Also in the letter:

■ Google working to address antitrust fears: Sanjay Gupta

■ Large deals in focus with $1 billion deal in pipeline: Wipro CEO

■ SoftBank to offload 1.1% stake in Zomato: report

Byju’s taps PE funds to prep for Aakash sale test

Byju Raveendran, founder and chief executive of Byju’s, and his advisers are talking to private equity firms to discuss the sale of a controlling stake in Aakash Institute, considered the crown jewel of the troubled edtech, people aware of the numbers said.

Generating interest: Exploratory talks have been held with the likes of Bain Capital and KKR. Some of the PE funds such as Carlyle are open to the option of backing Aakash Chaudhry, former CEO and part of the family that founded Aakash, to buy back the company.

Most funds approached so far have only been interested in a deal that involves a change in management control, with at least 51% stake being sold to them, said the people cited above.

Yes, but: Byju’s parent firm denied the move. “Think and Learn is not considering any sale of Aakash Education Services. AESL is core to the growth strategy of T&L,” a spokesperson told ET.

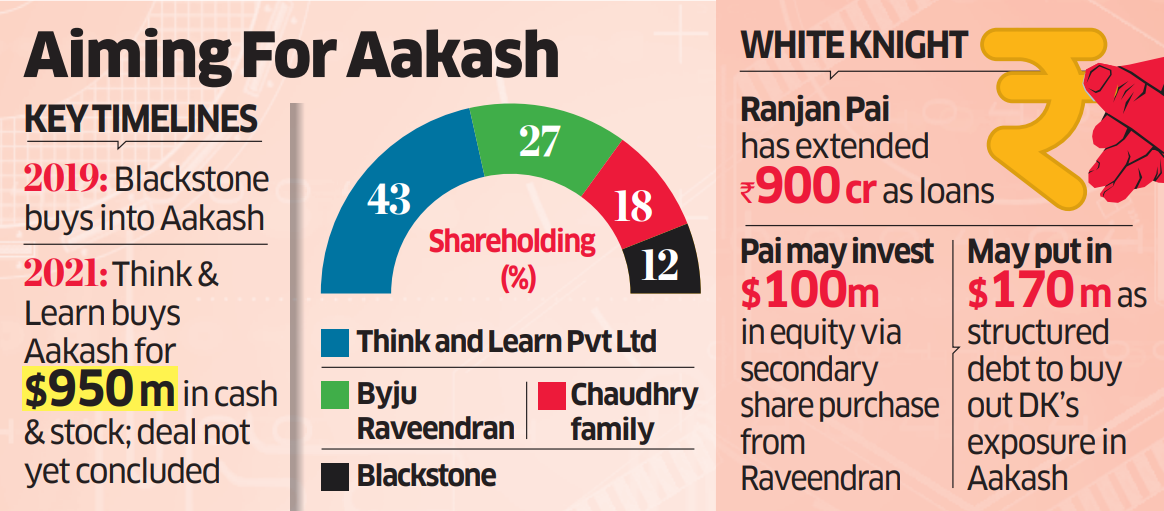

Quick catch-up: These talks take place as Byju’s has also asked Chaudhry to return to the company in his previous role, replacing Abhishek Maheshwari. Meanwhile, Manipal Group chairman Ranjan Pai has stepped in as white knight. Pai is said to be looking at an equity investment of $100 million through secondary share purchases and a $170 million structured debt investment to help Byju’s clear dues to Davidson Kempner.

Word for word: “Byju is juggling multiple balls. The immediate concern will be to settle DK’s dues. The idea is to take forward the deal that comes through,” said one of the executives cited above. “So with Ranjan Pai as an anchor, PEs are smelling a buyout opportunity.”

Also read | ETtech Recap: Five must-read stories on Byju’s crisis

UK’s Prudential may lead Udaan downround; below $2 billion value seen

Vaibhav Gupta, founder and CEO, Udaan

Business-to-business (B2B) ecommerce firm Udaan is in talks to close a new round of funding led by UK-based M&G Prudential. But there are riders.

Driving the news: The Lightspeed India-backed company is likely to see a significant drop in its valuation during the new financing, which is expected to be under $2 billion, compared to its last peak valuation of $3.2 billion, sources said.

Details: While new equity capital is coming into Udaan, M&G Prudential and others who had invested in the firm last year through convertible notes will fully convert the debt to equity in this round, sources added. Udaan was among the first set of companies to have tapped convertible notes to safeguard its valuation when the funding winter had started to set in.

Money matters: As per current conversations, the fresh equity infusion could be in the range of $100-150 million. It had raised around $300 million in convertible notes from M&G Prudential, Microsoft, Kaiser Permanente, Nomura and others.

Jargon buster: When funding happens through convertible notes, there is no valuation ascribed to the company at the time, but the investors would get to convert their notes into equity – typically at a discount – in the next liquidity event like a funding round or an initial public offering.

Clipping wings: Udaan has been significantly scaling down its operations to cut its burn amid a tightening liquidity market as well as realignment of its priorities to focus on profitability, even at a smaller scale. From a peak of about $4 billion in gross merchandise value (GMV) run-rate after Covid-19, the company is said to be on an annualised GMV run-rate of over $1-$1.5 billion, people aware of the number said. The company has also cut its workforce significantly over the last two years.

Also read | Udaan CTO Gaurav Bhalotia to exit as B2B startup rejigs units, roles

Google working to address antitrust fears, fake news: India head Sanjay Gupta

Sanjay Gupta, vice president and country manager of Google India

Even as tech giant Google works to make India a priority and kickstart local manufacturing, it has some loose ends to tie up, like its Play Store commissions dispute and antitrust allegations. Sanjay Gupta, country manager and vice president of Google India, told ET, that the company is working with regulators to address these issues.

Google’s India woes: The company is currently involved in a prolonged legal battle with the government on various issues. The latest is Google’s challenge to the Competition Commission of India’s (CCI) findings wherein the regulator found it guilty of monopolistic practices in both the Android market and Play Store.

On the battle with startups: The disagreement with Indian startups, Gupta said, will work itself out as they are gradually convinced about the commitment that Google has for Indian technology and the small developer community.

Also read | Google says court order not to remove Disney+ Hotstar app is interim

Made-in-India Pixel 8: Google is in advanced talks with Indian electronics manufacturer Dixon Technologies as well as with Bharat FIH, an arm of Taiwan’s Foxconn, to set up production of its flagship smartphone Pixel 8 in India, people aware of the development told ET.

Google’s stated plans come on the back of its biggest competitor Apple scaling up local production in India for domestic use and exports, to the extent that it made available some models of its latest iPhone 15 series that were made locally, simultaneously with China-made ones.

Also read | Apple bites big, turns largest smartphone exporter from India

Large deals in focus with $1 billion deal in pipeline: Wipro CEO

Thierry Delaporte, CEO and MD, Wipro

Three years into an organisational revamp while being at the helm at Wipro and losing more than half-a-dozen senior talent, chief executive and managing director Thierry Delaporte continues to believe that his transformation exercise will yield long-term growth despite the near-term slowdown. Edited excerpts from his interview with ET:

On large deals: “What we’ve seen over the last 6-7 quarters, we started with over $100 million deals, then $200 million and then $300 million. Last six quarters, we have closed 14 large deals including two half-a-billion-dollar deals. That is new. The next step for us is to close a $1 billion deal. We have it in the pipeline.”

On cutting clients: “It’s a strategic decision to reduce investments into very small accounts where a lot of investment is lost because the cost of acquiring business is too big than the volumes of business we get from them over time. So our decision is to focus on the large accounts.”

Also read | Wipro reports muted Q2, net profit almost flat at Rs 2,667 crore

Deal wins to ramp up H2 growth, says LTIMindtree CEO: Deals won during the first two quarters of FY24 would ramp up through the year to help LTIMindtree meet its targeted margin guidance, CEO Debashis Chatterjee told ET. During the second quarter, the company reported a deal total contract value of $1.3 billion, up 20% on year. LTIMindtree reported a 2% dip in net profit for the second quarter amid a “challenging business environment” that was marked by wage hikes and muted growth.

SoftBank to offload 1.1% stake in Zomato: report

Japanese investment behemoth SoftBank is looking to sell a 1.1% stake in Gurugram-based online food delivery company Zomato through block deals on Friday, according to multiple reports.

Details: Per a CNBC TV-18 report, the offer price for the transaction is estimated to be in the range of Rs 109.4 to Rs 111.6 per share, with the overall transaction value amounting to approximately Rs 1,024 crore. Notably, SoftBank currently retains a 2.17% stake in the company, as recorded at the end of the September quarter.

Tata Motors to buy 27% stake in Freight Tiger: Tata Motors Ltd said it will acquire 26.79% stake in Freight Tiger, a digital logistics solutions platform, for Rs 150 crore. The company has also outlined plans for an additional investment of Rs 100 crore over the next two years.

Freight Tiger, backed by private equity firm Florintree and venture capital firm Lightspeed India, provides end-to-end logistics value chain solutions for cargo movement. The startup reported revenue of Rs 19 crore in FY23, compared to Rs 15.4 crore in FY22.

ETtech Done Deals

.jpg)

(L-R) BharatAgri founding team Aman Verma, Tanmay Krishna, Siddharth Dialani and Sai Gole

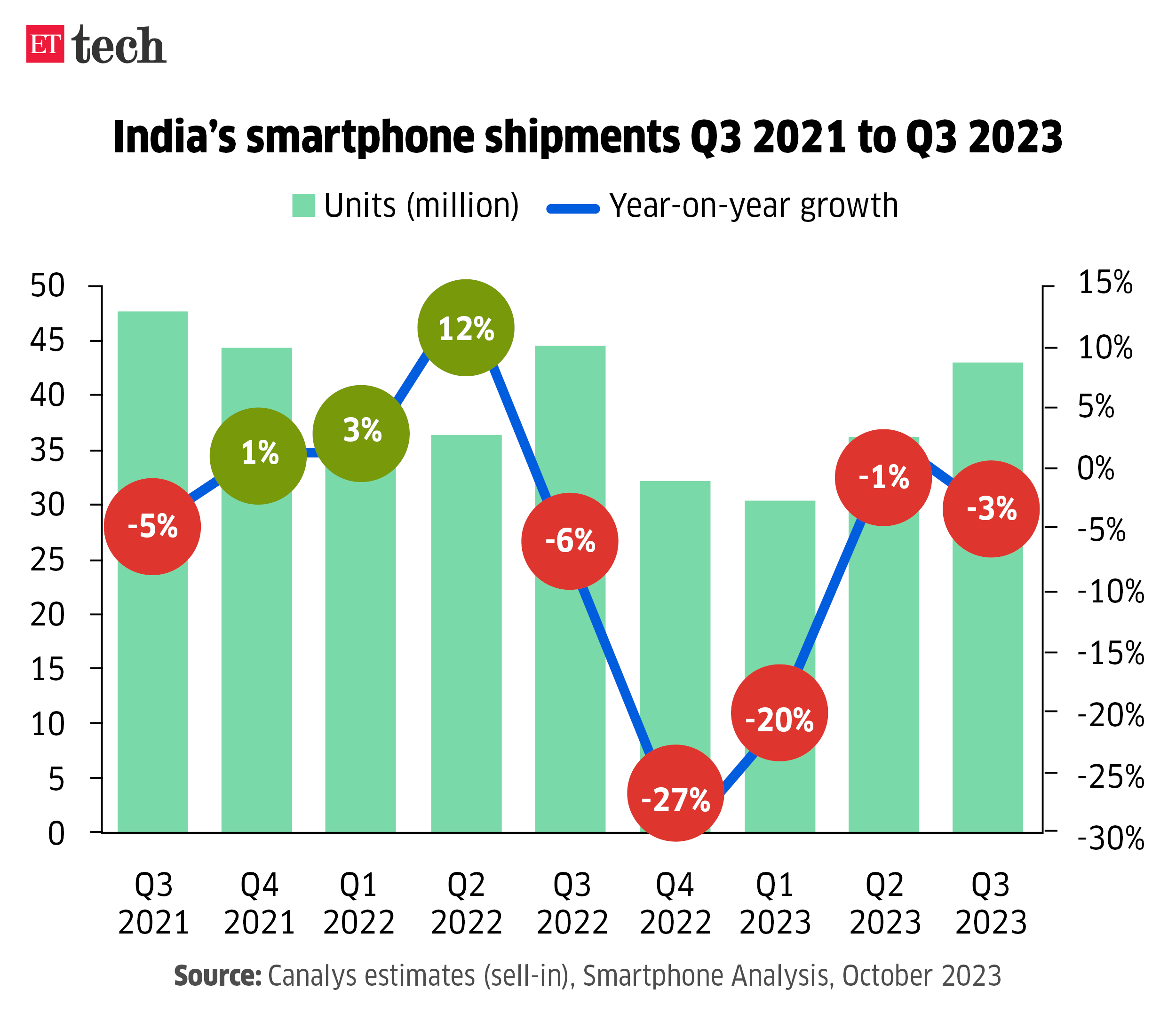

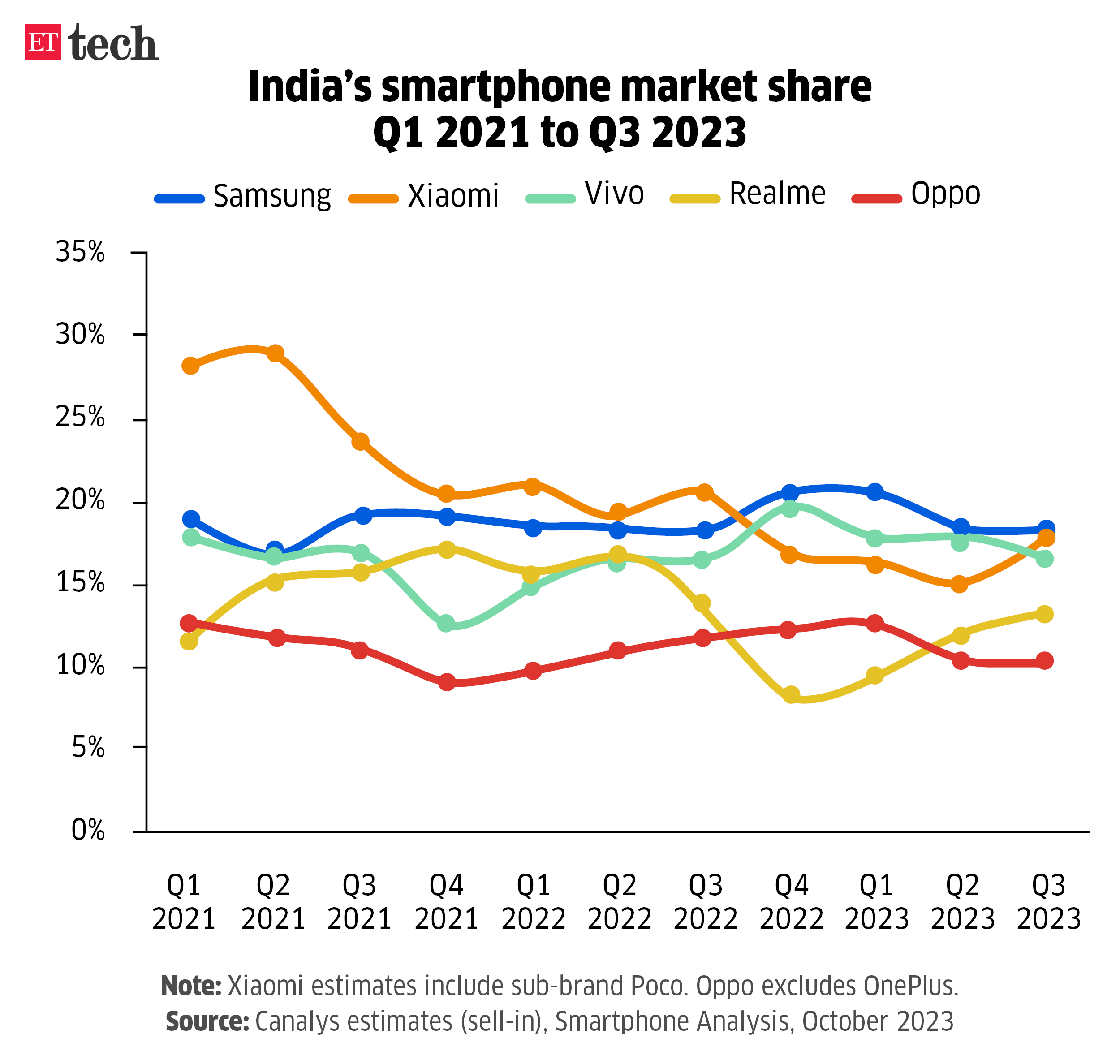

Infographic Insight: India’s smartphone shipments fell 3% in Q3 2023

India shipped 43 million smartphones in the third quarter of 2023, a 3% year-on-year drop, according to market research firm Canalys.

Despite the slight dip in shipments, the market witnessed an enhanced consumer environment, enabling vendors to leverage the demand for new devices.

In Q3 2023, Samsung retained its leading position, capturing 18% of market share with a substantial shipment of 7.9 million units. Xiaomi secured the second spot, shipping 7.6 million units, predominantly driven by the launch of its budget-friendly 5G models.

Other Top Stories By Our Reporters

Cleartrip’s loss nearly doubles in FY23; income falls 17% | Online travel company Cleartrip saw its total loss for the fiscal year ended March 31 almost double from a year ago to hit Rs 676.6 crore, even as its income fell. The Flipkart-owned company reported a total income of Rs 96.7 crore in FY23, against Rs 117 crore in FY22, a decline of 17%, according to data from business intelligence firm Tofler.

Greaves Electric offers to pay Rs 125 crore for flouting FAME subsidy norms: Greaves Electric Mobility, formerly known as Ampere Electric Vehicles, has offered to refund the subsidy it received under the FAME India scheme. The company is one of seven electric two-wheeler makers accused of selling vehicles without meeting localisation requirements. Greaves plans to repay around Rs 124.91 crore, making it the second company to offer a refund.

Global Picks We Are Reading

■ Inside a TikTok talent factory for misfit stars (Wired)

■ AI will never threaten humans, says top Meta scientist (Financial Times)

■ Chief executives turn to CIOs for digital leadership (WSJ)