Also in this letter:

■ Not worried about short-term volatility, says Snap cofounder

■ Early-stage valuations in India remain expensive: Freshworks CEO

■ Meta Q1 results beat expectations, stock soars 17%

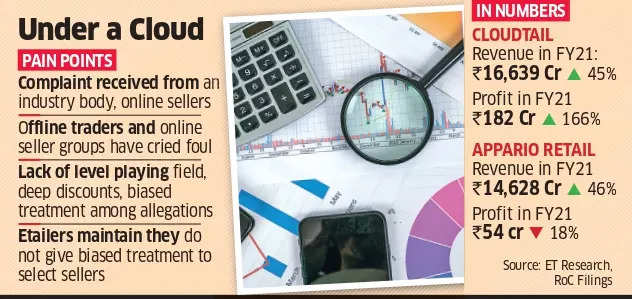

CCI raids top Amazon sellers and other ecommerce vendors

Officials from the Competition Commission of India (CCI) searched the offices of some of the country’s largest online sellers on Thursday, sources told us.

Details: These included Amazon-owned Cloudtail and Appario Retail, a joint venture entity between Amazon and the Patni group, they said. The officials also searched the offices of a few big sellers on Flipkart and social commerce major Meesho.

Why? The raids were in relation to complaints about the alleged anti-competitive practices by the sellers, which move large order volumes for the giant ecommerce platforms. Offline traders and small online sellers have long raised these issues with the government and the regulator.

A first for CCI: Legal experts said this is the first time CCI is probing a case involving ‘vertical agreements.’

Vertical agreements are those where a large player (in this case an ecommerce company) strikes exclusive deals with select vendors, giving them preference over others.

Until now, the competition watchdog has investigated allegations relating to abuse of market position or the formation of cartels.

2020 case: In early 2020, CCI began investigating allegations of antitrust practices at Amazon India and Flipkart based on complaints from offline retailers, who accused the two ecommerce giants of fostering close relations with so-called “ alpha sellers”, which handle a significant chunk of their deliveries.

Cloudtail disappears: The raids came as Cloudtail hit the end of the road as a seller on Amazon India. There are currently no listings under Cloudtail on the platform. Some products previously listed under it have been moved to other seller firms, while others, including Amazon’s private labels such as Solimo, are unavailable for sale.

Not worried about short-term volatility, says Snap cofounder

US social media firm Snap Inc is not worried about short-term volatility owing to the ongoing geopolitical uncertainties, which have hurt its digital advertising revenues and those of Alphabet Inc, cofounder and chief technology officer Bobby Murphy told us in an exclusive interview.

Catch up quick: Last week, the parent entity of Snapchat missed Wall Street expectations for profit and sales. Daily active users (DAUs) grew by 18% annually to 332 million. The company said then that Russia’s invasion of Ukraine and other economic headwinds would continue to hurt demand for advertising.

The company’s revenue – $1.06 billion in the first quarter of 2022 – is currently driven by advertising.

Optimistic outlook: “There’s a lot going on in the world right now and these macroeconomic factors are playing a role in companies’ willingness and capacity to advertise…. We continue to be very optimistic about the way that our community is growing and the engagement that we see on our platform,” Murphy said.

“We certainly believe that, while there may be short-term volatility in advertising, over the long-term, we remain very optimistic and think there’s a tremendous opportunity to continue growing our business,” he added.

India boost: Snapchat has registered a significant uptick in its user base in India, a market it had not focussed on until a few years ago.

Last October, Evan Spiegel, chief executive of Snap, told us the company had 100 million monthly active users (MAU) in the country, its second largest market after the US.

The company attributes its growth in India to its augmented reality (AR) initiatives.

Early-stage valuations in India remain expensive, says Freshworks CEO

This is part of a series of interviews with winners of The ET Awards for Corporate Excellence 2021.

Early-stage valuations in India have not yet seen a full correction, Girish Mathrubootham, founder and chief executive of software-as-a-service (SaaS) firm Freshworks, told us.

He was referring to the ‘funding winter’ that many believe has gripped the Indian startup ecosystem. Mathrubootham is the ET Entrepreneur of the Year 2021.

He said the startup growth story in India is a durable, long-term opportunity.

“There are funds that have raised a lot of money and India’s seeing a lot of high-quality startups,” he said. “Early-stage valuations in India have not corrected. Maybe it will come down a little but right now, it’s still quite expensive.”

On the spate of corporate governance issues that have come to light lately in the startup community, Mathrubootham said that there was a lot to learn from large legacy players that have stood the test of time in corporate India.

ETtech Done Deals

■ Geniemode, a business-to-business cross-border tech platform for lifestyle goods, has raised $28 million in a funding round led by Tiger Global. The company will use the funds to deepen its penetration in key international markets.

■ Ayu Health Hospitals has raised $27 million in a funding round led by The Fundamentum Partnership. The company said it would use the funds to expand its hospital network and invest in technology.

■ The Singapore government’s private equity fund Temasek will anchor the three alternative investment funds managed by the InfoEdge Group, an early backer Zomato and PolicyBazaar, by bringing in 50% of the total corpus, with the rest being funded by the company.

■ Convin.ai, an AI-driven platform for virtual assisted selling for businesses, has raised $2.1 million (Rs 16 crore) in its seed funding round led by Kalaari Capital with participation from Good Capital, Plan B Innovations, Bharat Founders Fund, and Digital Sparrow.

Meta Q1 results beat expectations, stock soars 17%

Meta has reported its Q1 earnings, with profits down 21% to $7.5 billion year-on-year. However, revenue saw a rise of 7% to $27.9 billion with a comfortable rise in daily active users (DAUs). The company’s active users count rose by 4% to 1.96 billion after it lost a million users last quarter, leading to a $230 billion drop in its market value.

Wall Street cheers: The report card certainly left investors happy. The stock jumped over 19% in after-hours trading. The Street took a breath of relief, recalling the brutal numbers from February when the shares tumbled more than 20% in extended trading.

Meta’s main thrust: Meta’s founder and chief executive officer Mark Zuckerberg said three of its main investment priorities, which will drive growth going ahead, are Instagram Reels, ads, and the metaverse.

India growth: Meta said regional growth saw “particular strength in India,” which benefited from good supply tailwinds. The social media giant said it expects second-quarter revenue to be in the range of $28-30 billion.

Also Read |India is among the markets that is doing incredibly well: Spotify CEO Daniel Ek

Twitter Q1 results: Meanwhile, Twitter posted quarterly earnings of $513 million, days after it agreed to be sold to billionaire Elon Musk. The social media company said revenue rose 16% to $1.2 billion in the three months to March compared with the same period last year. It reported an average of 229 million daily active users in the quarter, up 16% from last year.

Other Top Stories By Our Reporters

PolicyBazaar rejigs its top deck: PB Fintech, the parent firm of insurance marketplace PolicyBazaar, has elevated cofounder and chief financial officer Alok Bansal to executive vice chairman, one of many organisational changes at the firm.

Coinbase CEO questions crypto ‘shadow ban’: Coinbase cofounder and CEO Brian Armstrong has questioned the informal curbs on cryptocurrencies by the Reserve Bank of India (RBI) and National Payments Corporation of India (NPCI), asking if they violate a 2020 Supreme Court.

Global Picks We Are Reading

■ Netflix’s battle for Asian subscribers pits it against rich rivals, hundreds of local upstarts (WSJ)

■ Truth Social review: Trump’s uncensored social app is incomplete (NYT)

■ Digital blackmail and endless threats: scammy loan apps soar across India (Rest of World)