Also in this letter:

■ Banks raise concerns on regulation of fintech firms

■ Paytm’s Rs 568-crore deal to acquire Raheja QBE is off

■ Eight Roads Launches $250M India Healthcare, Lifesciences Fund

Raising all kinds of capital for multi-billion-dollar buys: Byju’s CEO

In March, Byju’s founder CEO Byju Raveendran said he was investing $400 million of his own money into the company as part of a $800-million funding round.

The transaction was reminiscent of one executed by Oyo founder Ritesh Agarwal in 2019. He had bought back stakes held by Sequoia Capital and Lightspeed Venture Partners in the startup in what was an unprecedented bulk-up of his shareholding.

But Raveendran has yet to receive loans that will help him increase his ownership in the company, sources said.

What’s the hold up? Raveendran told us in an exclusive interview that formal commitments are in from various lenders but negotiations on the terms of the loans have led to delays in closing the transaction.

“It’s largely from banks and large institutions in the US, [including] some of the prominent names… commitment is there for more than $400 million,” Raveendran said without giving any more details.

Shopping spree: Byju’s has spent the bulk of its recent funding on new acquisitions in India around the world and is now looking at a possible buyout of California-based online tutoring company Chegg, sources said.

Raveendran did not confirm whether there have been discussions to buy Chegg, but said the next 12 months will be the best time to acquire companies.

“We are looking at multi-billion dollar acquisitions… That’s why we are accessing all kinds of capital. We are exploring acquisitions in the US,” he said.

Edtech back to earth: After a two-year, pandemic-induced boost, edtech firms are now seeing a slowdown as physical schools and coaching centres have reopened. Unacademy has laid off 1,000 employees (permanent and contractual) as we previously reported, as have Vendantu, Lido Learning and others.

But Raveendran said, “I don’t see a lack of demand for any kind of capital for Byju’s despite strong headwinds out there… This is also a good time for companies to differentiate.”

IPO in 9-12 months? On Byju’s IPO plans, he said, “We are still thinking of an IPO in nine to twelve months and if it’s in the US then it will be through a SPAC (special purpose acquisition company).”

Banks raise concerns on regulation of fintech firms

Banks have reached out to the Reserve Bank and the government, flagging the grey areas in regulations around fintech companies, people familiar with the matter told us.

The banks said they fear a breach of anti-money laundering guidelines and loosening adherence to know your customer (KYC) norms by these companies, the sources said.

What’s the issue? Most fintech companies fall within the definition of the ‘merchant’, which enables them to function as pseudo-payment aggregators handling public funds. Banks, which handle the cash flows associated with such transactions, are concerned that the burden of KYC will fall on them and they will be held liable for any lapses.

“Our view is that banks should not face the burden of compliance with KYC norms on behalf of these fintechs,” said a senior bank executive aware of the developments. He pointed out that banks did not have visibility on the underlying transactions and could face breach of anti-money laundering (AML) guidelines.

“There is a need to regulate this space and a level playing field is to be created,” said Sunil Mehta, chief executive of industry body Indian Banks’ Association. “We will reach out to the regulator and concerned authorities on the matter.”

Another bank executive, who did not wish to be named, said that the Reserve Bank is also concerned about unregulated fintech entities.

In a recent report, the RBI said that since fintech unbundled services across a wide range of domains, it was necessary to clearly demarcate responsibilities of various regulators to ensure avenues for regulatory collaboration.

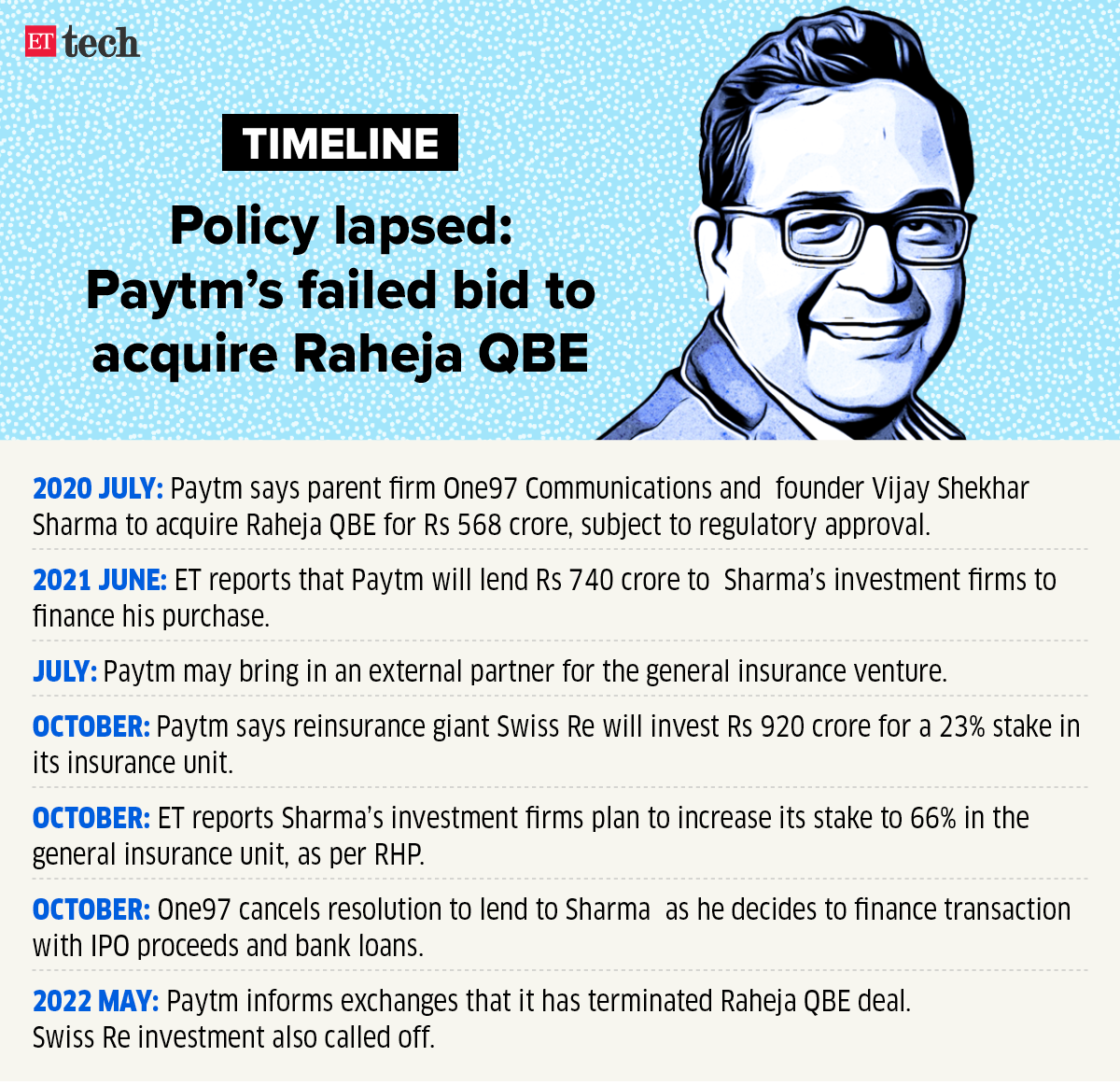

Paytm’s Rs 568-crore deal to acquire Raheja QBE is off

One97 Communications, the parent company of Paytm, has said its deal to acquire Raheja QBE General Insurance Company Ltd has been terminated.

The news comes nearly two years after the digital payments firm first announced its plan to fully acquire Raheja QBE.

Driving the news: In a stock exchange filing late on Sunday night, One97 Communications said “the share sale and purchase transaction has not been consummated within the time period envisaged by the parties under the said agreement, the agreement has automatically terminated.”

Prism Johnson, which holds 51% in Raheja QBE, also said in a filing that the deal stands terminated.

Insurance biz on hold: Paytm had struck a deal to acquire Raheja QBE for Rs 568 crore and was expected to launch its insurance business this year.

Paytm founder Vijay Shekhar Sharma was expected to use the proceeds from his offer for sale in Paytm’s November 2021 IPO to fund his stake in Paytm Insuretech. In its red herring prospectus (RHP), Paytm had said Sharma would hold over 60% in the unit.

Swiss Re announced last October that it would invest around Rs 920 crore ($127 million) in Paytm Insuretech for a 23% stake. It is not immediately clear what will happen to Swiss Re’s investment now that the deal with Paytm has been terminated.

But Paytm said it remains bullish on its roadmap for general insurance and plans to seek approvals for a new general insurance licence for a new company in which it will hold 74% upfront.

Alibaba, Ant Group exit Paytm Mall: Meanwhile, Paytm Ecommerce, the parent entity of Paytm Mall, said on Monday that two of its early investors, Alibaba and Ant Group, have exited the company as it pivots to India’s Open Network for Digital Commerce (ONDC) network and explores opportunities in the export business.

TWEET OF THE DAY

Eight Roads Launches $250-million India Healthcare, Lifesciences Fund

Eight Roads, a global investment firm backed by Fidelity, has launched its first dedicated India healthcare and lifesciences fund. With a corpus of about $250 million, it is the largest pool of capital available for the sector in India.

“The healthcare market in India is at a tipping point. We have seen that play out in the markets such as China and the US,” Prem Pavoor, senior partner, head of India and healthcare investments at Eight Roads Ventures, told us.

He added that the fund will make early- to growth-stage bets of up to $40 million on around 15-20 companies in lifesciences, healthcare services, consumer health and digital health sectors.

“We are looking to deploy this capital over the next three to four years,” he said.

First bet: Since it’s a single LP fund, the firm has already started deploying from it. It made its first investment in Doceree, a global network of physician-only platforms for programmatic marketing.

ETtech Done Deals

■ Neso Brands, a brand roll-up subsidiary of omnichannel eyewear retailer Lenskart, has raised more than $100 million in a seed funding round led by KKR, Softbank, Alpha Wave Global and Temasek. This makes Lenskart the latest entrant in the brands roll up space in India.

■ Smytten, a product sampling and engagement platform for direct-to-consumer brands, has raised Rs 100 crore (around $15 million) in a funding round led by existing investors Fireside Ventures and Roots Ventures.

■ Honasa Consumer (HCPL), the parent company of Mamaearth and The Derma Co., has acquired Dr Sheth’s, a dermatologist-formulated premium skincare brand. Through this acquisition, HCPL will take a majority stake in Dr. Sheth’s at a valuation of Rs 28 crore.

IIT Hyderabad will soon offer India’s first VLSI chip design course

The Indian Institute of Technology (IIT), Hyderabad, will soon offer an undergraduate course in very-large-scale integration (VLSI) design and technology, a first-of-its-kind programme in India that will help create a pool of semiconductor engineers and technical talent.

This follows talks between the ministry of electronics and information technology and the All India Council for Technical Education, three officials in the know told us.

For the training of shop-floor technicians, the government has tied up with Taiwan’s Industrial Technology Research Institute and The Agency for Science, Technology and Research (A*STAR), Singapore, sources said.

While IIT Hyderabad will be the first institute of higher education to offer the programme, other institutes are also likely to initiate admissions to the course soon, another senior official said.

The courses are a part of the IT ministry’s plan to train 85,000 engineers for various roles in the semiconductor industry, apart from nearly 250,000 shop-floor technicians and junior engineers.

Leading crypto exchange Bitmex starts spot trading in India

Bitmex, one of the world’s top cryptocurrency exchanges, is launching spot trading in India on Tuesday, despite the bloodbath in the crypto market and an unfavourable regulatory environment in the country, a top executive told us.

The spot exchange will allow Indian users to instantly buy, convert, deposit and withdraw multiple cryptocurrencies.

The exchange will start spot trading globally with the launch of Bitmex Spot.

Recently, rival exchange Coinbase had a bitter experience after launching its India operations with a bang. Within days it had to soon suspend buy orders after coming under pressure from regulators over its use of the county’s Unified Payments Interface (UPI).

So how does Bitmex plan to execute its trades? “For customers to be able to move money in and out of the exchange, we will use Bitcoin and Tether (a stable coin). We also have the payment gateway Onramps that will allow you to trade directly,” said Mikhalchenko.

Other Top Stories By Our Reporters

GST Council urged to not hike tax on gaming firms: Two industry associations, the Internet and Mobile Association of India (IAMAI) and the E-Gaming Federation (EGF) on Monday urged the GST Council to maintain the GST on online gaming at 18%. They said any increase would be “detrimental” and “disastrous” to the overall wellbeing of the industry.

Funding for Asia-Pacific fintech firms hits three-year high: Fintech companies based in the Asia-Pacific (APAC) region raised $3.3 billion in over 186 deals in Q1 2022 — the most in any March quarter in the past three years, according to a report by S&P Global Market Intelligence.

Global Picks We Are Reading

■ Ola e-scooters have buyers hurting — physically and emotionally (Rest of World)

■ $7.6bn of ‘stablecoin’ tether redeemed since start of crypto crisis (The Guardian)

■ For tech startups, the party is over (WSJ)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.