Also in this letter:

■ MeitY may write to Wikimedia for Khalistan edits on cricketer’s page

■ Onboarding larger incumbents may provide ONDC credibility

■ India’s Data Bill rethink act of wisdom: Microsoft’s President

CCI clears PayU’s $4.7-billion BillDesk acquisition after a year

The Competition Commission of India (CCI) has cleared online payments major PayU’s $4.7 billion acquisition of payment gateway firm BillDesk, the antitrust regulator said in a tweet on Monday evening.

A year-long wait: This comes after a year-long wait for the Prosus-owned PayU which has had to answer several questions from the regulator over the past year since the deal was officially announced in August 2021.

Past troubles: PayU had filed a revised merger notification with the CCI on the deal and the revised notification said “the proposed transaction will not cause any appreciable adverse effect on competition in any of the above relevant markets or their constituent segments.”

The earlier merger application filed by PayU was marked as ‘Notice Not Valid’ on CCI’s website, which typically means that the regulator is not convinced about the application.

How it unfolded: A timeline

Aug 2021: PayU announced it will acquire online payment aggregator BillDesk for $4.7 billion

Feb 2022: CCI makes PayU notice seeking nod invalid, asks for more info

Apr 2022: PayU submits revised merger notification with CCI, seeks clearance

Sept 2022: CCI clears PayU’s BillDesk deal

Why the deal matters? The deal —pegged as the second-largest buyout in the Indian internet sector after Walmart’s $16-billion acquisition of ecommerce major Flipkart in 2018 — will involve the merger of the payments gateway businesses of two of the country’s largest players in the sector.

IT ministry might write to Wikimedia Foundation for Khalistan edits on cricketer’s page

The ministry of electronics and information technology (MeitY) is likely to write to Wikimedia Foundation to seek an explanation on how the Wikipedia page entry of Arshdeep Singh, a fast bowler from the India men’s cricket team, was changed to reflect an association with Khalistan.

Way forward: The IT ministry may also later summon Wikimedia India executives if it is not satisfied with the reply received from the foundation regarding the checks and balances put in place to contain unauthorised editing by volunteers, sources told us.

Catch up quick: The Wikipedia page entry of Singh was changed after India’s five-wicket loss to Pakistan in the ongoing Asia cup on Sunday. The page entries, changed and subsequently restored, read that Singh had been selected to play for the ‘Khalistani national cricket team.

This happened after the 23-year-old fast bowler was criticised heavily on Twitter by fans of the Indian cricket team after he dropped a catch during a crucial stage in the game.

Verbatim: “It is a serious issue. The edits have been traced back to servers in the neighbouring countries and can cause serious damage to the internal peace and national safety of India. We will ask them (Wikipedia executives) how such an edit could be allowed to stay on for quite some time,” a senior government official told us.

Minister of state for IT Rajeev Chandrasekhar said such “deliberate efforts to incitement” could not be permitted.

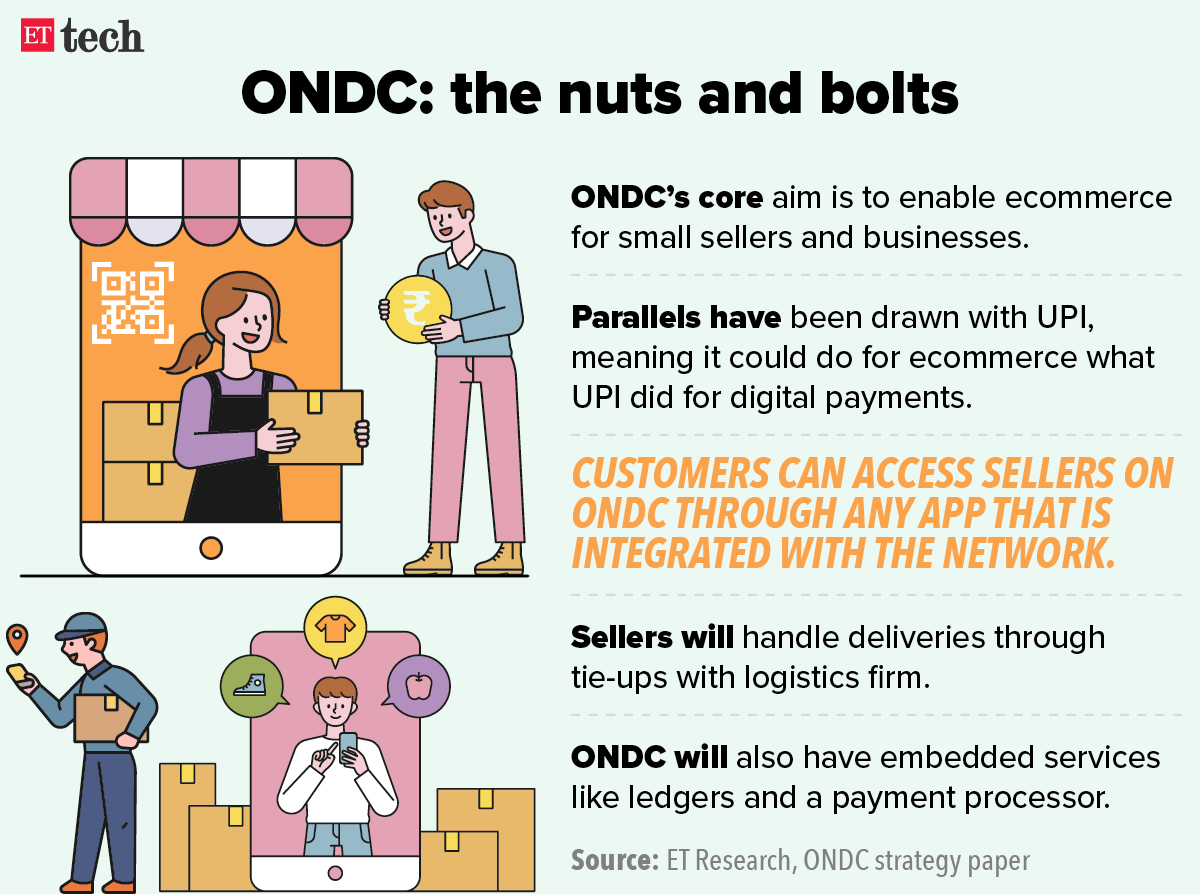

ONDC is not the giant killer which we all thought it would be

Everyone thought the government’s ecommerce initiative ONDC would be the giant killer that would disrupt Amazon and Walmart-backed Flipkart. But, turns out the best-case scenario for ONDC would be to work along with the incumbents, JM Financials has said in a report.

Why? It said that onboarding some of the larger incumbents early might provide ONDC with the much-needed scale and credibility with buyers and sellers. We were the first to report that Flipkart, Amazon, and Reliance may join the network in May. Flipkart’s e-kart, its payment app PhonePe, and Reliance’s Grab have already integrated with ONDC.

Not so disruptive: JM Financials did some data analysis based on the testing that is being done in over 100 cities. In food tech, the price comparison of some products in Bengaluru restaurants suggests the final order value on ONDC is on par or sometimes even higher than other apps.

However, discounts and other offers on the Zomato platform can make it a better value proposition for the customer compared to ordering from ONDC.

In the groceries category, ONDC has most products listed on the MRP and a delivery fee is charged on orders. On quick commerce apps (Swiggy Instamart and Dunzo), these are available at a discount and free delivery is offered above a certain order value.

Still lucrative: According to the report, the commission on ONDC could be 8-15% depending on the category, and might still be lucrative for investors. Sources have told us that over 300 players have signed up to integrate with the network on the buyer and seller side, as well as in logistics.

Also read: Exclusive | NPCI set to pick up 9-10% stake in government’s e-commerce project ONDC

India reconsidering on data legislation an act of wisdom: Microsoft President

The government’s move to rethink the data protection Bill has been ‘an act of wisdom’, Microsoft president and vice-chairman Brad Smith told us in an exclusive interaction during his recent visit to India.

Quote Unquote: Smith Applauded the government for “pausing on the privacy Bill” and said it was an intelligent way since it gave the government time to connect the dots on this important legislation.

“That notion, that a government would pause to think about how a privacy law should move with a better connection to other fields — that’s an act of wisdom,” he told us.

Background: Last month, the government withdrew the Personal Data Protection Bill — which had been in the works for nearly five years. It said the Bill would be replaced by a comprehensive legal framework that will be designed to address contemporary and future challenges of the digital ecosystem.

India leading the way: The Microsoft president said India took an “extraordinary” leap digitally in the global economy and made about five years of progress over the last two years of the Covid-19 pandemic. He pointed out that India has always been one of the major sources of talent in software, but is now joining the ranks of the top 2-3 software economies in the world.

“We are increasingly looking to enable India to be one of the great exporters of software IP… to take what has worked here, and make it work for many other parts of the world as well,” Smith told us.

Also read: Software superpower India to join world data capitals: Microsoft Corp president Brad Smith

TWEET OF THE DAY

Financing startup Klub closes Rs 200-crore maiden fund

Sequoia Capital-backed revenue-based financing platform, Klub, on Monday announced the closure of its Rs 200 crore maiden fund. Klub, a Sebi-registered Category II Alternative Investment Fund.

Aim: The fund aims to accelerate disbursements across growth-stage businesses during the festive season. The fund has disbursed 30% of its total corpus and is looking to make more investments in the coming few months.

CEO speaks: “Revenue-based financing fits perfectly for the festive season capital needs of businesses. This festive season we will expand our investments in small businesses as well as unicorns by two-fold (2x) through our RBF Fund over the next six months,” said Anurakt Jain, cofounder and chief executive officer (CEO) at Klub told us

What does Klub do? Founded in 2019, Klub provides digital businesses with flexible capital without having to dilute equity. It provides liquidity for recurring marketing, inventory, and capital expenditure (capex), with a focus on companies across domains of e-commerce, direct-to-consumer, and edtech.

Klub invests anywhere between Rs 5 lakh and Rs 30 crore in businesses for a tenure of up to 24 months.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi and Judy Franko in Bengaluru. Graphics and illustrations by Rahul Awasthi.