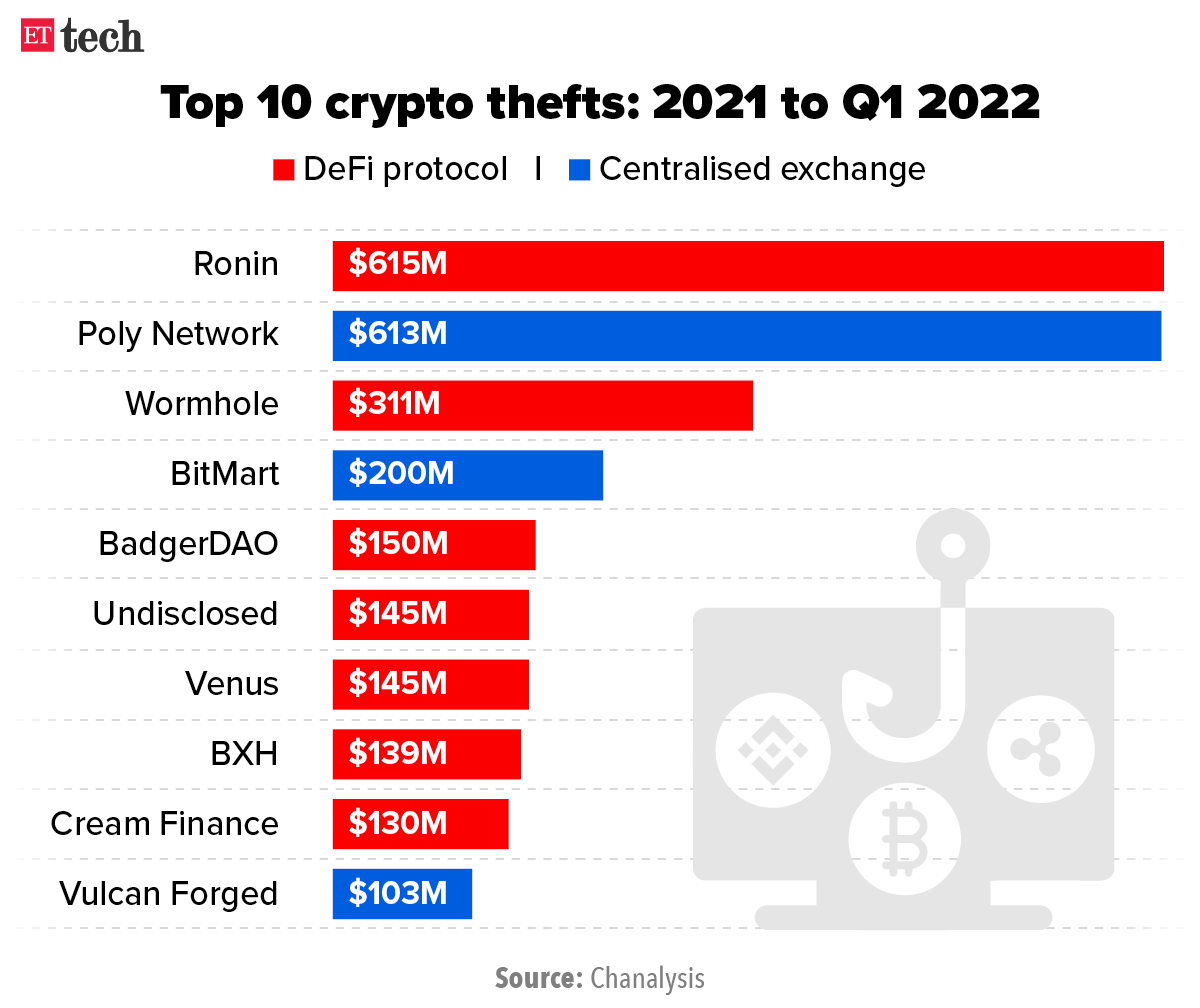

At this rate, digital crooks are on track to steal crypto worth $5.2 billion in 2022, after swiping $3.2 billion in 2021.

And with DeFi emerging as their top target, you can expect these platforms to be under intense bombardment for the rest of the year and beyond.

What’s DeFi? Decentralised finance refers to blockchain applications that cut out middlemen from financial products and services such as loans, savings and swaps. Rather than trust a middleman like a bank or fintech firm with their money, people trust “the code”. DeFi essentially uses blockchain technology to unlock value that traditional finance cannot. It comes with high rewards but also carries plenty of risks.

Read more | Explained: How DeFi could one day liberate finance

Bug hunters: Many cryptocurrency “hacks” are actually the result of simple security breaches in which hackers gain access to victims’ private keys. That’s more like picking someone’s pocket than doing any actual, you know, hacking.

The largest DeFi thefts, on the other hand, are due to more sophisticated attacks that target specific bugs in software that hackers spend hours poring over. Their job is made easier by DeFi’s faith in decentralisation and transparency, which means most such apps are open source.

Since DeFi protocols move funds around without a central authority, it’s important for users to be able to check the underlying code so they can trust the protocol.

But hackers exploit this openness, scouring scripts for vulnerabilities and turning DeFi’s biggest strength upon itself.

Following the money: DeFi is still in its infancy but has grown rapidly over the past couple of years. The sector currently has over $210 billion in digital assets flowing through its veins, according to data collected by DeFi Llama.

In June 2020, that number was around $1 billion.

Hackers have caught on just as quickly. Chainalysis’s report showed that seven of the 10 largest crypto thefts from January 2021 to March 2022 involved DeFi protocols. Just three targeted centralised exchanges.

How is it laundered? According to Chainalysis, a larger share of stolen funds flowed to DeFi platforms (51%) in 2021 than ever before.

It said centralised exchanges, once the top destination of stolen funds, have been falling out of favour of late, receiving less than 15% of the total.

This, it said, was probably because more centralised crypto exchanges now have know-your-customer and anti-money laundering processes, which threaten the anonymity of cybercriminals.

Open source DeFi platforms, on the other hand, actively shun these processes – and all other middlemen – and are thus likely to remain the top target of crypto crooks for the foreseeable future.

Written by Zaheer Merchant in Mumbai.

Other Top Stories By Our Reporters

What’s new in ecommerce

Amazon acquires Glowroad to boost social commerce ambitions: Amazon India has acquired women-focussed social commerce startup Glowroad in an all-cash deal, sources told us. This is the first inorganic bet that Amazon is taking on the social commerce space where sellers use platforms like Whatsapp and Facebook to sell their wares.

How Reliance is bulking up on women’s innerwear segment through acquisitions: On March 20, Reliance Retail said it had acquired 89% in online lingerie retailer Clovia. That was its third acquisition in the space in the past two years, after Zivame and Amante.

But why? Women’s apparel contributes about 37% to the overall apparel market and is expected to grow to $39 billion by FY25 from $25 billion in FY20, according to research firm Wazir Advisors. Innerwear is likely to drive this growth. In 2021, the innerwear segment was estimated at around $4.4 billion. This is likely to reach $8.5 billion FY25, Wazir Advisors estimates.

Nykaa makes strategic investments in Earth Rhythm, Nudge Wellness and Kica Active: Nykaa, the listed beauty and personal care company, said it has made strategic investments in brands across categories such as clean beauty, athleisure and neutri-cosmetics. In a stock exchange filing, the company said it has acquired 18.51% of Earth Rhythm, a clean beauty and personal care cosmetics brand, for Rs 41.65 crore, and 60% of Nudge Wellness, dietary supplement and nutricosmetics products maker, for Rs 3.6 crore.

Industry wants government to fix small etail’s GST compliance problem

From the EV corner

Govt asks EV firms to voluntarily recall defective vehicles: The centre has asked electric vehicle manufacturers to voluntarily recall defective two-wheelers.

In a series of tweets, Road Transport Minister Nitin Gadkari said, “Companies may take advance action to Recall all defective batches of vehicles immediately.” He said that an expert committee was constituted to enquire into these incidents and make recommendations on remedial steps.

Ola Electric says there was no scooter malfunction in recent Guwahati accident: Ola Electric said a recent accident involving one of its electric scooters in Guwahati, Assam that left the rider seriously injured was not caused by a malfunction in the scooter. On April 15, the person’s father claimed on Twitter that the scooter accelerated when the rider tried braking, leading to the accident.

EV battery explosion kills man, injures two others in Nizamabad: The battery of a Pure EV electric scooter burst in a home in Nizamabad town on Tuesday night, killing an 80-year-old man and injuring his wife and grandson. A case has been registered against Pure EV.

EV makers, related firms on a hiring spree: Electric vehicles and related companies are on a hiring spree, ramping up their teams across domains amid rapid capacity expansion and setting up of new plants to meet rising demand for EVs. Hiring in the sector is likely to grow by 20-25% in the next 6-12 months.

Fintech and cryptoverse

RBI ups scrutiny on fintechs as it issues payments aggregator licences: Online payment gateways including Cashfree and MobiKwik have come under the scanner of the Reserve Bank of India (RBI), multiple people aware of the development said. These fintech players face a possible rejection of their payment aggregator licence applications, the people told ET.

Zerodha clocks 60% yearly jump in revenue, profit: Zerodha, India’s largest retail stock brokerage firm, continues its profit-making spree. In an exclusive chat with ET, Zerodha’s founder and chief executive, Nithin Kamath, said the company has exited FY22 with revenue of roughly Rs 4,300 crore and a profit of Rs 1,800 crore.

Shunned by banks and payment firms, crypto exchanges turn to P2P transactions: Many crypto exchanges are facilitating peer-to-peer (P2P) deals while some are directly accepting deposits from coin buyers to bypass curbs imposed by banks and payment companies.

Also Read | Crypto investors may switch to peer-to-peer transfer in case of ban

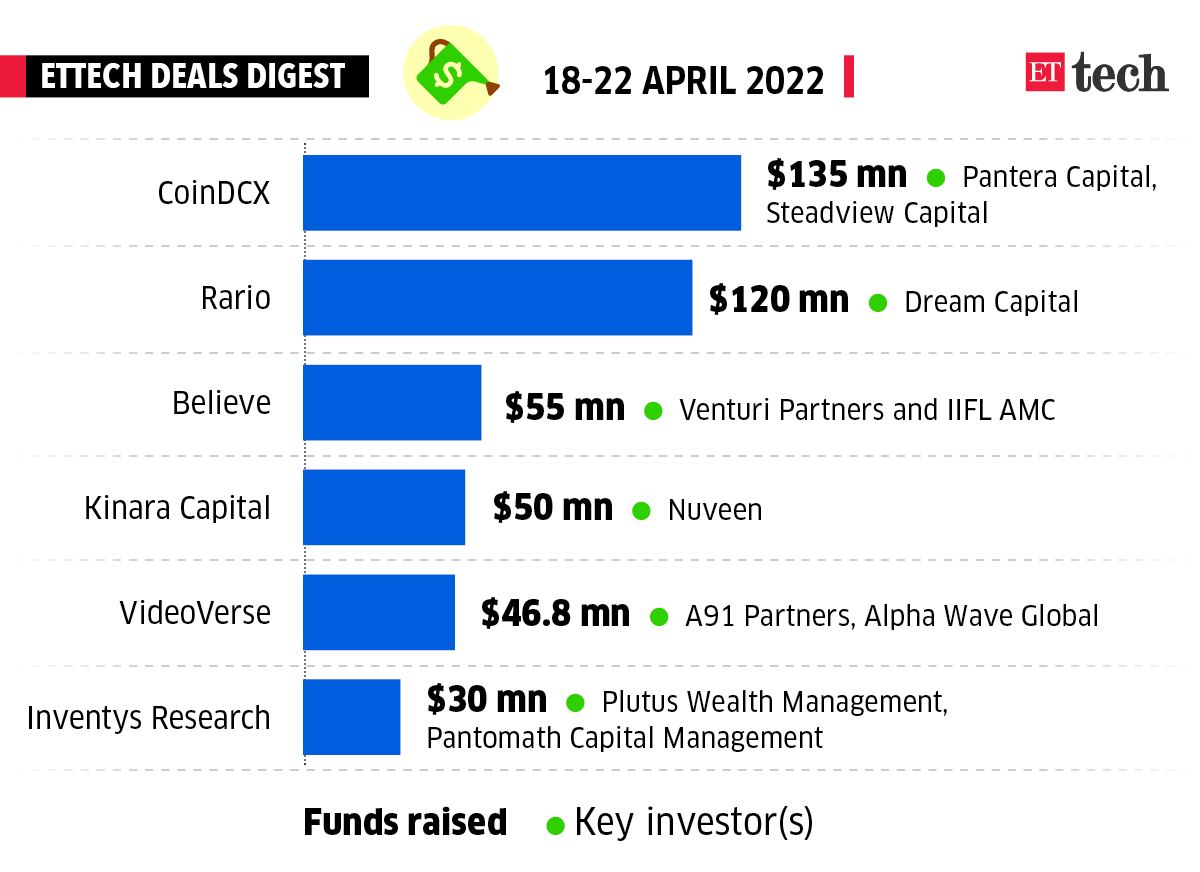

CoinDCX raises $135 million, doubles valuation to $2.15 billion: Crypto trading exchange CoinDCX has raised $135.9 million (about Rs 1,000 crore) from investors led by Pantera Capital and Steadview Capital, doubling its valuation to $2.15 billion in less than a year to make it the highest-valued crypto trading platform in India.

IT services wrap

Will revisit FY23 outlook as things become clearer through the year, says Infosys CEO: Global demand for technology services “looks very good” with no impact as yet from geopolitical issues, Infosys chief executive and managing director Salil Parekh told us in an interview. Buoyed by the “robust deal pipeline” India’s second-largest software exporter expects to grow at a fast clip, having forecast revenue expansion of 13-15 % for the year, its “strongest guidance in a long time,” Parekh said.

Mindtree, Larsen & Toubro Infotech chase deals together, say CEOs: Mindtree and Larsen & Toubro Infotech (LTI), group companies of L&T, have been collaborating with each other as they chase big deals, the chief executives of both firms told us. Debashis Chatterjee is the CEO of Mindtree, while Sanjay Jalona heads LTI. Sources also told ET that merger talks between the companies are at an advanced stage, though a timeline has not been finalised yet.

HCL Tech Q4 Results: Net profit zooms 226% to Rs 3,593 crore: HCL Technologies on Thursday said its consolidated net profits for the quarter ending March stood at Rs 3,593 crore, up 226% from Rs 1,102 crore in the same quarter last year. The profit jump is due to much higher tax expenses in the base quarter. The adjusted growth in profit is 23.9 per cent year on year (YoY), the company said.

LTI net profit up 4.1% qoq in Q4, misses analyst expectations: L&T Technology Services’s consolidated net profit for the March-ended quarter rose 35% year-on-year to Rs 262 crore on strong operational performance. The company’s revenue rose 22% on year to Rs 1,756 crore as all verticals clocked double-digit growth. On a sequential basis, net profit rose 5% while revenue grew 4%.

Zomato launches 10-min food delivery in Gurugram

Logistics wars: A new battle has begun between the country’s three largest ecommerce focused logistics firms and new-age logistics aggregators. Delhivery, Ecom Express and Xpressbees have simultaneously increased shipment charges by as much as 35-40% for orders received via online logistics aggregators such as Shiprocket, Pickrr, Shipyaari and others, said people with knowledge of the development.

ETtech Done Deals

■ Cricket non-fungible token (NFT) platform Rario has raised $120 million in a round led by Dream Capital, the corporate venture capital and M&A arm of Dream Sports.

■ Mattress maker Peps Industries is in talks with Rajeev Gupta-led Arpwood Capital for a complete sale of the company, valuing it between $130 million and $150 million, said three people with knowledge of the company’s plan.

■ Restaurant management platform UrbanPiper raised $24 million in a new funding round led by existing investors Sequoia Capital India and Tiger Global, and food aggregator majors, Swiggy and Zomato. This is the first time both these food-delivery majors have invested together in a startup.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.