The transaction value is 40% lower than Blinkit’s last valuation of just over $1 billion. As per discussions held earlier, the deal was pegged at $700-750 million.

Blinkit had become a unicorn — or a privately held company with a valuation of $1 billion or more — last year following a $120 million funding round from Zomato and New York-based investment firm Tiger Global.

In total, Blinkit has raised $692 million so far from investors including Japan’s SoftBank, DST Global and Tiger Global, according to data from industry tracker Tracxn. Zomato currently holds about 9% in Blinkit.

According to the deal, the shareholders of Blinkit will get about 7% in Zomato at 70.76 per share.

The transaction is expected to close by early August, Zomato informed BSE after its board meeting on Friday.

Discover the stories of your interest

It is subject to customary shareholder and stock exchange approval, chief financial officer Akshant Goyal said in a letter to shareholders. “This foray into the next big category (quick commerce) is timely as our existing food business is steadily growing towards profitability,” Zomato’s founder and chief executive Deepinder Goyal said in a note to shareholders on Friday.

ET Tech

ET Tech“Zomato has grown at a CAGR of 86% in the last 4 years to an adjusted revenue of $710 million, while the adjusted Ebitda margin has improved from (153%) in FY19 to (18%) in FY22,” he said.

Zomato defines adjusted Ebidta as Ebidta less share-based payment expenses.

Goyal has said previously that the restaurant aggregator platform was “very conscious” about not overpaying for Blinkit in the event of a deal.

“We are very conscious that we do not have to overpay for any M&A (merger and acquisition), and we have strong governance processes. We will follow the process and not make any mistake on that front,” he said during an investor call in May, when asked how Zomato would value Blinkit.

Blinkit’s investors must compulsorily hold Zomato’s shares for 12 months.

In addition, 50% of the shares attributable to Albinder Dhindsa, founder of Blinkit, will be locked in for 24 months, while the rest will have a lock-in period of 12 months.

Saurabh Kumar, cofounder of Blinkit, left the firm last year to start a new venture but continues to be a shareholder in the company.

It is not clear if the 24-month lock-in period will be applicable to his stake in Zomato as well.

Shares attributable to the exercised or vested employee stock ownership plan (Esop) of Blinkit will be locked in for the mandatory six months.

SoftBank and DST Global are also investors in Zomato rival Swiggy.

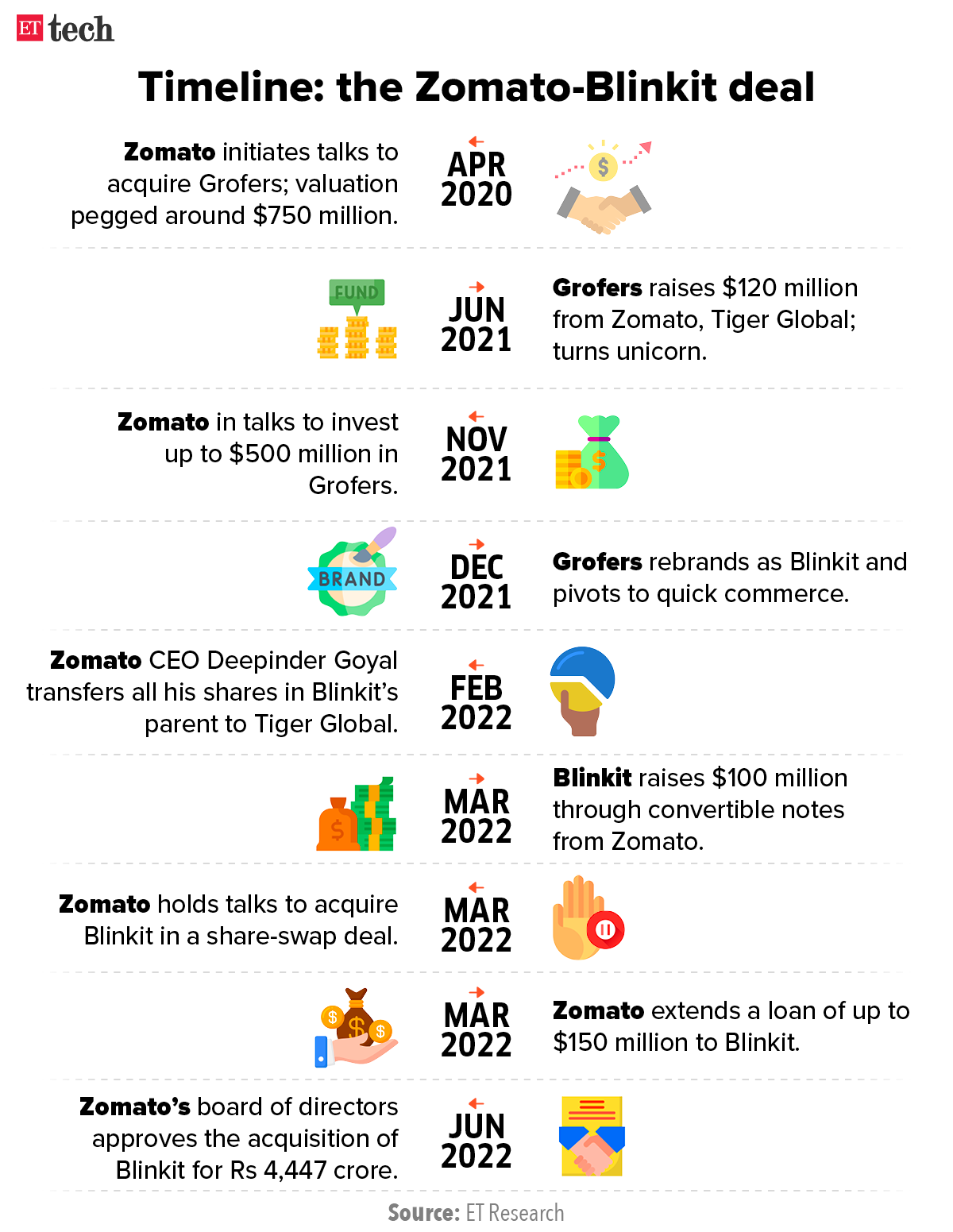

ET was the first to report that both the companies had first explored a deal more than two years ago.

We are 1% done today, towards the larger journey we envision for ourselves in the long run.Read here for more det… https://t.co/g1zPc7lWzy

— Deepinder Goyal (@deepigoyal) 1656082138000

Blinkit Numbers

As per the shareholder letter, Blinkit had a revenue of Rs 22.1 crore in January, its first month of operation as a fully quick commerce business. This has jumped to Rs 58 crore as of May.

The same month, it clocked a gross order value (GOV) of Rs 402.8 crore compared with Rs 295.5 crore in January.

Blinkit’s revenue includes its marketplace commission income, customer delivery charges, advertisement revenue, warehousing and ancillary services income.

It is present in the top 15 cities.

Zomato CFO Akshant Goyal said quick commerce increases its addressable market, the potential profit pool and also makes its business more defensible.

“The peak demand times for food delivery are also complementary to the quick commerce demand peaks in non-meal times. This will help increase our hyperlocal delivery fleet utilisation and reduce the cost of delivery,” he said, adding that the company is seeing food delivery and quick commerce converging globally.

Chief executive Deepinder Goyal said quick commerce will help it increase customer wallet share spent on Zomato and also drive higher frequency and engagement from customers.

Blinkit GOV is already around 63% of Zomato’s food delivery GOV in Gurugram, the company said.

The average order value on Blinkit is higher than Zomato.

ETtech

ETtech

Competition

The Blinkit purchase is expected to help Zomato — which has been bullish on quick commerce — strengthen its position significantly in the buzzy, ultra-fast grocery delivery space. Rival Swiggy has allocated at least $700 million for its quick commerce business under Instamart, while the sector has also seen other well-funded startups like Zepto, Retail-backed Dunzo, and Tata-owned BigBasket.

The sector has, however, yet to show signs of turning profitable.

“Yes, competition is high, but the market is also very large. The online commerce penetration is so low in India today that high competition is actually healthy,” Deepinder Goyal said on the current competition landscape.

“Different companies will innovate differently to drive growth. It will lead to faster category creation, like how it happened in food delivery, a few years ago. This will benefit players (like us) that are well positioned to achieve scale.”

Zepto raised $200 million in May, in a funding round led by existing investor Y Combinator’s Continuity Fund.

Zomato has been trying to enter the quick commerce space and had twice dropped plans to deliver groceries online since the onset of the Covid-19 pandemic in 2020.

“What changed in the case of quicker deliveries is the product-market fit, and that the customer proposition has become much stronger than kiranas (brick-and-mortar grocery shops),” Akshant Goyal said during an investor call in May.

He said in the shareholder letter that Zomato was acquiring a portion of the debt given to Blinkit as part of the transaction. Zomato had given Rs 1,125 crore as debt to Blinkit, of which Rs 575 crore was still available as cash.

“This means that we have an additional Rs 1,875 crore as per the plan for further potential investments in quick commerce going forward,” he said, adding that most of this capital would go towards funding losses in Blinkit during the remainder of the ongoing calendar year as well as next year.