Debt investors are presently effectively searching for a FD scheme with higher interest rates in the market since fixed deposit interest rates are on the ascent. Banks and the Department of Posts both proposition fixed deposits, which have various advantages and disadvantages that investors ought to know about prior to making a speculation.

Investors are generally keen on SBI’s interest rates with regards to bank fixed deposits in light of the fact that SBI is the biggest nationalized bank in our country and a Fortune 500 organization. An examination of interest rates and the online account laying out process is certainly fundamental, taking into account the Post Office Fixed Deposit scheme offers higher interest rates than SBI.

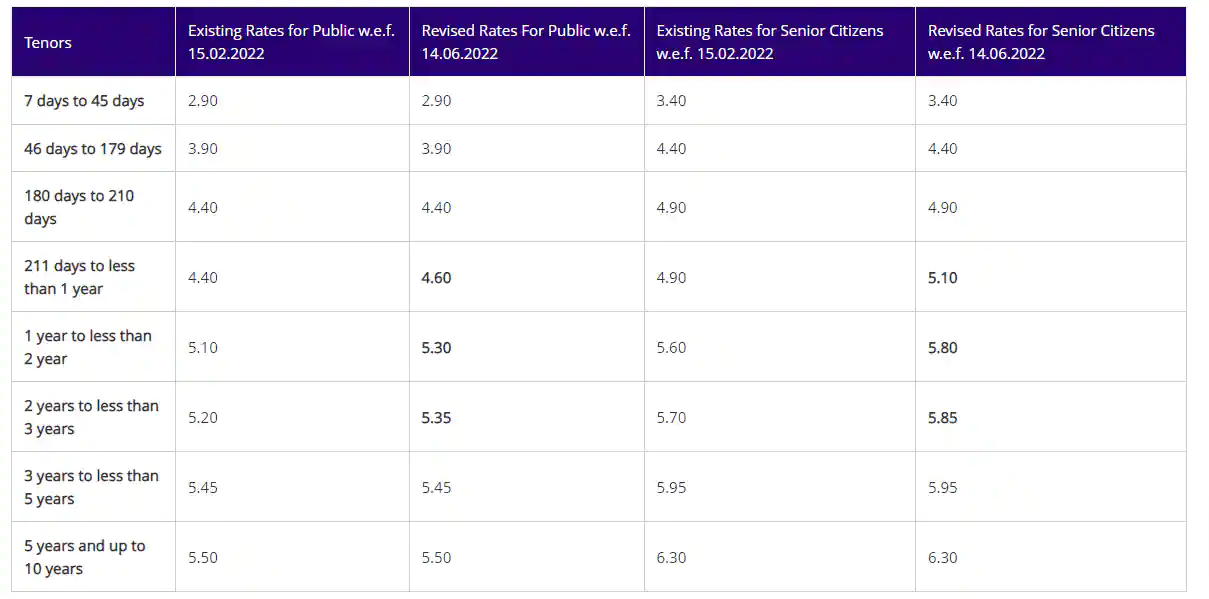

SBI FD Rates

On fixed deposits of under ₹2 Cr, SBI had last changed its interest rates on 14.06.2022. Following the correction, the bank is currently offering an interest rate going from 2.90% – 5.50% for the overall population and 3.40% – 6.30% for senior residents. On tax saving fixed deposits, SBI is offering an interest rate of 5.50% and 6.30% to senior residents.

SBI has said on its site for more seasoned people that “An exceptional “SBI Wecare” Deposit for Senior Citizens presented in the Retail TD section wherein an extra premium of 30 bps (over and over the current 50 bps as definite in the above table) will be paid to Senior Citizen’s on their retail TD for ‘5 Years or more’ tenor as it were. “SBI Wecare” deposit scheme stands broadened upto 30th September, 2022.”

How to open a SBI FD account online?

- Visit retail.onlinesbi.com/retail/login.htm and click on ‘Proceed to login’.

- Now enter your username, password and click on ‘Login’.

- Now click on ‘Deposit and Investment’ choice and under the drop-down menu, select ‘Fixed Deposit’.

- Now click on ‘Fixed Deposit (e-TDR/e-STDR)’ and afterward enter the OTP shipped off your enrolled mobile number.

- Now click on ‘Continue’ and enter your desired sum to store.

- If you are a senior resident, tick mark the classification.

- Now select venture type from STDR which is a total choice and TDR which is a non-combined choice.

- Select the tenure and maturity guidance.

- Acknowledge the agreements and snap on ‘Submit’.

- Check the submitted subtleties and snap on ‘Affirm’.

- You will currently receive an effective message on the screen, and your FD account subtleties will be displayed under the account list segment.

Post Office FD

A minimum deposit of INR 1000 and deposits in products of 100 with no greatest sum are expected to open a Post Office Time Deposit account. The account accompanies a tenure going from 1 to 5 years. Segment 80C of the Income Tax Act of 1961 is relevant to ventures under five years, precisely like it is to bank fixed deposits. Nonetheless, Post Office Time Deposit pays loan fees of 5.5 percent for deposits made for one to three years and 6.7 percent for those made for quite a long time.

This interest rate on post office fixed deposits, which is 6.7 percent, is fundamentally higher than the FD rates presented by SBI, yet in addition other significant banks like HDFC, ICICI, Axis, BoB, PNB, and others. One thing to remember, however, is that while the Post Office Fixed Deposit Scheme doesn’t give such an advantage to senior residents, bank fixed deposits really do give senior residents an extra pace of revenue.

How to open a Post Office FD account online?

- Visit ebanking.indiapost.gov.in and login to DoP eBanking gateway utilizing your client ID and secret word.

- Now click on the ‘General Services’ menu and afterward select the ‘Administration Request’ choice.

- Now select ‘New Requests’ starting from the drop menu, and afterward click on ‘TD Accounts – Open a TD account’.

- Now enter the deposit sum, deposit length, and select your debit account.

- Now determine your restoration and recovery guidelines and snap on ‘Submit Online’.

- Under the ‘Request Confirmation’ page, check your entered subtleties and enter your account password to affirm the subtleties.

- You will Now receive an effective message on the screen and an online receipt of your exchange, which you can download in PDF design.