Also in the letter:

■ YouTube Shorts vs Instagram Reels

■ BluSmart raises $25 million

■ Explained: Apple makes changes in EU

Byju’s seeks $200 million in rights issue at $250 million valuation amid deep cash crunch

Desperate for funds, troubled edtech firm Byju’s has kickstarted a rights issue today to raise up to $200 million, as per a notice sent to investors. It is likely to price the share offering at as low as $5 per share, which would ascribe it a post-money valuation of around $220-250 million, a far cry from its peak.

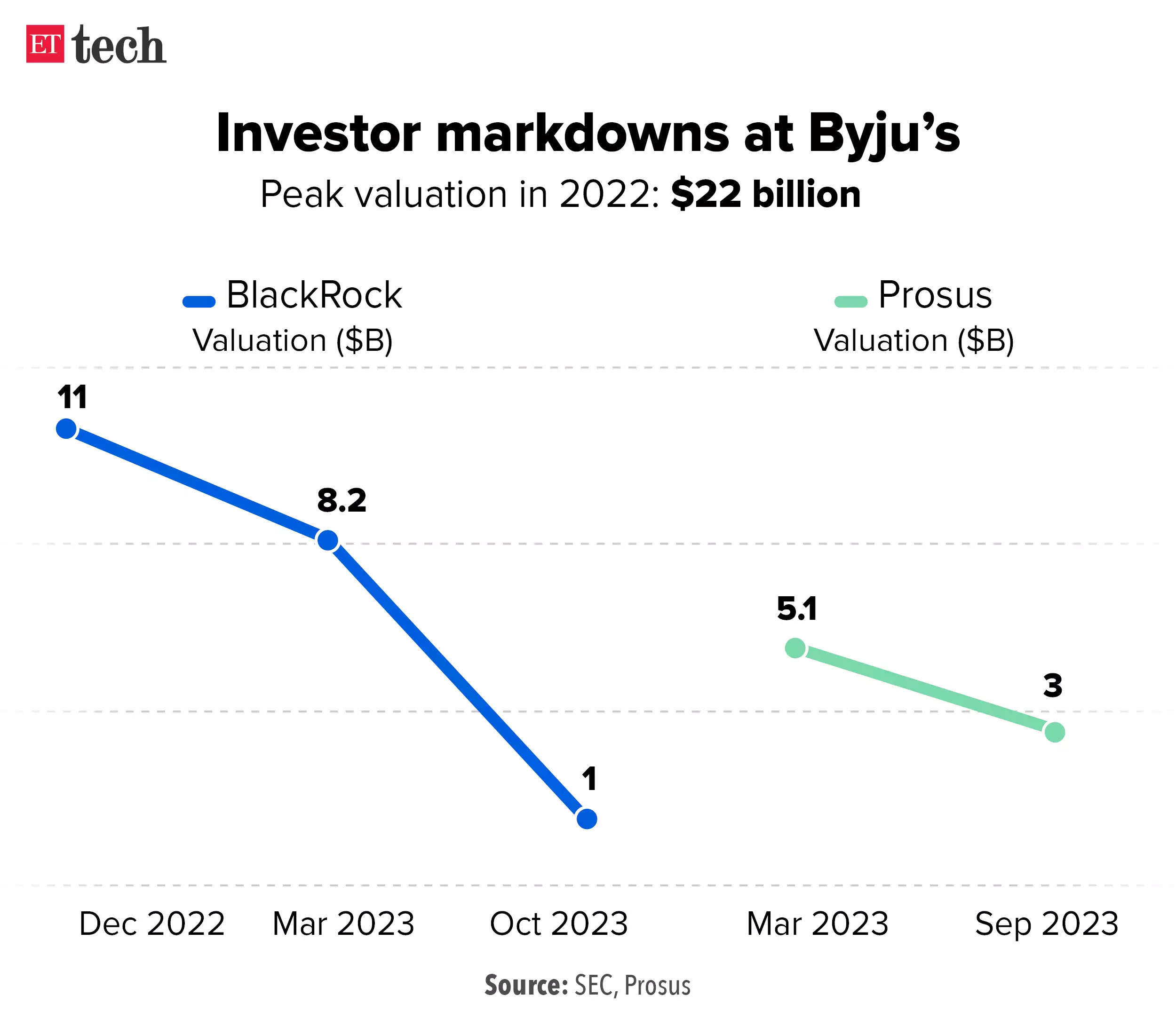

On the downswing: Byju’s was last valued at $22 billion in 2021, and the latest rights issue pricing is at a steep cut of 99% in valuation. The company has seen significant downgrades from several investors including BlackRock to just about $1 billion. Prosus, another key investor, last valued it at $3 billion.

Yes, but: In case the issue is not fully subscribed, the fair market value of the company would be arrived at separately, sources in the know told us. CEO Byju Raveendran said the issue will offer existing shareholders the opportunity to participate in the proposed capital raise to the extent of their shareholding and beyond.

Also read | US lenders drag Byju’s to bankruptcy court in India

Verbatim: In the note seen by ETtech, Raveendran said the company has not “shied away from taking several tough decisions” amid its current challenges.

“The board believes it is imperative that the company raises capital in order to create a glidepath to deliver strong shareholder value. This capital raise is essential to prevent any further value impairment and to equip the company with necessary resources to deliver on its mission,” he said.

Also read | For more capital, Byju’s must pass a tough test

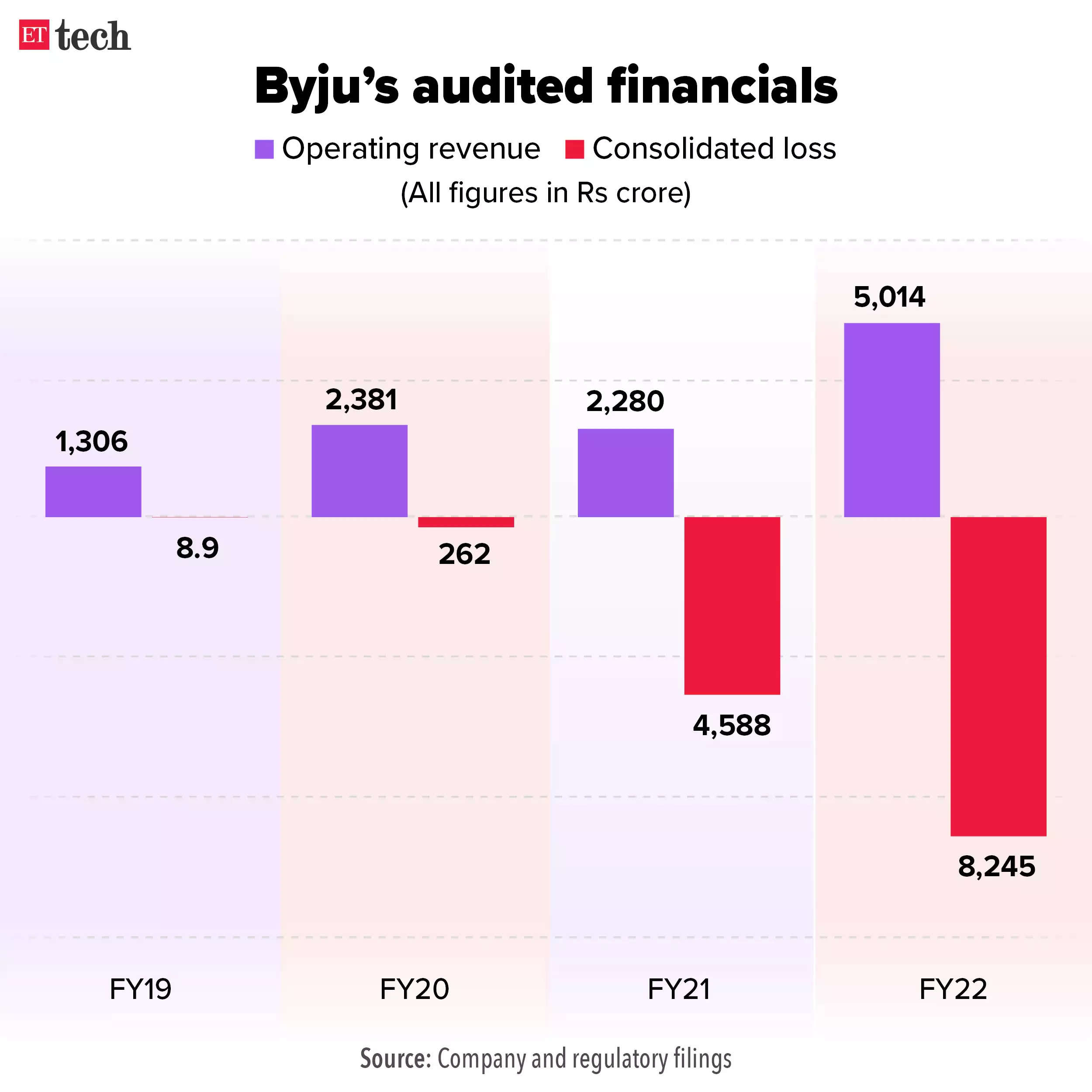

Catch up quick: ET reported on January 24 that Byju’s parent, Think & Learn, reported a consolidated loss of Rs 8,245 crore on operating revenue of Rs 5,014 crore for FY22. Sources had told us that the company had approached existing shareholders to raise $100 million via a rights issue at a valuation of as low as $500 million to $1 billion.

Cryptocurrency comeback: Indian exchanges shine amid offshore challenges

After a tumultuous few years and losing traders to offshore platforms, Indian crypto exchanges are witnessing a dramatic reversal. Following a government crackdown on foreign exchanges like Binance and Kucoin due to anti-money laundering concerns since December, local exchanges like CoinDCX and Unocoin have enjoyed a windfall, witnessing up to 2,000% surges in registrations and deposits.

Counting riches: Eager to capitalise on the influx, Indian platforms are rolling out enticing deposit offers and cashbacks, cementing their dominance in the newly reshaped crypto landscape. CoinDCX alone announced a $1-million sum to be disbursed as incentives to depositors.

Too soon to celebrate: Early signs of recovery are visible, with Indian exchanges reporting a surge in volumes for January. However, nearly $4 billion in crypto assets of Indian investors are parked in foreign wallets, of which only a few million have come back.

The crypto freeze has been thawing in recent weeks in India but experts warn that more needs to happen. Despite banning foreign exchanges, for instance, trading on these platforms is active thanks to previously installed apps and VPNs.

Losing interest: Experts have pointed to Binance’s silence on the ban, and believe that foreign platforms do not have a business case by registering themselves as Financial Intelligence Unit (FIU)-compliant entities in India.

Moreover, not only is the crypto investor community in India small, offshore platforms must also worry about retrospective taxes of nearly Rs 3,500 crore for trades that occurred in the past one-and-a-half years.

Also read | Google removes Binance, other offshore crypto apps from Play Store

YouTube Shorts vs Instagram Reels: The battle for dominance

To cater to the ever-dwindling attention span of internet users, a battle royale is underway in India’s content creator space between YouTube Shorts and Instagram Reels. While YouTube boasts of better discoverability for influencers, Instagram is where their originality is put to the best use. Both apps are competing for control over our scrolling habits.

How did we get here? For a decade, YouTube reigned supreme in the burgeoning creator economy, while Instagram provided personal expression. With TikTok’s short-form video revolution, Instagram shifted from a social network to a content platform, and YouTube Shorts were introduced.

Luring creators: Instagram now allows paid subscriptions for creators and has extended its Reel time limit to 90 seconds. YouTube has recently opened up ad-revenue-sharing for Shorts and launched other fan-funding features like Super Thanks and channel membership.

Both platforms are introducing feature after feature to outdo each other’s impact. But what do creators prefer?

Also read | Instagram reigns supreme: The biggest app trends of 2023

Who aces what? Creators told ET that YouTube Shorts lacked original content. Even though a lot of Reel trends are essentially TikTok hand-me-downs, original India trends do originate on Reels.

On the flip side, influencers appreciated YouTube’s ‘Skip Ad’ feature, which enabled brands to consider user behaviour and avoid interfering with their viewing experience. Many pointed to the stagnating nature of Instagram followership, as opposed to YouTube which sees much more organic growth.

Also read | After 15 years in India, YouTube expects creators, new tools to drive growth

BluSmart raises $25 million in debt, equity funding from climate investment firm ResponsAbility

Anmol Singh Jaggi, cofounder and CEO, BluSmart Mobility

Electric vehicle (EV) ride-hailing platform BluSmart has raised $25 million from Zurich-based climate finance firm ResponsAbility and will use the money to expand its EV charging infrastructure.

Details: The funding comprises $20 million in debt and $5 million of equity, BluSmart cofounder and chief executive Anmol Singh Jaggi told ET. With ResponsAbility’s investment and support, the company will continue to rapidly expand its 100% EV ride-hailing service and EV charging infrastructure, he added.

Back-to-back funding: In December, the startup had raised $24 million from existing investors, founders and the leadership team. In an earlier round in May, when it raised $42 million, nearly half the funding had come from its six founders who currently own nearly 35% of the company.

Also read | BluSmart Mobility unveils new pricing policy for rush, relaxed hours

Cybersecurity firm ClearTrust raises $1.9 million in funding: ClearTrust, a new-age ad tracking and fraud detection platform, said it raised $1.9 million in a pre-Series A funding round led by venture capital firm Ideaspring Capital with participation from Piper Serica Angel Fund.

Angel investors exercise caution amid changing startup dynamics

Indian angel investors have grown wary of mere potential, demanding startups prove their viability through execution before earning their backing. This is a massive reversal from a couple of years earlier when the high-risk, low-liquidity world of startups was a favoured investment arena for high net worth individuals (HNIs) and C-level executives.

Shifting trends: India’s startup ecosystem witnessed a surge of investor interest in 2021 and 2022, with 40 new angel investment firms coming up. However, the tide turned in 2023 with the number of new angel networks dwindling to a mere six.

Global phenomenon: According to Crunchbase, globally, early-stage startup funding was down by more than 40% on year in 2023. The US startup ecosystem, the world’s largest, has also experienced a similar shift.

Apple app ecosystem changes in Europe: Why app developers are unhappy?

Apple has caved in to pressure from the European Union (EU) and the new rules under the Digital Markets Act. Users in the EU can ditch the App Store, while developers also get an escape route from Apple’s payment system.

Critics, however, remain skeptical of these changes, claiming they fall short of EU demands. Let’s untangle the standoff.

About the changes: Users can now install apps from third-party app stores. Apple will conduct baseline reviews of all apps regardless of their distribution for malware and platform integrity, using automated and human intervention. Developers can either choose Apple’s in-app payment system or integrate a third-party system for payments.

Not enough? App developers, especially those who have protested against Apple’s ‘walled garden’ policy, alleged the changes are not enough to abide by the EU regulations.

Spotify founder Daniel Ek called the changes ‘a farce’ and said that by inventing a new tax system to replace the old, Apple mocks the spirit of the law and the lawmakers who wrote it. Epic Games CEO Tim Sweeney also called the changes a “devious new instance of malicious compliance”.

Also read | Apple ready to open iPhone tap-to-pay to rivals—in the EU

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar in Bengaluru.