Also in this letter:

- Homegrown platforms join live commerce rush

- Indian SaaS firms to hit $30 billion in revenue by 2025

- WhatsApp beefs up disappearing messages feature

Crypto bill will allow Sebi, RBI and taxman to scrutinise KYC data of exchanges

India’s cryptocurrency bill will require cryptocurrency exchanges to share the know-your-customer (KYC) data of their customers with regulators and government agencies including the Securities and Exchange Board of India (Sebi), the Reserve Bank of India (RBI) and the tax department. This will help regulators zero in on transactions across platforms, check them against bank deposits and scrutinise them for discrepancies.

The new cryptocurrency rules will also include a uniform KYC process that every exchange will have to follow, they said. Currently, cryptocurrency exchanges have different KYC processes.

“KYC data will become the key for any scrutiny by any regulator,” one of the persons aware of the development said. “And unless this is spelled out in the law and made mandatory, the cryptocurrency operators (exchanges) need not share it.”

Reason for scrutiny: Sources told us that many in the government feel that cryptocurrency investors could be operating multiple accounts, not just across platforms, but even with multiple banks and non-banking financial companies.

Insiders also said that because most banks have refrained from providing services to crypto exchanges, cryptocurrency transactions are structured in a different manner, which may make it harder for regulators to scrutinise.

Changes to tax law: The government is looking to amend the income tax law, we first reported on December 4. It plans to add “cryptocurrency” to Section 26A of the Income Tax Act in the upcoming budget, which will require taxpayers to disclose their cryptocurrency investments in India and abroad.

Crypto payments continue: We reported on Monday that the union cabinet could discuss a legal framework for cryptocurrencies later this week, and the view in the government is that crypto could not be allowed as a currency but could be classed as an asset. Despite the uncertainty around their legal status in India, a number of businesses continue to offer cryptocurrencies as a method of payment.

India’s oldest crypto exchange, Unocoin, still lets users recharge their Fastag accounts using Bitcoin, and also allows Bitcoin transactions for bill payments and ecommerce.

“We are waiting for the bill to get tabled and be made available to the public before we can get the full details of what we can do and what we cannot. For the time being it is business as usual for us,” said Sathvik Vishwanath, cofounder of Unocoin.

The Rug Republic, an Indian home decor brand, started accepting crypto to show regulators that there is support for it from the Indian business community, its director Raghav Gupta said. “We continue to accept crypto for payments, though we are awaiting the laws and will of course abide by them,” he added.

Legal view: Legal experts said that the lack of regulation makes such transactions akin to barter deals, where acceptance is purely at the discretion of the recipients.

Homegrown platforms join live commerce rush

A number of online platforms are rushing to offer live online shopping as they bank on discovery-led commerce to drive greater sales and monetisation. These include homegrown social media platforms Moj and Roposo, ecommerce platforms Flipkart and Myntra, and video sharing site YouTube.

Who’s doing what? Short video platform Moj recently tied up with Flipkart to kick off live and video shopping. It said it is targeting a gross merchandise value of $1 billion in the next three years and plans to start selling directly to consumers by the second half of 2022.

- Myntra meanwhile aims to churn out close to 1,000 hours of live video content every month to deepen consumer engagement as it believes social commerce is likely to engage about half of its monthly active users in the next 3-4 years.

- TikTok (which has partnered with Shopify), Instagram, SnapChat and Twitter have all introduced new shopping features.

- Earlier this year, YouTube bought live shopping app Simsim for an undisclosed amount to “help small businesses and retailers in India reach new customers in even more powerful ways”.

Rise of social commerce: Social commerce has established itself as a major force in the ecommerce and mcommerce industries as shopping and checkout capabilities continuously improve, according to app analytics platform Sensor Tower.

Live commerce, a subset of social commerce, represents the ‘mandi-isation’ of commerce, according Manohar Singh Charan, chief financial officer at Mohalla Tech, Moj’s parent company.

Digital advertisements have limited scope of making money for social media platforms in India in the near term compared to mature markets such as the US, Charan said. “An ad alone will not get you the kind of profitability that it does for players like Facebook or Snap in the US.”

Tweet of the day

ETtech Done Deals

■ Sense, an artificial intelligence (AI)-driven talent engagement and communication platform, said it has raised $50 million in new funding led by SoftBank Vision Fund II. Post this funding, Sense is valued at around $500 million, sources said. ET first reported on December 6 that SoftBank was in the final stages of talks to invest in Sense amid a flurry of deals in software-as-a-service (SaaS) companies like Chargebee, Innovaccer and others.

■ Edtech startup PlanetSpark has picked up $13.5 million in a Series B funding round led by Prime Venture Partners and other angel investors. The company said it will use the funding for product development, hiring senior leadership and global expansion. The startup had previously raised $3.7 million from Prime Ventures, FIITJEE and several angel networks. The latest round takes the total amount raised by the firm to $17.2 million.

■ Communications platform-as-a-service (CpaaS) company CometChat has landed $10 million in series A funding round led by US-based Signal Peak Ventures with participation from existing investors Matchstick Ventures, Range Ventures and Unbound VC. The money will be used to fund growth, for platform enhancements, scaling platform infrastructure and tech upgradation, a senior company official said. Last year, CometChat had raised $1.6 million in a pre-Series A round.

■ Audio streaming platform Pocket FM said it has raised $22.4 million in its Series B funding round. Led by Lightspeed, the round also involved new investor Tanglin Venture Partners and existing investors including The Times Group, which owns ETtech. The startup plans to use the fresh capital to scale up operations, build a community of content creators, expand its presence across geographies and invest in technology for better recommendations.

■ Simplified, an AI-powered content creation and marketing platform, said it has raised $8.5 million in a seed funding round led by Craft Ventures with participation from Khosla Ventures and Wing Venture Capital. The company will use the funds for product development, to develop machine learning models, enhance the artificial intelligence (AI) copywriting experience, and expand support into other languages, it said.

■ Small businesses-focussed mortgage lender LoanKuber has raised Rs 13 crore in a pre-Series-A funding round led by Lets Venture and Inflection Point Ventures. LoanKuber will use the proceeds to hire more talent, enhance the existing tech stack and grow the loan book.

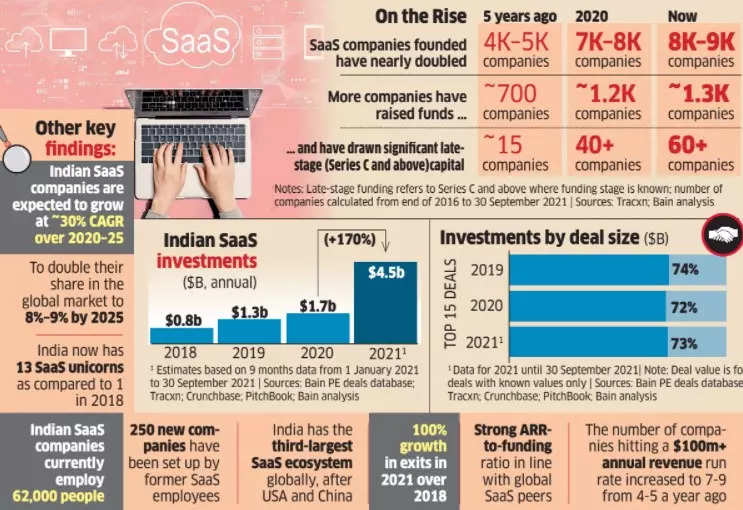

Indian SaaS firms to hit $30 billion in revenue by 2025

Indian Software-as-a-Service (SaaS) companies are poised to hit $30 billion in revenue, capturing 8% to 9% share of the global SaaS market by 2025, according to a new report by Bain & Company.

Investments jump: The report said that investments in the space increased by 170% over 2020 and are expected to reach $4.5 billion in 2021.

Quote: “While the overall growth in funding has been driven by an increase in deal volume across stages, there has been notable growth in the volume of deals larger than $50 million, as investors give a clear vote of confidence in the potential of Indian SaaS companies to achieve substantial future growth,” said Arpan Sheth, a partner and leader at Bain & Company’s Global Vector Solutions Group.

By the numbers

- Indian SaaS companies are expected to grow at ~30% CAGR from 2020-25 and double their share in the global market to 8-9% by 2025.

- India now has 13 SaaS unicorns as compared to just one in 2018.

- 250 new companies have been set up by former SaaS employees, which employ about 5,000 people.

- India has the third largest SaaS ecosystem globally, after the US and China.

You can now set all WhatsApp messages to disappear by default

WhatsApp is beefing up its disappearing messages feature, introduced a year ago, by offering more options. The Meta-owned messaging platform said users will now be able to turn on disappearing messages automatically for all new one-to-one chats.

It also said users will now be able to set messages to disappear in 24 hours, seven days, or 90 days. When the feature was launched last November, users could only set messages to disappear after seven days.

To turn on disappearing messages by default for all new individual chats, go to WhatsApp settings, tap account, privacy, default message timer, and select a duration.

WhatsApp wrote in a blog post: “The most recent selection only controls new messages in the chat. This setting won’t affect messages you previously sent or received in the chat. In an individual chat, either user can turn disappearing messages on or off. In a group chat, any group participant can turn disappearing messages on or off. However, a group admin can change group settings to allow only admins to turn disappearing messages on or off.”

Infosys scraps COO position, other top execs to pick up the slack

Infosys will not look for a replacement for its long-time employee and chief operating officer (COO) UB Pravin Rao, who will retire later this month. Instead, the company will distribute his responsibilities among a handful of top executives. These include its two presidents in the US and the UK.

CEO Salil Parekh told leaders of the company about the additional responsibilities for presidents Ravi Kumar and Mohit Joshi, CFO Nilanjan Roy, executive vice presidents and some senior vice presidents in a recent email.

- Kumar, who is also deputy COO, will take on the additional responsibilities of immigration, cyber security, procurement and the India business unit.

- Joshi, who heads the company’s financial services and healthcare businesses, will additionally manage information systems and computers and communications.

- Other executives with additional responsibilities include EVP Karmesh Vaswani, who will manage quality; CFO Nilanjan Roy, who will now manage infrastructure, facilities and physical security; and group HR head Krish Shankar, who will also be in charge of talent acquisition.

- Infosys’ general counsel Inderpreet Sawhney will be in charge of privacy and data protection.

- Rafee Tarafdar, who heads the company’s strategic technology group will be made CTO and will report to Kumar.

Other Top Stories By Our Reporters

Qualcomm Ventures to exit MapMyIndia with blockbuster returns: Qualcomm Ventures, the investment arm of chipmaker Qualcomm Inc, will exit MapMyIndia with blockbuster returns after the Indian digital-map provider goes public with a Rs 1,040 crore initial public offering (IPO) this week. Qualcomm Ventures invested $5 million in the company about 13 years ago, at an average share price of about Rs 52.20 per share, according to its Red Herring Prospectus.

Incubators to get grant of Rs 135 crore under Startup India Seed Fund Scheme: As many as 34 incubators will get a grant of Rs 135 crore under the Startup India Seed Fund Scheme, the skills development ministry said in response to a question in Lok Sabha. Under the scheme, a corpus of Rs 945 crore will be spent over the next four years for providing seed funding to eligible startups through eligible incubators across India.

Global Picks We Are Reading