Also in this letter:

- Implications of India’s tax rules for crypto

- Digital-first mindset steers education reforms

- Govt’s digital push to drive big business for startups

Crypto industry hails validation but rues 30% tax rate

For an instant, euphoria took over crypto companies and investors during Finance Minister Nirmala Sitharaman’s budget speech on Tuesday. Then came the fine print and clarifications, and reality set in.

“Taxing does not automatically bring legitimacy,” the finance minister said during a media interaction after her budget speech.

Here’s the TL;DR on crypto:

- A 30% tax on income from crypto assets.

- Losses can not be set off against any other income.

- 1% TDS on all crypto transactions above a certain threshold.

- Gift taxes, if any, will be the liability of the recipient.

- RBI-backed ‘digital rupee’ to be launched in FY23.

That said, this was the first time the budget explicitly defined “virtual digital assets”. Non fungible tokens (NFTs), which we have written about extensively, also got a mention. The industry has come a long way from just a few years ago when it was facing down a proposal to imprison anyone holding cryptocurrency for up to 10 years.

- The government has defined “virtual digital asset” to mean any information, code, number or token, generated through cryptographic means or otherwise, that provides a digital representation of value, or functions as a store of value or a unit of account, and can be transferred, stored or traded electronically.

What does this all mean? It is clear that tax guidelines issued by the FM for virtual digital assets came with a clear objective – earning revenue from the fast-growing industry. According to news reports, the turnover of some crypto exchanges is upwards of Rs 1 lakh crore so it’s no surprise they have caught the taxman’s attention.

Taxes like gambling: To give you some context, crypto profits will be taxed at double the rate of short-term gains from stocks, and at par with income from lotteries (31.2%).

While some in the crypto industry believe official recognition will bring in millions of users, including institutional investors who have been on the fence so far, others say the high tax rate could deter traders and cause them to flee Indian crypto exchanges.

What’s still unclear: Here’s what we still don’t know, among other things.

- Whether gains from one crypto can be offset against losses from another.

- Rules around transferring crypto to exchanges or private wallets registered in another country.

- Whether traders can hold crypto as stock in trade.

- How crypto-to-crypto trades will be treated.

ETtech Opinion: Implications of India’s tax rules for crypto

Sumit Gupta, Cofounder, CEO CoinDCX

The Finance Minister presented a budget that was progressive and futuristic, highlighting India’s focus on digital innovation and promoting blockchain technology. The budget touched on key points that will help the industry create powerful and sustained growth.

Introducing a central bank digital currency (CBDC) is a strong move, and sends a clear message that India wants to be digital-first, efficiency-driven, and transparency-led.

The taxation of virtual digital assets – ie, crypto – is also a step in the right direction. It gives much-needed clarity and confidence to the industry.

However, it is a case of two steps forward and one step back.

While taxation brings legitimacy to the industry, the high tax rate is discouraging. The finance minister said that income from crypto-related transactions will be taxed at 30%, on par with tax on gains from speculative activities such as lotteries, gambling and other gaming activities.

Crypto is an asset class and an investment product. Trading crypto requires specific skills and cannot be compared to gambling. The tax rate should have at least been the same as it is for other asset classes. The proposed 30% tax may hamper wider adoption.

Click here to read the full column by Sumit Gupta, cofounder and CEO of CoinDCX.

Got a minute?

ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

ETtech Opinion: Digital-first mindset steers education reforms

Byju Raveendran

Union Budget 2022-23 delivers strongly on the market expectations of a capital expenditure push to help India emerge from the shocks of the three Covid waves in the last two years.

The increase in outlay for capex by 35.4% will have a positive, cascading effect on the economy. Most of the additional capex will go towards the development of physical and social infrastructure in the country.

This is bound to boost private sector investment through a crowd-in effect. At the macro level, the budget numbers reflect a strong revival in the economy with good tax buoyancy. The fiscal deficit projection for next year at 6.4% of a much larger nominal GDP base indicates that the government can proceed as planned with the development and investment in social infrastructure, particularly education.

This Budget has many positives for the education sector. There has been a substantial increase in allocation for education in this Budget, with many policy announcements that will make learning more accessible, equitable and affordable in India.

The Ministry of Education has been allocated Rs 104,277 crore for 2022-23, which is a welcome and timely jump of about 12% over the previous year. What impresses me the most is that the government has approached its schemes with a digital-first mindset, which is the surest way to capitalise on India’s demographic dividend.

Click here for the full column by Byju Raveendran, CEO of Byju’s

Govt’s digital push to drive big business for startups

Technology startups focused on areas such as drones, space imagery and artificial intelligence will likely be among the biggest beneficiaries of Budget 2022.

Finance Minister Nirmala Sitharaman on Tuesday proposed several initiatives, centred around technology, to boost a range of sectors such as agriculture, education, mental health and logistics, and for bolstering small and medium enterprises.

IT industry body Nasscom said the budget bet big on technology and would help turn this into India’s technology decade, or “techade”.

Rajesh Gopinathan, managing director at Tata Consultancy Services (TCS), said the budget provided many growth opportunities for the technology industry across sectors such as railways, healthcare, education and financial services, which would accelerate India’s growth.

“The decision to introduce e-passports will further streamline the overall citizen experience, enhance security, and facilitate smoother international travel,” he said.

The government also announced a big push for drones. Startups will be encouraged to facilitate drone usage through varied applications, including drones as a service. The FM said the government would also promote the use of drones by farmers for land surveying, spraying of insecticides and digitisation of land records.

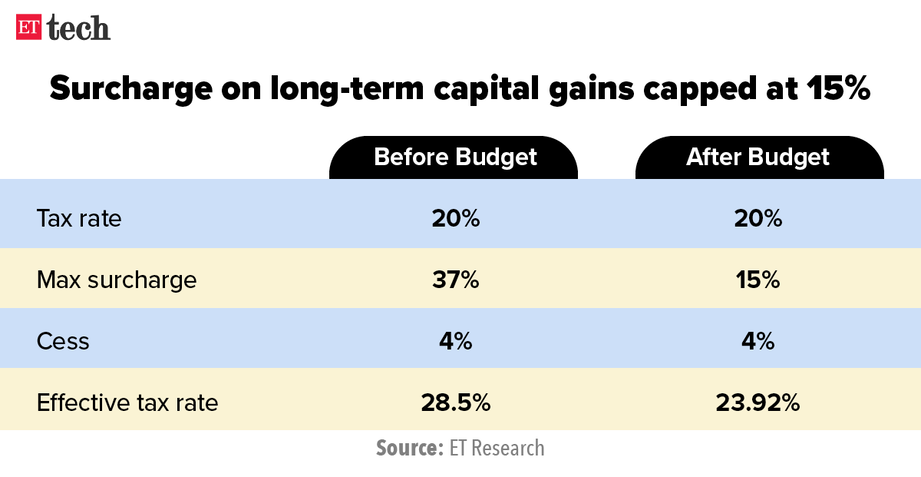

Startup founders, investors to benefit from 15% cap on tax surcharge

The surcharge on long-term capital gains (LTCG) tax has been capped at 15% for all listed and unlisted companies, Finance Minister Nirmala Sitharaman said in her budget speech.

This addresses a long-standing demand of new-age companies, which wanted share sales of unlisted firms to be taxed at par with those of listed ones. To be sure, only the surcharge levied on unlisted share sales has been reduced – from 37.5% to 15%. The tax rate remains unchanged at 20%.

Tax burden down 16%: Industry executives told ET this change would not only cover employee stock option sales but all transactions by privately-funded startups, reducing their tax burden by around 16%.

What else? The government also extended the tax incentives it offers to new startups for the first three years of their incorporation to four years, taking the pandemic-induced fiscal pain into account.

Sitharaman also said an expert committee would be set up to examine and suggest appropriate measures to boost venture capital and private equity investments in startups.

EV firms cheer as FM announces battery swapping policy

To increase the adoption of electric vehicles, the government will release a policy for battery swapping this year, the finance minister said, one that brings in standardisation and interoperability.

What’s that? Battery swapping or battery-as-a-service allows customers to lease batteries as a separate component of the car. Customers can remove the discharged battery and replace it with a fully charged one. Battery leasing can help EV owners save costs and also address range issues.

‘Interoperability’ here means that batteries built by one company should work with not just their own vehicles but those of other EV manufacturers as well.

EV sector stakeholders welcomed the move. Vivekanda Hallekere, cofounder and CEO at Bengaluru-based Bounce, said, “Government bodies have been working on interoperability standards. This announcement is likely to accelerate the process. We have been working with the government for the past year. We have also brought other manufacturers on board and we have all agreed on certain things.”

A lack of interoperability “would be like having a separate petrol pump for Maruti and Hyundai vehicles,” said Kunal Khattar, who heads the VC fund Advantedge, which focuses on investing in mobility startups.

The announcement of a battery swapping policy is also likely to boost the setting up of charging stations for electric vehicles through subsidies and incentives.

What else? The FM also said the government will give out $6 billion in incentives to companies to build clean vehicles and produce batteries locally. It plans for electric cars to make up 30% of total private cars sales by 2030, and for electric bikes and scooters to make up 40% of total two-wheeler sales by then.

Other Top Stories By Our Reporters

Budget 2022: ‘Infra status to data centers may spur Rs 70,000-72,000 crore investments over five-ten years’: The finance minister granted infrastructure status to the data center industry while announcing the Budget 2022-23 on Tuesday — a decision which has been welcomed by the industry. (read more)

Budget 2022: Tech industry disappointed over lack of clarity on WFH incentives: Nasscom: Even though the Union Budget 2022-23 provided a massive push to digitization, the technology industry was disappointed by lack of clarity on the interpretation of “work from home” exemptions under section 10AA of the Income Tax Acts as well as taxation and Esop related issues of the startup ecosystem which remain unaddressed. (read more)

Budget 2022: Govt to set up 75 digital banking units in 75 districts: Finance Minister Nirmala Sitharaman said that in recent years, digital banking, digital payments and fintech have grown rapidly in India. She said the government has been encouraging them to ensure that the benefits of digital banking reach every corner of the country in a consumer-friendly manner. (read more)

■ Free Covid Tests Provide Latest Venue for Suspected Fraudsters (Bloomberg)

■ How Facebook Is Morphing Into Meta (NYT)

■ Chats are the new letters. Here’s how to preserve them accordingly (Washington Post)

Today’s ETtech Morning Dispatch was curated by Aditya Rangroo in New Delhi and Zaheer Merchant in Mumbai.