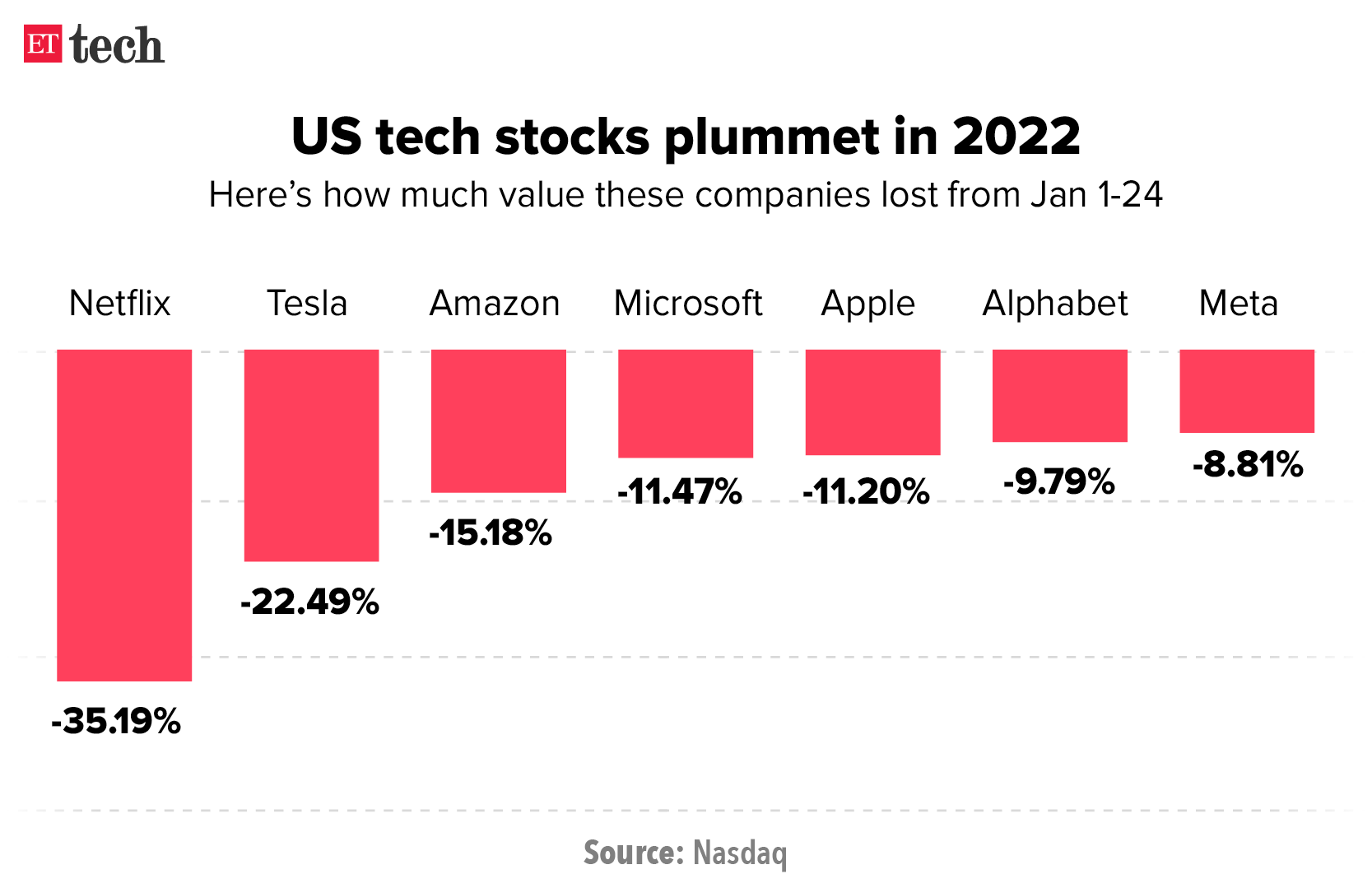

Today we bring you news that Boat, one of India’s largest direct-to-consumer audio brands, is expected to file for an IPO this week. The start of 2022 hasn’t been kind to India’s recently listed tech firms (the BSE IPO Index is headed for its worst month since March 2020), so a successful Boat IPO would bring some much-needed cheer.

Also in this letter:

- Wealthy investors transfer crypto outside India

- SAP picks up minority stake in Icertis

- Hackers attack Indian crypto YouTube accounts

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Boat may file for Rs 2,000-crore IPO this week

D2C audio brand Boat is set to file draft papers for a Rs 2,000-crore IPO with the Securities and Exchange Board of India this week, people aware of the matter told us. “The draft red herring prospectus (DRHP) should be filed by Thursday,” one of these people said.

Details: The IPO will be split evenly between a fresh issue of shares and an offer for sale (OFS), in which existing investors will sell some of their shares, the sources said.

Boat is expected to seek a valuation of $1.5-2 billion in the offering.

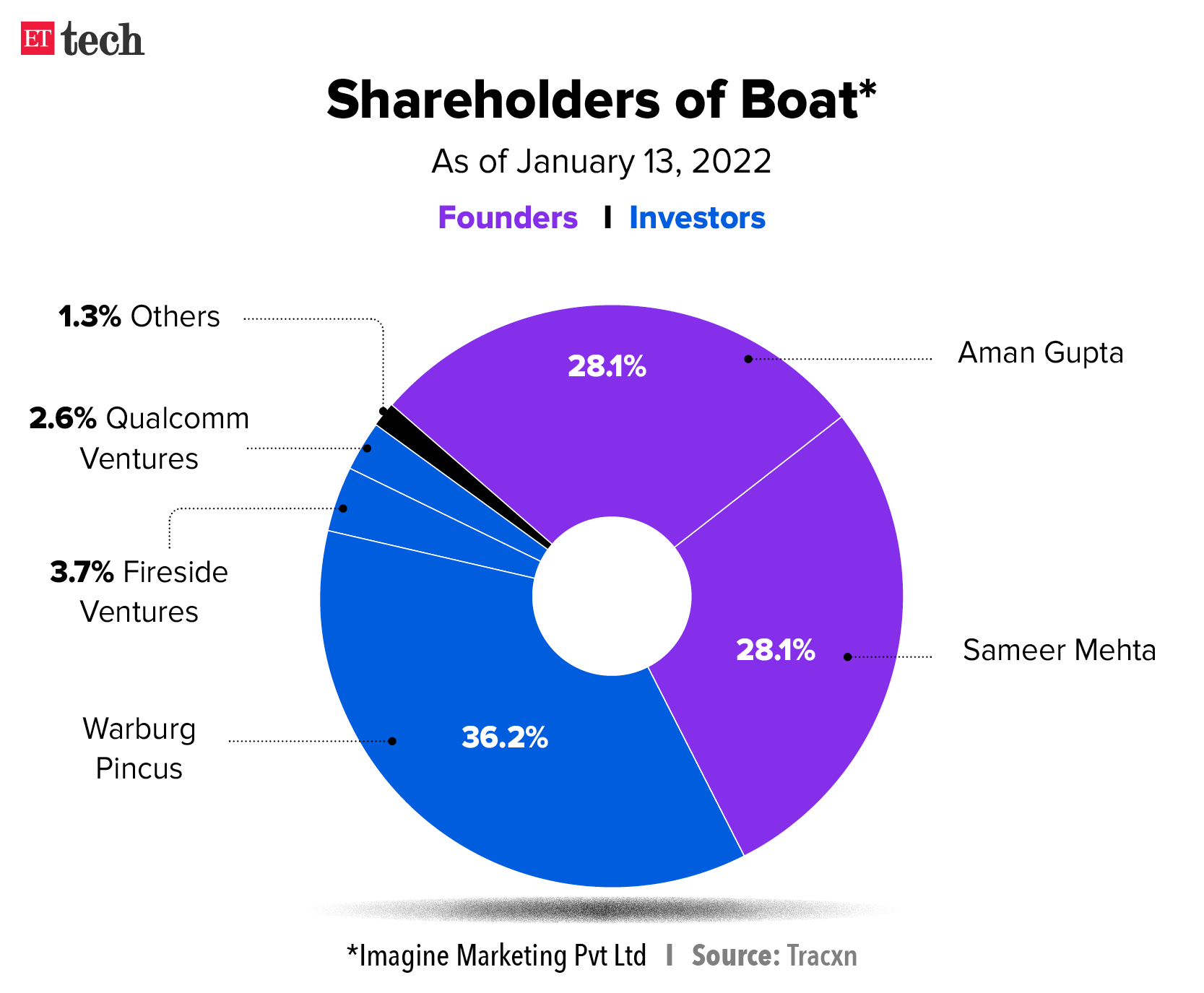

Private equity major Warburg Pincus, the single largest shareholder with around 36%, will sell shares worth Rs 700-800 crore. Cofounders Aman Gupta and Sameer Mehta, who together own around 56% in the firm, are also expected to sell some shares.

Boat was last valued around Rs 2,200 crore when it raised Rs 50 crore in a round led by Qualcomm Ventures last April. It is now eyeing a valuation of 5-6 times its revenue for this fiscal, the people cited earlier said. Boat clocked Rs 1,500 crore in revenue and a net profit of over Rs 78 crore in FY21.

Yes, but: Sources said the final IPO pricing may still change depending on broader external market conditions. Recently listed new-age Indian companies have seen their stocks getting hammered in recent days as part of a broader market fall.

D2C fund: Boat is also setting up a fund to invest in early-stage D2C brands. “The fund size is being finalised. It will essentially invest in promising brands early on,” a source told us.

The plan comes at a time when Thrasio-style companies, which acquire online brands and scale them, are gaining prominence in India. Thrasio itself has entered the country and plans to invest $500 million, as we reported previously.

Wealthy individuals, family offices stash their crypto abroad

Wealthy individuals and their family offices that bought cryptocurrencies in the past two years have started transferring them to family trusts and wallets outside India as the country drags its feet on cryptocurrency regulations, tax advisors told us.

In most cases, the investments were made through Indian exchanges and have grown two to three times. Many of these individuals and family offices are now looking to hedge their risks, insiders said.

Lose to win: In most cases, transferring crypto assets outside India could lead to a loss of value. “Cryptocurrencies in India trade at 8-10% premium and there will be a straightforward loss if these assets are transferred outside India. But many family offices are willing to take this risk,” said a tax advisor.

Yes, but: Industry trackers said this could lead to some regulatory complications.

“While it is technically possible for anyone to transfer cryptocurrency outside the country, there is a comfort that the promoters and even exchanges are in some way based in India. Also, this could violate FEMA (Foreign Exchange Management Act) regulations if crypto assets worth more than $250,000 are transferred during a year,” said Siddharth Sogani, founder CREBACO, a cryptocurrency research firm.

While there are no specific regulations against transferring cryptocurrencies outside India, FEMA regulations put a limit on remittances outside India.

The government wants to capture cryptocurrency income and investments within and outside India, and could spell out regulations in the upcoming budget, ET first reported on December 6.

Tweet of the day

ETtech Done Deals

■ SAP AG has picked up a minority stake in Icertis in a deal that will see the German firm co-sell products created by the Pune-based SaaS startup. Icertis Contract Intelligence will see further integration with SAP, Ariba and SAP Customer Experience solutions.

■ Indiamart Intermesh Ltd., a business-to-business marketplace, has agreed to acquire 100% of accounting platform Busy Infotech Pvt. Ltd. for Rs 500 crore.

■ Flint, a crypto investment app, has raised $5.1 million in a funding round led by Sequoia Capital India and Global Founders to acquire users, enhance its product base, and hire for senior positions across engineering, design and product.

■ NowPurchase, a procurement technology company for the metal manufacturing industry, said it has raised $2.4 million in a funding round led by Orios and InfoEdge Ventures.

Hackers attack Indian crypto firms’ YouTube accounts

The YouTube accounts of various Indian crypto companies including CoinDCX, CoinSwitch Kuber, WazirX and Unocoin were among those compromised in a worldwide hack Monday.

- The breach was revealed when an unidentified hacker posted a video promoting a crypto scam called ‘One World Cryptocurrency’ on the compromised channels.

Reponse: Many crypto exchanges told us that they had conducted internal investigations and found there was no suspicious activity—such as a change of password—on their accounts prior to the hack.

Expert view: Cybersecurity expert Rajshekhar Rajaharia said the incident may have been due to the integration of compromised accounts with third-party API used for live streaming. An API is a type of software that allows two other pieces of software to talk to each other.

Extreme volatility: The hacking incident comes at a time when Indian cryptocurrency exchanges have recorded higher trading volumes in the past few days owing to extreme volatility in the market.

- Traders and investors have liquidated some of the riskier tokens, rebalanced their portfolios by moving to stable coins and also indulged in opportunistic buying to average down their portfolios.

But while most recorded higher transaction levels, a few witnessed a dip too.

- “We saw a sharp decline in trading volumes during the weekend as most investors were trying to figure out the reasons and consequences of the current dip in crypto,” the CEO of a top exchange said on the condition of anonymity.

- “Many users on our platform are long-term retail investors. They have seen similar dips and recoveries in the past. They use the opportunity to add to their portfolio,” CoinSwith Kuber’s Ashish Singhal said.

Some of the popular coins that were hammered in the market during the past few days witnessed some fresh buying.

Infographic Insight

Budget 2022 Expectations: Crypto and Fintech

With the Union Budget 2022-23 just a week away, India’s crypto and fintech sectors are clear about their wish lists for the government.

Crypto firms want clarity on taxes: Cryptocurrency companies say they have been suffering due to a lack of regulations and clarity on taxation. There is widespread confusion among crypto firms on matters of indirect taxes, and the GST implications on the purchase and sale of cryptocurrencies.

The government has sought the opinion of senior tax advisors on whether income earned from trading cryptocurrencies could be treated as business income, as against capital gains.

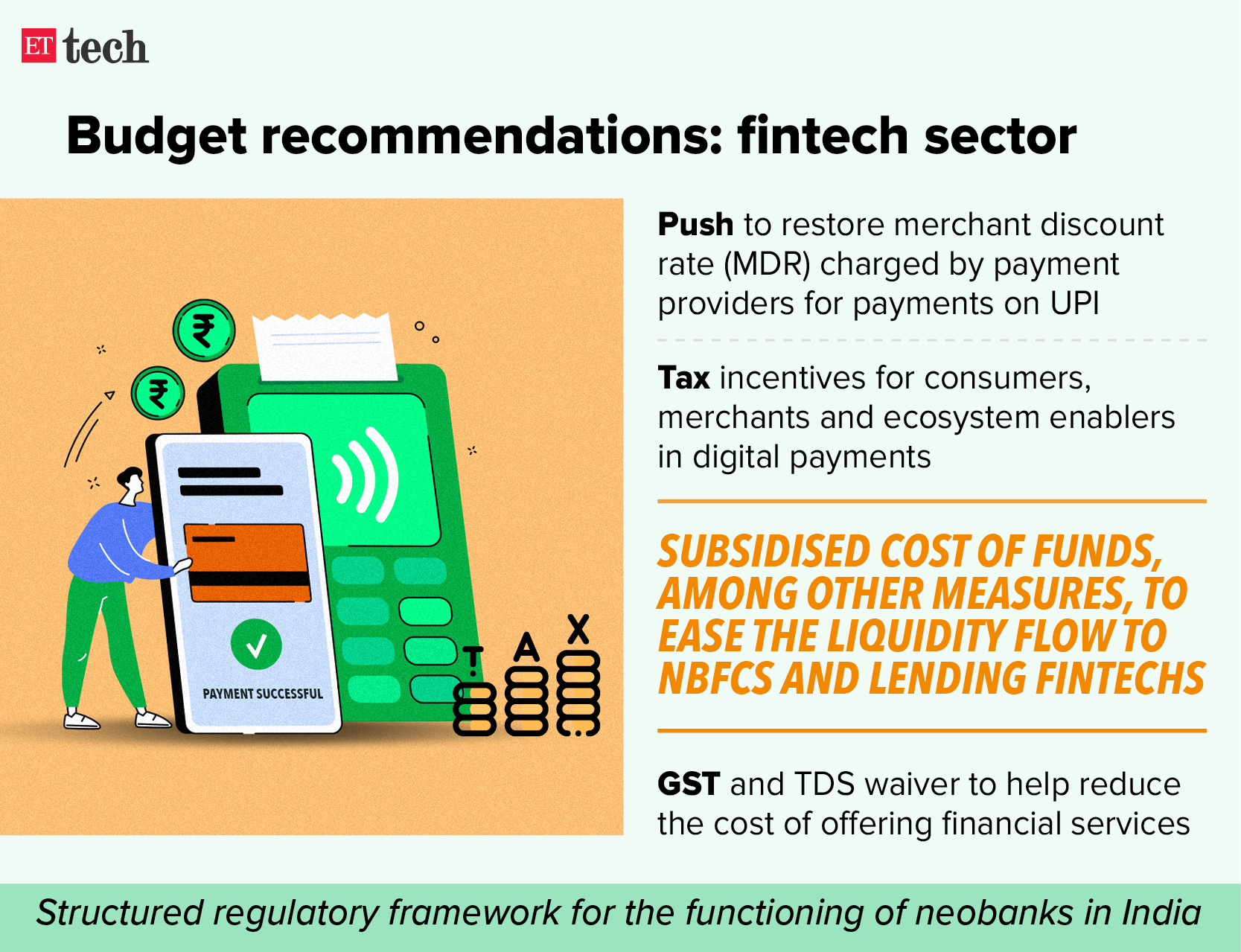

Fintech firms rally for sops: Fintech companies, meanwhile, are lobbying the government to bring back the merchant discount rate (MDR)—a fee that payment providers charge for each transaction—on the Unified Payments Interface (UPI).

The digital lending industry, which was severely hit at the start of the pandemic, wants the government to announce measures to ease liquidity flow to NBFCs.

India’s fledgling neobanks, meanwhile, are just looking for recognition. Since they are not eligible for banking licences under RBI rules, they have to tie up with traditional banks to offer their services.

Other Top Stories By Our Reporters

MakeMyTrip founder Deep Kalra

MakeMyTrip’s Deep Kalra transitions to chief mentor role: The outgoing founder and executive chairman will now devote his time towards mentoring the travel portal’s leadership team, along with focusing on strategic initiatives within the company. (read more)

TCS announces Microsoft Cloud for Retail partnership: India’s largest IT services firm will combine its retail domain experience and multi-horizon cloud transformation framework to help clients accelerate their growth and transformation journeys using the industry-specific Microsoft Cloud solutions. (read more)

Retool to expand India presence: The San Francisco, US-based low-code platform is expanding its presence in India with exclusive offerings as it sees huge traction from IT services providers and startups alike. (read more)

Global Picks We Are Reading

■ Substack adding video to lure new creators (Axios)

■ The Rise of the Crypto Mayors (NYT)

■ Peloton’s big whoops (Vox)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.