Also in this letter:

■ Early-stage deals bloom amid ‘funding winter’

■ Udaan fires 180-200 staff, 5% of its workforce, to cut costs

■ Swiggy, Byju’s, Pay U drive ‘strong growth’ for Prosus in India

Private-market correction just getting started: Alpha Wave’s Navroz Udwadia

It has been a meteoric rise for Falcon Edge (now Alpha Wave Global), which has been catapulted into the top league of technology investors locally in a short time.

After a hyper-busy two years of dealmaking and with a $10-billion corpus at its disposal, Alpha Wave has emerged among the biggest propellants of the latest technology bull run in India, which is now coming to an end.

The 10-year pool of capital shored up by Alpha Wave, spawned from the New York-based Tiger Global Management, is among the largest for a technology fund globally, with India at its centre.

Secret sauce: Navroz Udwadia, cofounder and partner at Alpha Wave Global, said the fund enjoys a lot of flexibility, which gives it “competitive advantages” over others.

“A fund of this scale, flexibility of mandate (early-stage, late-stage) and this duration (10 years) gives us significant competitive advantages versus peers,” Udwadia told us in a rare media interaction.

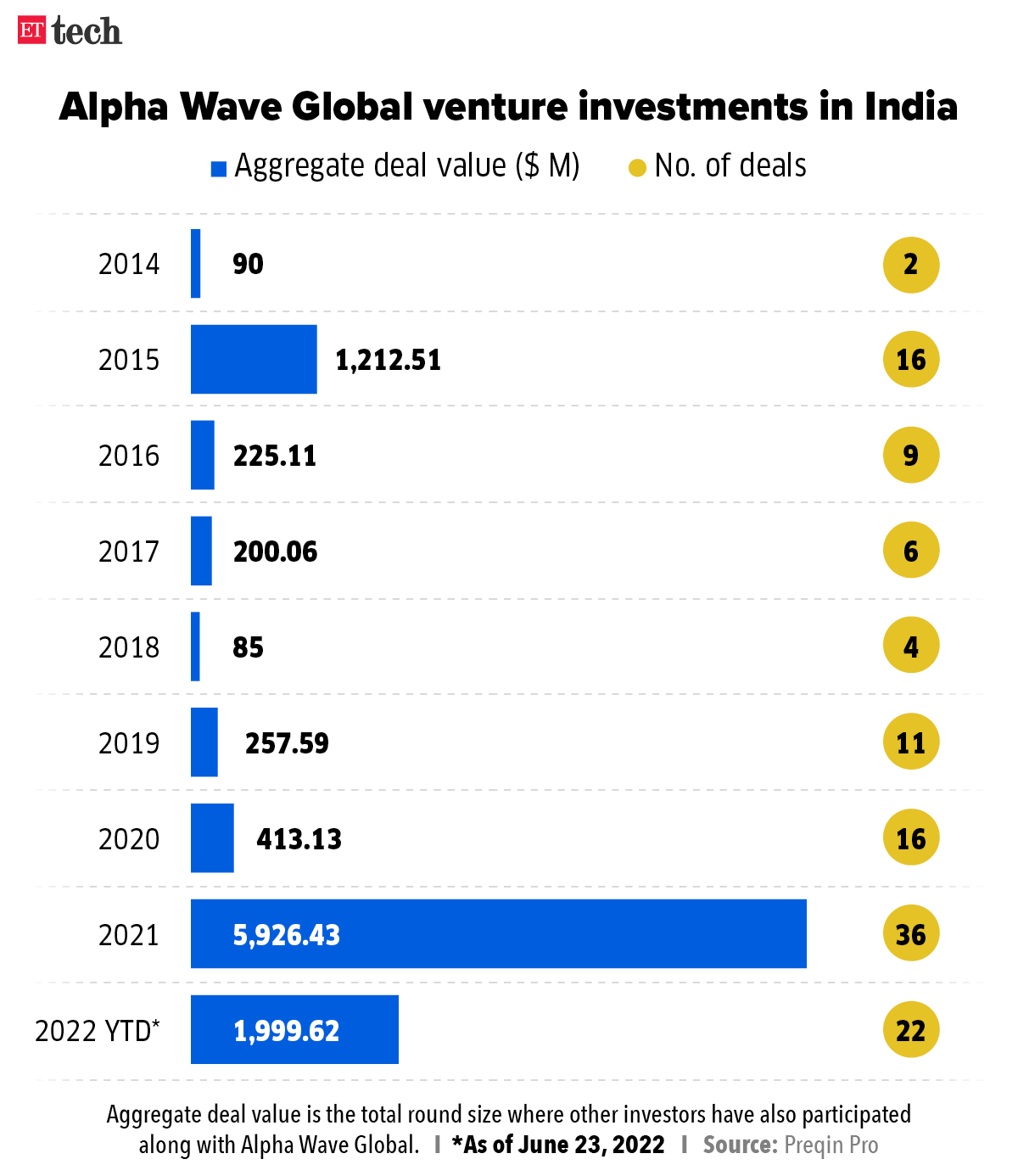

According to data from London-based Preqin Pro, the fund closed 36 deals last year, compared to 16 and 11 in 2020 and 2019, respectively. So far this year, it has been part of 22 funding rounds.

Yes, but: Alpha Wave’s fundraise comes at a time when the technology world is bracing for one of its toughest phases as investors issue cautionary notes to their portfolio companies – something that startups haven’t seen for a few years now.

With the downturn in mind, the fund will look to make more early-stage bets, Udwadia said. While Alpha Wave Venture II will continue to cut cheques of $50 million to $300 million, it will take more early-stage bets across India, US, Israel, and Europe, he added.

Having seen the mayhem play out in the US public markets since December 2021, the fund had turned cautious early on. Typically, private tech valuations lag behind public markets by four-to-six months. Udwadia said Alpha Wave slowed its capital deployment “early and hard”.

He added, “We do think the private market correction is still in its infancy – (there is) much more to come, and so, patience is critical.”

Early-stage deals bloom amid ‘funding winter’

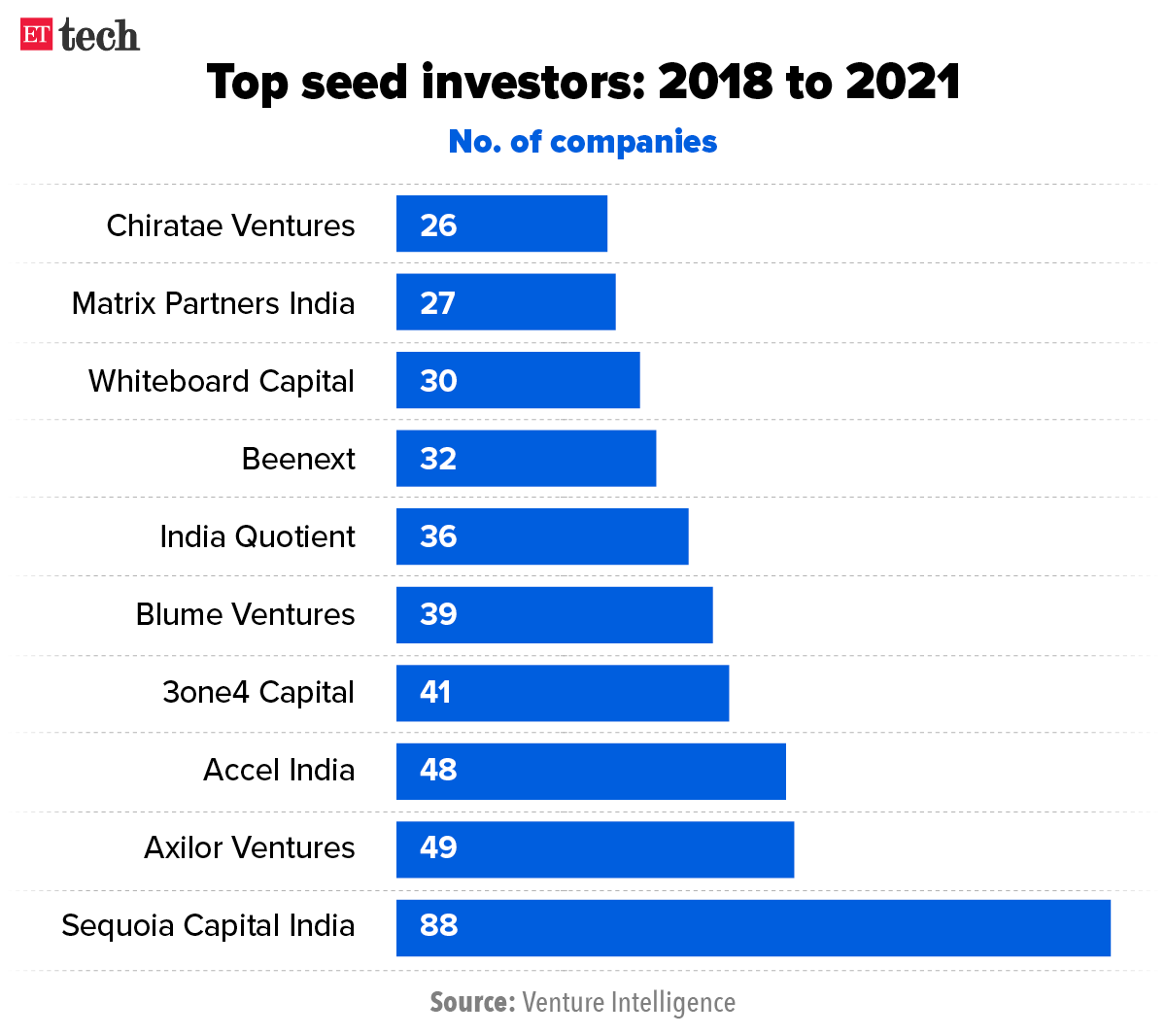

Early-stage funding, especially seed and Series A, remains vibrant in India despite a visible slowdown in late-stage deals.

Seed and Series A investments rose 88% and 22%, respectively, in January-March over the same period in 2021, according to data from Venture Intelligence.

Early-stage investments in 2021 were up 75% over 2020, with around 250 companies raising Series A rounds against 143 companies, the data showed.

“In the early stage, founders are building companies that aim to be valuable over 3-4 years in the future. So, a correction today is largely unlikely to affect a founding team just getting started,” said Pranav Pai, founding partner, 3one4 Capital.

“Tech companies have a gestation period, and now there is more capital available to provide this runway to these young companies. This is a good thing for India, and this ecosystem has been nurtured over 15 years now.”

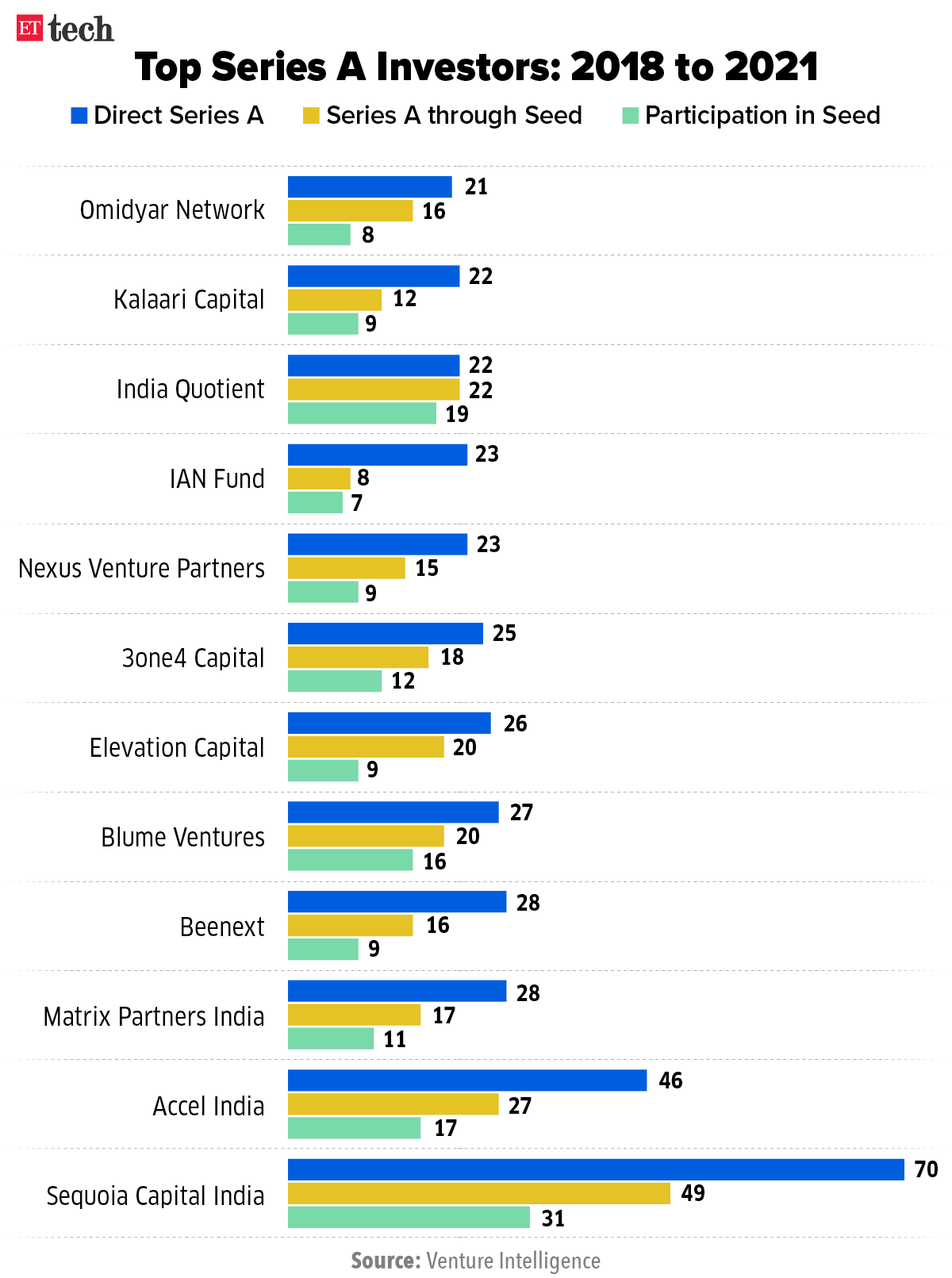

Early birds: Marquee fund managers such as Sequoia India, Accel and Matrix, which have recently shored up larger capital pools from investors, are gunning for early-stage deals.

According to the report, between 2018 and 2021, Sequoia Capital (88 deals) was the most active Seed to Series A investor in terms of number of deals, followed by Axilor Ventures (49), Accel India (48), 3one4 Capital (41) and Blume Ventures (39).

Sequoia recently said it had set aside more capital to invest in its Seed program Surge, and will look to write larger cheques of up to $3 million, as we reported last week.

ETtech Done Deals

■ Proptech startup PropShare has secured Rs 367 crore ($47 million) in funding led by WestBridge Capital, with participation from existing investors Pravega Ventures. It will use the capital to scale its platform across geographies and real-estate asset classes.

■ Solv, a marketplace for small businesses, has raised $40 million in a round of funding led by Japan-headquartered SBI Holdings, with participation from SC Ventures, which has been an incubator and early-stage investor of the B2B digital marketplace. This round takes Solv’s total funding to nearly $80 million.

■ Electric vehicle (EV) battery swapping startup Battery Smart said it has raised $25 million in a funding round led by Tiger Global, with participation from Blume Ventures and Orios Ventures. The company said it would use the funds to expand to new territories, strengthen its technology, and build its team to continue scaling operations.

■ Business-to-Business (B2B) lending platform Progcap has raised $40 million in an extension of its Series C funding round. Existing backers Creation Investments, Tiger Global Management and Sequoia Capital led the round, with Google coming on as a new investor.

TWEET OF THE DAY

Udaan fires 180-200 staff, 5% of its workforce, to cut costs

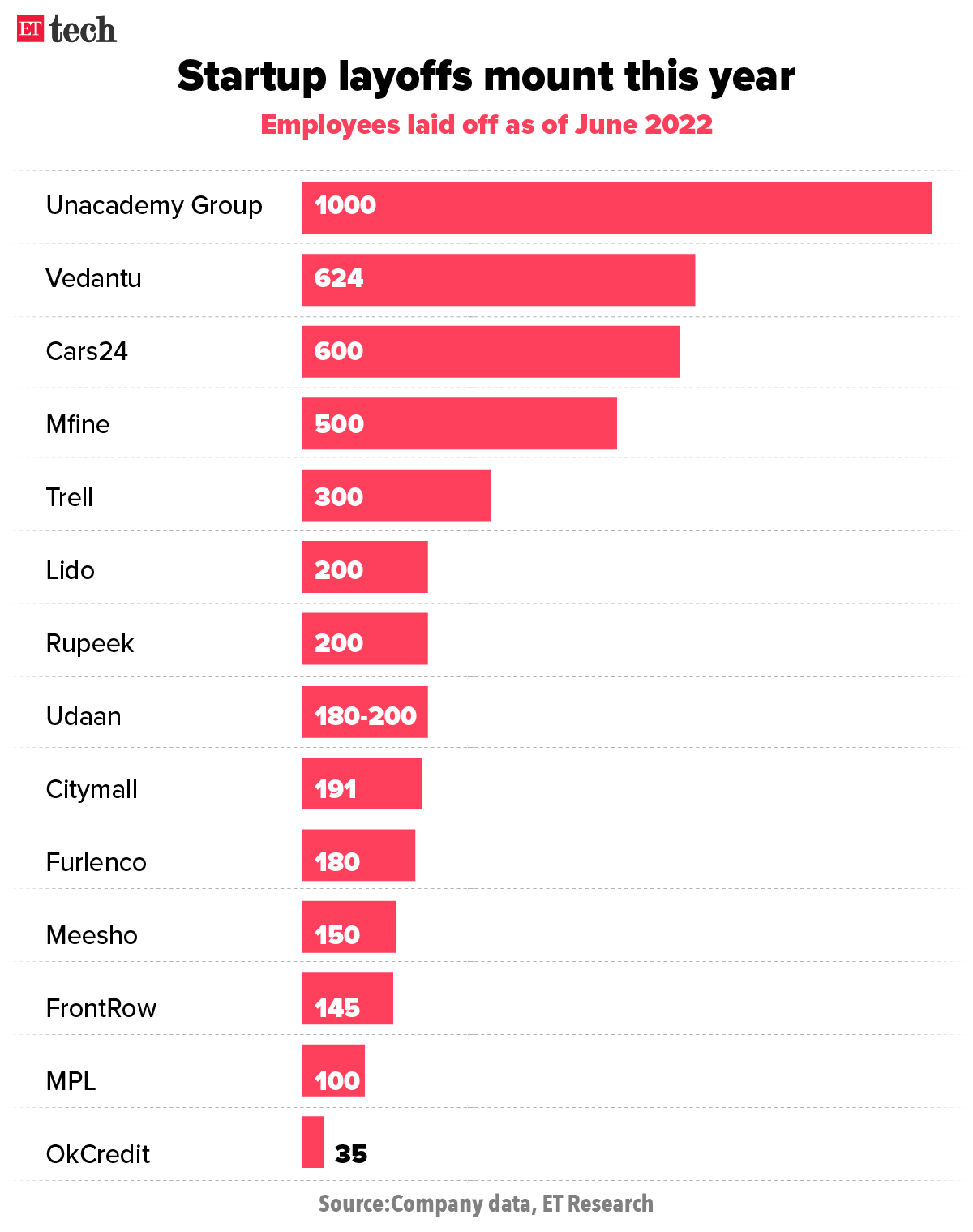

Business-to-business (B2B) ecommerce unicorn Udaan has laid off around 180-200 employees, or 5% of its workforce, according to a person briefed on the matter. In a town hall with employees on Monday, the company termed the move “unusual”.

A company spokesperson confirmed the development to us without disclosing the number of employees it had fired. The company said in a statement that an ‘efficiency enhancement exercise’ resulted in certain redundancies in the system, with some roles no longer required.

Join the club: Owing to a broader slowdown in big ticket funding, a number of startups including Unacademy, CityMall, Vedantu,Cars24 and others have fired more than 4,000 employees over the past few months.

The layoffs come after CEO Vaibhav Gupta told his staff in an internal note that the company hit a positive contribution margin in the last quarter of fiscal 2021 and was on track to become unit-economics-positive in the ongoing quarter, as we reported on June 15.

Udaan recently closed a $225 million debt financing round through convertible notes and Microsoft is one of the investors, we reported on April 18.

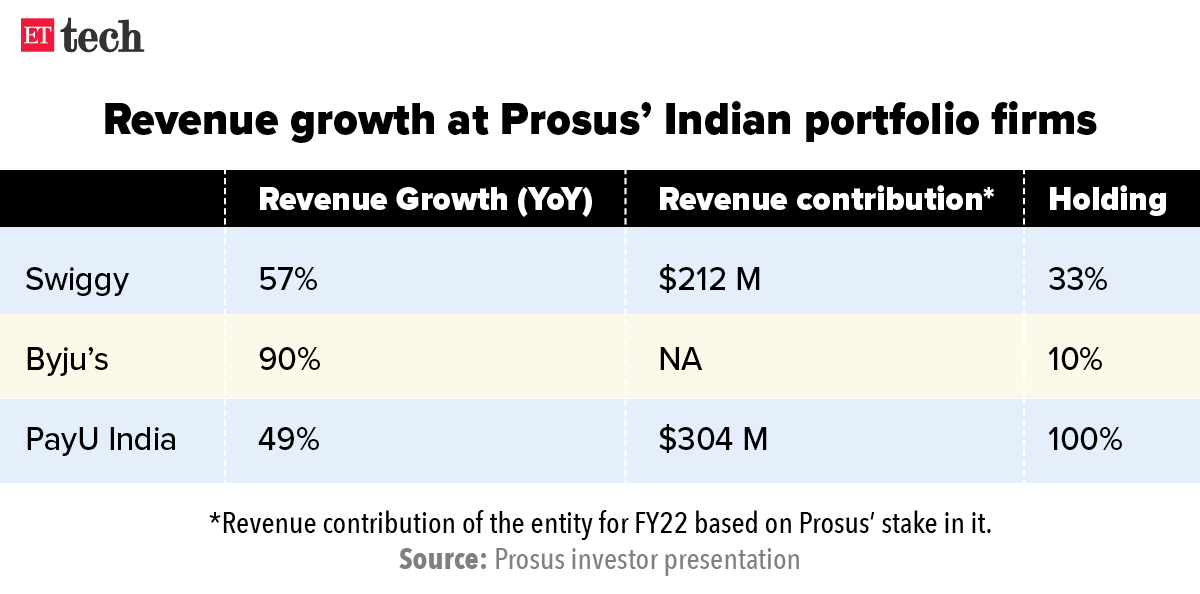

Swiggy, Byju’s, Pay U drive ‘strong growth’ for Prosus in India

Prosus NV, the Dutch-listed arm of Naspers, said it has seen strong growth in its Indian portfolio, while announcing its results for the financial year 2021-2022 (FY22).

Foodtech: It said Swiggy contributed to $212 million of its almost $3 billion food tech revenues. Overall losses for Prosus’ foodtech arm stood at $724 million in FY22, on account of its portfolio companies expanding into quick commerce.

Edtech: While Prosus remains bullish on quick commerce, it also said its overall revenues from edtech grew to $425 million in FY22 on account of increased demand for online learning among its portfolio entities.

It said its share of revenues from Byju’s grew almost 90% year-on-year, driven by market expansion and enhanced offerings from the Indian edtech company. Prosus currently holds a 10% stake in Byju’s.

Fintech: The global internet group also operates its fintech arm PayU in India. It said PayU India revenues stood at $304 million in FY22, driven by merchant diversification, Prosus said. Further, total payment value (TPV) clocked for the year in India grew 66% to $43.8 billion.

Indian gaming companies plan to leverage Web3, play-to-earn

Indian game publishers are looking to leverage the metaverse and play-to-earn (p2e) elements of Web3, influenced by blockchain-based games such as The Sandbox in the US and Axie Infinity in Southeast Asian nations.

In these games, players can own digital characters and virtual digital assets like the land, fire and wood in the form of non-fungible tokens (NFTs) or game-based tokens, industry executives and experts said. They can buy or sell these tokens inside the game’s universe using in-game cryptocurrency, which can be exchanged for cash later in the secondary market.

The time spent or the gamers’ accomplishments are directly proportional to the cryptocurrency that they earn.

“When you are investing time (into the game), why can’t the value creation be shared by everyone who is using the platform?” said Manish Agarwal, chief executive of Nazara Technologies, India’s first listed gaming company.

According to a report by BCG and Sequoia Capital, India’s gaming market is worth $1.5 billion, or around 1% of the global pie, but is expected to more than triple in size to $5 billion by 2025.

EV chargers body proposes ‘black boxes’ to curb battery fires

The Charge Point Operators Society (CPOS) of India has recommended installing a black box system in electric vehicle (EV) batteries to keep track of untoward incidents that may lead to EV fires.

CPOS is an industry body representing EV charging station companies. It claims to have 21 members with over 3,000 EV charging points in place. On Monday, the members of the society also committed to install 4,000-5,000 EV chargers as a pilot project in 2,000 locations across Central Delhi.

The safety recommendations have been made for battery swapping and charging infrastructure. They follow a draft battery swapping policy floated by Niti Aayog.

Other Top Stories By Our Reporters

■ AI no longer fringe tech in India, says report: A new report by Bain & Company said that artificial intelligence is no longer a fringe technology in India, with 80% of enterprises surveyed having at least one AI model in production. The report, From Buzz to Reality: The Accelerating Pace of AI in India, will be launched on Tuesday and is based on a survey of nearly 150 providers and 350 enterprises.

■ CSC services via India Post in slow lane: A government plan that encourages post offices to provide services done exclusively by Common Services Centres (CSC) has yet to pick up pace due to a lack of incentives and infrastructure for postal workers, sources said.

■ Over 400 crypto ads violated ASCI guidelines in five months: More than 400 crypto ads on social media violated the Advertising Standards Council of India’s (ASCI) guidelines in the first five months of 2022, the ad body said. ASCI issued guidelines for promoting crypto assets and crypto exchanges in February and the rules kicked in on April 1.

Global Picks We Are Reading

■ China built your iPhone. Will it build your next car? (Wired)

■ With clock ticking, battle over tech regulation intensifies (The Washington Post)

■ How a schoolteacher became one of Nepal’s biggest YouTube stars (Rest Of World)