The Reserve Bank of India last week briefly allowed banks to acknowledge new FCNR(B) and NRE stores from non-occupant Indians (NRIs) without respect for current interest rate limits, with impact from July 7, 2022.

As per the RBI round, ” In this association, banks are exhorted that with impact from July 07, 2022, the interest rate roof appropriate to FCNR (B) deposits is briefly removed for gradual FCNR (B) deposits activated by banks for the period until October 31, 2022.

Following the circular many banks including SBI, HDFC Bank, and ICICI Bank changed their FCNR deposits.

What is FCNR account?

Foreign Currency Non-Resident Account is alluded to as FCNR. A FCNR Account, which empowers you to keep cash procured abroad in foreign money, is a choice in case you are a NRI and wish to hold a Fixed Deposit Account in India.

As per HDFC Bank, “FCNR Accounts are a great venture choice for NRIs in case you wish to hold your cash in foreign money and procure great returns simultaneously. Since your cash will be held in foreign section, you can be saved the gamble of conversion standard variances. This likewise guarantees that you procure higher, without risk returns. Likewise, assuming you are uncertain about where to save or contribute your hard – brought in cash, you can decide on a FCNR Account.”

State Bank of India FCNR rates

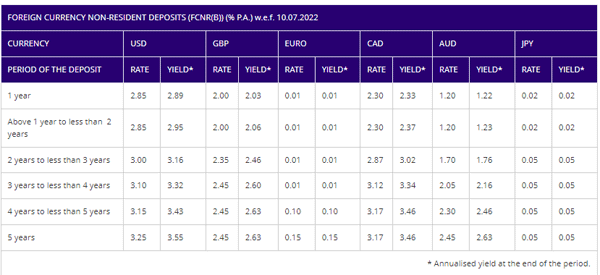

State Bank of India modified Foreign Currency Non-Resident rates with impact from July 10, 2022. As per SBI site, for 1 year’s FCNR deposit, straightforward Interest is appropriate. For stores over 1 year, interest is accumulated at half yearly recurrence.

SBI loan fees for FCNR deposits is in the scope of 2.85 percent to 3.25 percent for USD money.

Untimely withdrawals of FCNR (B) Deposits

Assuming the deposit is removed before one year, no interest is payable. There is no early withdrawal punishment for deposits removed following one year. Be that as it may, premium will be paid at the rate essentially during the time the deposit was held by the Bank. Premium will be paid at the rate in actuality upon the arrival of deposit.

HDFC Bank FCNR rates

HDFC Bank interest rates for FCNR deposits is in the scope of 2% to 3.35 percent for USD money. The bank has updated FCNR rates with impact from July 9, 2022.

As indicated by the HDFC Bank site, “Compelling first JULY 2021 FCNR deposit for GBP,EURO and JPY monetary standards will be offered exclusively for 1 Year residency. Existing FCNR deposits booked under GBP, EURO and JPY monetary standards for the tenor 1 year 1 day to long term and which are expected for auto recharging will be auto restored for 1 year tenor naturally.”

ICICI Bank FCNR rates

The new FCNR interest rates are relevant w.e.f July, thirteenth 2022. ICICI Bank offers FCNR deposits for USD, GBP, SGD, CAD, AUD and HKD.