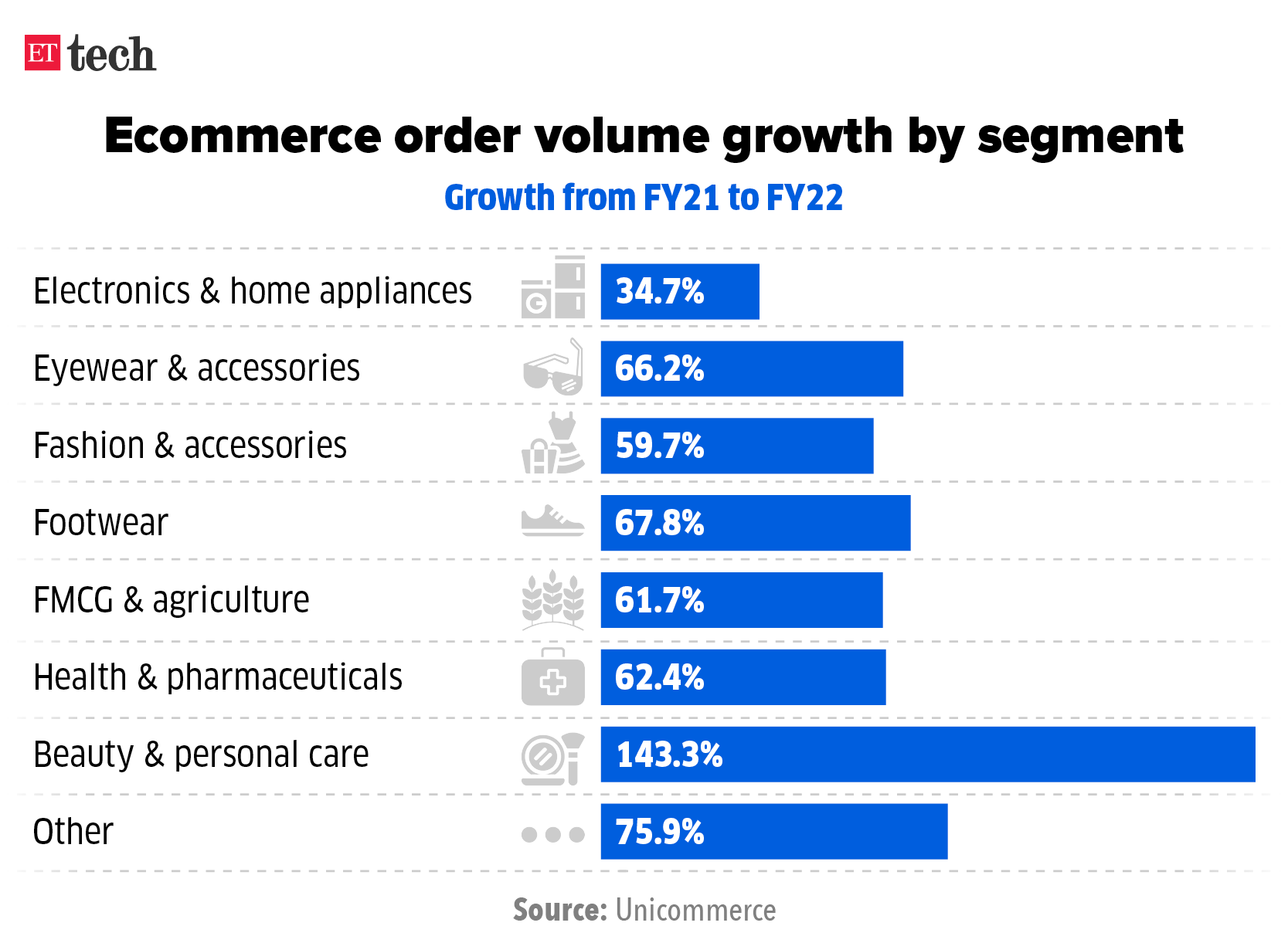

Ecommerce sales volume grew 69.4% in FY22 compared to 44% in FY21, according to a report by Unicommerce in collaboration with Wazir Advisors.

The beauty and personal care category continued to drive this growth, with a 143% increase in volumes year-on-year.

Gross merchandise value (GMV) grew by 73.6%, outpacing order volume growth. This showed that consumers were more confident of spending on discretionary items in FY22 than in FY21, when the GMV growth was just 37.2% and volume growth was 44%.

The faster GMV growth has resulted in a 2.5% increase in average order value, the report said.

The beauty and personal care category was followed by footwear, eyewear, fashion and accessories as people started stepping out more often, it said. Footwear, fashion and accessories have traditionally been the biggest contributor to overall ecommerce order volumes over the years.

Yes, but: Despite clocking strong year-to-year growth in FY22, ecommerce is seeing consumption growth moderating across categories thanks to rising inflation, especially in segments considered to be discretionary, as we reported on July 25.

Uber hikes prices by 5% in the UK to attract more drivers

Ride-hailing giant Uber is increasing rates across the UK, and by an average of 5% in London, as it looks to attract 8,000 more drivers to meet the growing demand for its services there, Bloomberg reported.

This comes a year after Uber suffered a shortage of drivers, with many choosing to move to courier jobs like Just Eat Takeaway and Amazon, owing to low wages. Last year, the company also reclassified its drivers as workers in the UK and agreed to give them vacation pay and pensions.

Over 10,000 drivers have joined Uber in the UK since it announced holiday pay.

Musk-Twitter update: Meanwhile, Chancellor Kathaleen McCormick of the Delaware Court has ordered Twitter to collect and share documents from Kavyon Beykpour, its former general manager of consumer product, with Elon Musk. Beykpour, who left Twitter in April, was identified as one of the key members in calculating the number of spam accounts on the platform, according to Musk’s court filings.

Tweet of the day

Ether jumps as the ‘Merge’ inches closer

With the much-anticipated Ethereum upgrade, dubbed the ‘Merge’, all but certain to take place in September, the price of its native token ether, the world’s second-largest crypto asset, has risen for six consecutive weeks to over $1,900 from a low of $880 in June.

Though way off its November 2021 peak of $4,868.79, ether now accounts for nearly a fifth — 19.7% – of the total crypto market cap of $1.14 trillion, up from less than 14.9% two months ago, according to CoinMarketCap.

Ethereum’s ‘Merge’ will make the creation of new ether tokens less energy-intensive by shifting the blockchain from proof-of-work validation of transactions to proof-of-stake. If it’s successful, the blockchain’s electricity requirements will fall by over 99%.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.