Credit: Giphy

Also in this letter:

■ SoftBank to cut investments by more than half this year: CEO

■ Byju’s in talks with lenders for $1 billion funding: report

■ Jack Dorsey says he won’t return as Twitter CEO

Ather raises $128M led by the Indian govt’s sovereign fund, Hero MotoCorp

Tarun Mehta, cofounder and CEO of Ather Energy

Electric scooter maker Ather Energy said it has raised $128 million in funding even as its rivals struggle to contain the fallout from a spate of recent EV fires and battery explosions.

Details: The round was led by National Investment and Infrastructure Fund (NIIF), the Indian government’s sovereign wealth fund, and existing investor Hero MotoCorp.

Incidentally, the Indian government is currently investigating many of Ather’s rivals over the recent fires.

Big brother? Hero MotoCorp, having first invested in Ather in 2016, is its largest shareholder with a stake of around 35%. But Ather cofounder and CEO Tarun Mehta said the company will remain independent, and that all its shareholders are aligned towards the goal of an initial public offering (IPO) in the “not so distant future”.

Mehta said the new funds will be used to expand Ather’s manufacturing facilities, invest in research and development and its charging infrastructure, and grow its retail network.

EV firms feel the heat: More than two dozen electric scooters made by Ola Electric, Okinawa Autotech, Pure EV, Jitendra EV and Boom Motor have caught fire across India since March. Ola Electric, Pure EV and Okinawa have since said that they will recall over 7,000 vehicles combined.

But Mehta said these incidents have not dampened Ather’s sales. “More than 10,000 orders are coming in every month,” he said. “So the demand is very high and it has continued to grow even through this fairly dark chapter for the EV industry,” he said.

Govt probe: In April, the government formed a committee to investigate the EV fires and explosions. On May 7, IANS reported, citing sources, that experts found defects in the battery cells and battery design of nearly all the EVs that caught fire.

Ola Electric refuted this, saying a preliminary assessment by its experts indicated it was probably “an isolated thermal incident”.

ETtech Done Deals

■ Fintech startup BharatX has raised $4.5 million in a funding round from Y Combinator, 8i Ventures, Multiply Ventures and Soma Capital. The company said it plans to use the funds to expand its team and develop its product.

■ Wealth tech platform Bhive.fund has raised funds from key investors, including Nikhil Kamath, cofounder of Zerodha. Kamath did not share the details of his investment. Bhive.fund plans to raise $1 million in a pre-Series A round to fuel its growth.

■ Fanztar, a blockchain-based monetisation platform for creators, has raised Rs 5 crore in a funding round led by India Quotient. Angel investors included ShareChat founders Ankush Sachdeva, Bhanu Pratap Singh and Farid Ahsan; Sarthak Misra, SoftBank India’s investment director; Manohar Charan, ShareChat’s CFO; and Tarsame Mittal, founder of TM Ventures.

Tweet of the day

SoftBank to slash investments by more than half this year, says Son

SoftBank CEO Masayoshi Son said on Thursday that this year the company will invest only half, or even a quarter, of what it did last year.

“Peak of investment was Q1 but there was a huge slowdown in Q4. Compared to the amount of investment made last year, I would say the amount of new investment will be half or could be as small as a quarter,” Son said in a post-earnings call in Tokyo.

Time for defence: Son’s comment confirms what the startup ecosystem in India and globally has expected for some time – a slowdown in big-ticket funding led by macroeconomic factors and the ongoing Ukraine-Russia crisis.

One of his presentation slides, after the company announced its final-quarter results, indicated that ‘defence’ would be the Japanese fund’s strategy for now.

SoftBank will not only slow its pace of investment but will also spend more time on due diligence and have stricter criteria for new investments, Son said.

Record losses: SoftBank’s ‘defence’ strategy comes as its Vision Fund reported a record loss of $26 billion for the year.

Tiger Global, another aggressive tech investor, reported a loss of $17 billion amid the global tech sell-off, The Financial Times reported recently.

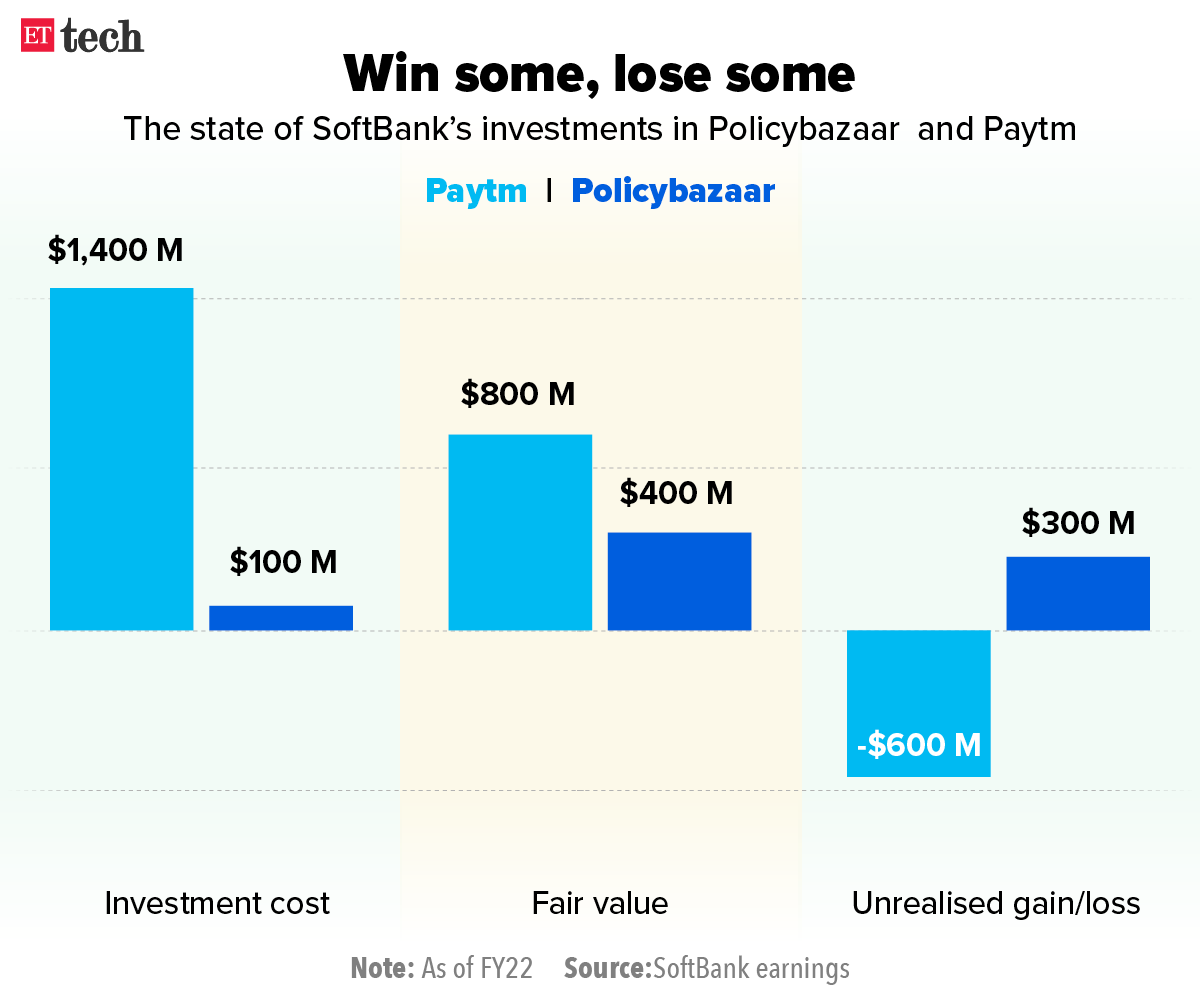

Ups and downs: Among its listed portfolio companies, SoftBank reported an unrealised loss of $600 million as of FY22 from its $1.4 billion investment in payments firm Paytm.

But Policybazaar parent PB Fintech, which went public the same week as Paytm, has reported an unrealised gain of $300 million over the same period on a $100-million investment from SoftBank.

Also Watch | SoftBank’s Rajeev Misra in conversation with ET’s Samidha Sharma

Byju’s in talks with lenders for $1 billion funding: report

Edtech giant Byju is in talks with lenders to raise more than $1 billion in the financing, sources told Bloomberg.

The sources said it is in talks with banks, including Morgan Stanley and JPMorgan Chase & Co., for the funding, which it will use to acquire another edtech company. They didn’t disclose details of the acquisition target and said the terms of the transaction and the funding are yet to be finalised.

Byju’s wants moar: Byju’s, which plans on going public soon, acquired about 10 companies for a combined $2.5 billion in 2021, according to GlobalData. These included Aakash Educational Services for $1 billion and Great Learning for $600 billion.

On May 10 we reported, citing sources, that Great Learning has acquired Singapore’s executive education provider Northwest Executive Education for roughly $100 million in a stock and cash deal.

Byju’s was valued at $22 billion after raising funds earlier this year and is working on its IPO plans.

Jack Dorsey says he won’t return as Twitter CEO

Since his pal Elon Musk struck a deal to buy Twitter, the social media platform’s cofounder has been tipped by some to return as its CEO. Now Dosey has put those rumours to rest, replying: “Nah I’ll never be CEO again” to a Twitter user who predicted he would return to lead the company he cofounded.

Dorsey believes no one should be the CEO of Twitter. He tweeted a few days ago: “In principle, I don’t believe anyone should own or run Twitter. It wants to be a public good at a protocol level, not a company.”

Foggy: Since Twitter’s board accepted Musk’s $44 billion buyout offer on April 25, there has been little clarity on the company’s new leadership once the deal closes. However, a recent regulatory filing showed that Musk was in talks with Dorsey to contribute his shares to the proposed acquisition.

Cast out: Dorsey had a tumultuous run as the head of the social media company. He was replaced as Twitter CEO in 2008, two years after launching the service, but took over the top job again in 2015 before ceding the role to chief technology officer Parag Agarwal late last year.

IPO-bound Navi inducts Meesho founder Vidit Aatrey as a board member

Vidit Aatrey, cofounder & CEO of Meesho

Fintech startup Navi’s has appointed Vidit Aatrey, cofounder and chief executive of ecommerce startup Meesho, as an independent director on its board, effective April 9.

The board: Navi’s other board members include:

- Cofounders Sachin Bansal and Ankit Agarwal

- Anand Sinha, former deputy governor of the Reserve Bank of India

- Abhijit Bose, head of WhatsApp India

- Shripad Shrikrishna Nadkarni, an FMCG industry veteran

- Usha A. Narayanan, who earlier worked with PwC and was on the board of Bank of Baroda

With Aatrey’s appointment, Navi’s board, which now comprises seven members, will have a majority of independent directors.

Quote: “I am pleased to welcome Bobby (Abhijit), Shripad, Usha, and, most recently, Vidit to our board. They each bring a unique perspective and I believe they will add significant strategic value to Navi as we continue to grow,” Bansal said. He added, “These appointments further reinforce our commitment to setting high standards in corporate governance.”

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant and Aishwarya Dabhade in Mumbai. Graphics and illustrations by Rahul Awasthi.