Credit: Giphy

Also in this letter:

■ Amazon counsel approaches Reliance Retail for talks

■ ESTA 2021 winners and the jury that picked them

■ Biden orders US govt to study digital dollar, crypto risks

Blinkit gets $100 million from Zomato, in talks to raise another $300 million

Blinkit cofounder Albinder Dhindsa

Blinkit (formerly Grofers), which recently pivoted to the quick commerce segment, has closed an additional $100 million financing as a part of its ongoing fundraise, cofounder and chief executive Albinder Dhindsa told employees on Thursday.

The funds are being raised through convertible notes from Zomato, which will later be converted into equity, people aware of the discussions told us.

This is a part of a larger $400-million funding Blinkit is looking to raise from Zomato and other investors, which is expected to close in the next two quarters, one of the persons aware of the discussions said.

It is in addition to the $100 million that Zomato invested in the company and its wholesale entity Hands on Trades last year, catapulting the quick commerce startup’s valuation to $1 billion. In August 2021, the Competition Commission of India (CCI) approved the investment.

While announcing its December quarter results, Zomato said that it continued to be bullish on quick commerce and would potentially invest an additional $400 million in the space over the next two years.

Volatile markets delayed round: We first reported in November that Zomato may invest $500 million in Blinkit to push its quick commerce ambitions, potentially valuing the company at $1.5 billion. The company has also raised the upper limit of its potential investments in the quick commerce segment, it said last month.

However, volatility in the public markets and its effect on Zomato’s share price has delayed the round, which was expected to close this month.

- “The market conditions have affected Zomato, and thus Blinkit’s planned fundraising. The funding is expected to be negotiated again, with fresh terms. To go ahead with its plans, Blinkit, for now, has raised the first tranche of $100 million from Zomato,” a source told us.

Zomato’s stock has shed over 41% in the past three months, owing to a sell-off in tech stocks and, more recently, increased volatility due to Russia’s invasion of Ukraine.

ETtech Done Deals

■ Game streaming platform Loco said it has raised $42 million (Rs 330 crore) in a funding round led by crypto major Hashed, with participation from Makers Fund, Catamaran Ventures, Korea Investment Partners, Krafton, Lumikai, and Hiro Capital.

■ Audio content platform Kuku FM has raised $19.5 million as a part of a funding round led by South Korean gaming giant Krafton. The round also saw participation from its existing investors including 3one4 Capital, Vertex Ventures, and India Quotient. Founder Bank Capital and Verlinvest came on as new investors.

■ Fresh produce supply chain startup Ninjacart said it has acquired Tecxpryt, a software as a service (Saas)-based communication platform. The entire team of Tecxprt will join Ninjacart as a part of the deal. The company did not disclose the transaction size.

Amazon counsel approaches Reliance Retail for talks

Law firm AZB & Partners has approached Reliance Retail on behalf of Amazon with a proposal to discuss an out-of-court settlement of their battle over Future Group, a source familiar with the development told us.

Catch up quick: Last Thursday, the lawyers of Amazon and Future Group told the Supreme Court they would look to settle their 18-month dispute through talks. Following this, the court postponed its hearing of the dispute to March 15.

Reliance unlikely to budge: If Reliance Retail agrees to the talks, it will be the first such interaction between the three parties.

The agenda of the meeting will be sent to Reliance soon, the source said, and the three-way talks are expected to start this week. But Reliance is unlikely to sell any stake or partner with Amazon to resolve the issue, he added.

“Partnering with Amazon does not fit into Reliance’s scheme of things. Reliance has already established itself as a major omnichannel player in Indian retailing. Partnering with Amazon is not going to help Reliance take (its online venture) JioMart global either, as Amazon would not like to create more competition in other markets,” the source said.

Reliance terminates 835 leases: Meanwhile, days after it emerged that Reliance Retail had started taking control of many Future Retail stores, the ailing firm said on Thursday that Reliance has terminated the leases of 835 of its stores.

“So far notices have been received in respect of 342 large format stores (such as Big Bazaar, Fashion@Big Bazaar and 493 small-format stores (such as Easyday and Heritage stores) of the company. These stores have been historically contributing approximately 55-65% of the company’s retail revenue,” Future Retail said.

Marathon dispute: Amazon and Future Retail have been battling for almost two years. In August 2020, Future Retail had agreed to sell its retail, wholesale, logistics and warehousing businesses to Reliance Retail for Rs 24,713 crore.

Amazon managed to get an arbitration court in Singapore to halt the deal, arguing that its 2019 deal with Future Coupons prohibited Future Group from selling its assets to anyone else.

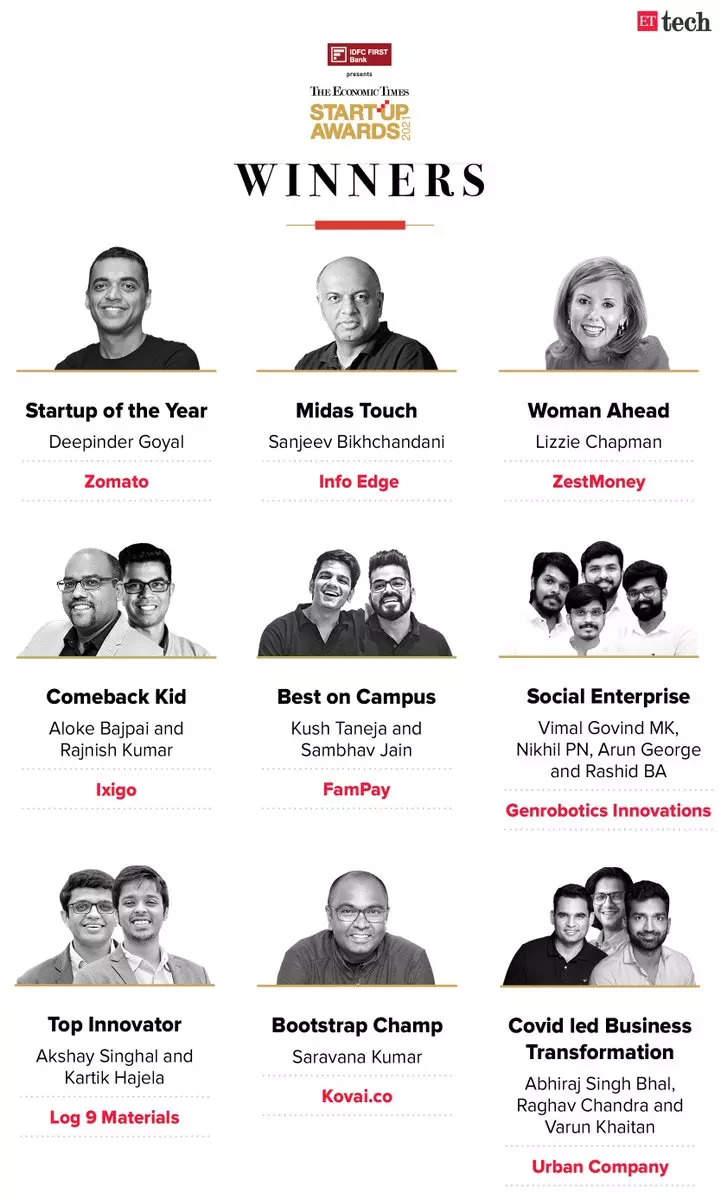

The 10 winners of ESTA 2021 and the jury that picked them

The who’s-who of Indian startups will join top policymakers and investors in Bengaluru this Saturday to celebrate the best of Indian entrepreneurship at The Economic Times Startup Awards.

The winners in nine categories, who were chosen by our high-powered jury at a virtual meeting on September 24, will receive their awards in person as the award ceremony returns after a nearly two-year hiatus.

The winners: Zomato, which blazed a new trail with its stellar public listing in 2021, won Startup of the Year. In doing so it joined a prestigious list of previous winners, which include stock trading platform Zerodha, logistics and supply chain firm Delhivery, online transportation app Ola, enterprise software maker Freshdesk, food delivery platform Swiggy, and hospitality brand Oyo.

The jury: ET had assembled a jury comprising top Indian and global business leaders, investors and entrepreneurs. Headed by Nandan Nilekani, cofounder and non-executive chairman Infosys and the architect of Aadhaar, it also included:

- Deepinder Goyal, cofounder and CEO, Zomato

- Gokul Rajaram, product and business leader, DoorDash

- Sachin Bansal, founder and CEO, Navi Technologies

- Nithin Kamath, founder and CEO, Zerodha

- Anu Hariharan, partner, Y Combinator Continuity Fund

- Amit Agarwal, global SVP and country head, Amazon India

- Satyan Gajwani, vice chairman, Times Internet Ltd

- GV Ravishankar, MD, Sequoia Capital India;

- Harsh Jain, cofounder and CEO, Dream11

- Ankiti Bose, cofounder and CEO, Zilingo

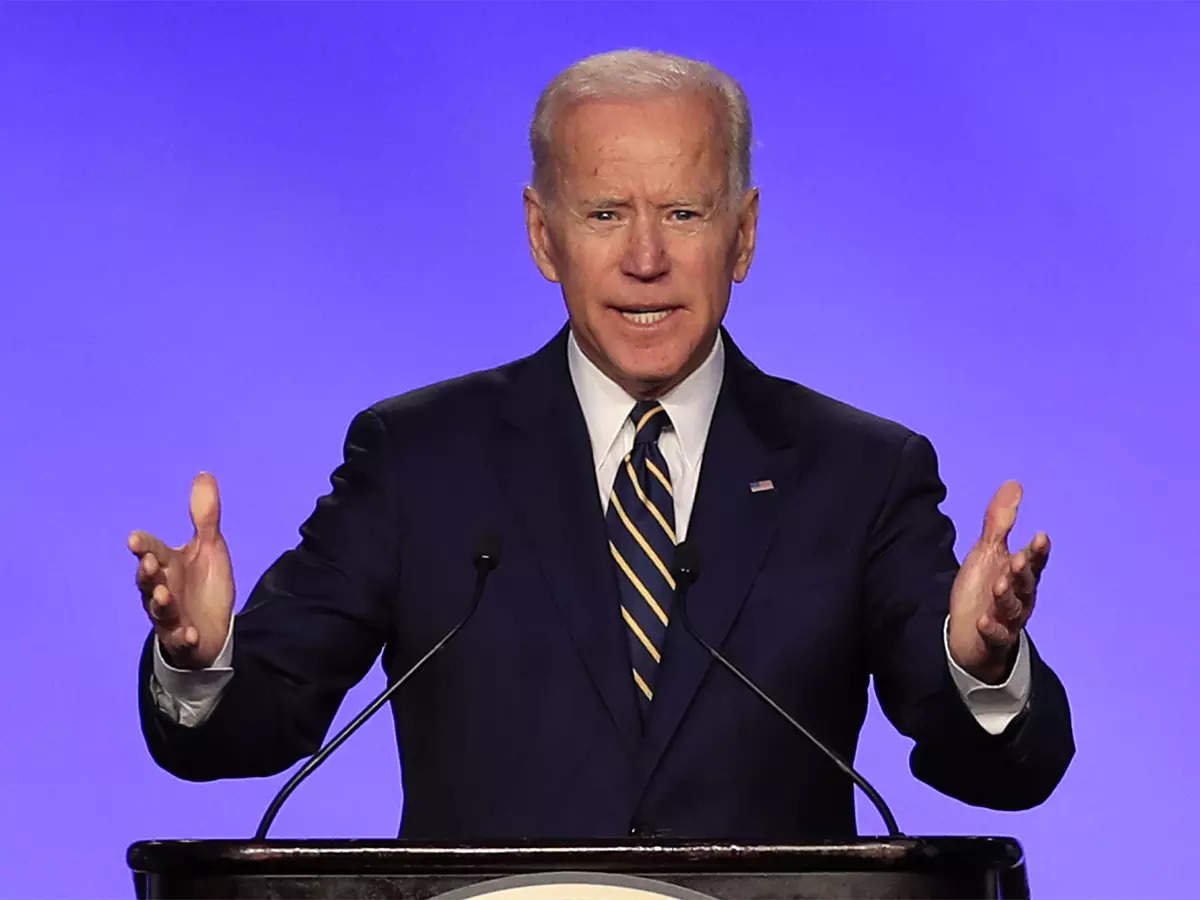

Biden orders US govt to study digital dollar, other crypto risks

US President Joe Biden has signed an executive order requiring the government to assess the risks and benefits of creating a central bank digital dollar, and other crypto issues.

What this means: Analysts view the long-awaited executive order as a stark acknowledgement of the growing importance of cryptocurrencies and their potential consequences for the US and global financial systems.

Here are a few key takeaways:

- The Biden administration directed the Treasury Department, along with other key agencies, to submit a report by September analysing the potential costs and benefits of a digital dollar.

- The executive order specifically requested that the report focus on how a digital dollar could improve financial inclusion, what implications it could have on economic growth

- It sought clarity on how foreign digital dollars could impact the greenback’s status as the world’s reserve currency.

- The order encouraged the Federal Reserve to continue its ongoing research into the possibility of a digital dollar and to “develop a strategic plan” for how a central bank digital currency could be implemented.

- It also tasked agencies with outlining the conditions that would drive “mass adoption of different types of digital assets” and the related risks and opportunities.

Crypto in illicit finance: The increasing popularity of digital assets could heighten the risk that they may be used to launder money, finance terror groups and facilitate cyber crimes, the Biden administration warned.

The order directed the Treasury Department, the Director of National Intelligence and the Department of Homeland Security, among others, to detail how cryptocurrencies could be used in illicit finance and to form a coordinated action plan to mitigate the risks.

Ukraine prepares for potential move of sensitive data to another country

Ukrainian is preparing for the potential need to move its data and servers abroad if Russia’s invading forces push deeper into the country, a senior cybersecurity official told Reuters.

Victor Zhora, the deputy chief of Ukraine’s State Service of Special Communications and Information Protection, emphasised his department was planning for a contingency, but that it is being considered at all suggests Ukrainians want to be ready for any Russian threat to seize sensitive government documents.

Government officials have already been shipping equipment and backups to more secure areas of Ukraine beyond the reach of Russian forces, who invaded on Feb. 24 and are laying siege to several cities.

Amazon suspends shipments in Russia: Amazon has suspended shipment of retail products to customers based in Russia and Belarus, and will no longer provide customers there with access to its streaming service Prime Video.

The company also said it would no longer be accepting new Russia and Belarus-based AWS customers and Amazon third-party sellers.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.