Also in this letter:

■After Oyo, PharmEasy may have to pare its IPO

■Flipkart launches 45-min grocery delivery in B’luru

■India to extend deadline for semiconductor scheme

BharatPe board accepted resignation I never gave, says Madhuri Jain

Madhuri Jain, head of controls at BharatPe and wife of the company’s embattled cofounder Ashneer Grover, has accused the company board of accepting her resignation though she hadn’t tendered one.

New twist: The fintech firm, however, told us it had not asked for Jain’s resignation. “The board of BharatPe has never sought any resignation from Ms Madhuri Jain,” BharatPe said in a reply to ET’s queries. “Hence the question of the board accepting her resignation does not arise. She was asked to go on a compulsory leave of absence on January 20,” it said.

Multiple sources told us that there was confusion between board members and BharatPe’s top management over Jain’s resignation.

According to the people we spoke to, Grover, the managing director, had himself offered Jain’s resignation at a board meeting on January 19. This was recorded in the minutes of the meeting, the people added.

However, Grover later said the offer of Jain’s resignation was ‘spontaneous’ and that not all board members were in agreement with his proposal, the sources said.

Then, in a letter to the company board sent last week, Jain wrote that news of her alleged resignation was “rather astonishing and defies every known norm of corporate governance and propriety”. She added: “… neither did I have any information about the same (alleged resignation), nor have I tendered any such resignation.”

It seemed the “purported” resignation was accepted by the board “merely on account of my being Ashneer’s wife”, she alleged.

Payback acquisition under scrutiny: Meanwhile, the ongoing scrutiny of BharatPe’s financial practises includes its very first acquisition, that of multi-brand loyalty platform Payback India last June, three sources told us.

After Oyo, Pharmeasy may have to pare its IPO

Online pharmacy PharmEasy may have to reduce the valuation it was aiming for through a public offering, industry sources told us, as new-age companies feel the pressure of a broader market rout.

Grey skies: PharmEasy’s shares are currently trading between Rs 70 and Rs 80 on the grey market. They had been trading at more than Rs 100 earlier this year.

- “It (grey market pricing) signals the current nervousness on tech IPOs and valuations. Before Paytm IPO, PharmEasy’s secondary shares were available at Rs 120-130 as well,” one of the people directly aware of the grey market pricing of the company said.

PharmEasy’s parent company API Holdings is yet to get the final clearance from Sebi for its IPO and is also reconsidering the timing of its offering. Unlike Delhivery and Oyo Hotels & Homes, its IPO is entirely a primary share sale, with no offer-for-sale component.

It filed draft IPO papers in November, seeking to raise Rs 6250 crore (about $833 million). The company was last valued at $5.4 billion and was aiming at an IPO valuation of around $7-8 billion.

Dominant player: A recent report from Bernstein Research showed PharmEasy accounts for 50% of gross merchandise value (GMV) in India’s online pharmacy sector. Tata-owned 1mg has a 16% share and Reliance’s Netmeds has 15%.

Oyo, you too? We reported on February 10 that Oyo may also downsize its IPO. It had planned for a valuation in the range of $9-12 billion but could settle for around $7 billion. No final decision has been taken on pricing of its IPO as it awaits the final nod from Sebi.

Tweet of the day

Flipkart launches 45-min grocery delivery, to expand next month

Flipkart has started delivering groceries in 45 minutes in parts of Bengaluru through Flipkart Quick, which it had launched as a 90-minute delivery service in July 2020.

A source in Flipkart said the company was not overhauling its 90-minute delivery model, simply “optimising the steps” to reduce delivery times. Flipkart plans to expand the 45-minute service to more places next month, the source added.

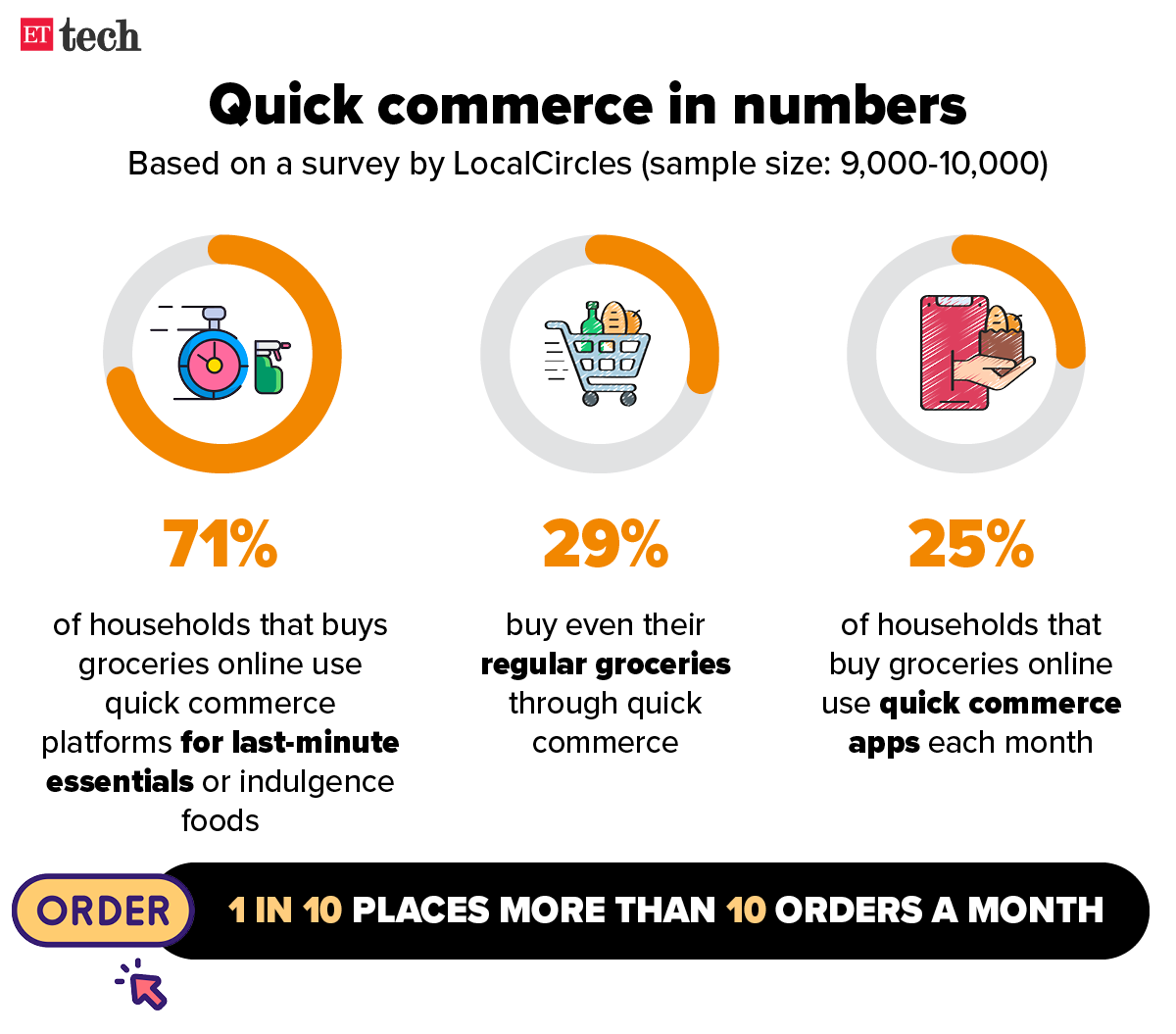

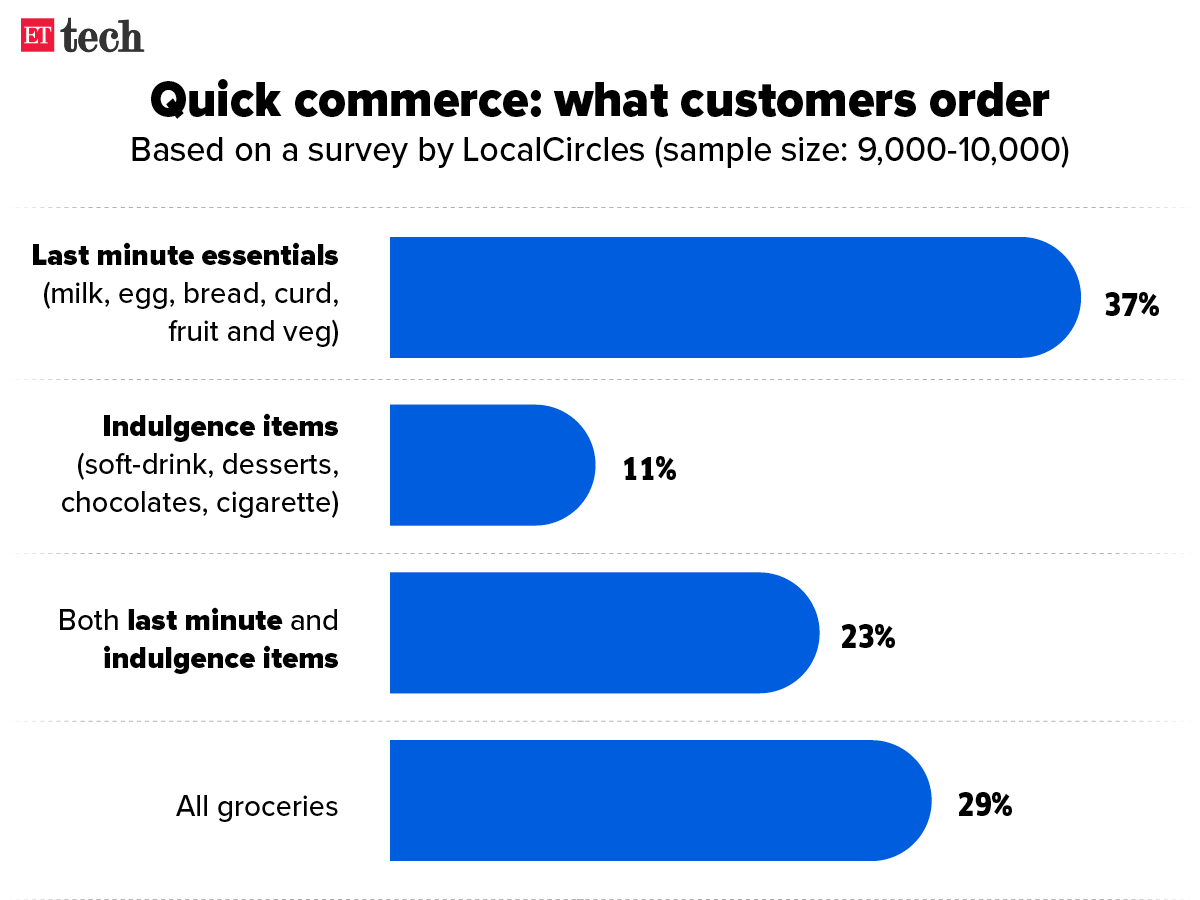

Semi-quick commerce? This comes as so-called quick commerce firms such as Blinkit, Zepto, Swiggy’s Instamart and RIL-backed Dunzo are competing to deliver a range of products in 15-20 minutes.

Flipkart’s 45-minute grocery delivery service is in line with the company’s belief that 10-20 minute delivery isn’t the right model in the long term. Flipkart group CEO Kalyan Krishnamurthy had told ET on January 4 that the company would prefer to focus on a model that’s sustainable and offers both good value and selection.

“I don’t think that (15-20 minute delivery) is the right long-term customer model,” he had told ET. “We will look at a more sustainable business which offers it in 30-45 minutes with good value and selection. That is the way we look at the convenience business rather than force-fitting a consumer need which is actually not there in the market.”

Selection vs speed: Quick commerce companies such as Swiggy’s Instamart and Zepto operate dark stores to facilitate the delivery of groceries in 15-20 minutes. These dark stores typically have a stock-keeping-unit (SKU) of 1,000-3,000 products per store. Flipkart will have a wider selection since the company takes longer to deliver.

India leads in quick commerce: According to a report by Bernstein Research, India leads other global markets on quick commerce adoption. Quick commerce penetration as a percentage of online grocery is 13% in India, 7% in China, and 3% in Europe.

Quick commerce targets mid/high-income households in large metros, who seek convenience over price. But players across the sector are currently burning through money with no profit in sight.

INFOGRAPHIC INSIGHT

ETtech Done Deals

■ Business-to-business (B2B) ecommerce platform ElasticRun said that it has closed a $330 million funding round led by SoftBank Vision Fund 2 and Goldman Sachs Asset Management. The round also saw participation from Chimera and Innoven along with long-term investor Prosus Ventures. The funds will be used for expanding into rural areas in several states and acquiring over one million kirana shop customers. ElasticRun will also use the fund to expand its services, like credit, nationally.

■ Social commerce grocery startup DealShare said it has raised $45 million from a subsidiary of the Abu Dhabi Investment Authority (ADIA) as part of a larger round. Other investors in the $210 million round, which it first announced on January 28, include Tiger Global, Dragoneer Investments Group, Kora Capital, Unilever Ventures, Alpha Wave Global. DealShare is now valued at over $1.7 billion.

■ Agrim, a business to business (B2B) platform for agri-inputs, said that it has raised $10 million in a funding round led by Kalaari Capital. The round also saw participation from existing investors Omnivore, India Quotient, and Accion Venture Labs. The startup plans to use this funding for talent acquisition, embedded fintech product development, and scaling up operations.

■ Ace Green Recycling, a battery recycling technology company, has raised over $7 million in a funding round led by Circulate Capital. Climate Angels also participated in the round along with angel investors. The startup has raised about $10 million to date, including this round.

India to extend deadline for chip manufacturing scheme

India will extend the window for applications to its ambitious incentive-backed semiconductor chip design and manufacturing scheme, Rajeev Chandrasekhar, minister of state for electronics and IT, told us.

Officials said the government has been in talks with industry heavyweights such as Intel, Samsung, Global Foundries and the Taiwan Semiconductor Manufacturing Company (TSMC) to apply for the marquee scheme and invest in India.

“There is no deadline as such. Conversations with many global leaders are ongoing and so extending the date is certain,” said Chandrasekhar.

The Centre’s move comes in the wake of top-level discussions with the world’s five largest chip manufacturers. According to officials, these firms have displayed significant interest in the $10 billion incentive package aimed at creating a comprehensive ecosystem for semiconductor chip design, packaging and manufacturing in the country. The scheme was announced last December and the government began accepting proposals on January 1.

‘India can lead mass crypto adoption if regulations are supportive’

Alexander Höptner, chief executive of top global crypto exchange Bitmex said if Indian regulators take a “progressive stance” on cryptocurrencies, the country could turn the needle for mass market crypto adoption globally, given how quickly the adoption of digital assets has grown here in the past year.

In October 2021, blockchain research firm Chainalysis had ranked India second globally in crypto adoption.

“The combination of the strength of the economy, the demographics and technological prowess makes India an ideal driving force in mass crypto adoption,” Höptner said.

Despite a high 30% tax rate on crypto gains, global executives like Höptner are welcoming the tax proposals announced during the recent union budget, saying that it is a first step towards a more stable crypto regime.

“Is a tax regime the ideal way to regulate the industry? I don’t know. But it gives a stable framework to work upon, and the most important thing right now is that it removes uncertainty,” said Höptner.

Other Top Stories By Our Reporters

China concerned about app ban: China has expressed concern over India’s recent ban on about 54 Chinese apps earlier this week citing privacy and security concerns. “We hope India can take concrete measures to maintain the sound development momentum of bilateral economic and trade cooperation,” Gao Feng, a spokesperson in the Chinese commerce ministry, was quoted as saying by Reuters.

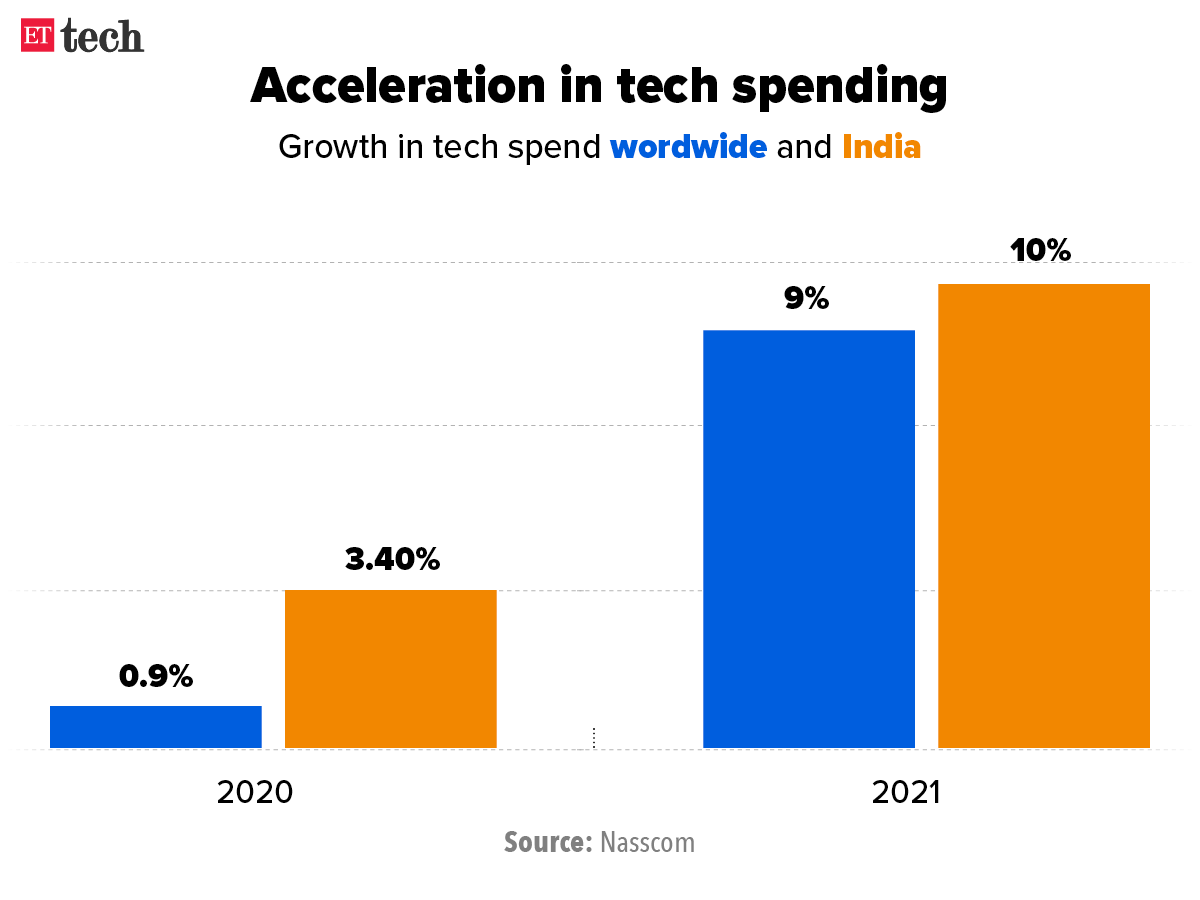

Indian IT to hire 3,60,000 freshers in FY22, says report: Indian IT companies are expected to hire about 360,000 freshers in fiscal year 2022, according to a study by cognitive intelligence platform UnearthInsight. The study, IT Industry Q3 Insights & FY22 Forecast, also said there is likely to be an increase in attrition to 22-24% in Q4 from 22.3% in the previous quarter and 19.5% in the quarter before that. This is expected to fall to 16-18% in fiscal 2023.

Capgemini bets big on India: The country will play an even bigger role globally for the French technology company Capgemini in managing its business, said CEO Aiman Ezzat. “We are increasing the number of account executives here as we believe India has a big role to play in managing our clients. We have grown the pool of executives and in the future see more Indian senior executives overall at Capgemini,” Ezzat said.

Global Picks We Are Reading

■ Sequoia Capital to create crypto fund of as much as $600 million (Bloomberg)

■ The world needs what Intel makes. Can it make a comeback? (NYT)

■ Sequoia Capital launches crypto token fund (Axios)