Also in this letter:

■ Karnataka may draft new law to ban online betting

■ ETtech Opinion: Let’s redefine unicorns

■ Shares of Zomato, Paytm and Nykaa hit all-time lows

Many banned Chinese apps continue to operate in India

Several mobile apps, backed by global tech majors, that have been banned by India in recent years continue to operate in the country, industry members and privacy experts told us.

The union government recently banned 54 Chinese apps, some of which are thought to be rebranded avatars of apps banned in 2020. India has so far banned around 224 Chinese apps — including popular ones like TikTok, Shareit and WeChat – since June 2020.

For instance? Bigo Live, which was among the first apps to be banned, continues to operate in India with a sizeable number of users. While it is not available for download on Google’s Play Store, users can easily install it with an APK file.

Sources also told us that several employees of Bigo and another app, Likee, have been moved to new entities such as Tiki mobile app, which is a Likee clone. The app, which is a platform for short videos, has over 50 million downloads on the Play Store.

Bytedance apps: A little before its flagship app TikTok was banned in India, ByteDance shut down its Vigo Video and Helo apps in the Indian market. However, Byte Dance still operates the editing app CapCut in India, which has over 10 million downloads on the Play Store.

Newer apps like Beijing-headquartered Asia Innovations Group’s UpLive are also coming up in India. The app, which allows users to broadcast and view live videos, has over 50 million downloads.

Playing whack-a-mole: “The typical modus operandi of these Chinese apps is to show that they operate from different countries such as the US, India or Singapore,” said Venus Dhuria, cofounder of mobile internet technology company AppyHigh.

He added, “Though there are mechanisms in the industry to find out their actual identity, it is very difficult for an Indian app user to identify that these apps are Chinese, as they quickly clone themselves, changing their identity and making basic tweaks to their design before returning.”

After legal blow, Karnataka may draft new law to ban online betting

Karnataka may draft a new law to prohibit online betting and gambling, after the legislation it enacted last year was partly set aside by the high court on Monday.

Home minister Araga Jnanendra told us that his department would prefer to come up with a new law than appeal against the judgement.

While terming the previous legislation unconstitutional, the high court said, “…nothing in this judgement shall be construed to prevent an appropriate legislation being brought about… in accordance with… the Constitution.”

Next steps: The government, Jnanendra said, was studying the judgement in detail, especially the sections of the law that the court said were not in conformity with the Constitution.

The state government has the option of appealing before the Supreme Court, but the home department would prefer to keep that as the last option, top officials said.

The home minister said, “We would prefer to rectify these shortcomings, and work on an alternative draft that would stand in a court of law.”

Short-lived law: Karnataka’s online gaming law, which came into force in October 2021 with amendments to the Karnataka Police Act, 1963, was being administered by the police department till it was struck down.

A number of online gaming firms, including the All India Gaming Federation (AIGF), who had mounted a legal challenge against the law, welcomed the court’s decision.

TWEET OF THE DAY

ETtech Opinion: Let’s redefine unicorns

In the lives of techies and startup founders, ‘hacking’ is a respected term, signifying punching above one’s weight. ‘Growth hacking’ is a core operating principle for early stage startups. This has now given way to ‘fundraise hacking’ in which you raise venture capital funds way above the current stage of your startup.

In principle this is a positive, as early access to serious money can be a big advantage in a competitive market. It’s another matter when fundraise-hacking becomes the only goal, though. Welcome to unicorn culture.

If you are a founder, you have your own circle of support for strategic or even day-to-day problems. Given how daunting fundraising can be, it is obvious you look up to those who have ‘cracked’ it.

Your highest respect goes to those who have raised huge rounds without commensurate visible business progress, because those guys must be the smartest at fundraise hacking. These founders have taken secondary exits, are living the good life and also willing to angel-invest in your company, just to ‘give back’.

They feature in unicorn lists regularly. The media, government and society can’t stop raving about them. You can’t wait to be like them. You want to be among the fastest to make it to those unicorn lists.

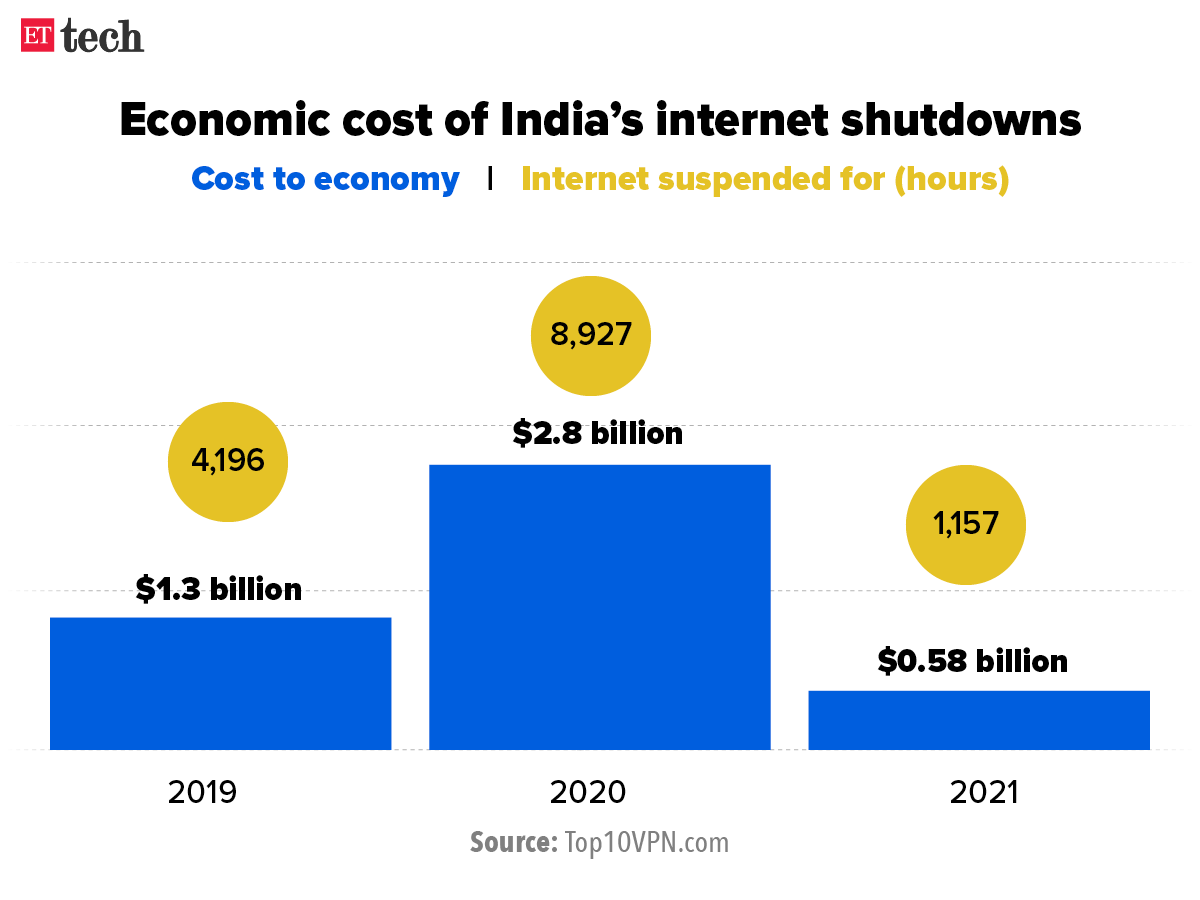

INFOGRAPHIC INSIGHT

Shares of Zomato, Paytm and Nykaa hit all-time lows

Shares of newly listed Indian tech firms such as Zomato, Nykaa and Paytm hit record lows on Tuesday as investors continued selling shares of loss-making internet companies even as the wider market recovered from frantic selling on Monday.

Zomato:Shares of Zomato crashed as much as 8% to hit an all-time-low of Rs 75.75 on the BSE. That’s below the IPO issue price of Rs 76. The stock had turned into a multibagger before the selling began but now it has wiped out all of its gains in the past three months.

The stock is down nearly 40% from its listing price and is more than 55% from its peak in November 2021. Zomato stock recovered some losses to close at 82.75.

The selling has persisted despite the company narrowing its losses drastically in the December quarter. Zomato also hinted it was very close to achieving breaking even, but none of this seems to have reassured investors.

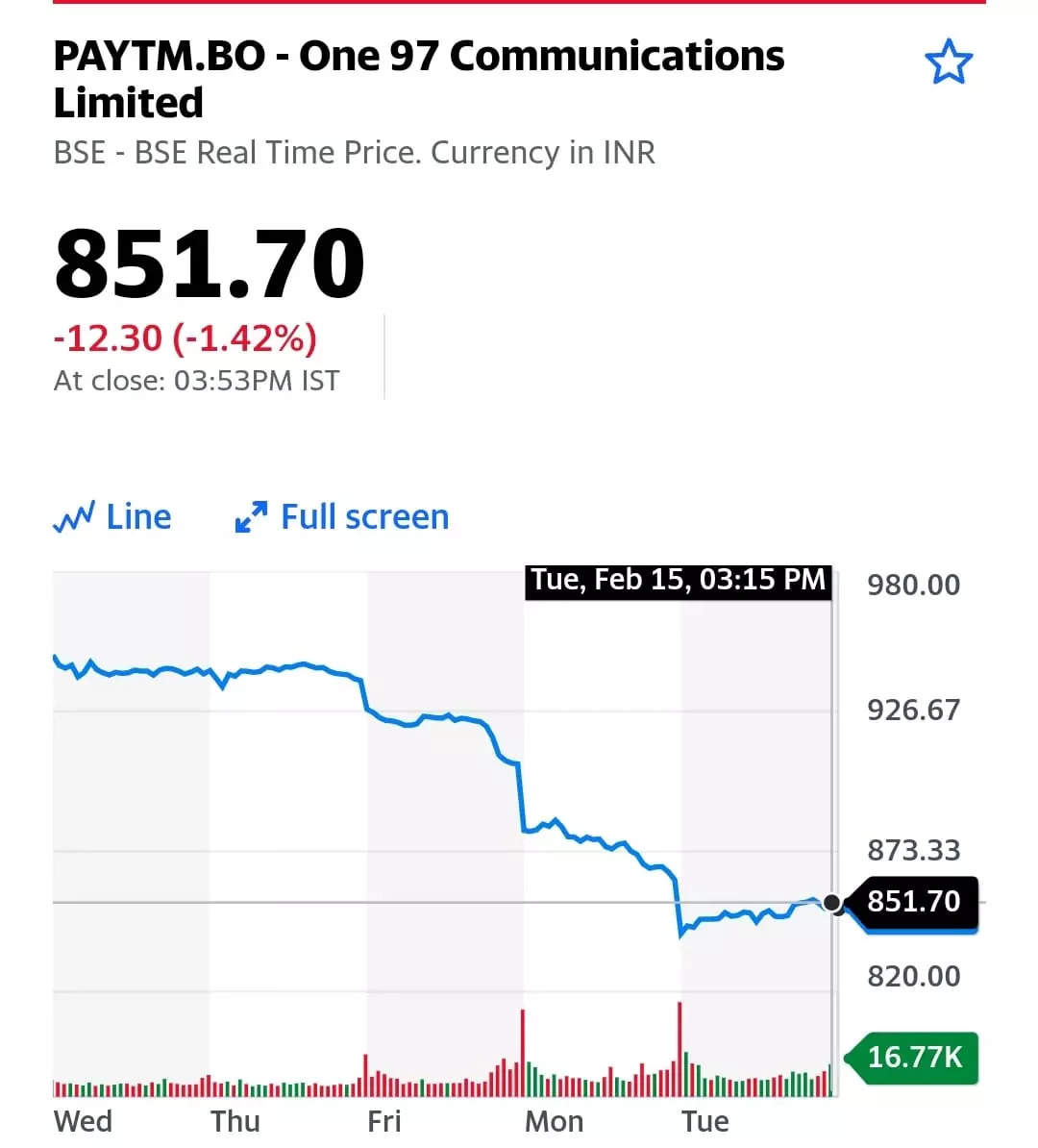

Paytm: Shares of Paytm’s parent firm One 97 Communications also hit an all-time low of Rs 840.05 on the BSE Tuesday. Its market cap slipped below Rs 55,000 crore.

The company’s shares have dropped about 60% since it listed on the stock exchanges on November 18, eroding about Rs 85,000 crore of investor wealth from the IPO valuation of Rs 1.39 lakh crore.

Last week, the company reported a loss of Rs 778.50 crore for the December quarter, up from Rs 481.70 crore a year ago. Revenue from operations rose 89% to Rs 1,456 crore.

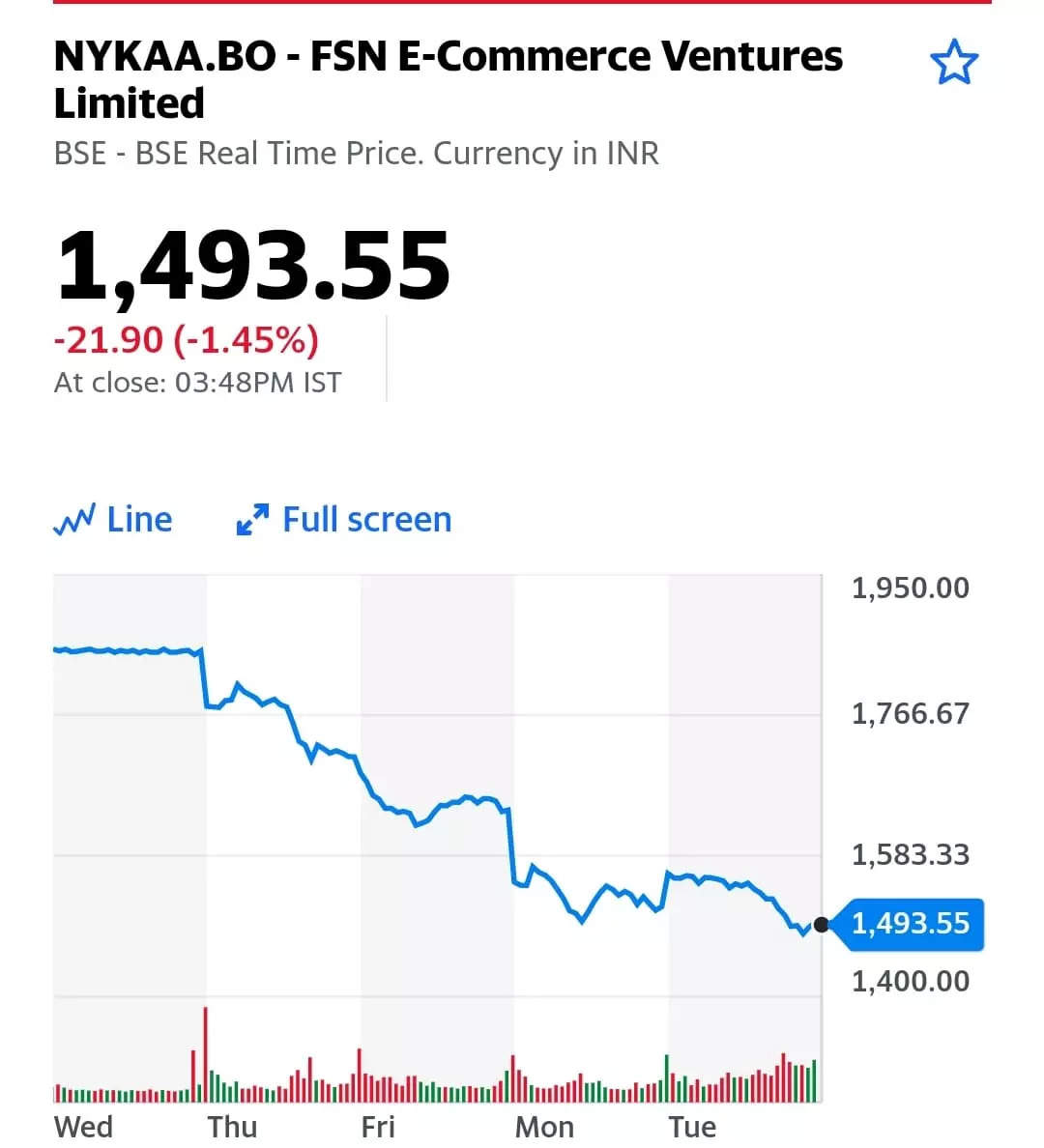

Nykaa: Shares of Nykaa’s parent firm FSN Ecommerce Ventures hit an all-time low of Rs 1,479 on the NSE. Still, it’s the only one of the three tech stocks that’s still trading above its IPO price.

Why is this happening? Shares of unprofitable new-age tech firms, which benefited from optimism in the IPO market in 2021 and were thus overpriced, are now seeing a reality check as the boom in global tech stocks has cooled. This, along with geopolitical tensions between Ukraine and Russia, foreign fund outflows and inflation pressure, has investors selling such stocks in their droves.

RBI statements on crypto mark return of FUD

Tough talk by senior RBI officials on cryptocurrencies is making the Indian crypto community nervous, leading to the return of FUD (fear, uncertainty and doubt).

What’s going on? On Monday, RBI Deputy Governor T Rabi Sankar called for an outright ban on cryptocurrencies. “Banning cryptocurrency is perhaps the most advisable choice open to India and there are strong reasons to keep cryptocurrencies away from the formal financial system,” he said.

Previously, RBI governor Shaktikanta Das had said private cryptocurrencies were a threat to India’s macroeconomic and financial stability. He said investors should keep risks in mind as such assets had no underlying value whatsoever.

FUD returns: The recent statements have added to the worries of Indian crypto investors, already reeling from the harsh tax rules for digital assets announced in the budget.

“The government is sending out a lot of conflicting signals. On the one hand, the FM has said that they want to foster innovation in blockchain in India, and on the other hand, the RBI officials are talking about a ban,” said Vishal Gupta, a Noida-based investor.

IT industry expected to cross $200 billion in revenues in FY22, says Nasscom

The Indian IT industry is expected to grow by $30 billion in FY2022, crossing $200 billion in revenues in the financial year, according to the Nasscom Strategic Review on Tuesday.

Quote: “This has been a watershed year for the tech industry thanks to the persistent focus on customer centricity…The industry has added $100 billion in ten years; the first $100 billion took 30 years,” said Debjani Ghosh, president, Nasscom.

The split: Exports contributed $178 billion to total revenues, growing by over 17%, while the balance was domestic, led by growth in hardware and products. There were close to 300 acquisitions announced during the year. IT services exports now account for 51% of India’s total services exports.

Job creator: The industry added 4.5 lakh new hires during FY22, the highest ever in a single year, of which 44% were women. The IT industry is now the largest private sector employer of women – over 1.8 million.

Other Top Stories By Our Reporters

Blockchain network 5ire bags $100 million: 5ire, a fifth-generation blockchain network, announced it has secured a $100 million capital commitment from GEM Global Yield LLC SCS (GGY), as it seeks to file for an IPO. By investing in 5ire, GEM will solidify its foothold in the emerging markets for a sustainable level 1 blockchains with a highly diversified portfolio of use cases and a growing cache of MoUs with government and private sector partners.

D2C firm Join Ventures raises $10 million: Join Ventures, which owns and operates a portfolio of digital-first brands across fresh, food, home and fashion categories, has raised $10 million (Rs 75 crore) in its Series A round, led by DSG Consumer Partners, Rajiv Dadlani Group, 9Unicorns and Venture Catalysts. The company, which has direct-to-consumer brands such as IGP, Interflora and Masqa, will use the capital to expand its captive dark stores network, tech advancements at the product level, and logistic improvements.

Return to office, infra spending to boost business, says new Quess CEO: The budget proposal to hike investments in infrastructure and the return of more employees to office will help boost growth for Quess Corp, said Guruprasad Srinivasan, the newly appointed chief executive of the business and staffing services provider. The company said on Friday that Srinivasan, among the first few employees at Quess, would take over as CEO from Krishna Suraj Moraje, who had led the firm for over two years.

Global Picks We Are Reading

■ Spotify’s Covid problems are bigger than Joe Rogan (The Verge)

■ Roblox: The children’s game with a sex problem (BBC)

■Mastercard is going on a crypto hiring spree (Bloomberg)