Also in this letter:

■ Edtech unicorn Vedantu lays off 200 employees

■ Ola Cars CEO Arun Sirdeshmukh steps down

■ ETtech Opinion: The way we evaluate startups needs to change

After shrunken IPO, Delhivery to double down on expansion

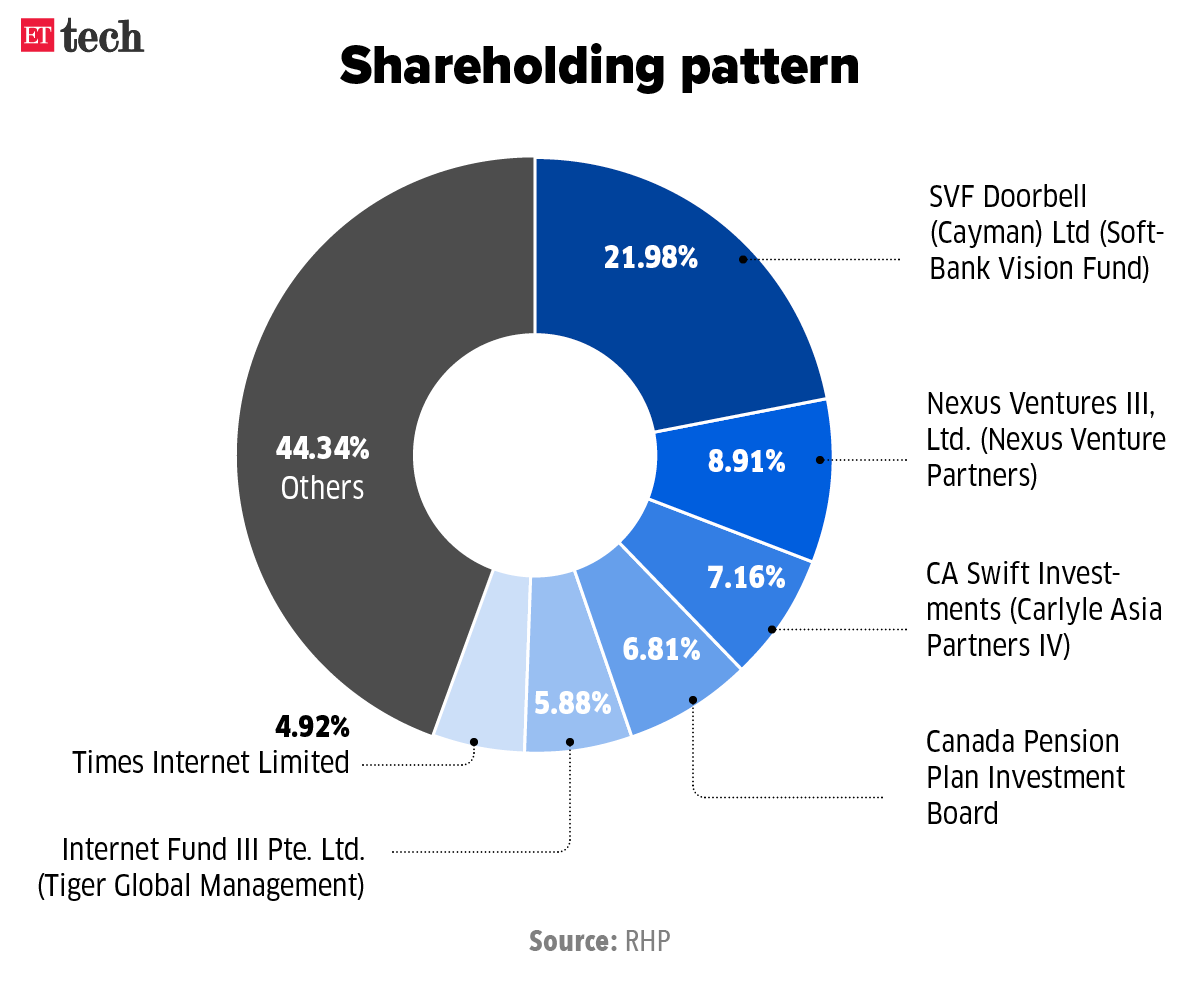

New-age logistics startup Delhivery has fixed a price band of Rs 462-487 a share for its Rs 5,235-crore initial public offering (IPO). The issue opens for subscription on May 11 and closes on May 13.

Also Read | ETtech IPO Watch: A decade of Delhivery

Delayed and downsized: Delhivery filed for its IPO last November and planned to launch it in March, but delayed the offering owing to choppy market conditions.

The company also slashed its offer size from Rs 7,460 crore to Rs 5,235 crore.

What’s the plan? The company will double down on expansion in India through organic and inorganic investments, its executive director and chief business officer Sandeep Barasia told us.

“Today, at Rs 5,000 crore of revenue for the first nine months of FY22, we are still at less than half a percent of the $300 billion market opportunity we have,” he said.

Delhivery plans to use Rs 2,000 crore from the IPO for organic expansion and another Rs 1,000 crore for inorganic growth through acquisitions and other initiatives. The rest of the proceeds will be for general corporate purposes, it said.

IPO details: Delhivery will issue fresh equity shares worth Rs 4,000 crore, while existing shareholders and promoters will offload shares worth Rs 1,235 crore in the offer for sale (OFS) component.

- The company has allocated shares worth Rs 20 crore to eligible employees, who will get a discount of Rs 25 a share during the bidding process.

- Investors will be able to bid for shares in multiples of 30.

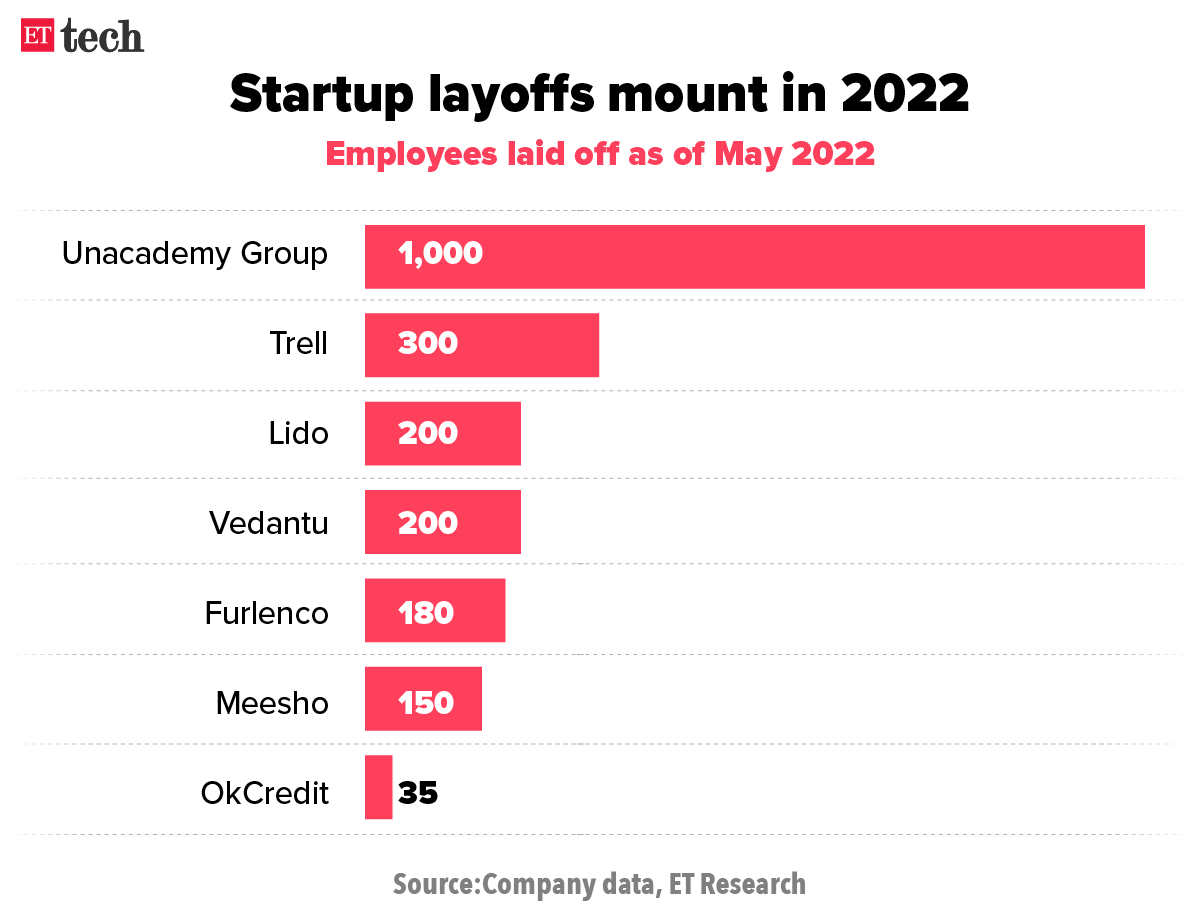

Edtech unicorn Vedantu lays off 200 employees amid dry spell

Online tutoring platform Vedantu is the latest startup to cut staff in an attempt to reduce costs as late-stage funding dries up.

The company has laid off about 120 contractual workers and 80 full-time employees. Almost all were from the company’s academic teams, working as assistant teachers.

Cutting costs by all means: The company recently slashed the cost of its courses to manage falling demand for online education as offline learning centres reopen.

It is also leveraging technology to reduce overall costs, which is also one of the reasons for the restructuring exercise, the company said.

Layoff season: On April 28, we reported that more than 1,800 contractual and full-time employees have been fired from various startups as investors begin to ask high-growth companies to go back to basics — chasing profits and reducing cash burn. Companies that have laid off employees over the past month include:

- Edtech firm Unacademy

- Social commerce startups Meesho and Trell

- Online learning platform Lido Learning

- Furniture rental startup Furlenco

More to come: As investors step up their diligence amid a softening of public market valuations, many late-stage rounds have been delayed, increasing pressure on late-stage companies to reduce their burn rate.

Industry experts said if these startups fail to raise new rounds, there could be more layoffs on the horizon.

Tweet of the day

Ola Cars CEO Arun Sirdeshmukh steps down

Arun Sirdeshmukh, the CEO of Ola Cars, has resigned, according to multiple sources familiar with the matter. Sirdeshmukh’s departure comes after the company’s chief financial officer GR Arun Kumar was promoted to a new position at the ride-hailing company.

We reported Kumar’s elevation on April 12.

Quote: “Our group CFO Arun Kumar GR now has an expanded role managing day to day operations,” said an Ola spokesperson over email. This includes overseeing the go-to-market (GTM) function, which Sirdeshmukh was heading, Ola said.

Timing: His departure comes at a time when Ola has been trying to broaden its business beyond ride-hailing, which still accounts for more than 90% of its income. Ola Cars, Ola Foods, Ola Dash and Ola Money are all ways for Ola to market itself as a ‘super app’ ahead of its IPO.

ETtech Opinion: The way we evaluate startups needs to change

We all believe that successful financing is proof that everything is going well with a company. This needs to change.

There has been plenty of news lately about corporate governance issues at a few high-profile startups. Social media is full of views on whose responsibility it is to run the governance function. As Info Edge founder Sanjeev Bikchandani said, maintaining the highest degree of governance and transparency is the fundamental responsibility of founders. At startups, the culture of the company is that of the founders.

Startups raise venture capital on a regular basis. In addition to providing capital, VC firms also attach their credentials to the company they invest in. In these times, the amount of money and the brand name that invests in the company is seen as a measure of success on all parameters, including that the company is well-run.

Hence, VCs must share the responsibility of ensuring good corporate governance at their companies – even more so when many VCs position themselves as company builders and not just asset managers. By lending their names to unknown companies, they signal not only that the company has huge potential but also that it has sound governance and transparency.

Click here to read the full column by Subramanya SV, cofounder and CEO of Fisdom

Musk bags $7.1 billion in new financing for Twitter

Elon Musk has secured about $7.1 billion of new financing commitments for his proposed $44 billion takeover of Twitter, winning the backing of some of the world’s largest investors.

Such as? The investors named in the filing on Thursday include crypto exchange Binance, Brookfield, Fidelity Management & Research, and Qatar Holding.

- Saudi Prince Alwaleed bin Talal, one of Twitter’s largest backers, has agreed to roll over his current investment. He previously rejected Musk’s bid, saying it failed to come “close to the intrinsic value of Twitter”.

- Musk has also won the support of fellow entrepreneur and Oracle cofounder Larry Ellison, who has a big stake in Tesla and a seat on its board. Ellison’s trust has committed $1 billion to finance Musk’s takeover.

Twitter courts advertisers: Meanwhile, Twitter faced a sceptical audience as it showcased its advertising opportunities at an event in New York City, three ad agency executives told Reuters, as its plans under Musk remain unclear.

The Tesla chief executive has tweeted that the platform should not have ads so it can have more control over its content moderation policies.

Most advertisers have not pulled back ad dollars from Twitter, but are watching closely to see how Musk could change the platform and its business, the ad executives said.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.