Also in this letter:

■ Bookmyshow backs D2C marketplace startup Popclub

■ Twitter withholds Goddess Kaali poster tweet on govt request

■ IT firms may report higher attrition in Q1

Cars24 shifts to slow lane amid funding winter

Used-car selling platform Cars24 is shifting gears to cut costs through a spate of measures as late-stage funding deals dry up, sources told us.

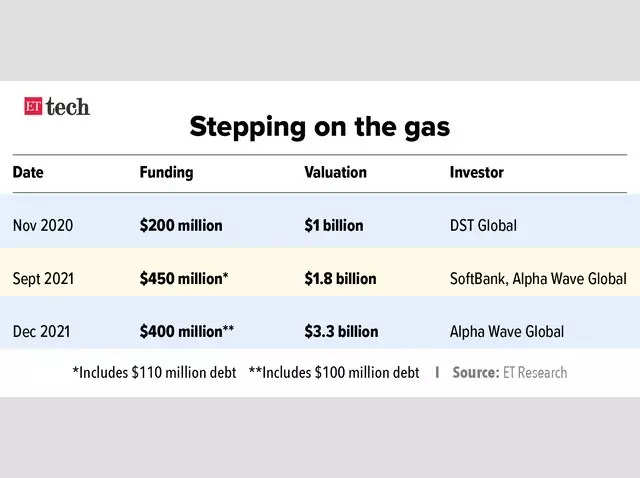

Details: The company, backed by SoftBank and Alpha Wave Global, is looking to reduce its burn by around 50% to extend its runway.

- It will start by halting its aggressive overseas expansion plans in markets like the Middle East, Thailand and Australia.

- The company had been burning through $20 million a month and is now looking to cut this in half, one of the sources said.

- It has also largely shut its offline centres across the country, except in the national capital, though this decision was taken last year.

- Sources also said the company has laid off at least 700 people, more than the reported number of 600.

Bleak outlook: These measures by Cars24 underscores the sense among founders and investors that the funding slowdown may get worse in the second half of the year.

We reported in May that Meesho, another well-funded startup, was also looking to cut costs amid the ‘funding winter’.

And on May 30 we reported that top venture capital (VC) funds are expected to go slow on large deals, having told their portfolio firms to cut costs and hunker down.

According to data from Venture Intelligence, VC funding into Indian startups dropped 37% in the second quarter of this year to $6.9 billion.

Bookmyshow backs D2C marketplace startup, to list it on platform

Online movie ticketing and events platform Bookmyshow (BMS) has invested around Rs 10 crore in Popclub, a new direct-to-consumer marketplace startup, according to regulatory filings sourced from Tofler.

Details: The startup – housed under Preebee Lifestyle Pvt Ltd — will use BMS’ large user base to drive traffic to the marketplace, sources told us.

BMS is also likely to create a tab on its platform for Popclub, as per current discussions.

Founded by The Label Life founder Preeta Sukhtankar, Popclub is in active discussions to onboard multiple D2C brands on its platform. Each brand will have a digital storefront on Popclub.

According to a presentation by Popclub, which we have reviewed, the platform is pitching four value propositions:

- Bookmyshow’s customer base

- Premium creator and celebrity access

- A loyalty currency (pop coins)

- A free sample giveaway programme called Pop Minis to onboard brands

It is targeting people with high spending power in tier 1 cities.

Covid rebound: BMS’ foray comes at a time when it is recovering from the aftermath of the Covid-19 pandemic, which decimated its business.

In an interview in April, Hemrajani told us business was rapidly approaching pre-pandemic levels.

Twitter withholds Goddess Kaali poster tweet on govt request

Twitter India on Wednesday withheld a July 2 tweet by filmmaker Leena Manimekalai that featured a poster of her film, which depicts the Indian Goddess Kaali smoking a cigarette.

The takedown, which Twitter reported to the Lumen Database, was In response to a legal request from the union government. On Tuesday, Twitter sued the government in the Karnataka High Court, saying some of its takedown requests constituted an abuse of power and an infringement of free speech.

Lumen is an American collaborative archive that aims to protect lawful online activity from legal threats.

The controversy: Canada-based Manimekalai’s film Kaali was screened at the Aga Khan Museum in Toronto on July 2. Following the announcement, the filmmaker faced severe social media backlash.

The Indian High Commission on Monday urged the Canadian authorities to withdraw the poster and other “provocative” material. On Tuesday, the Delhi Police and the Uttar Pradesh Police filed separate FIRs against Manimekalai.

IT firms may report higher attrition in Q1

Most Indian information technology companies may report an uptick in attrition yet again as they start reporting their financials for the quarter ended June. The attrition rate, however, is expected to start falling from this quarter onwards, experts said.

As IT companies report attrition on a last twelve months (LTM) basis, human resource professionals and industry executives said most companies would report another quarter of peak attrition, or number of employees quitting during the period, for the June quarter.

LTM is calculated based on the number of employees who have left the company in the last 12 months (July to June in this case) divided by average headcount of the company in the period.

“Attrition is expected to be high both on account of LTM and hike season. It could be at least 2% to 4% higher on a quarter-on-quarter basis unless internal definitions are changed,” said Gaurav Vasu, chief executive officer of IT market intelligence firm Unearthinsight.

The top four IT companies – TCS, Infosys, Wipro and HCL – reported record high attrition rates of between 17.4% and 27.7% in the quarter ended March.

TWEET OF THE DAY

Axilor launches $100 million second fund to double investments

In the wake of rising early-stage investments by VCs, Axilor Ventures is launching its second technology fund Axilor Technology Fund-II, worth $100 million, as it looks to double down on its Indian startup investments.

Founded by former Infosys cofounders Kris Gopalakrishnan, SD Shibulal and others, the firm used 90% of its first fund, worth Rs 200 crore, to back about 54 companies.

Axilor will now look to back 100-125 new companies across SaaS, supply-chain tech, fintech, healthcare and agritech at a time when late-stage funding has slowed down.

ETtech Done Deals

■ Financial infrastructure provider M2P Fintech acquired cloud-lending platform FinFlux for an undisclosed sum. Launched in 2010, Bengaluru-based Finflux offers loan origination, loan management, BNPL products and credit scoring services via its cloud platform, servicing over 12 million borrowers.

■ Direct-to-consumer (D2C) bakery brand The Baker’s Dozen raised $5 million in a mix of debt and equity funding led by Fireside Ventures. Founded in 2013 by Aditi Handa and Sneh Jain, The Baker’s Dozen makes bakery staples like sourdough bread, cakes, and cookies.

■ Finvu AA, a consent-based account aggregator, raised $2.5 million in funding from Varanium Nexgen Fund, IIFL, DMI Sparkle Fund and others. The company has processed over 7,50,000 consent requests and executed over two million APIs.

Other Top Stories By Our Reporters

Google’s looks to enable 10,000 startups: A majority of startups fail within the first five years for the same reasons – unmanaged cash burn, flawed demand assessment, ineffective feedback loops or lack of leadership – Aditya Swamy, director of Play Partnerships said on Wednesday at the launch of Google’s Startup School India, which is looking to enable 10,000 startups in tier 2 and tier 3 cities.

Capital Float rebrands as ‘axio’, unifies offerings: Online capital financing platform Capital Float has unified its offerings – Capital Float, Walnut & Walnut 369 – and rebranded itself as ‘axio’, it said in a blogpost on Wednesday. The unification brings checkout finance services, pay later, personal credit, and money management tools under one umbrella to cater to the company’s growing consumer base.

Global Picks We Are Reading

■ What Europe’s push to simplify chargers means for you (The Washington Post)

■ How tech rescued Sri Lanka’s tanking tourism industry (Rest of World)

■ How to avoid the worst Instagram scams (Wired)