Jhaveri, who spent 13 years at KKR and was part of several marquee transactions, will help Piramal build on its strong foundation in the alternatives business.

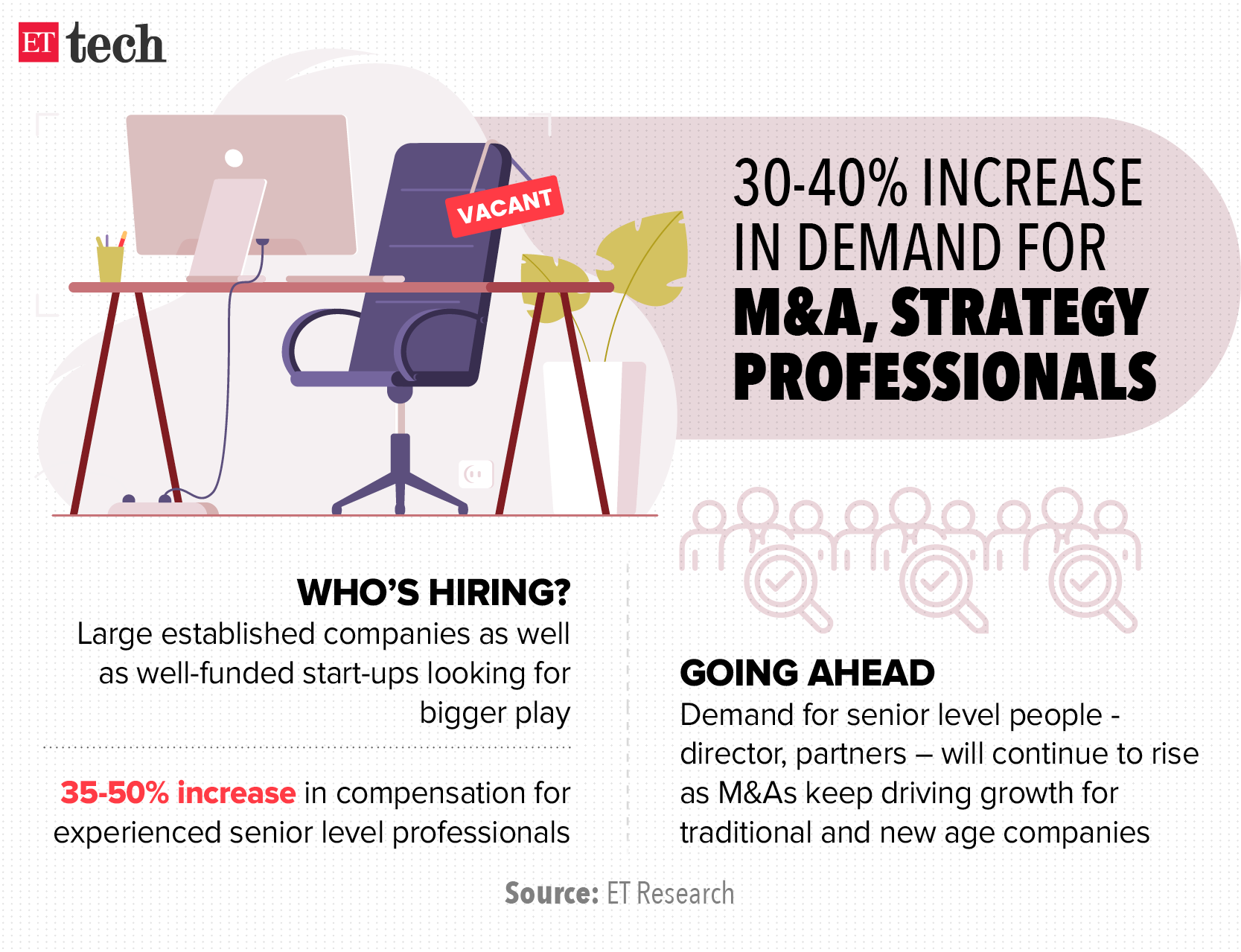

Like Jhaveri, more than two dozen finance professionals working with private equity or venture capital funds, investment banks, Big Four professional services firms and other corporates have taken up roles in companies that are aggressive in their inorganic growth plans in the last 6-12 months. Executive search firms said there is a 30-40% increase in demand for senior level professionals (directors and partners) in M&A and strategy roles at a time when the Covid-19 pandemic has accelerated disruption across sectors and large conglomerates as well as startups are responding to the changes through mergers, consolidations and new investments.

“There is a huge surge in demand for senior people in strategy, project management and M&A roles in the last six months – especially post waning of the second wave of the pandemic,” said Munira Loliwala, AVP- Engineering Staffing & RPO Solutions, Teamlease Digital.

Some of the recent moves include Puneet Renjhen, who from moved to Mahindra Group as head M&A from Avendus Capital, Pranay Shetty who joined Sharechat as head of corporate development from BNP Paribas, Niraj Sangharajka, who joined Allcargo Logistics from KPMG, Meetali Jain, head of corporate development at Cars24 who joined from Bank of America Merrill Lynch, Kunal Swarup who joined Zomato as head of corporate development from Kotak Investment Banking, Ashish Mukkirwar, who joined Glenmark Pharmaceuticals as Group VP Strategy from Moelis & Co, among others, according to data from execuitive search firm Native.

The speed-to-market strategy has led to M&A becoming one of the popular business strategies for corporate companies and is expected to gain momentum in the coming year.

-

“ETtech is a sharply-focused lens that brings alive India’s tech businesses & dynamic world of startups”

Kunal Bahl, Co-Founder & CEO, Snapdeal

-

“I read ETtech for in-depth stories on technology companies”

Ritesh Agarwal, Founder & CEO, Oyo

-

“I read ETtech to understand trends & the larger India technology space, everyday”

Deepinder Goyal, Co-founder & CEO, Zomato

ETtech

ETtech“There is a 30% increase in demand for such talent at the senior level,” said K Sudarshan, managing director, EMA Partners India. “Strategy professionals are always in demand but what we have seen in the last six months is a multifold increase in such mandates both from large established companies as well as from well-funded start-ups looking at bigger play,” he added. Companies are either poaching from each other or looking for experienced professionals in the field from the Big Fours (global consultancies), investment banks and corporate finance.

2021 has been a watershed year for the startup industry – not only in terms of record capital raised, but also the manner in which industry leaders shifted gears and accelerated their inorganic strategies. “With exponential growth in valuations and large inflow of capital, start-ups were able to leverage their cash and stock currencies to acquire other businesses for upfront-cash or stock swaps,” said Karan Sharma, executive director and cohead, Digital & Technology, Avendus Capital.

A recent report by Bain & Co stated that the nature of deal-making has changed from earlier years with executives making ‘scope’ deals—acquisitions outside a company’s core business – and ‘capability’ deals – acquiring a new capability. As many as 40% of deals this year fell in these categories.

“The heightened activity in the deal market has translated into a need for experienced professionals who have the capability and competency to bring in new business initiative and decode a roadmap ahead for new leads and investments,” said Loliwala.

While Piramal Enterprises scooped up DHFL Finance, BillDesk’s acquisition by PayU set the records ringing. Byju’s went on a massive acquisition spree to enter new segments like test prep, professional education and coding classes for kids. IPO bound players like Pharmeasy and Delhivery went shopping to bulk-up both financials and category additions, as they gear up to list in the next few months. To top this up, there were several Thrasio-like models that acquired upwards of 200 brands in the last year, which is a core roll-up strategy.

Companies are willing to loosen their purse strings to rope in top talent in the field leading to 35-50% increase in salaries at the senior level, said search experts.

“With M&As going to continue to drive the growth for most new and old economy companies even in 2022, the demand for advisory bankers across levels will continue well into the new year,” said Ruchi Thakkar, director-Capital Markets at Native, a leading executive search firm. “The talent for M&A experts is limited and there is a healthy churn amongst investment banks on poaching from peers especially at mid-levels,” she said, adding that the firm sees a selective trend of corporate development teams within corporates beefing up aggressively too.