Also in this letter:

■ Big funding rounds at Cars24, Slice

■ Update on the Crypto Bill as exchanges see major dip in new sign-ups

■ Consumer internet firms on an M&A spree

Cars24 may hit $3 billion valuation in new funding round

Cars24 founders

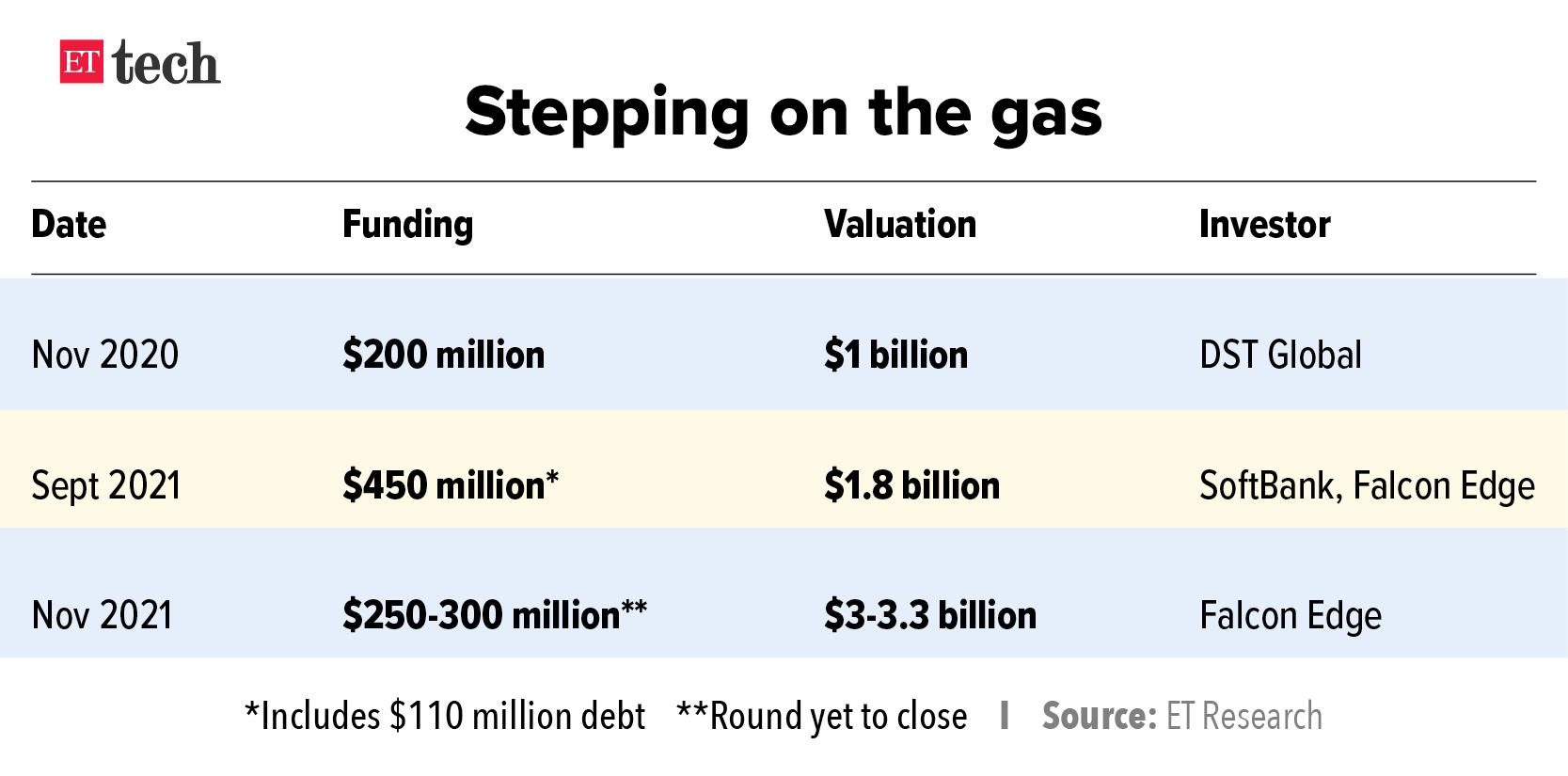

Cars24, an online platform for selling used cars, is in advanced stages of talks to close a $250-300-million funding round led by its existing investor Falcon Edge, multiple sources briefed on the matter said.

Valuation bump: If the round goes through, Cars24’s valuation is likely to increase to $3-3.3 billion, up from $1.84 billion in September when it closed a $450 million financing from SoftBank Vision Fund II, Falcon Edge and Yuri Milner’s DST Global.

Sources say: The company is considering a secondary share sale as part of the round as well but it hasn’t been finalised yet, the people said.

- “Unlike the last round, Falcon is cutting the single largest cheque this time. Rest of the existing investors will be participating in it as well,” a person aware of the matter said.

Its September funding round included a $110 million debt as well.

Expansion plans: Cars24 entered Thailand in November and it is present in UAE and Australia. “It is looking to enter more countries in Southeast Asia and the Middle East over the next two quarters. Parts of new capital will be utilised for international expansion besides doubling down on the domestic market,” the person quoted above added.

Behind Paytm’s dismal IPO and its constant valuation catchup

Paytm’s founder Vijay Shekhar Sharma is synonymous with setting big goals and he isn’t shy about his grandiose ambitions. “Go big, or go home”, a sales slogan believed to have originated in the ‘90s America, is an exhortation emblematic of what Sharma and Paytm stand for.

So why did Sharma’s mega ambitions which involved orchestrating India’s largest-ever IPO turn into a disastrous show on the Indian public markets?

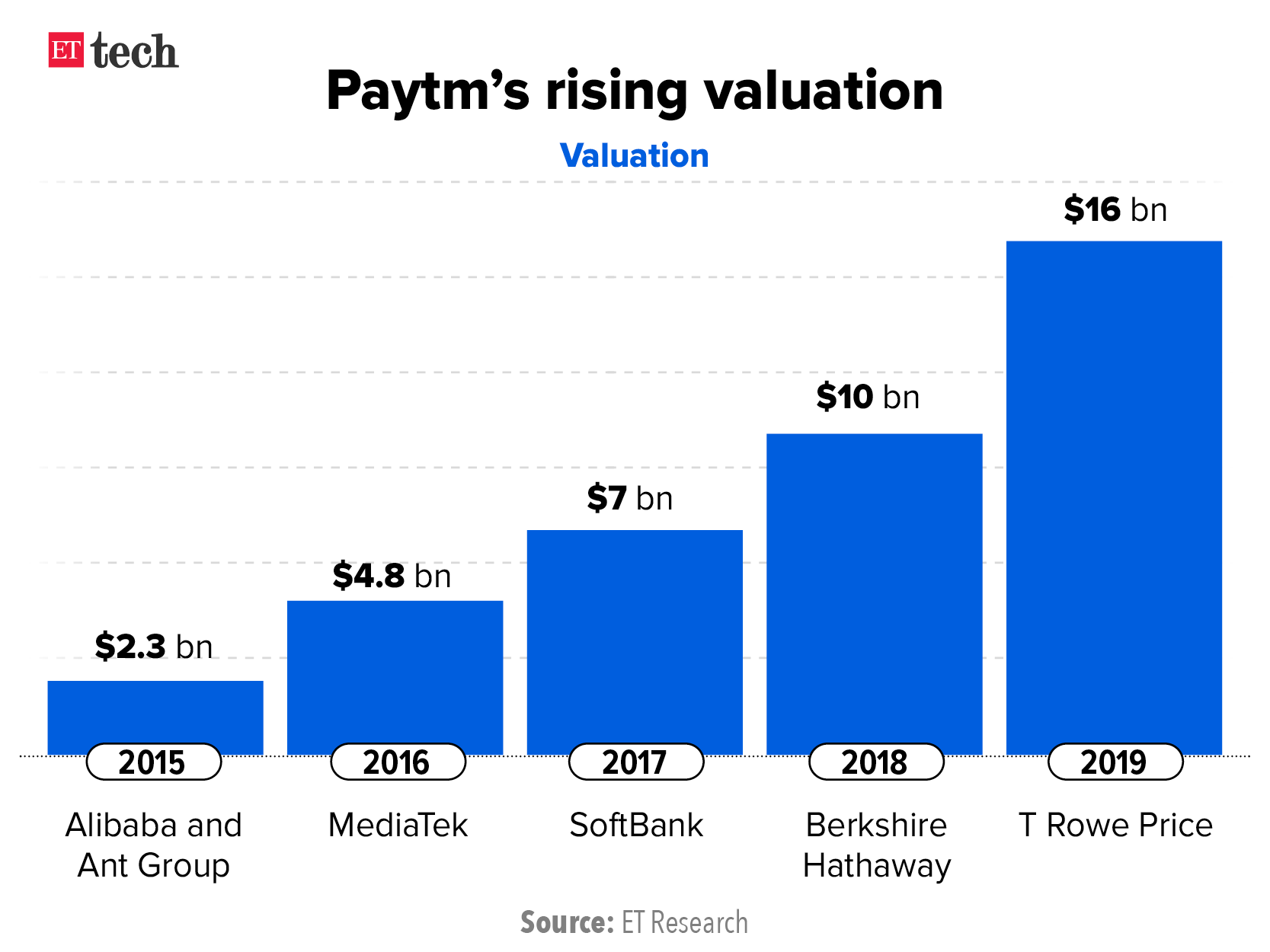

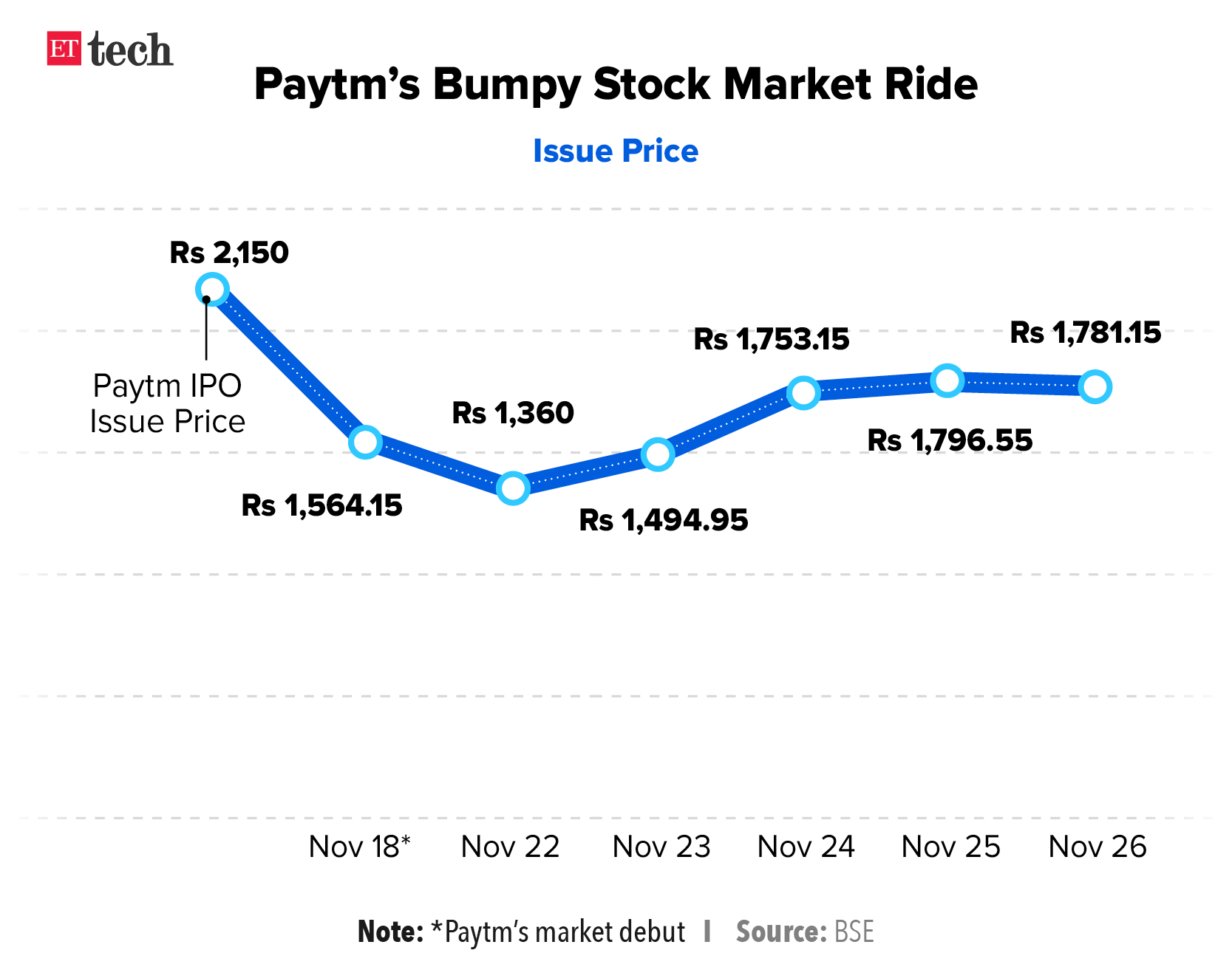

What happened? Billed as the largest ever Indian public offering at Rs 18,300 crore in size, the listing of One 97 Communications, which runs Paytm, turned into a nightmare in the first two days of trade as its market cap shaved off nearly 40% from its issue price of Rs 2,150, as retail investors cried foul. Paytm’s market cap was a little over $13 billion at the close of the first day of trade, far lesser than its last private market valuation of $16 billion two years ago.

While it made a recovery in stock prices over the next week, the stock was well below its issue price after it settled at Rs 1,781.15 on the BSE as of November 26.

Overpricing, steep valuation, unclear path to profitability were not the only reasons for the dismal show, many people ET spoke to said. It was also bad timing, failure to create buzz and sell a story to domestic institutional investors like mutual funds and high net worth individuals, all of which also impacted the IPO subscription and post-listing price, said experts.

Digbijay Mishra & Rajesh Mascarenhas find out what went wrong with the county’s largest IPO. Click here to read more.

Slice turns unicorn after raising $220 million

Slice founder Rajan Bajaj

Slice, a new-age credit card startup which offers flexibility to pay bills, manage expenses and give reward points, said it has raised $220 million in new funding led by US-based investors Tiger Global and Insight Partners.

Tell me more: Post the funding, the startup is valued at over $1 billion — a five times increase since its previous funding round six months ago. Advent International’s Sunley House Capital, Moore Strategic Ventures and Anfa are among its new investors joining the funding round that minted the latest unicorn taking the total number of members in this club to 37 this year, so far.

Existing investors: Gunosy, Blume Ventures and 8i also participated in the new funding round. Guillaume Pousaz, CEO of European fintech major Checkout.com, and Flipkart cofounder Binny Bansal have also participated in the round as angel investors, Slice founder Rajan Bajaj said.

Slice has also seen a minor secondary share sale in this round and may top up the current round with another $20-30 million, people briefed on the matter said.

Founder speak: “We are targeting a user base of one million by December. The new capital will be used for expansion and growth and further making the customer experience better,” Slice founder Rajan Bajaj said.

Tweet of the day

RBI-backed CBDC likely to feature in Crypto Bill: official

The proposal for a central bank digital currency (CBDC) backed by the country’s banking regulator may be included in the upcoming bill to regulate cryptocurrency, a top government official told ET.

Terming the government’s bill as a response to the central bank’s concerns about macro-economic stability, the official in the know of discussions on the upcoming legislation said the “government’s response is not to ban cryptocurrencies but rather to provide cryptocurrency via the RBI.”

Maintaining control? The Bill, slated to come up in the winter session of Parliament beginning on Monday, aims to also ensure that the Reserve Bank of India (RBI) does not lose control of the country’s monetary economics while minimising speculative betting around cryptos, the source said.

“Unregulated cryptocurrencies can destabilize the macroeconomy and create big speculative bubbles. To that extent, the RBI is right,” the person added.

The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, due to be introduced in the next session of Parliament, has triggered an industry-wide stir, as the Lok Sabha website in its briefing on the legislation states that it “seeks to prohibit all private cryptocurrencies in India” but allows for “certain exceptions to promote the underlying technology and its uses”.

In recent days, the price of major cryptocurrencies in the country has seen wide fluctuations as investors await greater regulatory clarity.

Measured approach: Acknowledging that crypto and blockchain are here to stay world over, the official said India will adopt a gradual approach to digital currency.

“The government’s approach to crypto may be careful, measured and evolving, we will start with a CBDC. ( the central bank) will launch that and in future there may be RBI authorised and regulated private stable coins,” said the person, while noting that “ functionally and theoretically, they (cryptocurrencies) disintermediate the conventional players in financial markets like bank accounts or credit cards and play that role.”

Crypto exchanges see their new sign-ups dip amid uncertainty

There has been a dip in new sign-ups on cryptocurrency exchanges, as prospective investors seem to be hedging their bets till regulatory clarity emerges on the asset class.

New user sign-ups are a matrix used to value crypto companies.

But, why? Investors have become jittery after the government decided to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, in the upcoming Winter session of Parliament.

The Bill seeks to prohibit all private cryptocurrencies in India but allows for “certain exceptions to promote the underlying technology and its uses.”

A massive hit: Crypto exchanges have recorded a 15-50% drop in new sign-ups in November so far. They have also posted a dip in their monthly transactions after some investors squared off positions and adopted a “wait and watch” mode.

Quote: “We have seen a 20% drop in new sign-ups on a week-to-week basis. We have had an average daily sign-up rate of 8,000-10,000 per day during the recent bull cycle. Right now, we’re getting around 5,000-6,000 new users every day,” said Shivam Thakral, CEO, BuyUcoin.

A few large exchanges, however, claimed that they had not seen any major changes, especially in the trading patterns of mature investors.

- “We have not seen any significant change in these numbers on our platform since we largely cater to retail investors who invest for the long term,” said Ashish Singhal, CEO, CoinSwitch Kuber.

Many investors seem to be opening additional accounts to sell the crypto assets they hold, say insiders.

Industry trackers said transaction volumes had increased in the last few days as investors rushed to sell crypto assets, but that has tapered off since Saturday.

WhatsApp Pay plans significant investments in next six months

WhatsApp Pay is planning to invest significant sums in India over the next six months to speed up the growth of its payment service and will work towards a full-fledged rollout, its top executive told ET.

Cleared for take off: WhatsApp, the instant messaging app owned by Meta (formerly Facebook), has received approval to scale up its payments business to a tenth of its India user base.

The National Payments Corporation of India (NPCI), India’s flagship payments processor, allowed WhatsApp on Friday to double the number of users on its payments service in the country to 40 million from the approved 20 million last year.

Userbase: WhatsApp claims it has more than 400 million users in India, but industry estimates peg it at about 500 million. It works on United Payment Interface (UPI).

Quote: “Over the next 6 months, we have planned significant investments in WhatsApp Pay across India—including many more “India-first” features—that we are sure will accelerate our growth,” Manesh Mahatme, director-payments, WhatsApp India, told us. “As the adoption of WhatsApp Pay increases with users across the country, we look forward to working with NPCI to further expand it to all users.”

India specific features: In the last several weeks, WhatsApp introduced India-specific features on WhatsApp Pay, including adding ₹ (rupee) symbol in its chat composer for sending payments, and the camera icon in composer, which lets users scan any QR (quick response) code.

- “Since our initial approval from NPCI, we have been working to deliver a simple, reliable, and secure experience for WhatsApp users that we hope will accelerate the adoption of UPI for the “next five hundred million” Indians,” Mahatme said.

A small share of the pie: WhatsApp Pay’s market share in UPI transactions stands at less than 1%, whereas Walmart-backed PhonePe and Google Pay’s market share is 46% and 34%, respectively.

Other top stories by our reporters

Consumer internet firms on an M&A spree: Indian consumer internet companies have acquired a record 75-plus firms between December 2020 and November 2021, data by market intelligence services firm Tracxn showed. The acquisitions, all-time high for any given 12-month period, ranging from 100% buyouts to partial equity stakes.

Gameloft partners with WinZO: French multinational gaming company Gameloft has entered into a partnership deal with Delhi-based social gaming platform WinZO to enable the creator of popular games like Asphalt 9 to tap into a large potential market in the country.

Dutch geospatial company TomTom is working on a new mapping platform that would help it strengthen its presence in countries in Africa, Latin America and Southeast Asia, chief executive Harold Goddijn said. A large part of the development is happening out of India, which has about a quarter of its total employee base.

Policies key to ride next tech innovation wave: India needs to be policy ready to capitalise on the next wave of technological innovation and compete with powerhouses such as the United States and China on a global stage. The country will also need to allocate more seed capital for research into Deep Tech, remove restrictions and foster risk-taking among its youth, a panel of experts said. They said the country was on the right path to harness genomic sequencing, artificial intelligence, robotics, nanotechnology, and other such technologies, but gaps needed to be addressed.

Decoding Data Protection Bill: Data protection, while ensuring individual privacy, and spelling out the state’s surveillance powers are the need of the hour. The finalisation of the data protection Bill is a step in that direction. Surabhi Agarwal breaks down the jargon and writes what it means for the common user.

Global picks we are reading

■ India tells public to shun Musk-backed Starlink until it gets licence (Reuters)

■ Visa complains to US govt about India backing for local rival RuPay (Reuters)

■ Australia to introduce new law to force media platforms to unmask onnline trolls (Reuters)