Also in this letter:

■ Bulli Bai: GitHub and the legal bottleneck police face

■ Avataar raises $45 million from Tiger Global, Sequoia India

■ A year after meme stock frenzy, GameStop zooms again

Startup grouping asks FM for clarity on crypto taxes

IndiaTech, an industry association representing tech startups, has written to Finance Minister Nirmala Sitharaman, asking her to lay down specific rules for taxing crypto assets in her upcoming Budget speech.

IndiaTech represents all the leading cryptocurrency exchanges, some of which have been under the taxman’s scanner.

Details: In its letter, parts of which we have reviewed, IndiaTech asked the government to tweak existing laws further and suggested that crypto-assets be named formally in tax laws. It also sought clarity on the method of taxation and the disclosures required.

Quote: “The Budget should ideally offer coherent rules on direct taxation and the GST council should detail the applicability of taxation else there will be confusion. Basically, the line of thinking is that we shouldn’t be waiting for a bill alone and the Budget should begin the process,” said Rameesh Kailasam, president and CEO of IndiaTech.

Scrutiny: The Directorate General of Goods and Services Tax Intelligence (DGGI) — a law enforcement agency under the ministry of finance — is scrutinising multiple crypto firms including Buyucoin and Unocoin for alleged tax evasion. Last month, the GST department slapped a Rs 40 crore demand on crypto exchange WazirX.

On this point, IndiaTech has recommended provisions to recognise and treat crypto as income from capital gains or gains from business and profession, depending on the business of the holder and the timelines and nature of the holding.

Confusion: Industry members said crypto platforms have failed to pay the “correct” amount of GST largely because of confusion over which provisions apply to their specific business models, as we reported previously.

For instance, exchanges such as WazirX and CoinDCX, which facilitate peer-to-peer transactions and charge a commission on each transaction, count this as their main source of revenue. Others such as Unocoin and CoinSwitch Kuber also act as a broker or an aggregator and buy and sell cryptocurrency to users, making profits on these trades.

It is this second model that is stoking greater regulatory scrutiny, executives said.

Bulli Bai case: GitHub and the legal bottleneck police face

The ‘Bulli Bai’ app case has flooded the internet and created a wave of rage and disgust. Like its predecessor Sulli Deals, the Bulli Bai app was created on GitHub, an open-source platform where app developers store and share their projects. It has so far refused to hand over information on suspects in both cases, asking the police to send it a legally valid request under the Mutual Legal Assistance Treaty that the two countries signed in 2005.

What’s GitHub? GitHub is a website that lets developers store and manage their code, track and control changes to it, and share it with others on the platform. Its user-friendly interface means even novice coders can take advantage of these features.

Because GitHub is collaborative, it is also a rudimentary social network, complete with display pictures, bios and followers.

What has GitHub done so far? GitHub quickly suspended the account used to create the Bulli Bai app, as it had done with Sulli Deals. The company also said it would cooperate with Indian law authorities, providing their requests were in accordance with internationally recognised legal procedures.

What does this mean? For companies based overseas, police have to use a procedure under the Mutual Legal Assistance Treaty (MLAT) to get information. This is a tedious process that involves multiple foreign ministries.

In the Sulli Deals case, the Delhi Police sent a notice under the Criminal Procedure Code to GitHub, asking for the IP address of the web page where the app was shared. In October, the company responded by saying the police would have to follow the procedure spelt out in MLAT, according to a report in The Hindu.

This, among other reasons, is why India’s upcoming Data Protection Bill calls for storing certain types of data within the country’s borders.

Click here to read the full article.

Spatial discovery platform Avataar raises $45 million from Tiger Global, Sequoia

Avataar, a leading AI and computer vision platform focused on spatial visual discovery, said it has raised $45 million in its Series B round led by Tiger Global, in which existing investor Sequoia Capital India also participated.

This is one of the largest fundraising rounds in the applied 3D and artificial reality space, the company said.

Avataar’s platform acts as an ‘inside engine’ powering multiple user experience shifts to interactive life-size Web 3.0.

Founder speak: Sravanth Aluru, its founder and CEO, said the digital world is undergoing a fundamental shift from static 2D content to a life-size virtual 3D world, aka the “metaverse”.

He said more than 60% of human sensory neural processing is visual, and the lack of spatial depth on flat screens today drives a big experience gap between the digital (static 2D images and videos) and physical worlds.

Rupifi raises $25 million: Rupifi, a digital payments startup focused on business-to-business payments, has raised $25 million as a part of its first round of institutional funding led by Bessemer Venture Partners and Tiger Global. Existing Investors Quona Capital and Ankur Capital also participated in the round, along with Silicon Valley-based early-stage investor, Better Capital.

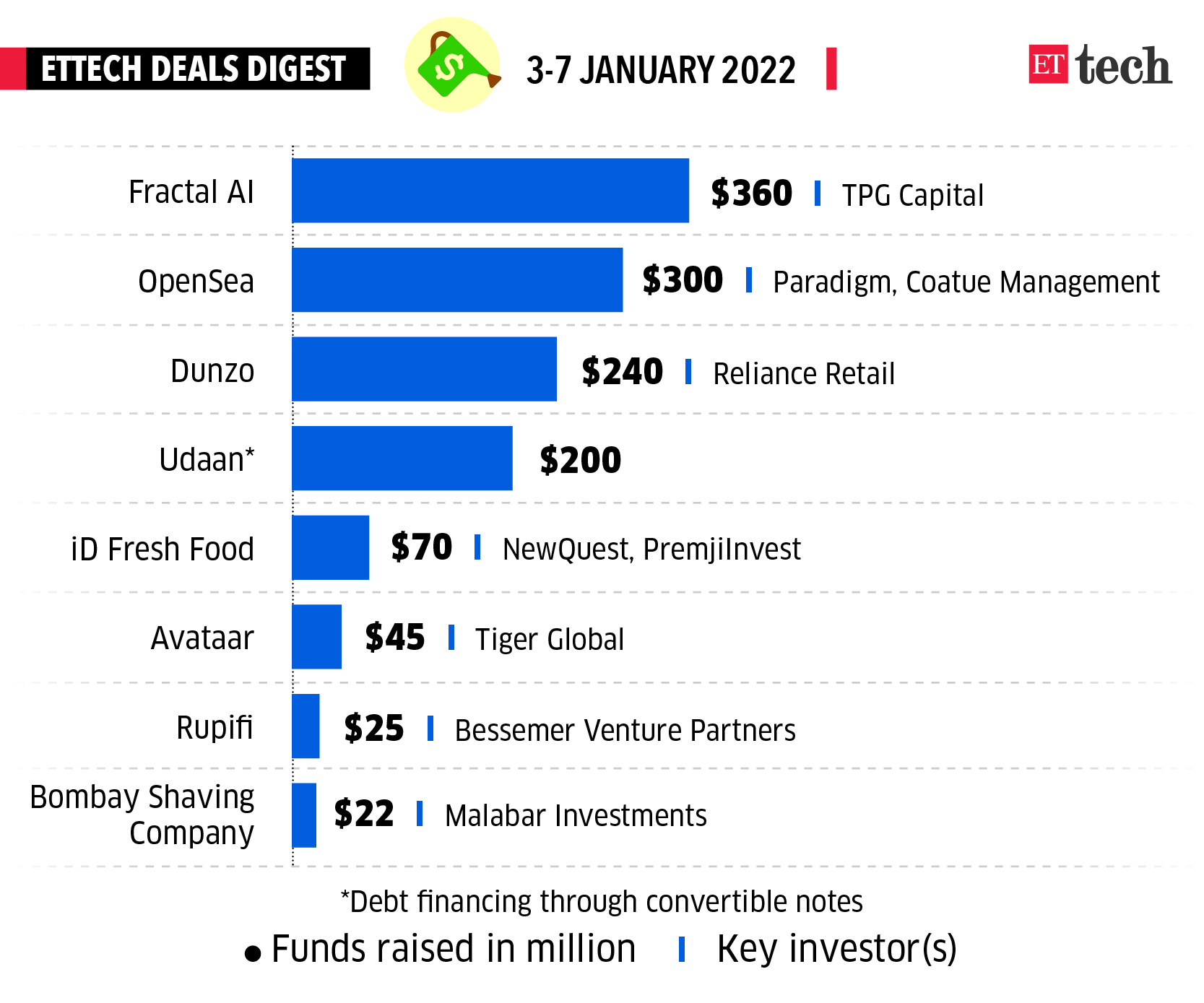

ETtech Deals Digest

Here’s a look at the top funding deals of the week.

TCS wins second phase of Passport Seva Programme

Tata Consultancy Services (TCS), India’s largest IT services firm, has won the second phase of the Passport Seva Programme of the ministry of external affairs. Analysts estimate the deal to be valued at about Rs 6,000-8,000 crore over a decade.

This is the country’s largest mission-critical e-governance programme to date.

Tell me more: TCS had won the original mandate in 2008, when the Passport Seva Programme was launched, to transform passport services through a digitised process. The programme saw TCS transforming the delivery of passport-related services, digitising the processes, and setting global benchmarks in timeliness, transparency, and reliability.

The company processes an average of 1.5 to 2 crore passports annually as part of the programme.

What’s next? In the next phase, TCS will refresh existing facilities and systems, develop innovative new solutions to enable the issuance of e-passports, enhance the citizen experience using biometrics, artificial intelligence, advanced data analytics, chatbots, auto-response, natural language processing and cloud solutions.

Quote: “Our partnership with MEA over the last decade has become a benchmark in a public-private partnership for citizen services. We are pleased to be selected for the next phase of the Passport Seva Program and look forward to driving further innovations and improving citizen experiences using our contextual knowledge and digital technologies,” said Tej Bhatla, Business Unit Head, Public Sector, TCS.

Tweet of the day

A year after meme stock frenzy, GameStop zooms again on NFT plan

GameStop Corp is launching a division to develop a marketplace for nonfungible tokens (NFTs) and establish cryptocurrency partnerships, a source familiar with the matter said, boosting the video game retailer’s shares 27% in extended trading.

Deja vu: The company was at the forefront of the “meme stock” trading frenzy this time last year, in which retail investors pumped up its stock price, causing huge losses to hedge funds that had short positions against the stock.

Getting online: The video game retailer is now undergoing a revamp, with chairman Ryan Cohen tapping executives from companies including Amazon.com Inc to turn GameStop away from brick-and-mortar and towards ecommerce.

The company is asking select game developers and publishers to list NFTs on its marketplace when it launches later this year.

Also Read: What is NFT, and why it matters in the crypto world

Assembling a team: The company has hired more than 20 people to run the unit which is building an online hub for buying, selling and trading NFTs of virtual videogame collectibles such as avatar outfits and weapons.

GameStop launched its NFT website last year and has been inviting creators to join the platform.

Bitcoin under $41K: Meanwhile, Bitcoin today slumped as much as 5% to its lowest since late September, tumbling under $41,000 amid a broader sell-off for cryptocurrencies. The cryptocurrency was last down 3.7% after touching $40,938, its lowest since Sept. 29.

Slow-motion crash: The world’s biggest cryptocurrency has lost over 40% in value since hitting a record high of around $69,000 in November. The volatility that has plagued it since its birth 13 years ago remains stubbornly present.

Kazakhstan crisis: The global computing power of the bitcoin network had also dropped sharply earlier this week following the shutdown of Kazakhstan’s internet as an uprising hit the country’s fast-growing cryptocurrency mining industry.