Also in this letter:

■ Apple asks CCI to junk App Store case, cites tiny market share

■ Ixigo gets Sebi’s nod for Rs 1,600-crore IPO

■ Blinkit halts delivery in areas it can’t service in 10 minutes

Cars24 closes $400 million round, OfBusiness raises $325 million

Cars24 founders

Two tech startups announced significant deals today. Cars24, a platform for buying and selling used cars, said it has closed a $400 million funding round led by Alpha Wave Global. Meanwhile, business-to-business (B2B) commerce startup OfBusiness is now valued at almost $5 billion after raising $325 million from Alpha Wave Global, Tiger Global and SoftBank Vision Fund 2.

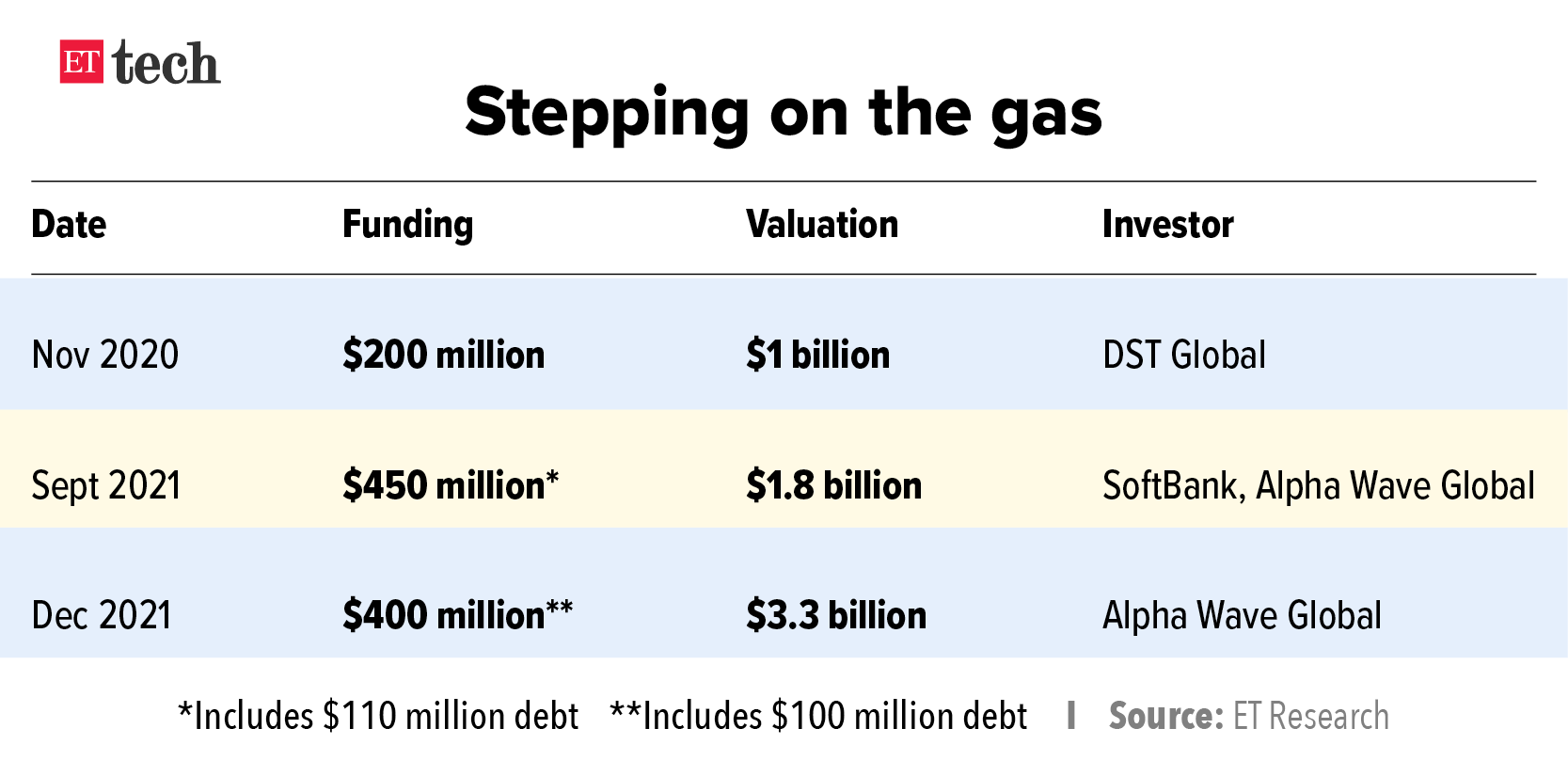

Car24’s valuation hits $3.3B: The Cars24 deal, which we first reported about on November 29, includes a $100-million debt component that has been sourced from investors such as Commercial Bank of Dubai and IFM Investors in Australia.

The funding bumps the company valuation to $3.3 billion, up more than 80% from its previous funding round in September, when it raised $450 million from SoftBank Vision Fund, Alpha Wave Global and Yuri Milner’s DST Global among others at a valuation of $1.8 billion.

Cars24 will use the new capital to build large refurbishing centres across the country to improve the quality of cars before they are sold to customers. This is part of its plans to go deeper within India.

Global ambition: We reported last month that the company was also looking to expand to the Middle East and Southeast Asia. It recently entered Thailand and also operates in the UAE and Australia.

Cofounder Gajendra Jangid said the firm has been expanding around the world this year and will continue with that strategy. “This is a $100 billion market opportunity in India and abroad, and a much larger game … The latest funding will help us make a dent not only in India but abroad too,” he said.

OfBusiness raises $325M: Meanwhile, Alpha Wave Global invested around $175 million, Tiger Global $100 million and SoftBank $50 million in OfBusiness.

The round also included a secondary share sale of around $140 million in which existing investors Matrix Partners India, Creation Investments and Zodius Technologies sold some of their shares. Around 80 employees with stock options also participated in the secondary transaction.

What a year: This is the company’s fourth major funding round this year.

IPO on the horizon: OfBusiness cofounder and CEO Asish Mohapatra said the startup will use the new funds to go deeper into supply chain on the commerce side and build technology for its software-as-a-service (SaaS) solutions and financing vertical. He added that the company was also aiming for an initial public offering in India in the next 9-12 months.

Another Done Deal

■ Bizongo, a business-to-business (B2B) ecommerce and supply chain enablement platform, said it has raised $110 million in a new funding round led by New York-based Tiger Global, taking its valuation to $600 million. The round also saw CDC and IFC EAF joining as new investors. It also involved existing investors B Capital, Chiratae Ventures, Schroder Adveq, IFC and Add Ventures by SCG. Manish Choksi, a member of Bizongo’s advisory board and vice chairman at Asian Paints, also invested in his personal capacity.

Apple asks CCI to junk App Store case, cites tiny market share

Apple has asked India’s competition watchdog to dismiss a case that alleged it abused its dominance in the mobile apps market.

The reason the case should be junked, the company said, is that it is too small a player in India, where Google’s Android dominates the smartphone market, Reuters reported, citing a filing by the US firm.

Under the lens: Apple made the filing after the Competition Commission of India (CCI) started reviewing allegations that the company hurts competition by forcing app developers to use its proprietary payments system, which charges commissions of up to 30% on in-app purchases.

Apple, however, did nothing to address the actual allegations, saying only that its market share in India is an “insignificant” 0-5%, while Google commands 90-100% of the market with Android.

- The numbers: Apple’s iOS powered about 2% of 520 million smartphones in India as of the end of 2020, with the rest using Android, according to Counterpoint Research. The report added that Apple’s smartphone base in the country has more than doubled in the past five years.

“Apple is not dominant in the Indian market … Without dominance, there can be no abuse,” Apple said in the submission, dated November 16, which was signed by its chief compliance officer Kyle Andeer. “It has already been established that Google is the dominant player in India,” it added.

The case: The complainant in the case is a little-known non-profit group called Together We Fight Society. It said that Apple’s iOS dominates the market for non-licensable mobile operating systems.

Apple countered that in its filing, saying the entire smartphone market – which includes licensable systems like Android — is the market that should be taken into consideration.

Apple also described the Indian complaint as a “proxy filing” in its CCI submission, saying that the complainant was “likely acting in concert with parties with whom Apple has ongoing commercial and contractual disputes globally and/or that have complained to other regulators”. It did not include any evidence in its submission to support its claim.

What’s next? In the coming weeks, the CCI will review Apple’s response and could order a wider investigation or dismiss the case altogether if it finds it to be without merit.

Google under the scanner: The CCI is conducting a separate investigation into Google’s in-app payment system as part of a broader probe into the company after Indian startups voiced concerns about its steep fees and monopoly overpayments last year.

In September, Google moved the Delhi High Court against the CCI over the leak of a report alleging that it abused its dominance in the Android smartphone market.

The probe by the investigative arm of the CCI had concluded that Google had restricted the ability of manufacturers to develop and sell alternative versions of Android.

Though the report did not constitute the CCI’s final orders, Google went to court claiming that the leak harmed its ability to defend itself.

Ixigo gets Sebi’s nod for Rs 1,600-crore IPO

Ixigo cofounder Aloke Bajpai

Le Travenues Technology Ltd, which operates travel platform Ixigo, has received markets regulator Sebi’s go-ahead to raise Rs 1,600 crore through an initial sharesale.

- The listing is likely in January or February, according to a person aware of the matter.

IPO details: Going by the draft papers, Le Travenues Technology’s IPO will comprise a fresh issuance of shares worth Rs 750 crore and an offer-for-sale (OFS) of equity shares worth Rs 850 crore by existing shareholders.

Offloading stakes: As part of the OFS, Saif Partners India IV will offload shares worth Rs 550 crore, Micromax Informatics will sell shares for Rs 200 crore and Aloke Bajpai and Rajnish Kumar will divest stakes worth Rs 50 crore each.

Currently, SAIF Partners holds 23.97% in the company, Micromax 7.61%, Aloke Bajpai 9.18% and Rajnish Kumar 8.79% stake in the firm.

What will the funds be used for? The proceeds of the fresh issue will be used to fund the company’s organic and inorganic growth initiatives and for general corporate purposes.

In October, cofounder Aloke Bajpai told us in an interview that going public is the best option as it not only gives exits to investors but also allows customers and other stakeholders to hold shares in the company and grow with it.

He said that even though ixigo’s private investors were ready to double down with fresh cheques, tapping the public markets would give the company a longer runway to access wider capital pools, and mean that it would not face liquidity constraints in the long run.

Tweet of the day

Blinkit suspends delivery in areas that it cannot service in 10 minutes

Blinkit cofounder Albinder Dhindsa

Blinkit, the quick commerce startup formerly known as Grofers, has suspended deliveries in areas that it cannot service in 10 minutes, cofounder Albinder Dhindsa said on Monday.

Quote: “In the near term this call will have a significant impact for our business size and for a large number of our customers,” Dhindsa said in a tweet. “We expect this to impact around 75,000 of the 200,000 daily customers we are serving. The company is ramping up fast, opening a new store every four hours and it is expecting to serve affected customers within four weeks.”

The timing: The decision comes soon after the company rebranded itself from Grofers to Blinkit amid increasing competition in the quick commerce space. Well-funded startups like Mumbai-based Zepto, Swiggy’s Instamart and Google-backed Dunzo are all promising to deliver groceries and other essentials in 10-20 minutes. Zepto’s USP is 10-minute delivery.

- “We hope to be insanely consistent with our 10 minutes promise and apologise to our affected customers in advance,” Dhindsa said in his post.

Pivot from groceries: The rebranding, like that of Facebook in late October, reflected a change of focus for the company as it looks to grab a share of India’s rapidly growing quick commerce market. It came just months after the company launched grocery deliveries in 10 minutes or less.

India’s quick commerce boom: According to a report by Redseer, India’s quick commerce market will be worth an estimated $300 million this calendar year and grow to $5 billion by 2025.

Elon Musk says he will pay over $11 billion in taxes this year

Tesla CEO Elon Musk

Tesla CEO Elon Musk in a tweet on Monday said he will pay over $11 billion in taxes this year—possibly the biggest tax bill in US history.

Twitter war: Earlier this week, Democratic US Senator Elizabeth Warren took to Twitter to say that Musk should pay taxes and stop “freeloading off everyone else” after Time magazine named him its “Person of the Year”.

In response, Musk tweeted, “If you opened your eyes for 2 seconds, you would realise I will pay more taxes than any American in history this year.”

Taxing issue: A report by ProPublica in June said Musk paid little income tax relative to his outsize wealth. However, Musk said that he doesn’t draw a salary from either Tesla or SpaceX, and pays an effective tax rate of 53% on stock options he exercises.

Tweets get Musk in trouble again: Over the weekend, Tesla was hit by a lawsuit over CEO Elon Musk’s social media posts including his Twitter poll on stock sales that pulled down its stock prices.

Tesla investor David Wagner called for access to internal documents to investigate whether Tesla and Musk violated an agreement with the US securities regulator and its board members failed to adhere to their fiduciary duties.

Tell me more: In 2018, Musk settled a lawsuit by the Securities and Exchange Commission over his tweet on taking the company private, agreeing to have the company’s lawyers pre-approve tweets with material information about the company.

Tesla shares, which had hovered near record-highs, lost their value by about a quarter after Musk said on Nov. 6 he would sell 10% of his stake if Twitter users agreed. He has since sold nearly $14 billion worth of shares so far.

An influencer, indeed: Musk, known for his Twitter banter, last week said he was considering quitting his “jobs” and becoming an influencer full-time. But even as a “part-time influencer”, the world’s richest person has managed to move markets at least once every month this year.

Also Read: Twelve times Elon Musk moved markets in 2021

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.