Credit: Giphy

Also in this letter:

■ Accel raises $650 million for seventh fund

■ Urban Company gig workers to get stock options

■ Apple halts all product sales in Russia

BharatPe accuses Ashneer Grover, family of ‘fraud’, Grover hits back

BharatPe said on Wednesday it has found cofounder Ashneer Grover and his family members guilty of fraud. It said Grover and relatives “engaged in extensive misappropriation of funds and syphoned money away from the company’s accounts”.

“The company reserves all rights to take further legal action against [Grover] and his family,” the BharatPe said.

The statement came after a meeting on Tuesday evening, during which the final report of a probe conducted by PwC was tabled before the board.

Highlights from BharatPe’s statement: “The Grover family and their relatives engaged in extensive misappropriation of company funds, including, but not limited to, creating fake vendors through which they syphoned money away from the company’s account and grossly abused company expense accounts in order to enrich themselves and fund their lavish lifestyles.”

- “Minutes after Ashneer Grover received notice that some of the results of the inquiry would be presented to the board, he quickly shirked responsibility by sending an email to the board submitting his resignation and fabricating another false narrative of the events to the public.”

- “The board will not allow the deplorable conduct of the Grover family to tarnish BharatPe’s reputation… As a result of his misdeeds, Grover is no longer an employee, a founder, or a director of the company.”

Grover responds: Grover said he was “appalled but not surprised” by the “personal nature” of the company’s statement, adding that it came from a position of “personal hatred and low thinking”.

“The board needs to be reminded of $1 million of secondary shares investors bought from me in Series C, $2.5 million in Series D and $8.5 million in Series E. I would also want to learn who among Amarchand, PwC and A&M has started doing audits on ‘lavishness’ of one’s lifestyle?” Grover said.

He added that he expected the board to “get back to working soon”.

BharatPe’s former head of controls and Grover’s wife Madhuri Jain was sacked by the company on February 22 on the grounds of misappropriating funds.

Accel raises $650 million for seventh fund

The investing team at Accel India

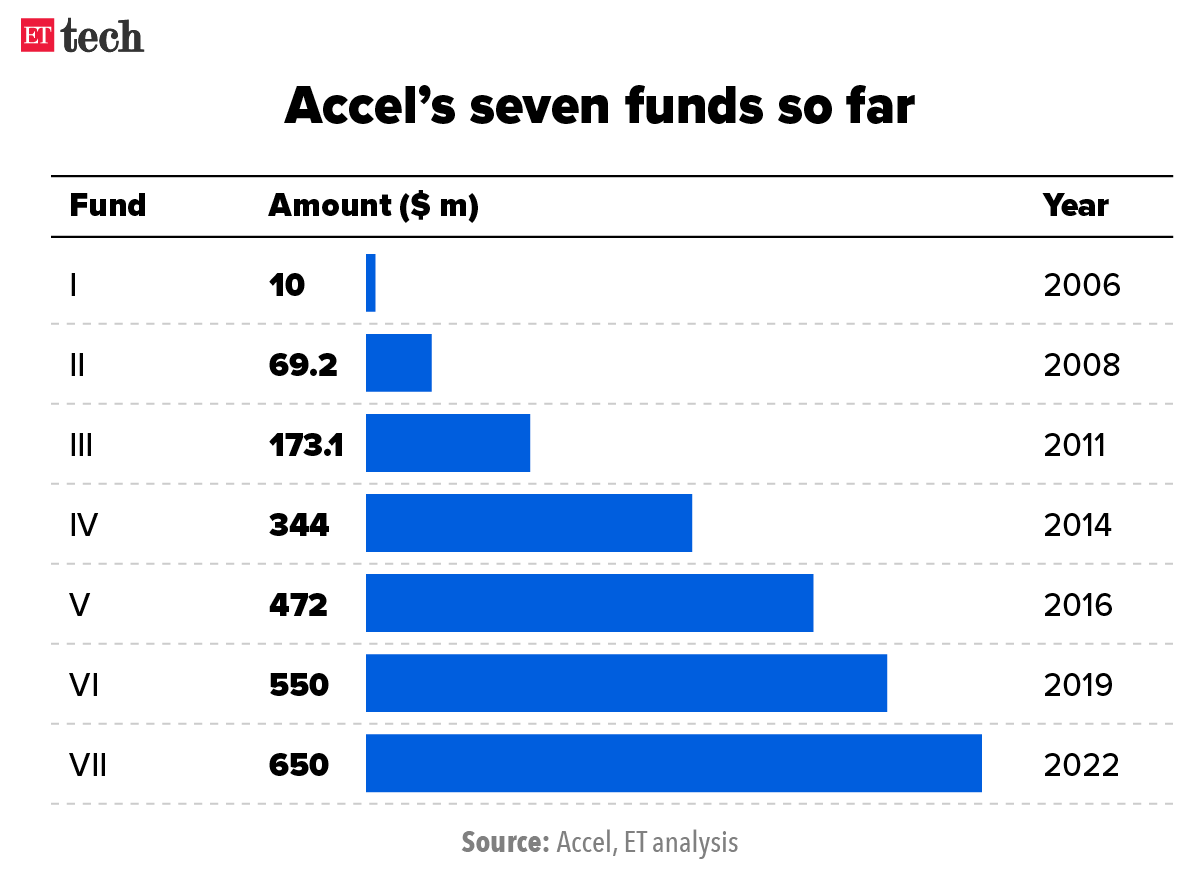

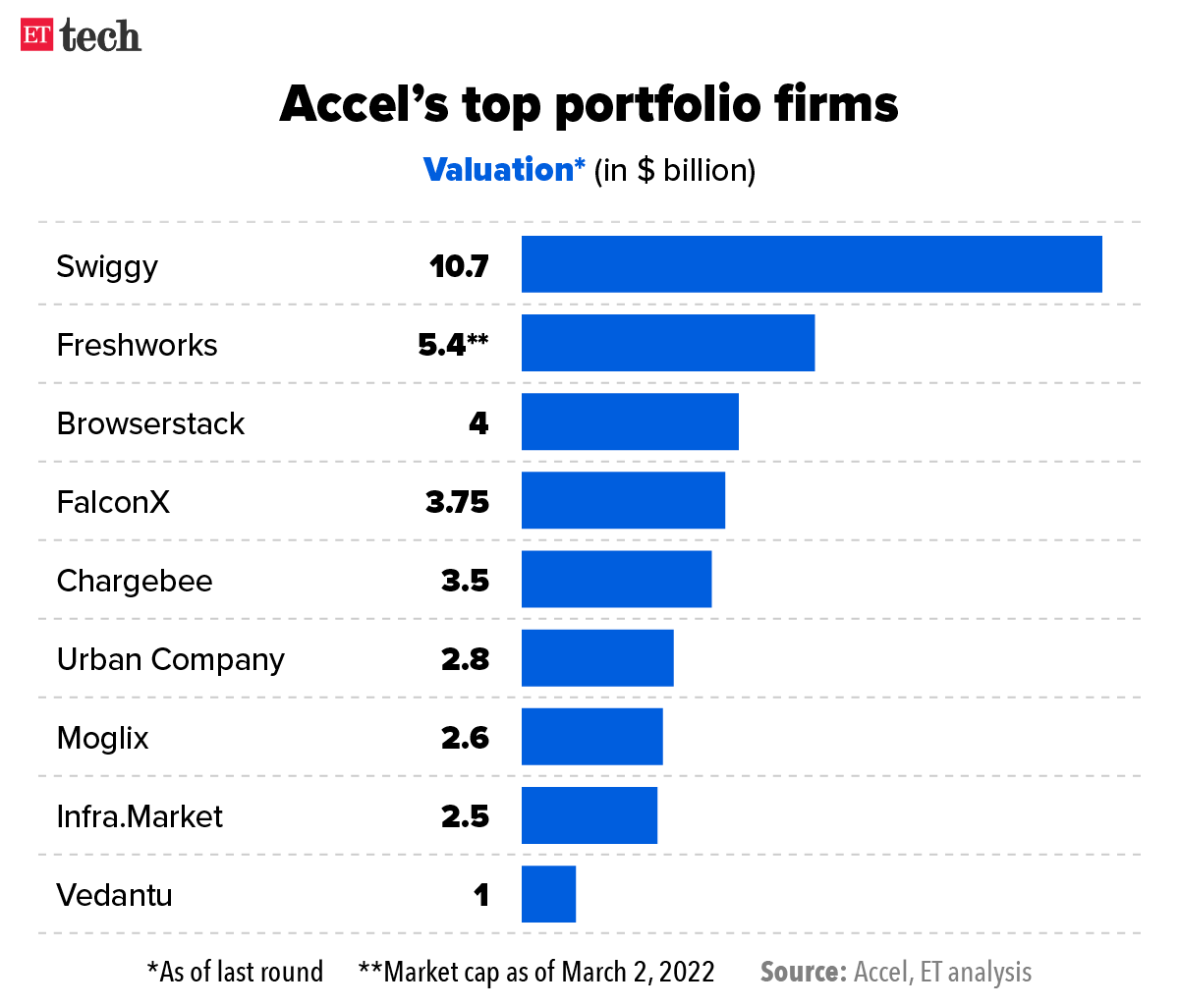

Accel, an early-stage venture capital firm that has backed the likes of Flipkart, Swiggy, Freshworks and Browserstack, said it has launched a $650-million seventh fund to back startups across India and Southeast Asia.

Context: The new fund comes three years after it mopped up $550 million as the VC firm continues to focus on early, seed and pre-seed stage startups, per senior executives at Accel. The total commitments for Accel in the region have now crossed $2 billion.

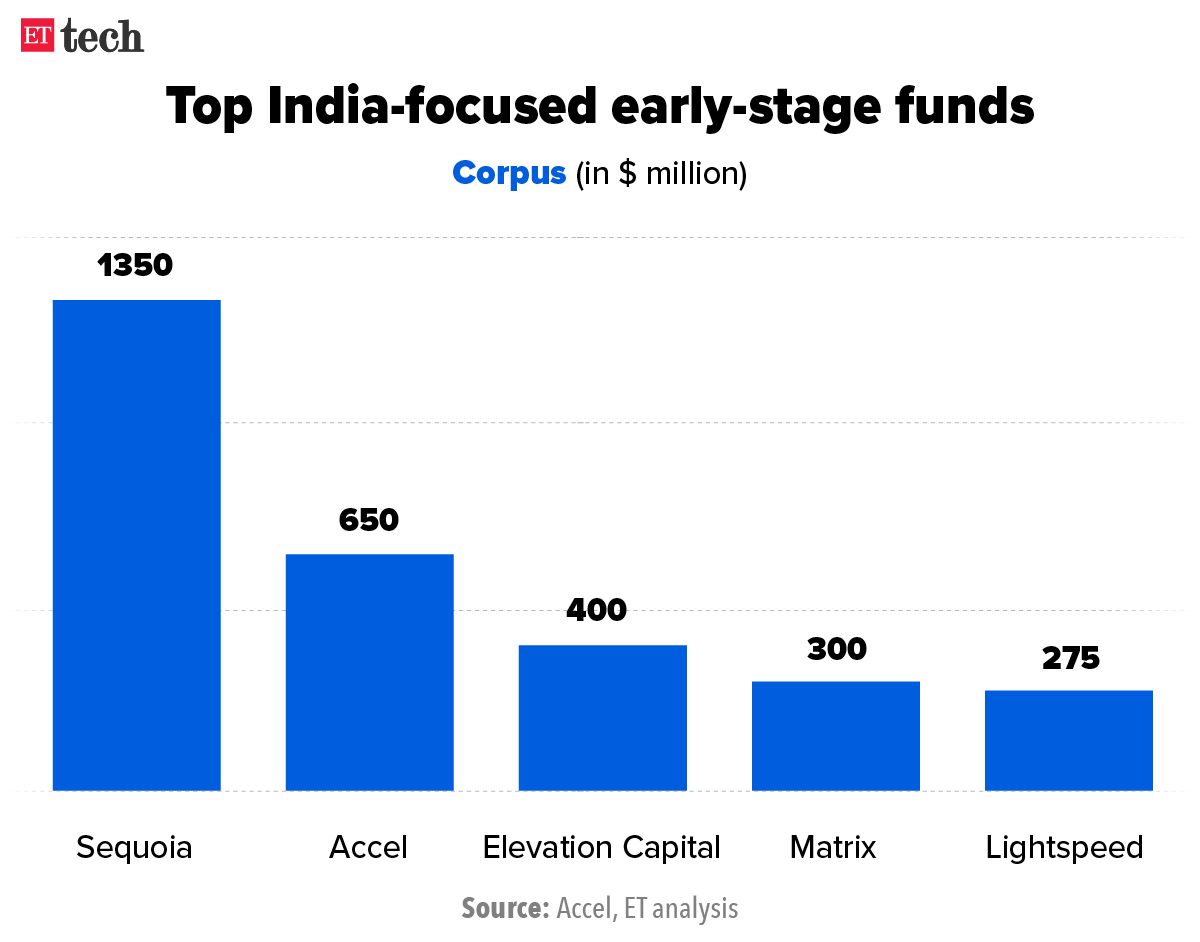

Famous for being an early Facebook backer, the Palo Alto-headquartered fund’s latest corpus will be the second-largest raised by a venture capital firm to invest in India and Southeast Asia after Sequoia India, which picked up $1.35 billion in 2020 to back early- and growth-stage startups. Sequoia is expected to close a much larger fund at around $2.8 billion.

What’s the plan? “We will continue to back companies in sectors such as consumer tech, global software-as-a-service companies (Saas), healthcare and ecommerce,” said Anand Daniel, partner, Accel India. As much as 90% of the latest find corpus will be deployed in the early stages, Daniel added.

IPOs here to stay: Accel’s big bet in cross-border enterprise software and the SaaS sector paid off with the Freshworks IPO on Nasdaq last year.

But with the current crash in tech stocks across global and Indian public markets, many tech startups have delayed their IPO plans. Chaturvedi, however, said exits for early investors in India through IPOs are here to stay, calling it an irreversible trend.

ETtech Done Deals

- Cloud kitchen company Kitchens@ announced that it has merged with Kitchens Centre. The merger makes Kitchens@ one of the biggest players in the space, with 1,000 kitchens in around 100 locations in 20 cities.

- Proptech startup and home sales guarantee platform Zapkey has raised $2 million seed funding led by Abhijit Pai and Nikhil Kamath-backed Gruhas Proptech.

- Healthy snacking brand Eat Better Ventures said it has raised Rs 5.5 crore funding in a seed round led by Java Capital and Mumbai Angels.

Urban Company to allot Rs 150 crore in stock options to gig workers

Urban Company cofounders

Urban Company said on Wednesday that it will allot stock options in the company worth Rs 150 crore to its gig workers – who comprise plumbers, electricians, cleaners, groomers and so on – through a ‘partner stock ownership plan’ (Psop).

Founder Raghav Chandra told ET that the Psop would be similar to employee stock option plans (Esops) of companies across the world that use stock options to reward employees.

How will it work? Under the plan, the company will allot shares worth Rs 150 crore to thousands of service partners over the next five to seven years. It will set up a trust to manage the Psop and the stock options will be alloted to gig workers over and above what they already earn. The company said it has received board approval for the first tranche of stock options worth Rs 75 crore, which are to be disbursed over the next three to four years.

Who is it for? The Psop is only for India, where the company employs more than 32,000 gig workers. It also operates in Australia, Singapore, the UAE and Saudi Arabia.

How big is it? Chandra did not disclose the percentage of total shares that will be allotted to the Psop but said the number of shares in it was “substantial”.

Is this a first for gig workers? Not quite. We reported last July that edtech company Unacademy plans to issue stock options worth $40 million to teachers on its platform over the next few years.

Apple says it has halted all product sales in Russia

Apple said it had stopped sales of iPhones and other products in Russia, adding that it was making changes to its Maps app to protect civilians in Ukraine.

- “We are deeply concerned about the Russian invasion of Ukraine and stand with all of the people who are suffering as a result of the violence,” the company said in a statement.

Economic war: Tech firms including Alphabet Inc’s Google dropped Russian state publishers from their news platforms, and Ford Motor – with three joint venture factories in Russia — told its Russian manufacturing partner it was suspending operations in the country. Motorcycle maker Harley-Davidson Inc suspended shipments of its bikes.

Google blocks RT, Sputnik from Play Store in Europe: The company said that it has blocked mobile apps connected to RT and Sputnik from its Play store, in line with an earlier move to remove the Russian state publishers from its news-related features.

Twitter to comply with EU sanctions on Russian state media: Twitter said it will comply with the European Union’s sanctions on Russian state-affiliated media RT and Sputnik when the EU order takes effect.

You can now buy NFT art at a vending machine in NY

Digital art collecting platform Neon has launched the first in-person non-fungible token (NFT) vending machine in New York City.

Tell me more: Located in a small storefront in Lower Manhattan’s financial district with a sign outside saying “NFT ATM,” it looks like a traditional vending machine, but offers QR codes that come on slips in small paper boxes. The drops range in price from $5.99 to $420.69.

Once the QR code is scanned, the user can see their new piece of art on any smartphone, laptop or tablet.

But there’s a twist: You have no idea what piece of digital art you might purchase.

“It’s for the crypto curious, the people who tried to buy cryptocurrency or they were interested in buying an NFT, but they just hit too many barriers,” Neon CEO Kyle Zappitell said.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.