Also in this letter:

■ Banning or not banning crypto will come later, says FM

■ Freshworks reports 44% jump in revenue in Q4

■SoftBank’s woes are mounting

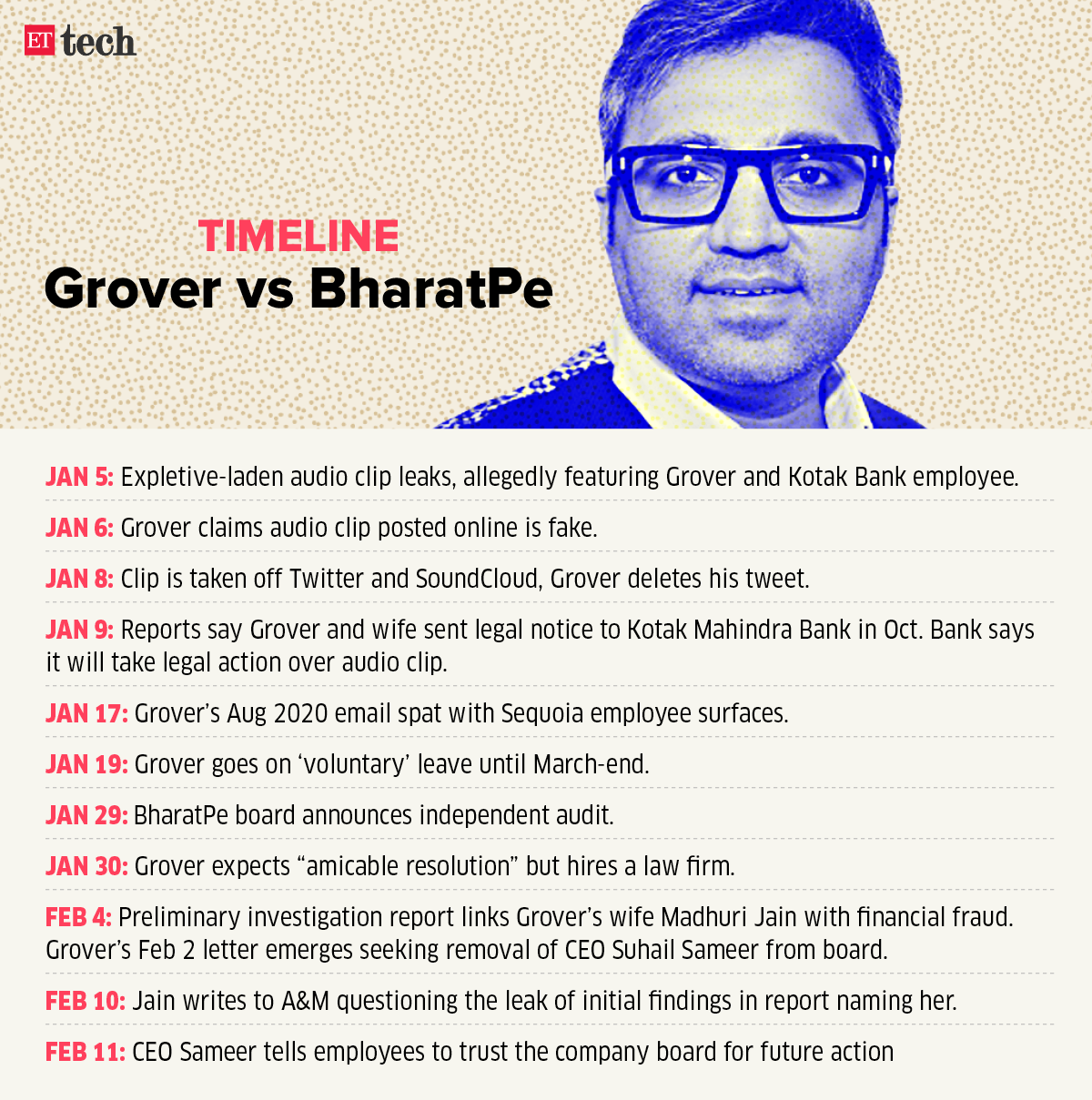

Nothing that can’t be corrected, BharatPe CEO tells employees

Suhail Sameer, chief executive officer of BharatPe

BharatPe’s chief executive Suhail Sameer wrote a letter to its employees on Friday morning, saying that while an audit of the company has thrown up some serious allegations, “this is nothing which can’t be corrected going forward”.

“We expect the review partners (consultants) to share an interim report with the board in a couple of weeks,” he said.

Sameer wrote that the company was “under constant scrutiny” and “what is being written is nothing but unsubstantiated rumours”. ET has reviewed the letter.

BharatPe chief’s missive to employees comes amid mounting tension between cofounder Ashneer Grover and the board.

Catch up: We reported last week that Grover had written to the board on February 4, asking it to remove Sameer as a director. Sameer’s letter also comes a day after BharatPe controller Madhuri Jain, who is also Grover’s wife, wrote in a letter to Alvarez & Marsal (A&M) that she may sue the firm over leaks of its preliminary report.

A&M has been conducting an audit of BharatPe at the board’s behest. On February 4, we reported its preliminary findings indicated that Jain and other family members were allegedly involved in financial irregularities at BharatPe.

Also Read: BharatPe’s Madhuri Jain may sue A&M over leaked report

Come together: Sameer wrote in his memo, “While many of the findings of the review are pretty standard for a fast growth company of our size, there are a couple of more serious allegations, which the review is still substantiating. This is nothing which can’t be corrected going forward, and none of it has any bearing on the medium to long term health of the business.

He also asked employees to trust BharatPe’s board. “Whatever the board decides will be beyond doubt, in the best interests of our employees, our merchants and our and our consumers,” he wrote.

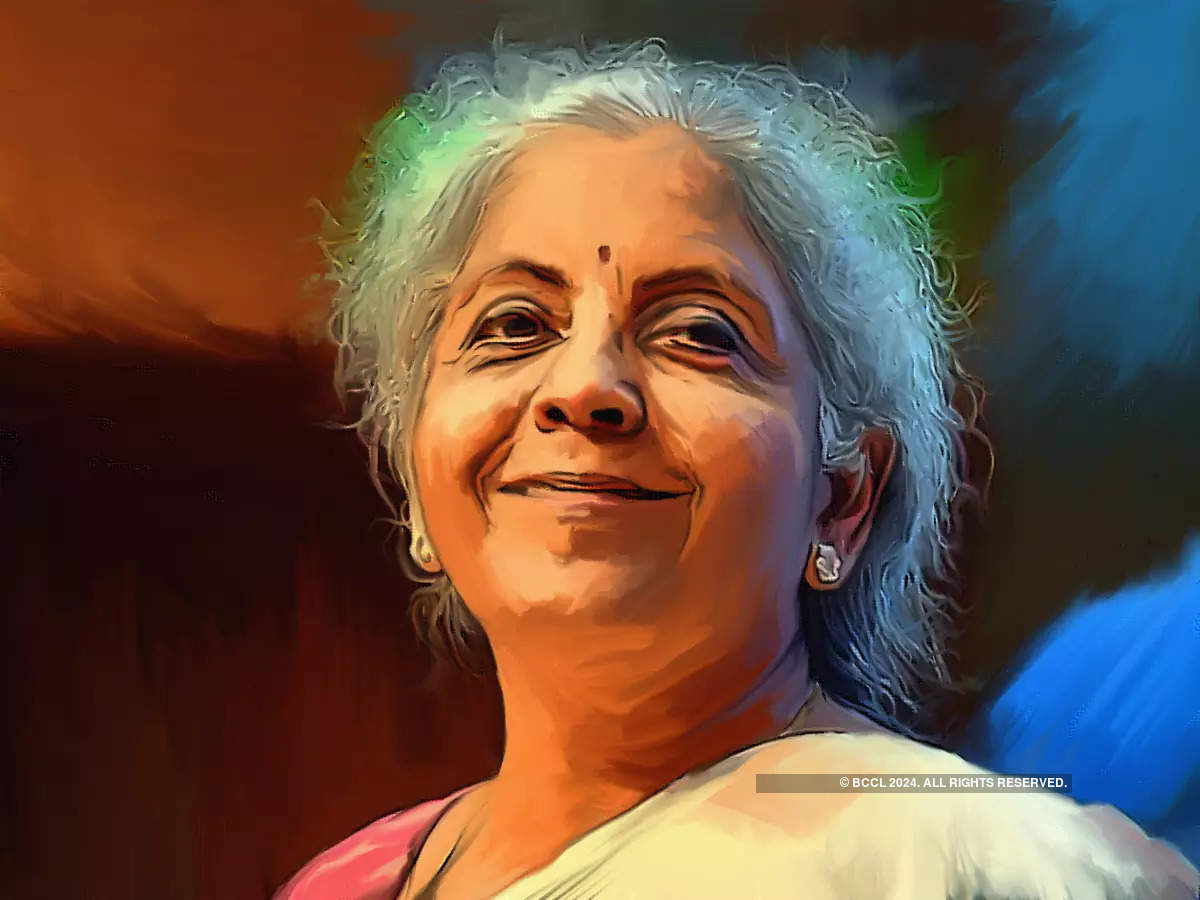

Banning or not banning crypto will come later, says FM

Finance minister Nirmala Sitharaman

Finance minister Nirmala Sitharaman said that the government has only decided to tax cryptocurrency transactions and hasn’t done anything to legalise or ban or regulate these assets.

In her words: “I am not going to legalise it or ban it at this stage. Banning or not banning will come subsequently when consultations give me input,” Sitharaman said.

Bill languishes: Even as the government announced cryptocurrency tax rules in the budget, the Cryptocurrency and Regulation of Official Digital Currency Bill wasn’t on the list of bills that will be taken up during the budget session of Parliament.

RBI vs crypto: The Reserve Bank of India, which may launch India’s official digital currency this fiscal, remains vehemently opposed to what it calls “private” cryptocurrencies, terming them a threat to India’s financial stability.

Speaking after the monetary policy review on Thursday, RBI governor Shaktikanta Das said, “Private cryptocurrency or whatever name you call it is a big threat to our macroeconomic stability and financial stability… and these cryptocurrencies have no underlying (value), not even a [that of a] tulip” – a reference to a speculative bubble that gripped the Netherlands in the 17th Century.

Das also said the RBI couldn’t provide a timeframe on when India’s official digital currency would be rolled out, adding, “Whatever we are doing, we are doing it very carefully and cautiously… We have to keep risks like cyber-security and counterfeiting in mind”.

Freshworks sees 44% jump in total revenue to $105.5 million in Q4

Girish Mathrubootham, founder, Freshworks

Software-as-a-Service (SaaS) firm Freshworks said on Friday its total revenue surged to $105.5 million in the quarter ended December 31, up 44% from the same period last year.

Revenue for the full year was $371.0 million, up 49% from 2020.

The company said the number of customers contributing more than $5,000 in ARR was 14,814, a 28% increase year-on-year.

Net dollar retention rate was 114%, compared to 117% in the third quarter of 2021 and 111% in the fourth quarter of 2020, the company said.

Indian SaaS: Freshworks became the first Indian SaaS company to list on Nasdaq on September 22, 2021, raising over $1 billion at a valuation of $10 billion.

According to a report by McKinsey and SaasBoomi, India’s SaaS industry will be worth $1 trillion by 2030. The country now has 13 SaaS unicorns as compared to just one in 2018, and is now the third-largest SaaS ecosystem globally after the US and China.

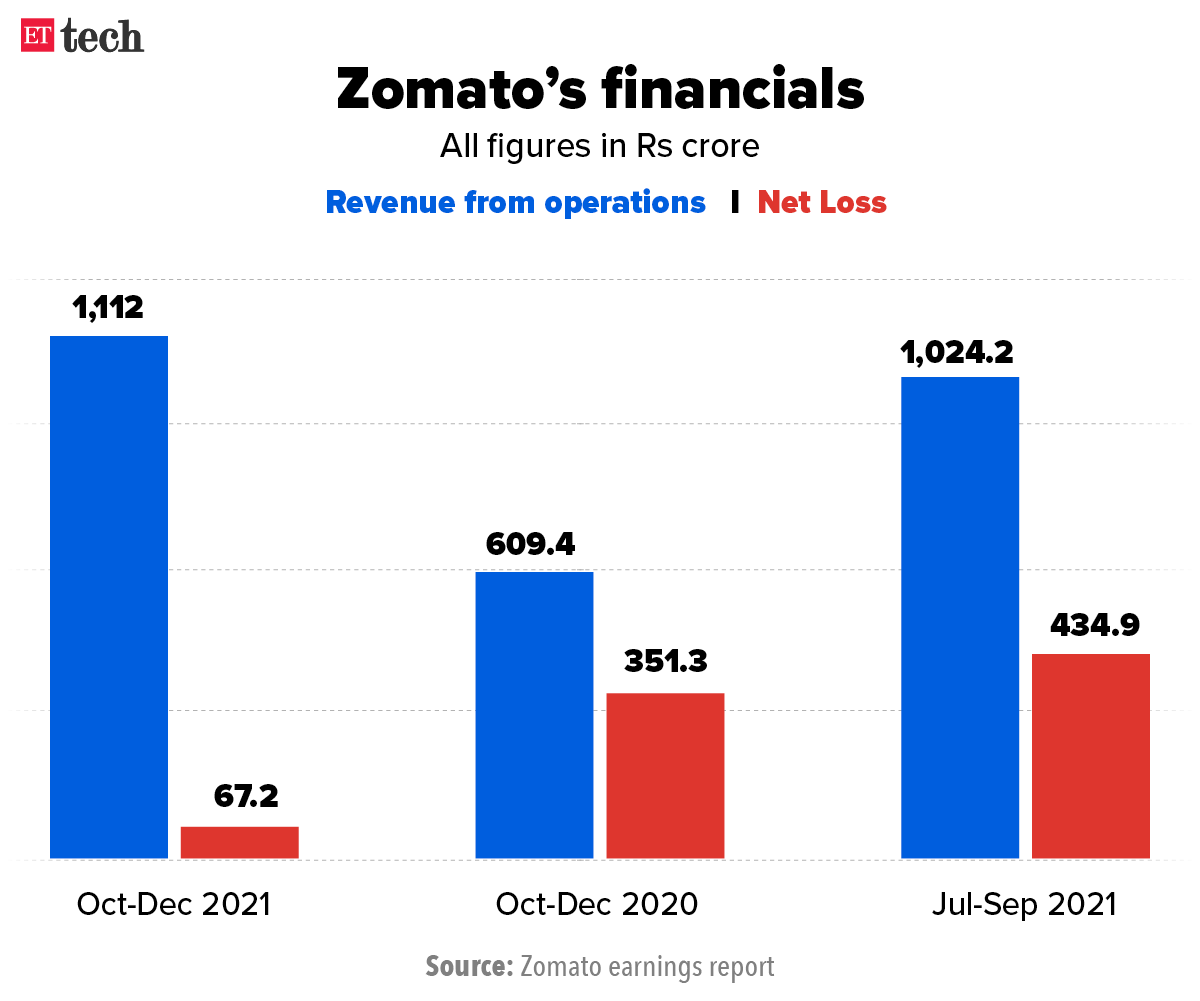

Zomato tanks: Back home, shares of Zomato plunged as much as 9% on the NSE as investors were seemingly unenthused by the company’s Q3 results, announced on Thursday evening.

Zomato had reported a consolidated net loss of Rs 67.2 crore in October-December as against Rs 434.9 crore in the previous quarter and Rs 351.3 crore in the same quarter in 2020.

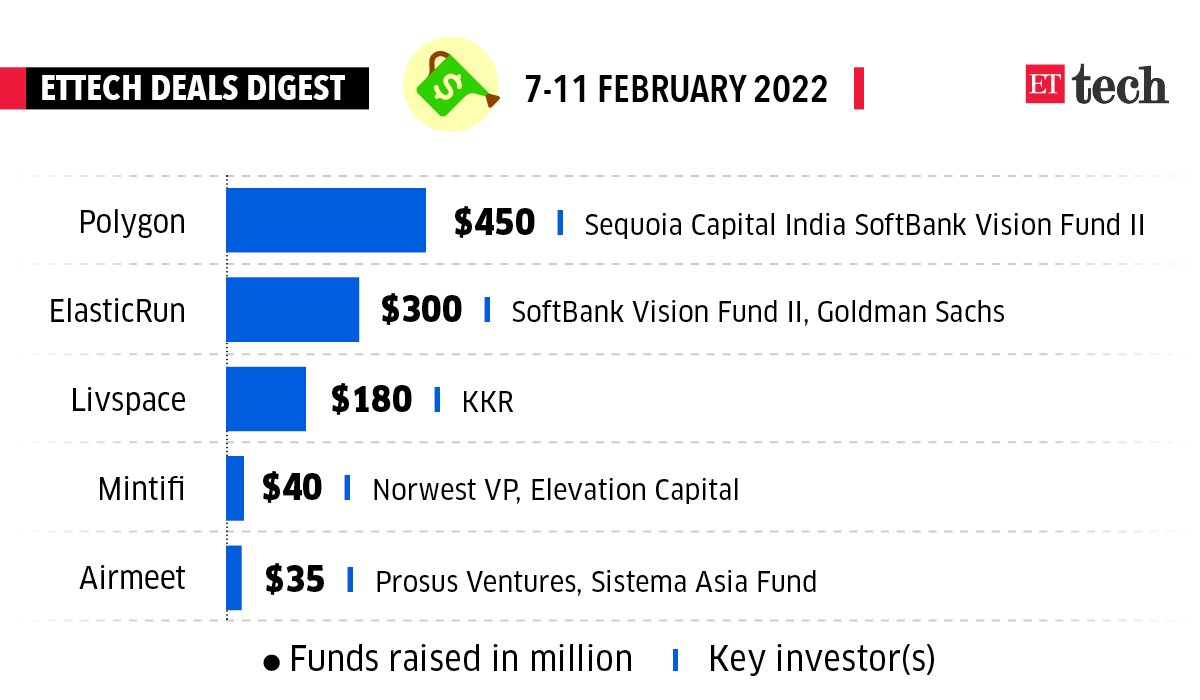

ETtech Deals Digest

This week saw three deals in excess of $150 million, including a mammoth $450 million investment in blockchain startup Polygon. Here’s a look at the top funding deals of the week.

SoftBank’s woes are mounting

SoftBank CEO Masayoshi Son

For the past decade, SoftBank and its founder Masayoshi Son grabbed headlines for eye-popping investments, becoming a fixture in the American technology scene by spending freely on startups and fundamentally reshaping how such companies had been funded, according to a report in The New York Times. Now, the bad news is piling up.

- This week, SoftBank’s planned $40 billion sale of Arm, a chip designer, to Nvidia, a Silicon Valley chipmaker, fell apart because of regulatory setbacks.

- Shares in a handful of large tech firms that SoftBank owns stakes in — from Alibaba to DoorDash — have plunged in recent months amid a wider sell-off in high-growth tech stocks.

- And one of Son’s key deputies, Marcelo Claure, left the firm in January after a bitter pay dispute.

The slump in SoftBank’s fortunes was reflected in its latest earnings report. Its quarterly earnings fell 97% from a year ago.

SoftBank’s performance reflects, among other things, the firm’s transformation in recent years from an operator of companies, mostly in telecommunications, to an investor in so-called disruptive technology companies, said Pierre Ferragu, an analyst at New Street Research.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.