Also in this letter:

■ SoftBank bets on Indian fintech again

■ Pristyn Care to spread its wings

■ ‘India to play huge part in building metaverse’

Cryptocurrency bill may not be introduced in the winter session

After all the FUD (fear, uncertainty and doubt), it turns out the cryptocurrency bill may not be introduced in the winter session of Parliament after all.

Why? That’s because the government is considering changes to the proposed framework, a senior government official told us.

More inputs needed: The issues being debated include the need for wider consultation on the bill, including seeking comments from the public, and whether the central bank digital currency (CBDC) to be introduced by the Reserve Bank of India should be part of this bill or dealt with under the RBI Act.

Quote: “After several rounds of discussions at the highest levels, it was felt that any legislation surrounding cryptocurrency must be in tandem with a global framework which is still evolving. It might be a better strategy to wait and observe how this space evolves globally,” the official said. “Also, it was felt that the government could consider [using] existing laws and regulations to ensure consumer protection and tax cryptocurrency transactions in the meantime.”

On Friday, Prime Minister Narendra Modi had called for united efforts to shape global norms for social media and cryptocurrencies to ensure they are used to empower democracy and not to undermine it.

What about the digital rupee? Policymakers are looking into whether the draft legislation should cover the proposed official digital currency. “Since this is currency, it could possibly be regulated through the RBI Act,” the official said, explaining the government’s thinking.

Highlights of the bill: Reuters had reported on December 7, citing a source and a summary of the bill, that the legislation would ban the use of cryptocurrencies as a method of payment, and that violators would be subject to arrest without a warrant and being held without bail.

The bill is also likely to use the term ‘crypto assets’ instead of ‘cryptocurrencies’, and appoint the Securities and Exchange Board of India (Sebi) to oversee them.

Another highlight was a deadline for crypto holders to declare their assets and comply with any new rules.

Data protection bill “at odds” with global norms: Moving on to another piece of long-delayed legislation. A senior Google executive said on Tuesday that India’s proposed data protection bill was at odds with global data governance frameworks.

These include provisions on non-personal data as well as data flow restrictions, said Katherine Charlet, director for data at Google, while pushing back against the country’s strict data localisation rules, which require certain types of data to be stored only on servers in India.

She said, “I strongly believe India will benefit from ensuring its data governance framework is interoperable with those in other jurisdictions… we can have strong privacy laws and data flows,” Chalet said at the Carnegie India Global Technology Summit 2021. “There are plenty of examples of laws that maintain privacy and control over the flow of data without undue restrictions.”

SoftBank leads $60 million funding in Juspay

Payments technology startup Juspay on Wednesday said it has raised $60 million in a funding round led by SoftBank Vision Fund II. The round also saw participation from existing investors VEF and Wellington Management. SoftBank invested $50 million, while the rest came from existing investors, said Vimal Kumar, founder and CEO of Juspay.

Significance: This is the first investment from SoftBank in an Indian payments firm after its portfolio firm Paytm went public last month in what was a disappointing debut on the bourses. SoftBank had invested around $1.6 billion in Noida-based Paytm. Last month, ET first reported that SoftBank Vision Fund was in advanced stages of talks to lead the new funding round in Juspay. After this funding, Juspay has been valued at $460 million compared to its previous valuation of around $140 million.

Bengaluru-based Juspay plans to use the funds to invest in its technology and product development to scale its business in payments and product adjacencies like credit – both in India and globally.

Quote: “We will need to hire more people and train them for this (expansion). We have around 600 people and should get to around 1,000 next year,” Kumar told us. He said his team was involved in building the Bhim app on Unified Payments Interface (UPI) in a matter of three weeks.

Other done deals

■ Uni, a fintech startup offering pay-later solutions through its cards, has raised $70 million in one of the largest Series A funding rounds. The new funding was led by General Catalyst. Eight Roads Ventures, Elevation Capital, Arbor Ventures have joined as new investors.

■ WeSkill, an online platform that enables live and interactive extracurricular learning for children, has raised more than $400,000 from angel investors and syndicates, as part of its pre-seed round of funding.The platform will utilise the funding to advance its product offerings, explore new channels for growth and build a team that can deliver on the platform’s vision to democratise holistic education for more than 270 million K12 learners in India.

Tweet of the day

New unicorn Pristyn Care to spread its wings, expand to 60-70 cities

Pristyn Care, a healthcare startup specialising in non-emergency surgeries, said that it will expand to 60-70 cities with the latest funds it raised.

On Wednesday, the company said it has raised $96 million, more than doubling its valuation in seven months to $1.4 billion. We reported about the fundraising first on December 8, citing regulatory filings.

The round was led by Sequoia Capital, Tiger Global, Winter Capital, Epiq Capital, Hummingbird Ventures and Trifecta Capital. Angel investors included Kunal Shah of Cred, Deepinder Goyal of Zomato, Abhiraj Singh Bhal of Urban Company and Varun Alagh of Mamaearth.

Expanding: In an exclusive interview, founder Harsimarbir Singh told us the company would include more types of surgeries in existing and new cities, expand into new disease categories, and double its 130-strong engineering team.

The company said it plans to increase its geographical footprint by March, by expanding to more than 50 cities and towns and more than 1,000 surgical centres.

It said it has grown 5X since January and expects to be profitable in the next 12-18 months.

India to play huge part in building metaverse: Meta CEO Mark Zuckerberg

Meta CEO Mark Zuckerberg

Meta CEO Mark Zuckerberg said India is going to play a huge part in building the metaverse, helped by the country’s huge talent pool of developers and creators, and its entrepreneurial spirit.

Also read: What is the metaverse and why is everyone talking about it?

Quote: “When we’re thinking about what the next generation is going to look like in terms of where all these creators and developers going to come from, who are going to really build the foundation of the metaverse I think it’s just obvious that India is going to be a huge part of that,” said Zuckerberg at the Fuel for India event.

In Zuckerberg’s vision, people will meet and communicate by entering virtual environments, whether they’re talking with colleagues in a boardroom or hanging out with friends in different corners of the world.

The melting pot: Zuckerberg said that India is on track to have the largest app developer base in the world by 2024, and already has one of the largest Spark AR developer communities. He added that the online gaming sector in India has seen a lot of growth over the past few years and Meta’s investment in gaming in the country keeps growing as it looks at how it’s going to take shape in the metaverse.

Meta is hoping to double up its social-media user base of more than three billion people into an audience that will embrace immersive digital experiences. He said for the metaverse to work, this isn’t going to get built by any one company or even a small number of companies.

Meta, CBSE expand partnership: Meta Platforms said it will expand its partnership with the Central Board of Secondary Education (CBSE) to provide a curriculum on digital safety and online well-being and augmented reality (AR) for over 10 million students and one million educators in the country over the next three years.

Additionally, in line with the government’s vision of universalizing education, Meta and CBSE will democratise the high school curriculum by allowing students access to quality educational content online through modules that would be made available on CBSE’s website.

WhatsApp’s digital payments push: WhatsApp has announced its pilot programme of adopting 500 villages across Karnataka and Maharashtra, aiming to empower residents with access to digital payments through WhatsApp.

- “We believe that WhatsApp’s ease of use and reliability can promote the adoption of UPI with users across, including those at the bottom of the pyramid,” said Abhijit Bose, head of India, WhatsApp.

Manish Maheshwari quits Twitter: Meanwhile, former Twitter India Head Manish Maheshwari has quit the company to work on an edtech venture. Maheshwari, who had been transferred to the US in August this year, shared the development in a tweet.

Paytm shares slide as anchor investors’ lock-in period expires

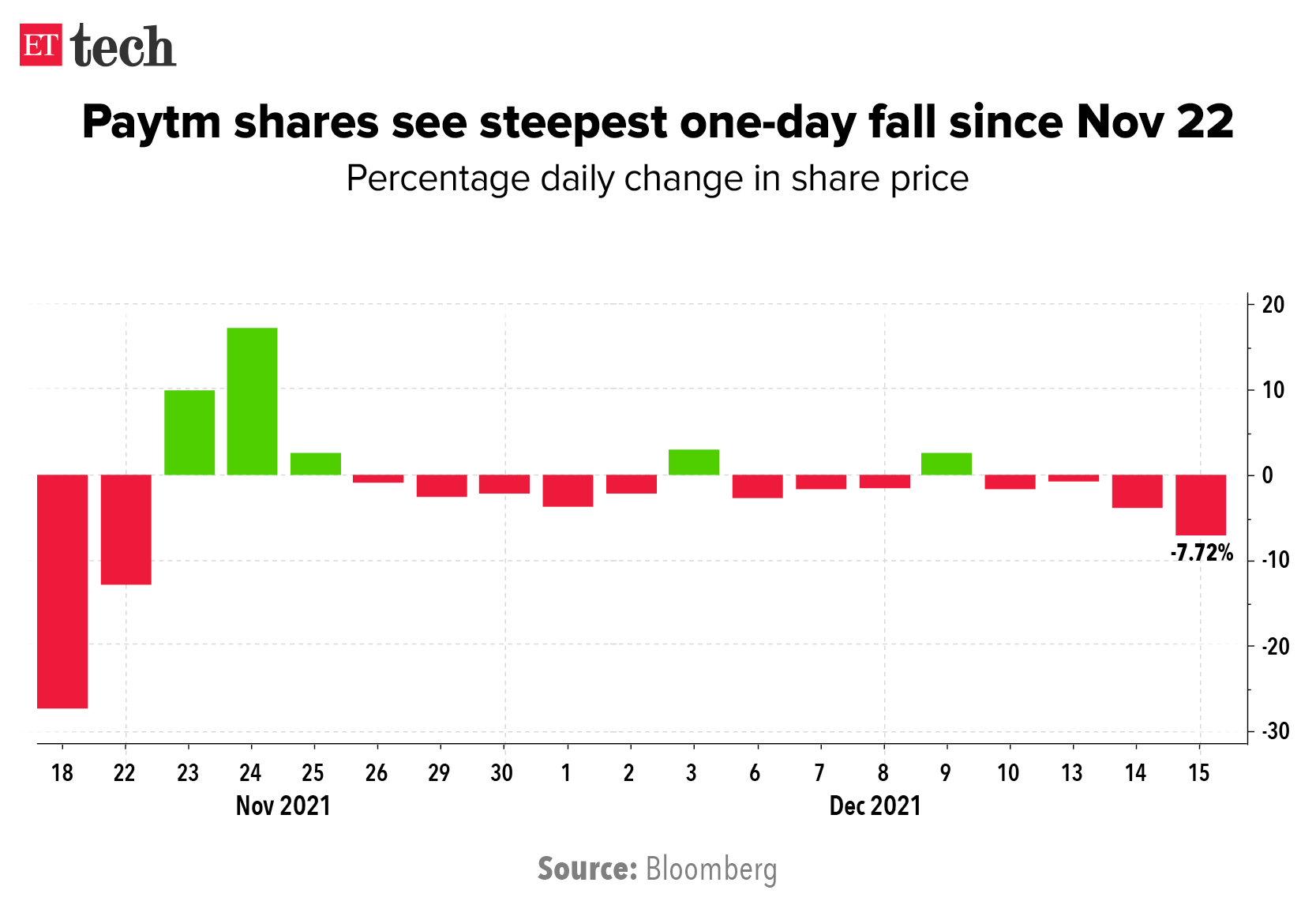

Shares of Paytm’s parent firm tumbled more than 13% at one point on Wednesday, hitting their lowest levels since last month’s dismal debut, after a lock-in period for anchor investors in the company’s initial public offering ended.

Early on Wednesday, the stock fell as much as 13.4% to its lowest since debut. It recouped some of the losses to end the day 7.72% lower at Rs 1,380.05, its biggest one-day fall since its second day of trading, November 22.

Taking stock: Issued at an offer price of Rs 2,150, Paytm’s shares crashed more than 27% on their debut. Including Wednesday, the stock has logged losses in 13 of 18 sessions.

Paytm, which counts SoftBank and Ant Group among its backers, raised $2.5 billion in its IPO, of which $1.1 billion was from institutional investors.

Questions over valuation: While some investors had questioned Paytm’s lack of profits and its lofty enterprise value of around 27 times gross profit, the extent of its price fall at the time of its debut shocked many and wiped more than $5 billion off the IPO valuation.

Expert speak: “Paytm’s fundamentals have not changed, their business model is complicated and path to profitability is unclear, the anchor lock-in period expiring is allowing some people to exit and nothing has changed,” Suresh Ganapathy, research analyst (financials), equity research at Macquarie Capital told Reuters. His target price for the stock has been Rs 1,200 since the debut.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.