Since, from the approaching February 1, the new principles will be executed.If you don’t know about the new guidelines, then, at that point, there might be inconvenience in the working of the bank.

Bank of Baroda’s principles connected with really look at leeway (Positive Pay Confirmation) will change from February 1. As indicated by the new principles of the bank, affirmation will be obligatory for actually look at installment from February 1. In the event that there is no affirmation, the check can likewise be returned. These standards will apply to checks of a measure of 10 lakhs or more.

Bank’s allure

The bank has engaged the clients – you should exploit the office of positive compensation for CTS clearing. The bank has done this standard to stay away from extortion in checks. The bank has said to shield yourself from extortion by re-checking the subtleties through different channels.

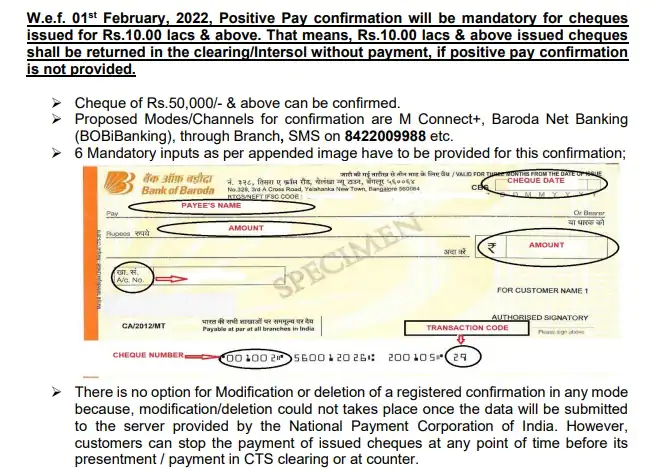

Bank of Baroda has given the office of virtual mobile number 8422009988 for positive compensation affirmation. In the wake of composing CPPS, affirmation can be made by sending it to 8422009988 with account number, check number, check date, check account, exchange code, name of the payee. Aside from this, complementary numbers can be approached 1800 258 4455 and 1800 102 4455.

For more data about the new rule, you can tap on the Bank of Baroda link.

What is actually look at positive compensation framework

Every once in a while, new safety efforts are taken by the Reserve Bank of India to forestall the occurrences of extortion connected with the bank. Another framework was acquainted with forestall the occurrences of duplicating through bank checks. The new framework is Positive Pay System for cheque(Positive Pay Confirmation). It was carried out in the country from January 1. Many banks have made this framework successful.

Full subtleties must be given to the bank

At the point when anybody gives a check under the positive compensation framework, he should give full subtleties to his bank. In this, the issuer of the check electronically through SMS, web banking, ATM or mobile banking, the date of the check, in whose name the check has been given, the ledger number, how much the check and other important data will be given to the bank. With this framework, where the installment with a money order will be protected, the freedom will likewise take less time.

The check guarantor can give this large number of data through electronic means like SMS, mobile application, web banking or ATM. These subtleties will be cross-checked before really take a look at installment. Assuming any disparity is found in it, the bank will dismiss that check.