“The decision for our director to step down from the Byju’s board was taken after it became clear that he was unable to fulfill his fiduciary duty to serve the long-term interests of the company and its stakeholders,” a statement from Prosus said. The investment firm holds less than 10% of Byju’s total stake and recently marked down the valuation of that investment.

Also read | Byju’s downsizes Bengaluru office space in cost-saving bid

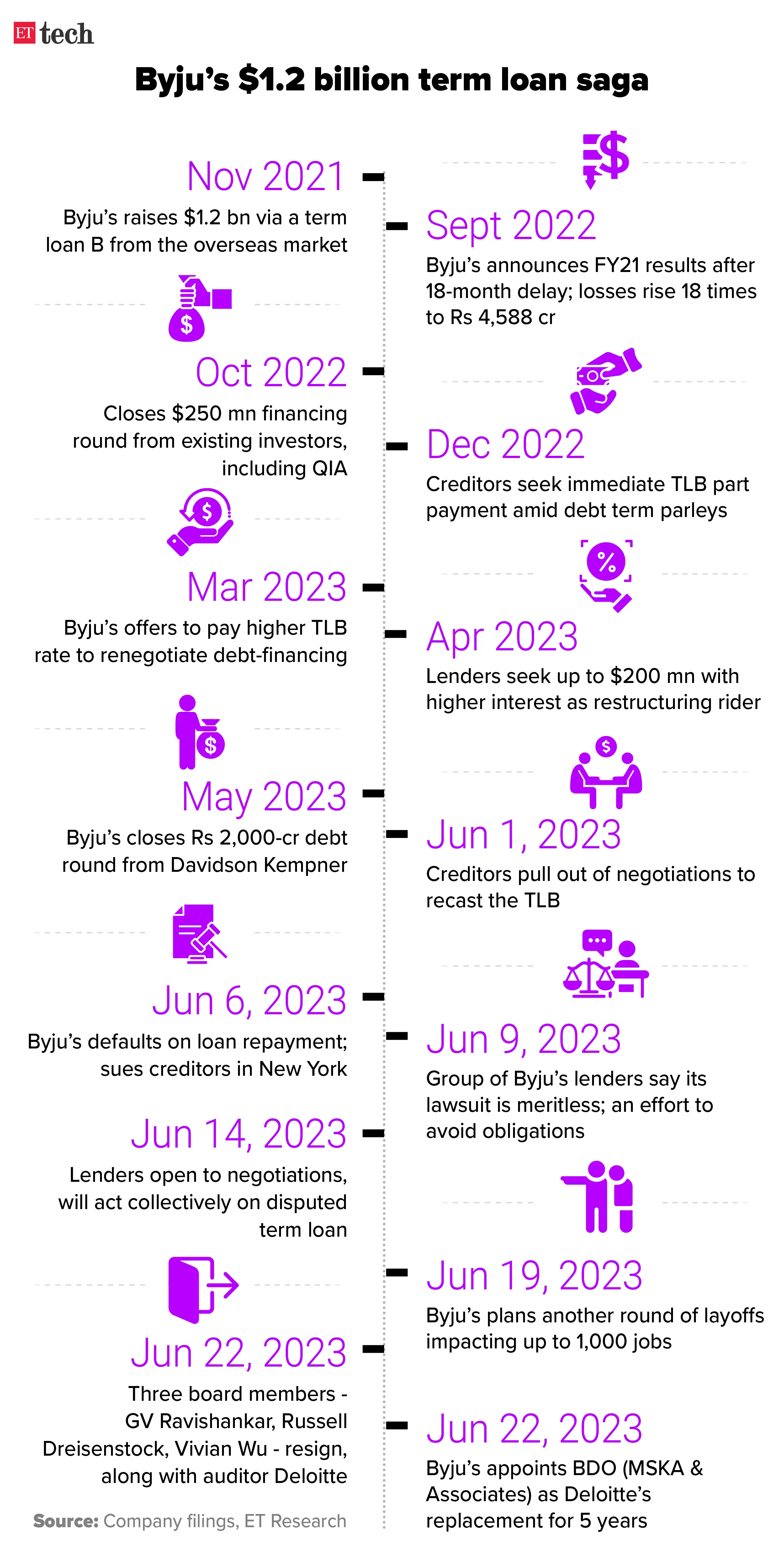

ET first reported on June 22 that board members representing investors Prosus, Peak XV Partners and the Chan Zuckerberg Initiative had resigned from the board.

Early backer GV Ravishankar, who is managing director at Peak XV Partners (formerly Sequoia Capital India), Russell Dreisenstock of Prosus (previously Naspers) and Chan Zuckerberg Initiative’s Vivian Wu, had stepped down from the board last month.

Prosus added that even though it no longer has a representative serving on Byju’s board, it will continue to believe in the potential of Byju’s and its role in revolutionising access to quality education in India and around the world.

Discover the stories of your interest

ETtech

ETtech“As a shareholder, Prosus will continue to assert its rights, collaborating with other shareholders and government authorities to safeguard the long-term interests of the company and its stakeholders,” the statement added.

The statement from Prosus on why its representative left the board comes a day after Byju’s and its lenders said they would hammer out an accord on changes to conditions in the company’s $1.2 billion Term Loan B. This is expected to speed up disbursal and end litigation between the two sides.

In response to the Prosus statement, a spokesperson for Byju’s said, “We have noted the observations of our valued investors. We have updated our shareholders about definitive steps taken to improve corporate governance and financial reporting.”

On June 27, citing Prosus’ annual report, ETtech had reported that the fair value of its investment of $578 million in Byju’s for a stake of less than 10% had been marked down to $493 million, as of March 2023. This translated to an enterprise valuation of about $5.1 billion for Byju’s, way below the $22 billion ascribed to it during its last equity funding.

On June 22, Deloitte resigned as Byju’s official auditor, citing delays in receiving the company’s financial statements for FY22.

The investor-appointed board members confirmed their exit on June 23. After Deloitte’s exit, the company appointed BDO (MSKA & Associates) as its statutory auditor for five years, beginning FY22. Cofounder Byju Raveendran and CFO Ajay Goel promised investors on June 24 that the company’s audited FY22 financials would be filed by September, while those for FY23 would be released by December 2023.

Byju’s reported its FY21 financials on September 14 last year, after an 18-month delay, reporting a higher loss of Rs 4,588 crore on revenue of Rs 2,280 crore.