Also in this letter:

■ $6.8B invested in Indian startups in Nov: report

■ ShareChat’s parent firm raises $266 million

■ Apple delays return to office indefinitely

Byju’s in talks to go public through SPAC route

Byju Raveendran, cofounder, Byju’s

Byju’s is in advanced talks to go public through a merger with one of Churchill Capital’s special-purpose acquisition companies (SPAC), sources told us. It is also evaluating a domestic listing in the second half of calendar year 2022, they said.

What’s a SPAC? Sometimes called blank-check companies, SPACs are shell companies created with the sole intention of merging with a private business. Read our full explainer on SPACs here.

Under India’s current regulations, companies headquartered in the country can’t go public through conventional initial public offerings in the US.

Details: “Michael Klein’s Churchill Capital has made an offer of investing $4 billion at a valuation of more than $48 billion,” the source said. “Since a large part of the business is in the US, a listing in that market is being considered,” the person added.

The startup was last valued at $21 billion in November, when it mopped up the first tranche of its intended $1.5 billion from investors.

Churchill Capital VII, the seventh blank check company founded by dealmaker and former Citi executive Michael Klein, raised more than $1.3 billion in an offering in February and trades on the New York Stock Exchange.

Yes, but: While an announcement could come as soon as January, the negotiations are not final. Byju’s or Churchill could still opt-out of such a deal, and Byju’s could consider an IPO in India next year, sources told Bloomberg.

The sources said Byju’s held talks with several potential SPAC partners is closest to working out an agreement with Churchill Capital. The startup had earlier discussed a SPAC merger with Michael Dell’s MSD Acquisition Corp. and Altimeter Capital Management, one of the sources said.

Change of plans? Byju’s had been aiming to file preliminary papers for a traditional IPO as early as the second quarter of 2022 and was also considering a SPAC merger, Bloomberg reported in September. That had been an acceleration of earlier plans to go public in 12 to 24 months. The startup and its bankers had discussed a valuation of $40 billion to $50 billion.

Byju’s has been on an acquisition binge in the past year, acquiring startups offering coding lessons, professional learning courses and test prep classes for competitive exams.

It has spent more than $2 billion on acquisitions in jut the past few months.

- In July, it announced two acquisitions: professional and higher education platform Great Learning for $600 million in cash and stocks, and Toppr for $150 million.

- On September 7, it acquired Gradeup, an online exam preparation startup, and plans to rename it Byju’s Exam Prep.

Reddit files for IPO: Meanwhile, social media platform Reddit said it had confidentially filed for an IPO with the US Securities and Exchange Commission. The platform, which became the go-to destination for day traders during this year’s meme stock frenzy, was looking at a valuation of more than $15 billion, Reuters had reported in September.

Risk investors put a record $6.8 billion into Indian startups in November: report

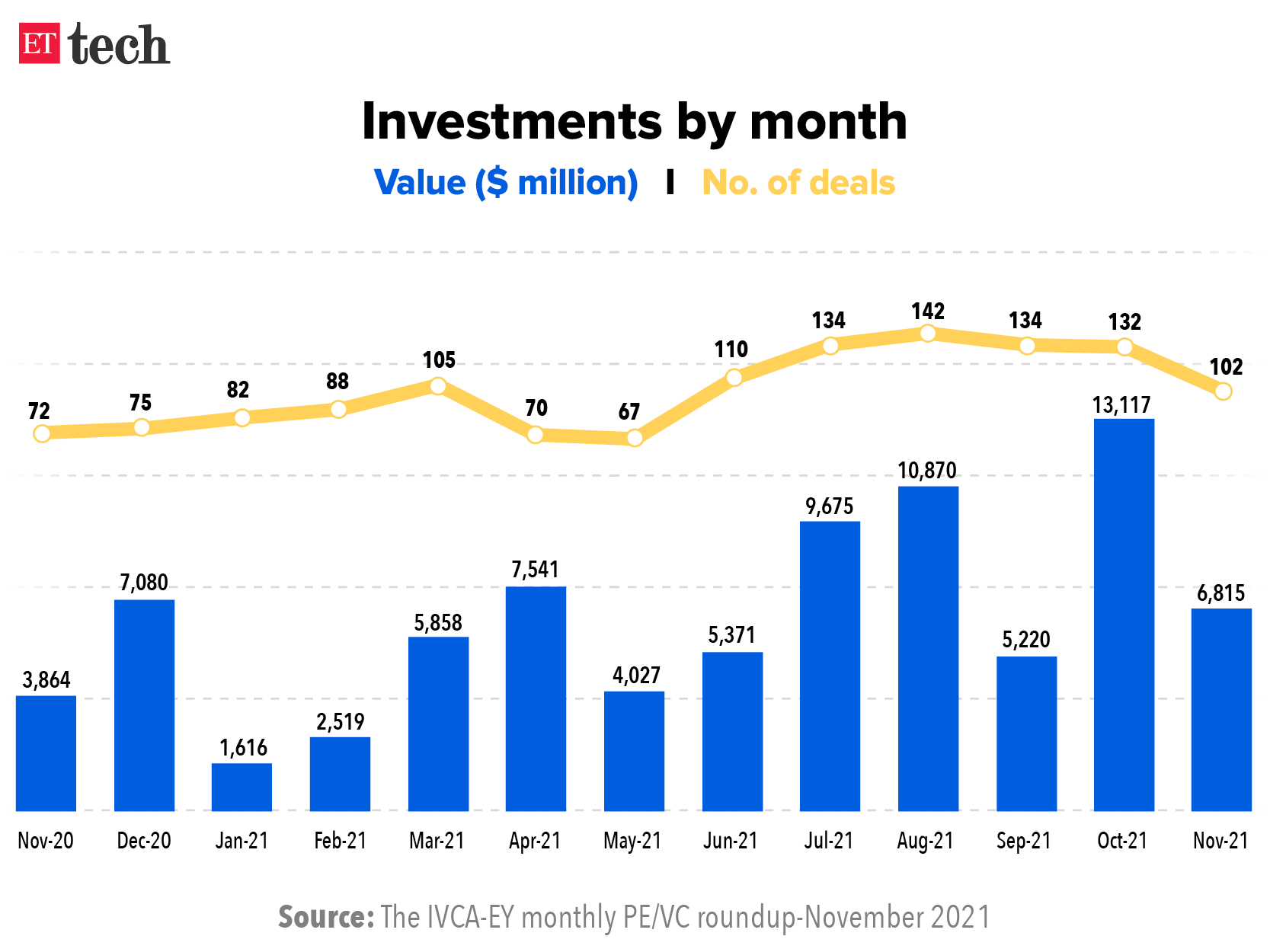

Investments by private equity (PE) and venture capital (VC) funds in November stood at $6.8 billion across 102 deals, a record for the month, according to a report by industry lobby IVCA and consultancy EY.

Comparison: In the year-ago period, such high-risk investors had infused $3.9 billion, while in October 2021, the total investments stood at $13.1 billion, the monthly data showed.

Overall investments in the first 11 months of the year touched $72.6 billion, which is 53% higher than the all-time high for a year, achieved in 2020, it said.

In November, the activity was led by $2.4 billion of investments into startups and exits by PE companies in nine initial public offerings, EY’s partner Vivek Soni said.

Quote: “Although India has found itself in a macroeconomic and geopolitical sweet spot, downside risks remain. The rise in domestic inflation on account of surging global energy prices, any potential slowdown in the government’s reform agenda in view of upcoming important state elections and the threat of a new variant driven third Covid wave remain key speed bumps to watch out for in the coming months,” he added.

November recorded 17 deals of over $100 million each, which alone totalled to $5.4 billion, while the pure-play PE/VC investments (excluding the ones in infrastructure and real estate) stood at $5.7 billion, it said.

The largest deals in November included the $1.5 billion buyout of Encora Digital by Advent and the $840 million investment in Dream11 by a group of investors including Falcon Edge, D1 Capital, Tiger Global, TPG and others.

The month saw 21 exits worth $3.6 billion, as against $974 million in November 2020 and $5.3 billion in October.

Venture Catalysts bets big on Indian startups: Meanwhile, early-stage startup investor Venture Catalysts plans to invest $108 million (around Rs 824 crore) in about 300 startups in 2022.

The Venture Catalysts group closed as many as 207 deals in 2021 and invested in 178 unique startups.

- “In 2022, we aim to invest $108 million and are targeting 300 unique start-ups,” Apoorva Ranjan Sharma, cofounder and president, Venture Catalysts Group said.

Sharma said, “We will continue investing in sectors such as fintech, edtech, agritech, FMCG, ecommerce, logistics and supply chain management. We expect D2C and deeptech to dominate in 2022 and many of these startups to emerge from small towns.”

Portfolio: Venture Catalysts’ investments this year include BluSmart, Dukaan, Klub, Melorra, Kala Gato, Mitron TV, Rage Coffee, Power Gummies, Coutloot, Prescinto, Resolve AI, Toch, Zingbus, RoundLabs, and Stage.

ShareChat’s parent firm raises $266 million at $3.7 billion valuation

Mohalla Tech, the parent firm of Moj and ShareChat, said it has raised $266 million as part of its Series G round at a valuation of $3.7 billion.

Fundraising champ: With this, the company has now raised over $1.177 billion across eight fundraising rounds, including $913 million in three rounds this year. It counts Tiger Global, Snap, Twitter and Lightspeed Ventures among its investors.

Details: The round, which was led by Alkeon Capital, also included new and existing investors such as Temasek, Moore Strategic Ventures, Harbourvest and India Quotient.

Mohalla Tech said the funding will help build capabilities such as social and live commerce, grow its artificial intelligence and machine learning team, which now has over 100 people spread across the US, Europe and India.

How’s business? Since January, the company has grown to over 2,000 employees and added several new features as it focuses on building its products. It is targeting $100 million in annualised creator earnings by the end of 2023. The company claimed that Moj has more monthly active users than any short video platform in India. It said the average user spends 34 minutes a day on the app, which clocks more than 4.5 billion views daily.

Other done deals

■ Ride-hailing company Ola said on Thursday it had raised a $500 million loan from international institutional investors, as the SoftBank Group-backed startup preps to make its stock market debut next year. The proposed loan issuance got a staggering response from investors with interest and a commitment of about $1.5 billion, the Bengaluru-based company said.

■ EaseMyTrip, an online travel platform, has agreed to acquire YoloBus, a next-generation premium intercity mobility platform, for an undisclosed amount to expand its non-air business. The acquisition includes the YoloBus brand, its technology, team, running business and data expertise.

■ Consumer products-focused Atomberg Technologies has announced a $20 million fundraise for a new manufacturing facility, in a round led by Jungle Ventures. The round, which takes the overall funds raised by the city-headquartered company to $45 million since inception in 2012, also saw participation from Inflexor Ventures, and existing investors A91 Partners and angel investor Ramakant Sharma.

Tweet of the day

Apple delays return to office indefinitely

Apple is delaying its return to office plans indefinitely. The iPhone maker said it has temporarily closed three stores in the US and Canada after a rise in Covid-19 cases.

Change of plans: The tech giant had set February 1, 2022, as the date for employees worldwide to return to their offices as it prepared for hybrid work in 2022. Apple had earlier delayed its return to the office until at least January 2022 as the US witnessed a surge in cases of the Delta variant.

WFH bonus: Apple CEO Tim Cook also announced that Apple would be giving all employees $1,000 to use for “work-from-home needs”.

Omicron scare: Growing worries over the rapidly spreading Omicron variant have derailed several companies’ plans for a return to normalcy. Google told its employees they would lose pay and eventually be fired if they did not follow the company’s vaccination rules, according to a report, while JP Morgan Chase & Co. has asked its unvaccinated staff in Manhattan to work from home.

Through the pandemic, Apple has closed some stores for short periods of time around the world as coronavirus-related lockdowns were brought in and lifted.

Infosys extends partnership with Australian Open

IT major Infosys today announced an extension of its digital innovation partnership with the Australian Open (AO) until the end of 2026.

Details: The extended collaboration with Tennis Australia will introduce enhanced broadcast match statistics and new initiatives to make tennis more accessible to all, while continuing to develop innovative digital stakeholder experiences, the company said.

The two partners will continue to harness big data and analytics, artificial intelligence, virtual reality and cloud technologies to elevate the AO experience for fans, players, coaches, partners and the media.

Quote: “For us, this collaboration is about digital innovation providing greater access to the wonderful sport of tennis and helping to build it into a truly global and inclusive game,” said Andrew Groth, executive vice president, Infosys.

Tech’s sporting chance: In June we reported that Tata Consultancy Services Ltd. will be the title partner of the London Marathon from 2022.

India’s largest IT services firm has been a technology partner of the London Marathon since 2016, and now as title partner will help improve the marathon experience with the use of technology. TCS has developed the official London Marathon app and now plans to enhance the event experience for future races, which will continue to be a hybrid of physical and virtual events.

In July, the company also signed an eight-year contract with the New York Road Runners (NYRR) to extend its title and technology sponsorship of the TCS New York City Marathon through 2029.

The company has also joined iconic British racing team Jaguar Racing as title partner ahead of the 2021/22 ABB FIA Formula E World Championship, we reported in November. The team will be known as Jaguar TCS Racing. Tech Mahindra is already active in this space through its Mahindra Formula E racing team.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.