Also in this letter:

■ Startups to benefit from 15% cap on tax surcharge

■ Opinion: Budget delivers for startups but issues remain

■ Government to set up 75 digital banking units in 75 districts

Budget 2022: Crypto industry hails breakthrough but 30% tax a concern

Indian crypto had its breakthrough moment on Tuesday when Finance Minister Nirmala Sitharaman said in her budget speech that income from trading these digital assets would be taxed at 30%.

What this means: Though her announcement doesn’t make crypto legal, it does give official recognition to these digital assets, bringing much-needed validation to the sector.

To be sure, several lawyers we spoke to said the industry remains in a legal grey area, and that only a full-fledged cryptocurrency bill would give these assets full legal status.

In an interview with news channel ET Now, Central Board of Direct Taxes chairman JB Mohapatra clarified that taxation does not imply legalisation.

A new chapter: For years, there have been reports of an imminent ban on private cryptocurrencies in India but the budget has closed that chapter, various crypto stakeholders including founders, venture capitalists and policy experts told us.

Here’s what Sitharaman proposed in her speech:

- Any income from transfer of crypto to be taxed at 30%.

- No deductions allowed while computing such income, except the cost of acquisition. Losses can not be set off against any other income.

- To capture transaction agents, 1% TDS on purchases (above a certain threshold) made with virtual currencies.

- Gift taxes if any will be the liability of the recipient.

Crypto defined: In another first, the government defined the term “virtual digital asset” to mean any information, code, number or token, generated through cryptographic means or otherwise, that provides a digital representation of value, or functions as a store of value or a unit of account, and can be transferred, stored or traded electronically. “Non-fungible tokens and any other token of similar nature are included in the definition,” it stated.

Yes, but: It wasn’t all good news, though. Several crypto platform executives said the 30% tax would hurt active traders and could force them to take their business to international exchanges. Nischal Shetty, cofounder of WazirX said the 30% tax rate would be a “damper for those who are at a lower bracket tax bracket because of their yearly income”.

Digital rupee: The budget also provided a specific timeline for India’s central bank digital currency (CBDC) launch.

Sitharaman said a “digital rupee using blockchain and other technologies” will be issued by the Reserve Bank of India in 2022-23.

“Digital currency will give a big boost to the digital economy,” said Sitharaman. “It will also lead to a more efficient and cheaper currency management system.”

Got a minute?

ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

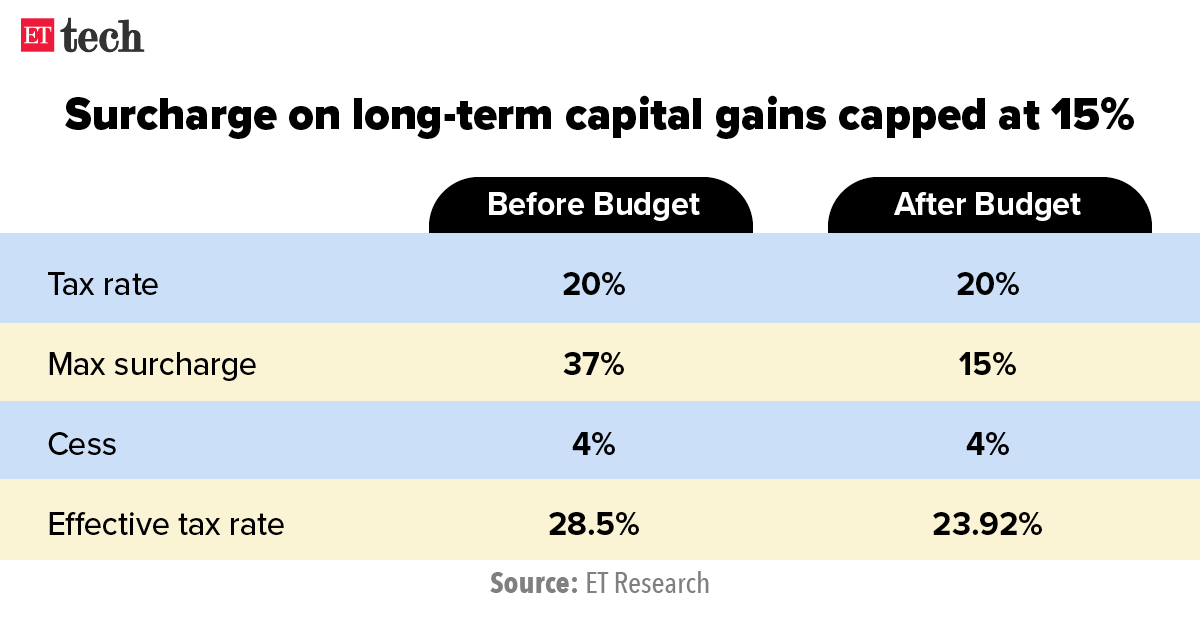

Startup founders, investors to benefit from 15% cap on tax surcharge

The surcharge on long-term capital gains (LTCG) tax has been capped at 15% for all listed and unlisted companies, Finance Minister Nirmala Sitharaman said in her budget speech.

This addresses a long-standing demand of new-age companies, which wanted share sales of unlisted firms to be taxed at par with those of listed ones. To be sure, only the surcharge levied on unlisted share sales has been reduced – from 37.5% to 15%. The tax rate remains unchanged at 20%.

Tax burden down 16%: Industry executives told ET this change would not only cover employee stock option sales but all transactions by privately-funded startups, reducing their tax burden by around 16%.

What else? The government also extended the tax incentives it offers to new startups for the first three years of their incorporation to four years, taking the pandemic-induced fiscal pain into account.

Sitharaman also said an expert committee would be set up to examine and suggest appropriate measures to boost venture capital and private equity investments in startups.

“Venture capital and private equity invested more than Rs 5.5 lakh crore last year, facilitating one of the largest startup ecosystems. Scaling this investment requires a holistic examination of regulatory and other frictions,” she said, explaining the need to set up the expert committee.

Tweet of the day

ETtech Opinion: ‘Digital India Budget’ delivers for startups but some issues remain

Budget 2022-23 will go down as the Digital India Budget. The government has committed to a digital path forward, with Indian startups as the primary vehicles of delivery. The finance minister acknowledged the role Indian startups have played during the pandemic and how they will supercharge India’s growth over the next 25 years. The word ‘digital’ was mentioned no less than 35 times in the budget speech.

For startups, the key tangible wins were:

- Extending the window for being a startup that can avail of tax benefits by a year.

- Creating parity on the tax surcharge applicable to unlisted equities with listed equities, by capping it at 15%.

- Creating a fund of funds mechanism for funding innovation in various sectors.

- Crypto taxation norms that legitimise crypto as an investment class.

Yes, but: These wins must be contextualised against what startups have been asking for.

One of these demands was complete tax parity between listed and unlisted securities. Unlisted securities pay long term capital gains tax at 2.4 times the rate of their listed counterparts. While the budget created parity on the surcharge, the tax rate for unlisted securities is still twice the rate for listed securities.

Government to set up 75 digital banking units in 75 districts

In a major boost for the digital economy, Finance Minister Nirmala Sitharaman said during her budget speech that the Centre proposes to set up 75 digital banking units (DBUs) in 75 districts across India through scheduled commercial banks.

Banking for all: The finance minister also announced that in 2022-23, all 1.5 lakh post offices will be connected to the core banking system, enabling financial inclusion and access to accounts through net banking, mobile banking and ATMs. It will also allow online transfer of funds between post office accounts and bank accounts.

Sitharaman also said the financial support announced for digital payments in the previous budget would continue in 2022-23.

FM announces plan to set up digital university, create skill courses

The finance minister announced in her budget speech that the government would set up a digital university to give Indian students access to world-class education.

She said the digital university would impart lessons in all regional languages, creating a ‘hub and spoke’ network. The digital university will work with the other central universities and provide the required infrastructure and training, she added.

The FM said new e-learning content delivery platforms would be launched via the internet, TV and radio to help students in rural and semi-urban areas. She also said ‘one-class-one-TV-channel’ would be implemented to provide supplementary education to children to make up for the loss of formal education due to the Covid-19 pandemic.

Sitharaman also announced that Swayam Prabha TV under the PM e-vidya scheme would be expanded from 12 channels to 200 and be made available in all regional languages.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.