Also in this letter

- IT firms roll out several tools to retain talent

- Tata seeks customers’ consent ahead of super app launch

- SoftBank founder Masayoshi Son on Paytm’s IPO

Will Bollywood and cricket bring India up to speed on NFTs?

In recent months, a plethora of sports and entertainment personalities have jumped on the NFT bandwagon as they look to monetise their brands. Founders believe that super fans, investors and collectors will see value in NFT-backed collectibles of such celebrities and be more willing to buy them.

What’s an NFT? Read our explainer here.

While their entry has generated a lot of buzz, which is leading to growing awareness and “maistreamisation” of the emerging industry, several founders of Indian NFT projects and sector experts that ET spoke to said that a few of these initiatives seem opportunistic and are only looking to make a quick buck.

Quote: “I think from the entertainment industry’s perspective, it’s primarily from a PR lens. NFTs are a craze right now, so I think from an individual artist’s or actor’s perspective, it’s the PR headline of dropping an NFT. All of this is great, because it’s creating awareness, and it’s helping us become mainstream,” said Vishakha Singh, vice president and cofounder of WazirX NFT Marketplace. Singh was also an actor and a film producer.

Those within the industry say that while these projects will lead to early evangelism of the industry, most of it is speculatory in nature. Many NFTs floating around do not embody the “true characteristics” of an NFT — uniqueness, rarity, and long-term credibility (so that the value goes up).

How valuable could a signed poster of a celebrity be? Why is it unique? And would it be better to have a physical poster? Will a collector ask these questions or invest in an NFT because his favourite star endorsed it? These are some of the questions that will eventually be answered as data rolls in from secondary marketplaces, where NFTs will be resold in the coming months.

Nascent market: Kalamint, an NFT marketplace founded by an Indian, which featured in the top 20 marketplaces globally by DappRadar, sold NFTs worth $2.7 million between April and October. According to Kalamint’s founder, Sandeep Sangli, demand from Indian buyers has been slow.

Crypto exchange WazirX’s NFT marketplace says it has sold NFTs worth $400,000 between July and October. In comparison, the world’s most popular NFT marketplace OpenSea clocked $1.88 billion in NFT sales in the past 30 days, per DappRadar’s website.

Operators of prominent Indian NFT marketplace attribute the moderate growth in sales to socio-economic trends as well as the lack of cultural inclination to invest in art. “Consumer behaviour is something that we realised early on, which is why we started positioning ourselves as a global marketplace, “ said Sangli.

Indian IT firms roll out a range of tools to retain talent

Information technology companies in India are rolling out retention tools ranging from employee stock options to upskilling opportunities in an effort to compete with startups for top talent.

Companies are also addressing concerns of long work hours and the siloed work culture that the IT industry is synonymous with. They believe that more than unprecedented salary hikes, a measured offer of a stable career will drive retention in the long run, industry experts said.

In addition, firms are offering massive upskilling opportunities to employees in an effort to retain them, HR experts said. Emphasising a progressive work culture, better career growth opportunities within organisations, and work-life balance are other measures that companies are evaluating for better retention, they said.

Who’s doing what? In September, Infosys said it has doubled the pool of employees eligible for stock options to 8,000 with a view to rewarding and retaining high-performing employees. It has already rolled out two compensation hikes in 2021 and increased the number of promotions.

Persistent Systems meanwhile has rolled out an employee stock ownership plan (Esop) covering almost 80% of its employees.

Sandeep Kalra, chief executive of Persistent Systems, said the Esop was in response to a request from employees and that it would encourage these employees to “partake in the wealth creation for multiple years”. He said the initiative, combined with good work opportunities and a good workplace, will help the IT midcap company retain talent.

IT company Happiest Minds said its brand recognition was a driver for retention and recruitment.

“We have seen that employee reference programmes have led to better employee engagement and retention initiatives,” said Joseph Anantharaju, its executive vice chairman. “It is not possible to compete with startups who are raising a lot of money but what we can do is that we can offer good engagement… and helping employees with their learning and development programmes with individual learnings plans will hopefully reduce attrition to some extent,” he said.

Tweet of the day

Tata Digital seeks consent from customers ahead of super app launch

Tata Digital has started taking ‘consumer consent’ from customers of Tata group companies to comply with India’s data protection norms before launching its super app.

The story so far: Tata Digital has already got the consent of customers of Tata Motors, Taj and Tata Starbucks, the group’s largest retail companies, but Titan and Trent are yet to get on board. The super app was rolled out among two-and-a-half lakh Tata employees for trials and Tata Digital offered attractive cash-back offers and discounts to encourage its use, employees said.

Quote: “It is indeed a daunting task for Tata Digital to get consent for sharing of data from its tens of millions consumers. Indeed, even the shareholders of various companies in different product & service segments may not want their customers’ data to be shared for such a platform,” said Arvind Singhal, chairman, Technopak Advisors. “It may be a relatively easier task for Tata Digital to acquire its own “customers” using its own efforts and resources, and this would be my recommendation to them.”

The Tata group is putting various offerings across ecommerce, financial services, fashion, lifestyle, among others, together under its super app to create a loyalty programme for its 45-million-plus customers.

Curefoods in talks to raise $30 million in funding

Cloud kitchen company Curefoods, which operates ‘EatFit’, is in talks to raise $30 million in an equity funding round led by Accel and Chiratae, sources told us.

What’s the plan? The Iron Pillar-backed company will use the funds to acquire almost half a dozen smaller brands in the space and for other inorganic growth opportunities, they said. Curefoods is also raising $10 million in debt from venture debt funds.

Quote: “Given the inbound interest from investors, the company is likely to raise an extended Series B round, taking the total funding in the round to $75 million,” said a person aware of the company’s plans. “The remaining fund raise will be at a higher valuation,” he said.

This funding follows the $13 million the company had raised from investors led by Iron Pillar in August as part of its Series A round. Last year, health and fitness startup Curefit had carved out its health food vertical EatFit as an independent entity to meet rising demand from the cloud kitchen sector.

Meanwhile, Zoomcar, a self-drive car rental company, has raised $92 million as equity through a private placement led by SternAegis Ventures with participation from international family offices and institutional investors, it said in a release.

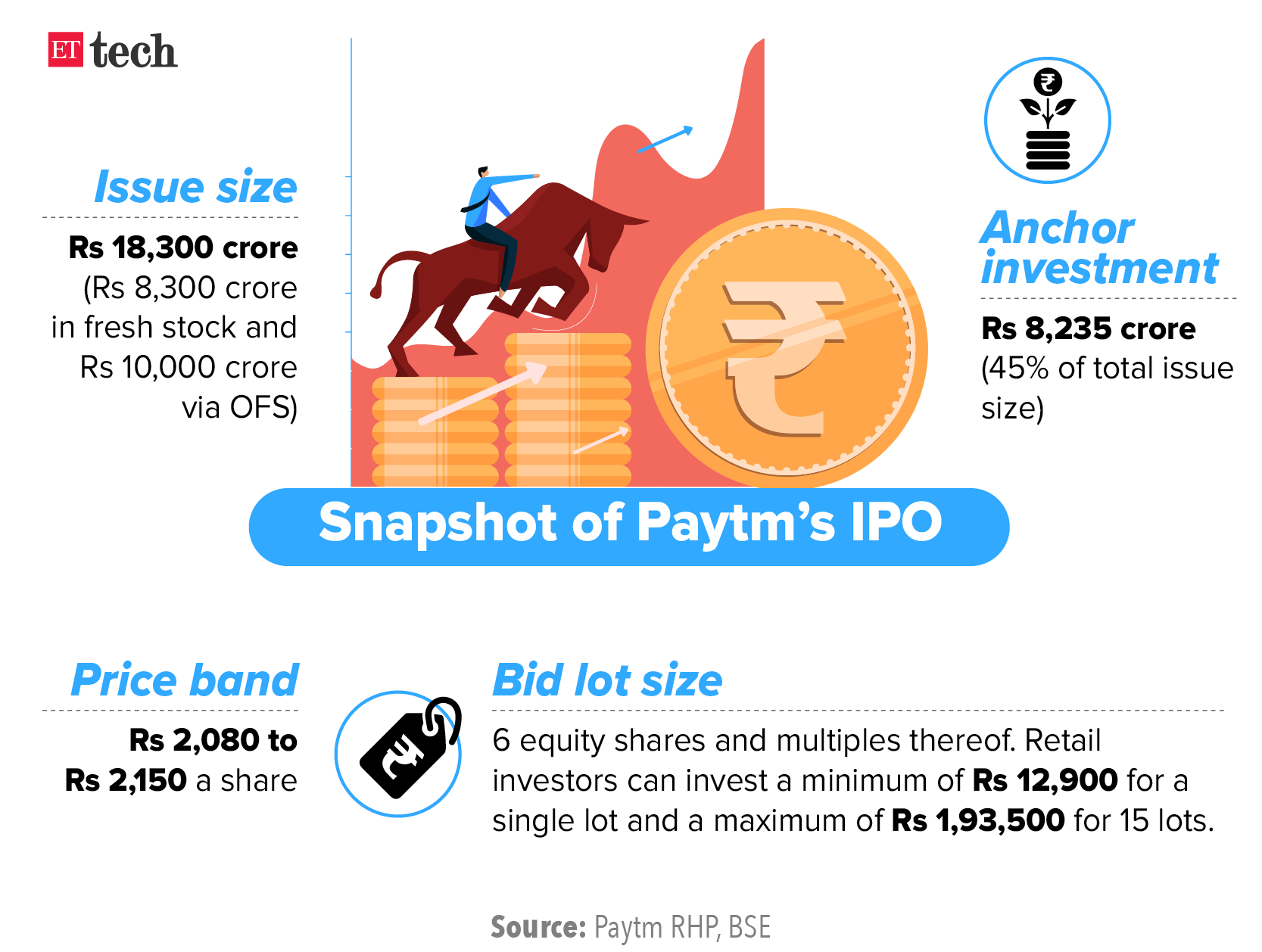

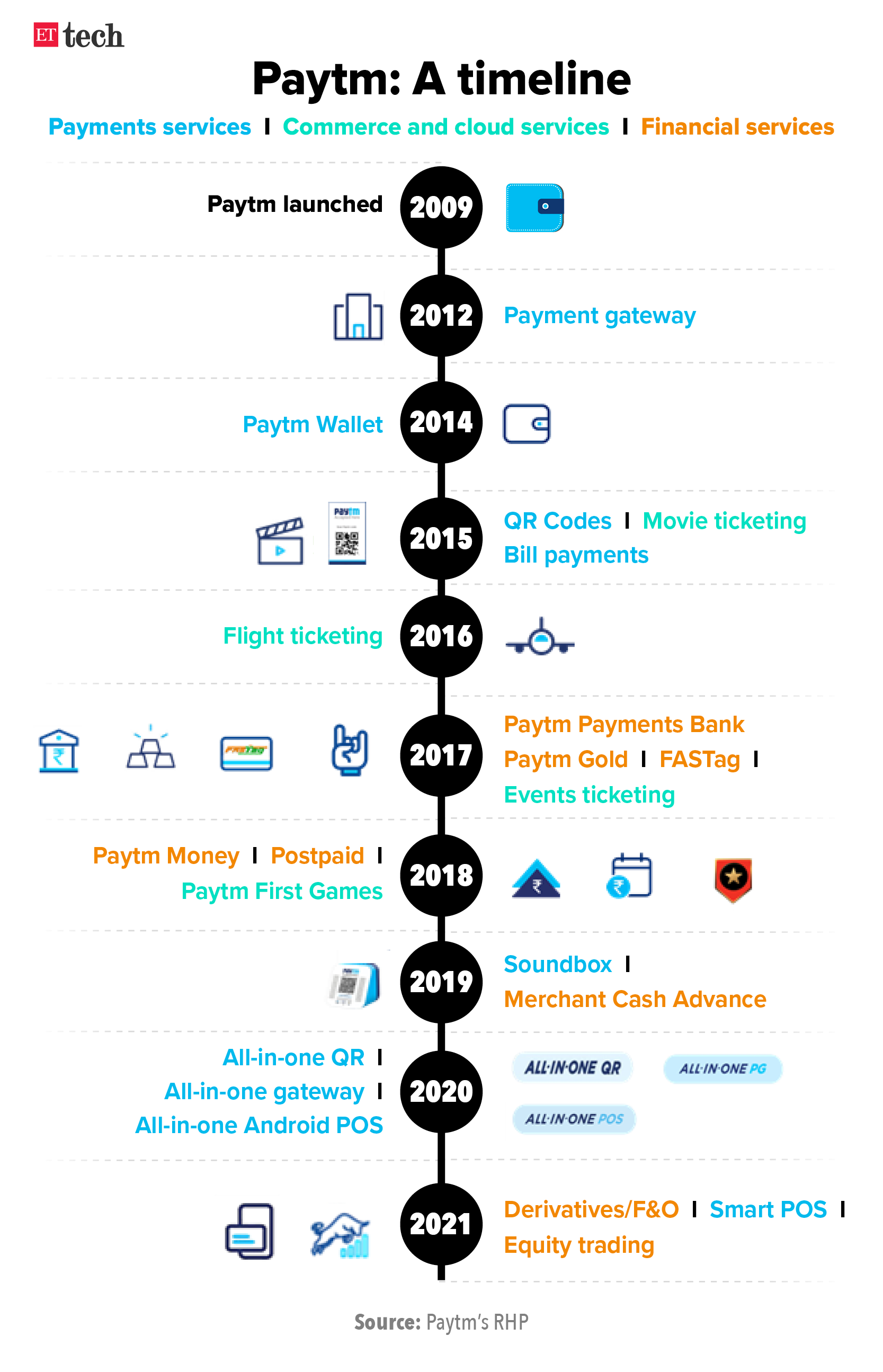

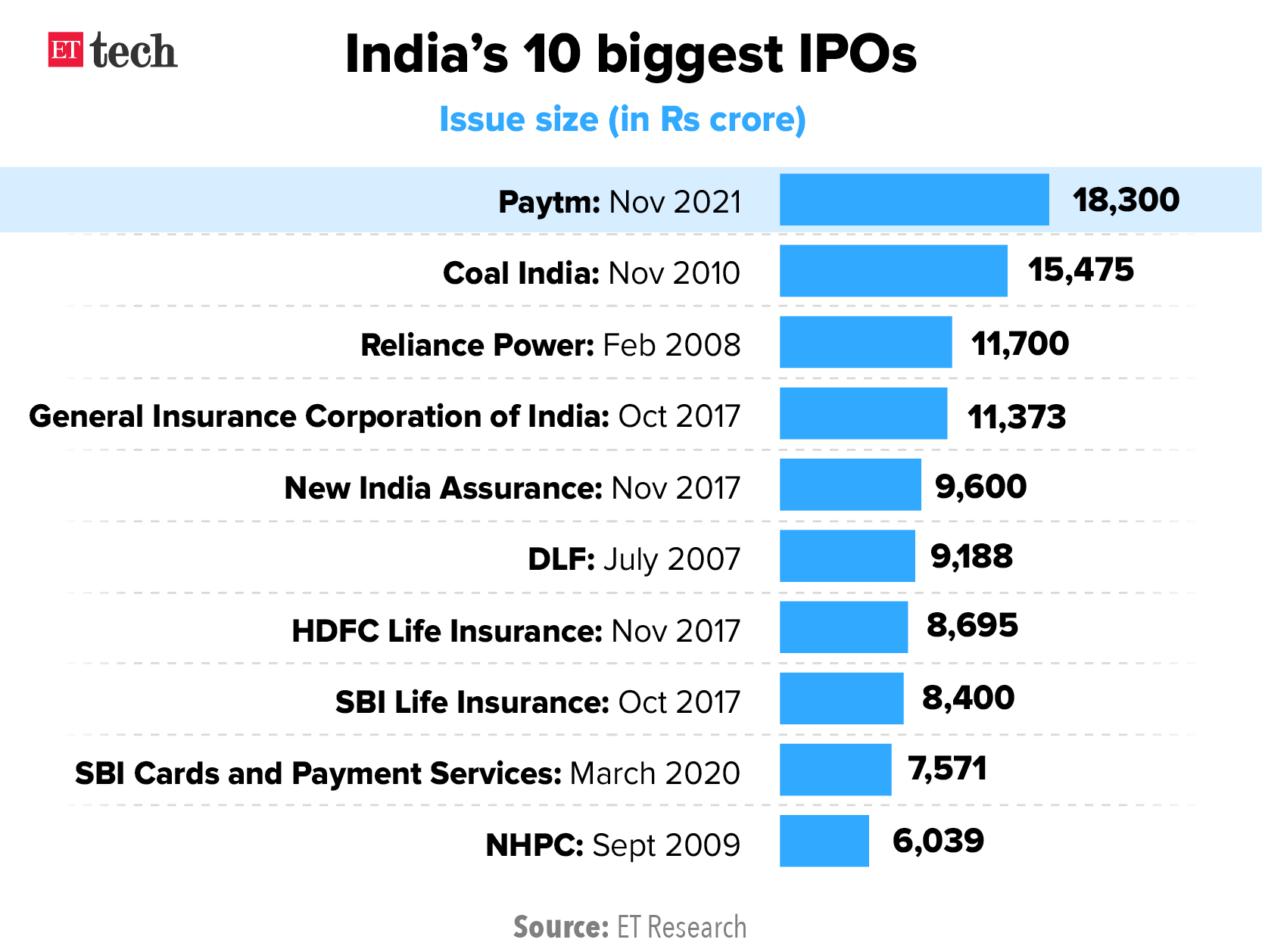

Paytm’s valuation should be higher than when we invested in it: SoftBank CEO

Masayoshi Son, founder and CEO of SoftBank, said Paytm’s IPO, which opened for subscription yesterday, should be a “great event” for the Japanese investment major.

Quote: “I believe Paytm should grow significantly… and valuation-wise. Of course, it depends on market conditions and investors’ appetite. Either way, I believe the valuation (of Paytm during the IPO) should be bigger than the cost that we spent when we made an investment (in the company). So for us, the IPO should be a great event,” Son told reporters after announcing SoftBank’s earnings on Monday. He was asked if Paytm’s IPO valuation of around $20 billion was less than expected, and what he thought about the company’s potential to grow the valuation after the IPO.

SoftBank had first invested in Paytm parent One97 Communications in 2017, after which the payments firm was valued at around $7-8 billion. SoftBank had put around $1.4 billion in Paytm in what was a mix of primary and secondary share sale four years ago.

“I believe they (Paytm) can grow their value going forward (after the IPO)… not only Paytm but there are other businesses that we have high expectations of,” Son said, adding that the number of IPOs from its portfolio has been increasing.

SoftBank, which owns 18.5% of Noida-based Paytm, will sell shares worth Rs 1,689 crore as part of the Rs 10,000 crore offer for sale (OFS) in Paytm’s IPO.

SoftBank’s financials: SoftBank meanwhile reported a quarterly loss as the Japanese conglomerate was affected by a $10 billion hit at its Vision Fund unit amid falling valuations and a Chinese regulatory crackdown on tech firms.

The group reported a net loss of 397 billion yen ($3.5 billion) compared to a profit of 628 billion yen ($5.53 billion) a year earlier. Vision Fund’s investment loss totalled 1.167 trillion yen.

Why? While Son describes SoftBank as a goose laying “golden eggs”, referring to its stakes in startups that go to market, IPOs have dropped off and shares in many top assets fell during the quarter. It has been trimming stakes in companies such as Uber and DoorDash following the expiry of lock-up periods.

Amazon Pay India’s revenue up 30% in FY21

Amazon Pay India saw its losses narrow by 18.8% in the financial year 2020-21 to Rs 1,516.4 crore from Rs 1,868 crore in FY20, according to its annual regulatory filings with the Registrar of Companies (RoC).

This comes at a time when Amazon has been attempting to make steady inroads into India’s digital economy over the last few years, competing with the likes of Paytm, Walmart’s PhonePe and Google Pay.

By the numbers: The firm’s revenue from operations grew by 30% in FY21 to Rs 1,716 crore from Rs 1,315 crore, even as expenses were flat at Rs 3,295 crore, against Rs 3,234 crore in FY20, showed the filings, accessed by ET through business intelligence firm Tofler.

- Amazon Pay India cut down its advertising and promotional expenses by 11% to Rs 1,967 crore in FY21.

- Expenses incurred to process payments nearly doubled to Rs 879 crore in the fiscal, as did legal and professional charges to Rs 16 crore, the filings showed.

Other Top Stories By Our Reporters

Edtech unicorn Byju’s raises $1.2 billion via term loan: India’s most valuable privately held startup, Byju’s, has raised $1.2 billion via a term loan from the overseas market. The edtech firm, valued at $18 billion, had earlier planned to raise $700 million, however, the round was upsized, as per people familiar with the matter.

HCL software head Darren Oberst resigns from firm: Darren Oberst, who heads HCL Technologies software and products business, has resigned as senior corporate vice president of the company. The Noida-headquartered IT services firm, which has struggled over the past few quarters, told the stock exchanges on Monday that he has “decided to leave HCL Technologies to pursue another opportunity”.

Former Blackstone India MD Amit Jain joins Carlyle: Amit Jain, former senior managing director at Blackstone India, has joined US-based PE firm Carlyle as managing director based in Mumbai and co-head of the Carlyle India investment advisory team.

Global Picks We Are Reading