Also in this letter:

- Digital rupee on blockchain may not be best idea: experts

- Crypto exchanges say signups jumped 30-50% on Tue

- WazirX founder announces new blockchain venture

On crypto tax, investors and experts have more questions than answers

The tax on cryptocurrencies and other ‘virtual digital assets’ announced in the budget on Tuesday is set to create a host of problems for investors and tax experts on how to calculate their gains and taxes.

One of the questions they have is on what happens to gains made by investors in previous years – that is, will the tax be retrospective?

The government has also said that losses from crypto cannot be set off against any other income. But what about losses made by investors in previous years? If the tax law is not retrospective, losses from the past could technically be carried forward, tax experts said.

There could also be an issue with how exactly the tax is computed from April to April, they added. Will Indians who saw their crypto assets appreciate during the year and didn’t convert them back into Indian rupees face a 30% tax bill as well?

Crypto investors in India are also trying to understand how tax will be applied in various real-world situations. Some CAs believe crypto losses can be set off against crypto gains in the same year, while others differ.

Take another situation: if an investor has mined his crypto, then could the cost of his mining setup be set off against the sale of crypto?

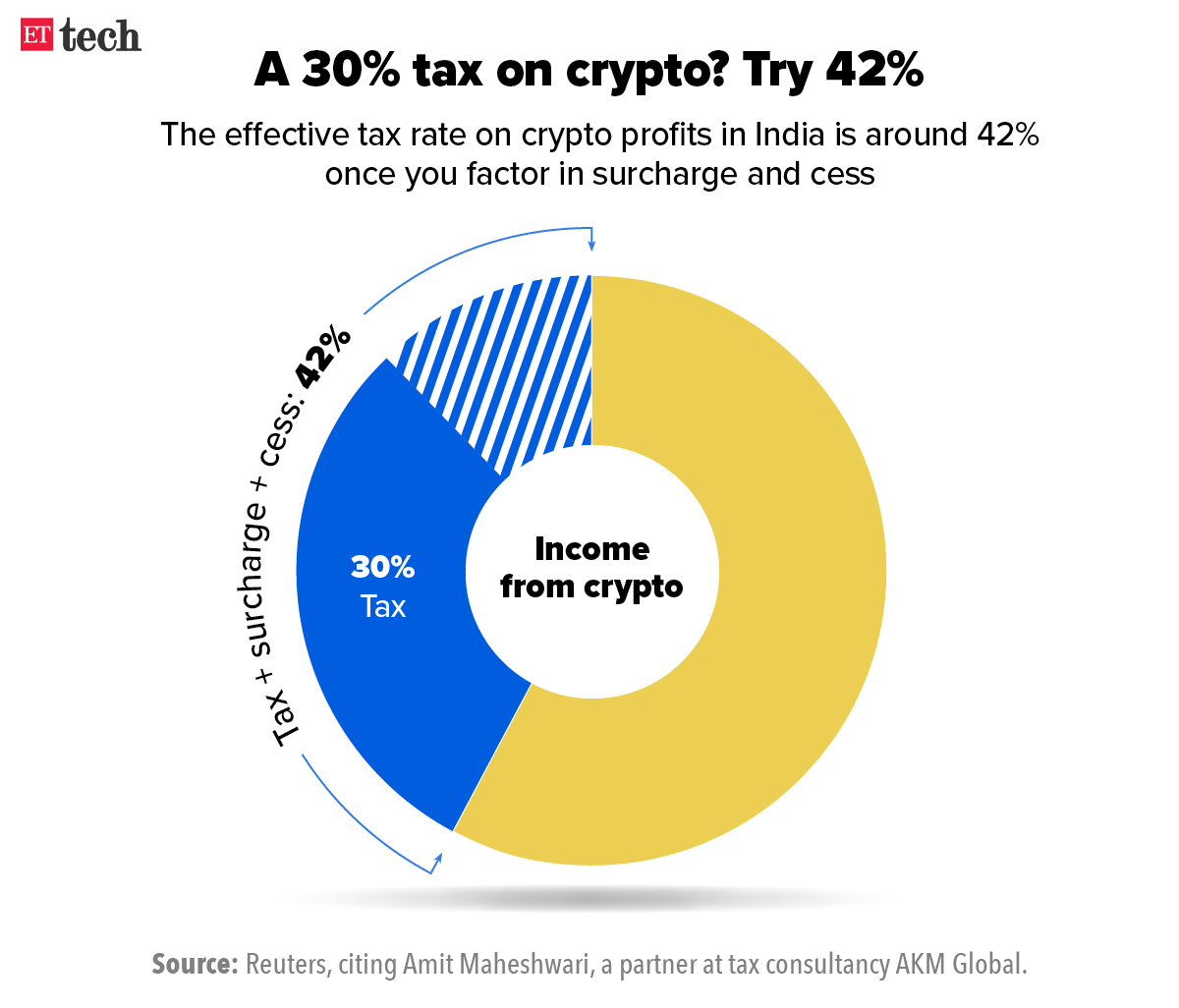

INFOGRAPHIC INSIGHT

CBDC on blockchain may not be the best idea, experts say

India’s central bank may consider other “centralised” technology models apart from blockchain– the popular digital transaction ledger—to host its proposed central bank digital currency (CBDC). That’s according to officials and industry experts.

Why? Blockchain may not be the ideal technology due to its massive power consumption, more so in a country like India with a population of 1.3 billion, the sources said.

- What’s a CBDC? Central bank digital currencies (CBDCs) are essentially the digital version of fiat currency. While they may share some common features with cryptocurrencies, they are centralised by nature (and name) and thus the polar opposite of decentralised cryptocurrencies such as Bitcoin, which can operate without a central trusted authority.

Alternatives: Instead, the RBI could either offer a “digital rupee” directly to citizens or use the “retail indirect” method by issuing digital currency to banks that can in turn offer it to citizens. This would be like the model China is currently piloting, senior officials aware of the developments said.

Digital rails: India’s public digital infrastructure, including Aadhaar and UPI, will act as digital infrastructure rails on which the entire CBDC initiative will run, officials said. This will enable real-time E-KYC (through Aadhaar) and automatic money transfer (through UPI).

Experts are of the view that India is best placed to launch a CBDC given its rapid adoption of digital banking and e-payment in recent years. Globally, central banks across China, Russia, Bahamas or the USA, are developing or researching the use of CBDC.

Crypto exchanges say signups jumped 30-50% on budget day

.jpg)

While crypto exchanges and investors digest the implications of India’s 30% tax on earnings from crypto assets, there has been an early rush to sign up to crypto platforms.

That’s according to data from crypto exchanges WazirX, CoinSwitch Kuber and Unocoin, all of which said the number of users who signed up on Tuesday was 30-50% higher than on the previous day.

Pent-up demand? Many crypto exchange executives told us the spike was a result of pent-up interest among risk-averse investors as well as corporates who had feared that the digital assets would be outlawed in India.

Jumping the gun: After the budget speech, a handful of crypto company CEOs, social media influencers who work with crypto exchanges, and crypto evangelists claimed that the digital assets had effectively been legalised in India or were at least “unbannable” now.

One of the world’s largest exchanges Binance, owner of WazirX, published a blog post saying that crypto was now legal in India. Its founder Changpeng Zhao reiterated the claim in a tweet. Binance did not immediately respond to our queries.

This interpretation is wrong, according to several legal experts ET spoke to, and government officials themselves.

On Wednesday, Finance Secretary TV Somanathan said, “People investing in private crypto should understand that it does not have the authorisation of the government. There is no guarantee whether your investment will be successful or not… one may suffer losses and the government is not responsible for this.”

WazirX founder announces new blockchain venture, Shardeum

Nischal Shetty

Nischal Shetty, founder of crypto exchange Wazirx, has announced a new blockchain called Shardeum that will compete with others such as Ethereum and Solana. This is one of the first layer-one blockchains being built out of India.

Shetty said that unlike other blockchains, Shardeum will solve for scalability and expensive transaction costs, while maintaining a high level of decentralisation, which he said was lacking in most blockchains today.

The bootstrapped venture, founded by Shetty and the builder of Shardeum, Omar Syed, plans to raise funds by April and launch in beta in the third quarter of the year. The blockchain itself will be opened for public adoption by the end of 2022.

Syed started building the blockchain in 2017 and Shetty has been in contact with him since 2019. He officially joined as a cofounder a few months ago.

Shardeum and WazirX, it’s worth noting, are not related. Shetty told ET that he would juggle his roles at WazirX and Shardeum, but the latter would be his priority for now.

Shardeum currently has a team of 20 people split between the US and India. While Syed handles the technical side, Shetty is responsible for building a community around the blockchain.

ETtech Deals Digest

■ India’s sovereign wealth fund –The National Investment and Infrastructure Fund (NIIF) — has made its first bet on the country’s internet economy with ecommerce firm FirstCry, people aware of the matter said. NIIF has led a $240 million secondary funding round in FirstCry, in which it has bought shares worth $100 million, the sources added.

■ Chargebee, an enterprise-focussed subscription management platform, has raised $250 million in a new funding round co-led by Tiger Global and Sequoia Capital, the company said. After the financing, the software-as-a-service (SaaS) startup will see its valuation jump to $3.5 billion.

■ Conversational messaging platform Gupshup said that it has acquired Knowlarity Communications for an undisclosed sum. Knowlarity is a cloud communications firm, providing cloud telephony, contact center automation, AI-powered voice assistants and speech analytics solutions.

■ Headout, an online experiences marketplace for travellers, has raised $30 million (Rs 224 crore) in its extended series B financing round led by Glade Brook Capital. Other existing investors such as Nexus Venture Partners, FJ Labs and 500 Startups also participated.

■ Los Angeles-based Spire Animation Studios said it raised $20 million in a funding round, which included an investment from Fortnite-maker Epic Games to collaborate and build metaverse experiences.

■ Social-tech startup Un1Feed said it has raised $1 million (Rs 7.5 crore) in a funding round led by Silicon Valley-based community-focused venture capital fund, Neo.

■ IPO-bound Pine Labs is in active talks to acquire API-based infrastructure company Setu for $70- $100 million in a cash and equity deal, three sources told ET. The deal comes as Pine Labs is looking to diversify its offerings from just merchant payments. If the deal goes through, Pine Labs will also get access to Setu’s Account Aggregator specs, helping it set itself for wider financial services play.

Govt says social media giants not doing enough to combat ‘fake news’

Indian government officials have held heated discussions with Google, Twitter and Facebook for not proactively removing what they described as fake news on their platforms, Reuters reported on Wednesday.

Details: The sources described the conversation as tense and heated, signaling a new low in ties between US tech giants and Prime Minister Narendra Modi’s administration.

The officials, from the Ministry of Information and Broadcasting (I&B), strongly criticised the companies and said their inaction on fake news was forcing the government to order content takedowns.

These in turn drew international criticism that authorities were suppressing free expression, two sources familiar with the proceedings at the virtual meeting on Monday said.

To this, executives from Google told the officials that one way to resolve that was for the ministry to avoid making takedown decisions public, adding this could be a “win-win”, according to one of the sources.

The government officials rejected this idea, saying the takedown requests also publicise how the companies weren’t doing enough to tackle fake news on their own, the person said.

Dec-Jan takedowns: The meeting was a follow-up to the I&B ministry’s use of “emergency powers” in December and January, when it ordered the blocking of 55 YouTube channels and some Twitter and Facebook accounts.

Also Read: Google to develop more products out of India, says Sundar Pichai

Global Picks We Are Reading

■ Top German court sides with lawmaker over slurs on Facebook (Reuters)

■ PayPal Joins the Growing List of Pandemic Boom-to-Bust Stocks (Bloomberg)

■ How to quit Spotify without losing your music (The Washington Post)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Aditya Rangroo in New Delhi.