Also in this letter:

■ Ahead of board meeting, Zilingo founders offer to buy firm

■ Startups tweak compensation structure, Esops amid downturn

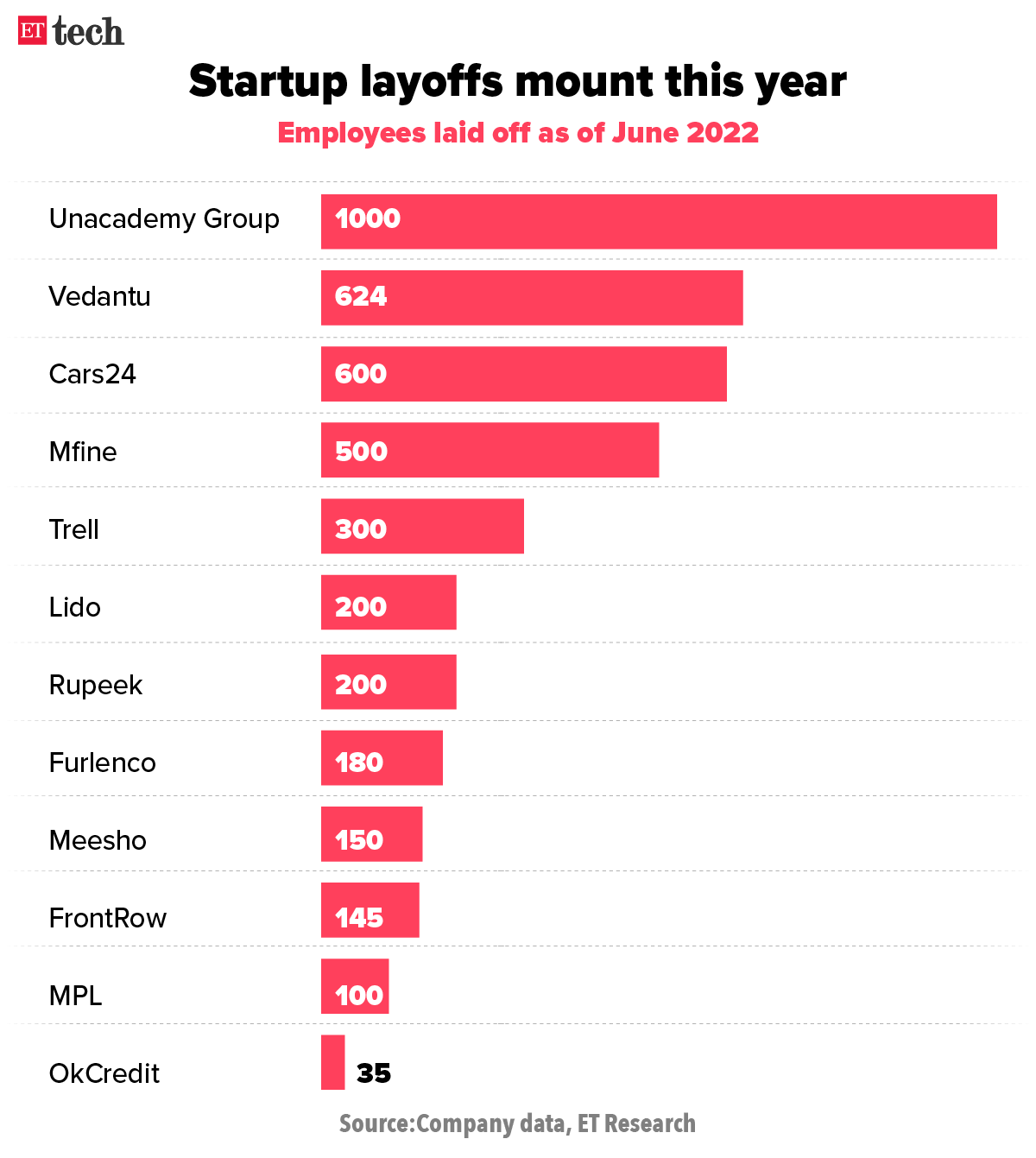

■ Citymall lays off 191 workers, three months after raising $75M

Indian crypto investors who succumbed to FOMO are being tested

Indian crypto investors remain under stress, anticipating that the worst may be yet to come.

Driving the FUD: The crypto market has recorded one of the worst crashes in its short history over the past fortnight, wiping off a few hundred crores of Indian investors’ money.

The world’s most popular digital currency, bitcoin, fell below $20,000 and even touched $18,000 on Saturday, its lowest level since December 2020.

After hitting an all-time high of $68,789.63 in November 2021, Bitcoin has lost more than 70% of its value.

The second-largest crypto asset by value, Ethereum, fell below $1,000 for the first time since January 2021.

FOMO bites back: As the bears’ grip on the market tightens, Indian investors who succumbed to FOMO (fear of missing out) and invested in crypto assets are faced with a choice—hang in for years to (hopefully) recoup their money or quit with heavy losses.

“I was caught in the crypto mania last year after some coins had given great returns in just a few months. I was a short-term investor, but with deep losses now I have no option but to be a long-term investor,” said Delhi-based Gopala Somani, a retail investor.

Hold on tight: Worried Indian investors are bracing for more shocks.

“We’re in an extensive bear market after almost 5 years. Almost everyone experiencing it for the first time is extremely paranoid and is trying to catch the bottom. Most altcoins won’t survive this, but those holding bitcoin will be rewarded for their patience in the coming years,” said Chahal Verma, a Gurgaon-based retail investor.

30% tax on crypto for employees: Companies will have to pay 30% tax on crypto assets they offer employees as compensation or otherwise.

This is among several detailed clarifications the government is expected to issue this week on the tax on virtual digital assets announced in the budget, officials told us.

Ahead of board meeting, Zilingo founders offer to buy company

Ahead of a crucial board meeting on Monday, which may decide the fate of Singapore’s troubled business to business (B2B) fashion startup Zilingo, Ankiti Bose, the ousted CEO of the company, has endorsed a proposal by estranged cofounder Dhurv Kapoor to prevent the firm from being liquidated.

The offer: In an email sent by Kapoor and endorsed by Bose, the two proposed to pay up $48 million in outstanding debt and infuse additional $8 million in fresh equity into the company.

The proposal didn’t mention if Bose would be back at the firm if an agreement was reached. Bose, Kapoor and the management of Zilingo hold about 25% in the firm.

“No matter what our differences may be, at the end of the day we started this company with the same goal. Today we have come together to fight for that same goal,” Kapoor said in the note.

Bose, who was ousted as CEO on May 20, responded to Kapoor’s email, saying she endorsed the proposal and urged the board to see “beyond the personal differences here and do what’s right”.

Bose vs Kapoor: In May, Kapoor had written to the company’s employees, addressing allegations of sexual harrasment and toxic work culture at the startup.

In an internal memo to employees, he wrote, “You may have heard that there is an allegation made that certain individuals at Zilingo ‘suppressed’ complaints of harassment. We’ve always had a culture that does not tolerate sexual harassment, workplace harassment, bullying or intimidation… In rare cases when workplace issues were reported, we’ve always followed due process and taken strict action.”

In a statement on May 2, Zilingo’s board said Bose had made allegations of sexual harassment after she was suspended in April.

Startups tweak compensation structure, Esops amid downturn

After laying off 100 employees in May and shutting down its Indonesian operations, Indian mobile esports and gaming unicorn Mobile Premier League (MPL) has introduced a new compensation structure as it works towards breaking even.

This comes amid a broader focus on profitability and positive unit economics that has gripped the startup ecosystem.

Tweaks: MPL has introduced a new system aimed at rewarding team performance over individual performance, changed its Esop (employee stock ownership plan) vesting period from yearly to monthly, and merged fixed and variable pay.

The Bengaluru- based gaming platform is not the only new age startup looking at tinkering its remuneration structures in the background of tightening liquidity globally.

Earlier this year, business to business e-commerce (B2B) major Udaan also changed its Esop policy to quarterly vesting as venture capital-backed companies look to retain key talent despite layoffs and the ongoing funding winter which has hit the technology world.

Employees with Esops bear the brunt of falling valuations if companies raise at a lower valuations, and this is something that a lot of the richly valued Indian startups may potentially face going forward.

Tweet of the day

Citymall lays off 191 workers, three months after raising $75 million

Social commerce startup Citymall said it has fired 191 employees to align its “evolving business model and the current business environment”.

On Sunday evening, the company posted on LinkedIn that it has decided to lay off a portion of its staff after exploring several options. Citymall said it realised certain roles at the company had to be dissolved to adapt to the current environment.

“Each and every employee affected by this layoff has contributed to building Citymall to what it is today, and this is one of the toughest decisions the company has ever had to make,” the company said.

Citymall was last valued at $350 million. Its investors include Accel Partners, Norwest Venture Partners, Elevation Capital, General Catalyst and others.

The company, which raised $75 million in March, is the latest startup to sack employees in recent months. Meesho, Cars24, Unacademy and others have fired more than 4,000 employees over the past two months to cut costs and conserve cash.

D2C dairy brand Milky Mist in talks to raise up to $120 million

Milky Mist, a direct-to-consumer dairy and fresh foods brand, is in talks with private equity funds such as Kedaara, True North, TA, Temasek and others to raise $100-120 million in a funding round. This will be the bootstrapped company’s first institutional funding round, four people with direct knowledge of the development told us.

“The final binding bids are expected to be in towards the end of the month or early next month. The deal is likely to close next quarter,” said one of the people.

Set up in 1992 by T Sathish Kumar, a high school dropout, the company began by selling milk and has since expanded to milkshakes, flavoured yoghurt, butter and cheese. It has a 55-acre plant in Perundurai, Tamil Nadu and supplies its products through a retail network of more than 1.5 lakh outlets.

ONDC partners with Nabard to activate ecommerce in agri-tech

The newly minted Open Network for Digital Commerce (ONDC) is working to activate ecommerce in the agriculture domain in partnership with National Bank for Agriculture and Rural Development (Nabard).

As one of the first initiatives to drive ONDC enablement in the domain, ONDC and Nabard have come together to host the Nabard-ONDC Grand Challenge, which aims to establish market linkages for the enabled players with market ready Farmers Producers Organisations (FPOs) in the country.

More than 400 entities have registered for the challenge, including around 250 agri-tech startups while 150 are non-agri-tech startups, ONDC chief executive T Koshy told us.

He explained that the startups will be given two challenges: to integrate existing agri-tech ecommerce players with the ONDC network; and to build innovative solutions that may accelerate adoption of the network.

Other Top Stories By Our Reporters

Musk reaffirms support for dogecoin: Just two days after a dogecoin investor sued him for allegedly running a pyramid scheme to profit from the meme cryptocurrency, Tesla chief executive Elon Musk tweeted that he will keep supporting dogecoin and plans to buy more of it.

Indian companies look to drop the code to save costs: Indian IT services providers and startups generated over $400 million in revenue during fiscal year 2021 from low code/no code (LCNC) software solutions, a report by IT industry body Nasscom and LCNC company Nagarro showed.

Global Picks We Are Reading

■ The crypto party is over (WSJ)

■ Peter Thiel helped build big tech. Now he wants to tear it all down (The Washington Post)

■ Rising food and fuel costs are making gig work unsustainable (Rest of World)