Also in this letter:

■ Binance’s venture arm closes $500 million crypto fund

■ Aditya Birla Group enters ecomm roll-up space

■ Slack launches in India, to help firms set up ‘digital HQs’

Cuemath, Slice and MoEngage raise big rounds amid funding winter

Three Indian startups announced what in today’s climate are large(ish) deals – a rarity in the ongoing funding winter.

MoEngage: Customer engagement platform MoEngage said today that it has raised $77 million in Series E funding, led by Goldman Sachs Asset Management and B Capital, with participation from the company’s existing investors Steadview Capital, Multiples Alternate Asset Management, Eight Roads Ventures, and Matrix Partners India. This is Goldman Sachs Asset Management’s first investment in an Indian SaaS company.

Cuemath: The math tutoring startup has raised $57 million in a round led by US-based Alpha Wave Global at a valuation of $407 million. This, it claims, is twice the valuation it commanded in its last funding round in December 2020.

The company plans to use the funding to strengthen its product outcomes and for acquisitions and partnerships.

It operates in more than 70 countries and plans to increase this to over 100 countries by FY2023.

Slice: The card-based lending and payment solutions provider has raised $50 million as part of new fundraise led by existing investor Tiger Global. Japan-based GMO Venture Partners has come in as a new investor.

Slice is looking to extend the financing round and raise at least another $50 million amid a wider slowdown in large funding deals. While the ongoing fundraise has not yet closed, it is expected to value Slice at over $1.5 billion, sources told us.

The fintech firm became a unicorn after raising $220 million last November from Tiger Global and Insight Partners.

Meanwhile, Bengaluru-based Bellatrix Aerospace has concluded an $8 million funding round led by BASF Venture Capital GmbH, and early-stage VC Inflexor Ventures.

Freeze sets in: On Monday, Reuters reported that Mohalla Tech, ShareChat’s parent company, has raised nearly $300 million in fresh funding from Google and others.

But such deals for Indian startups, which were almost commonplace in 2021, have become scarce in 2022.

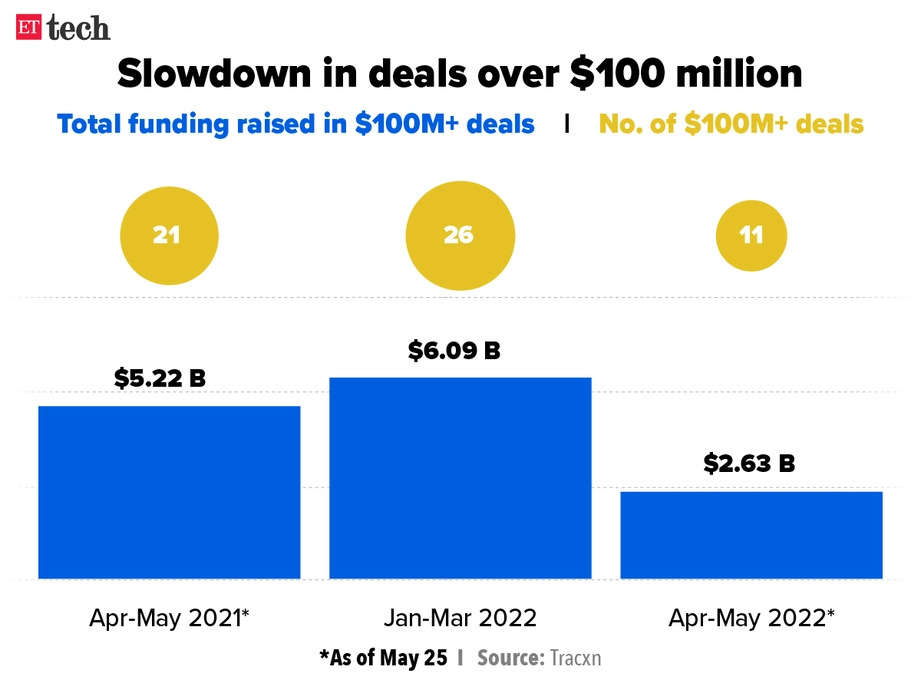

We reported on Monday that big-ticket funding rounds have suffered a huge blow in the past two months.

From April to May 16, there were only nine funding rounds of more than $100 million, totalling a little over $2 billion. There were 27 such deals in January-March, according to data sourced from New York-based analytics platform CB Insights.

Binance’s venture arm closes $500 million crypto fund

Binance Labs, the venture capital and incubation arm of crypto exchange Binance, has closed a $500 million fund from investors such as DST Global, Breyer Capital and others.

The new fund will invest in projects that aim to extend the use cases of cryptocurrencies and increase the adoption of Web3 and blockchain technology.

Quote: “The goal of the newly closed investment fund is to discover and support projects and founders with the potential to build and to lead Web3 across DeFi, NFTs, gaming, Metaverse, social, and more,” said Changpeng Zhao, founder and CEO of Binance.

Launched in 2018, Binance Labs has incubated over 100 crypto projects from more than 25 countries. Its portfolio includes popular projects like Polygon and Axie Infinity.

Big on crypto: Just a few days ago, VC giant Andreessen Horowitz had also announced a $4.5 billion crypto fund, signalling strong demand for digital currencies among investors despite the recent Terra crash.

Global crypto rules for banks: Meanwhile, global regulators announced they’re working on completing details regarding how much capital banks should hold to cover crypto assets. The new rules could see stablecoins and other tokens be treated like bonds, deposits and commodities.

India still waits for crypto rules: Back home, it looks like the crypto industry will have to wait a long time for regulations.

On Monday, we reported that the union government is planning a fresh consultation paper on cryptocurrencies soon, though a law on the digital assets is likely to take time, according to secretary of economic affairs Ajay Seth.

Last December, the government listed a cryptocurrency bill during the winter session of Parliament but it was not introduced.

In the budget for 2022-23, it imposed a 30% tax on gains made from virtual digital assets, along with a 1% tax deducted at source on all crypto transactions. It later clarified that taxation did not mean legalisation.

Aditya Birla enters crowded ecomm roll-up space with Tmrw

The Aditya Birla Group has announced the launch of its new ‘house of brands’ entity, Tmrw. Over the next three years, it will acquire and incubate more than 30 brands in the fashion and lifestyle segment.

The group has appointed former Facebook, Bain and Kalaari Capital executive Prashanth Aluru as cofounder and CEO of Tmrw. It said it would leverage the networks of Aditya Birla Group and Aditya Birla Fashion and Retail Ltd to build the venture.

Quote: “The formal launch of our D2C (direct-to-consumer) business, Tmrw, is a key milestone for the company. This venture has the potential to become a significant growth engine by tapping into the new wave of entrepreneurial energy in India,” said Ashish Dikshit, MD of Aditya Birla Fashion and Retail Ltd.

Crowded house: Tmrw will be entering an already crowded ecommerce roll-up space in India. On Tuesday we reported that Mensa Brands, founded by former Myntra CEO Ananth Narayanan, is aggressively expanding into international markets including the US, Middle East and Canada.

But Mensa’s trajectory differs from that of most of its peers, all of which received huge sums from investors in 2021.

While these companies started out with the same objective and similar funding rounds, well-funded ones such as Mensa and Globalbees have cornered a substantial chunk of investments and acquired a plethora of brands, as we reported on April 20. This has left smaller players such as Upscalio, Goat, 10Club, Powerhouse91, Evenflow and Bzaar struggling to catch up.

Slack officially launches in India, to help firms set up ‘digital HQs’

Workplace communication app Slack has officially entered India, with the aim of helping companies smoothly manage operations amid growing adoption of a hybrid working model.

Strong India presence: India is one of Slack’s top 10 markets for paid teams globally. The company has been operating in the country for the past four years and has a product engineering team in Pune.

Startups like Zomato, Dreamsports, Razorpay and Meesho among its prominent clients in the country.

Quote: “We have a significant footprint in big global tech companies with a major presence in India, like IBM, Amazon, Oracle, and Intuit. India is also a major focus for Slack due to the presence of large systems integrators like Wipro and TCS,” said Rahul Sharma, country manager, Slack India.

Tweet of the day

Salesforce forecasts strong profit, brushes aside inflation concerns

Cloud software giant Salesforce revised its full-year profit guidance to $4.75 a share from the previous forecast of $4.63, on the back of soaring demand for its services.

The company reported a 24% rise in its first quarter revenues to $7.41 billion. Net income declined to $28 million from $469 million in the same quarter last year.

No pressure: Despite an uncertain macroeconomic environment and rising inflation, Salesforce remains confident due to a rising demand from companies amid increased adoption of hybrid working models.

“Macroeconomic or geopolitical headwinds may show up sooner or later, but Salesforce is well positioned to capitalise on enterprise spending on digital transformatio, and the company has a fairly resilient model,” SMBC Nikko Securities analyst Steven Koenig said.

Shares of the company soared 8% in extended trading, after plunging 37% earlier this year.

Also read: Facebook’s parent company to change stock ticker to META on June 9

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.