Also in this letter:

■ MediBuddy raises $125 million and other done deals

■ New SEZ Act should factor in hybrid work structure: IT industry

■ China asks banks, firms to report exposure to Ant Group

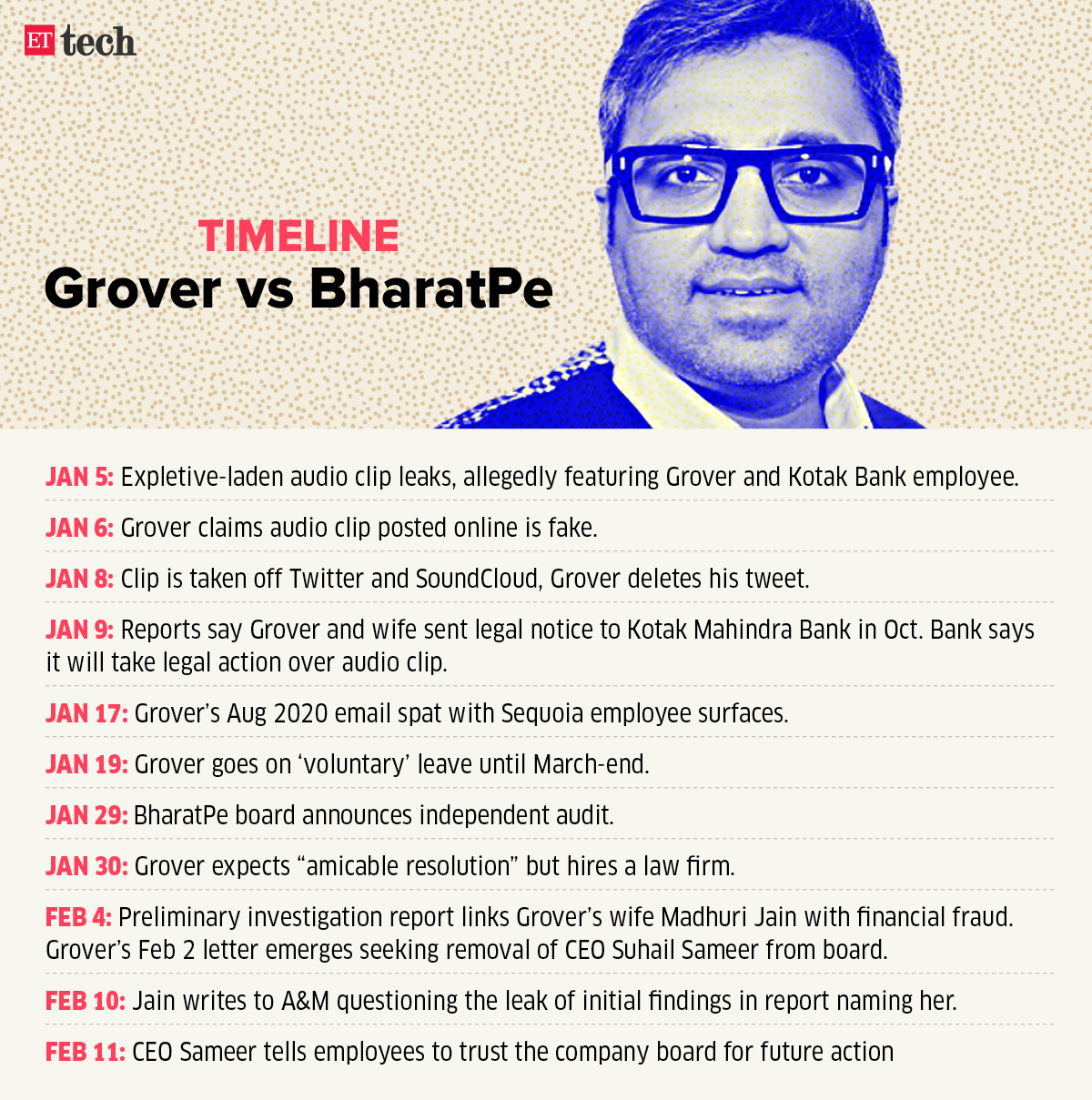

BharatPe’s Ashneer Grover seeks indemnity from future action

BharatPe cofounder Ashneer Grover has sought indemnity from any future action against him in his ongoing settlement discussions with the fintech firm, sources briefed on the matter told us.

The news comes even as Grover has filed an arbitration plea with the Singapore International Arbitration Centre (SIAC), seeking to keep his 9.5% stake in BharatPe intact.

Also read: Ashneer Grover in talks to sell his 9.5% stake in BharatPe

Settle down, then settle: People aware of the goings-on said Grover has been actively signalling his desire for a settlement with the board and the company. This marks a shift in how both parties are trying to address the issue, after a series of conflicts between them played out in public for almost two months.

- “There were talks last week and he (Grover) did mention he wants indemnity rights… it shouldn’t be that after the current dispute is settled a litigation is initiated after that,” a person aware of the matter said.

BharatPe audit: Meanwhile, consulting firm Alvarez & Marsal (A&M) has put forth preliminary results of the ongoing investigation into BharatPe, which were leaked earlier this month. On February 4, we reported that according to the initial probe findings, BharatPe controller Madhuri Jain, who is Grover’s wife, her brother Shwetank Jain, and her brother-in-law Deepak Jagdishram Gupta, allegedly committed fraud at the company.

Public spat: The battle between Grover and BharatPe has been playing out for months now. On February 10, Jain had written to BharatPe’s board, alleging that it had accepted her ‘resignation’ even though she had not tendered one, as we reported last week.

Earlier, Grover had asked BharatPe’s investors and board for Rs 4,000 crore for 9.5% stake in the company. However, ET reported on February 10 that he’d held talks with external investors as existing shareholders hadn’t engaged with him on his demands.

MediBuddy raises $125 million from Quadria Capital, Lightrock India

MediBuddy founders (from left) Enbasekar D and Satish Kannan

Healthtech startup MediBuddy has raised $125 million in a funding round from Quadria Capital and Lightrock India.

The digital healthcare platform will use the funds to invest in customer awareness, hiring, strengthening technology platforms including data science capabilities, clinical research, and product development.

Other backers: The latest funding round saw participation from existing investors Bessemer Venture Partners, India Life Sciences Fund III, Rebright Partners, Jafco Asia, TeamFund LP, FinSight Ventures, InnoVen Capital, Stride Ventures, and Alteria Capital.

Other Done Deals

■ Property operations software platform Facilio said it has raised $35 million in a funding round led by Dragoneer Investment Group with participation from Brookfield Growth and existing investors Accel India and Tiger Global Management.

■ In what is possibly the largest venture capital funding in the defence sector, NewSpace Research & Technologies, a Bengaluru-based startup that specialises in drone technology, has raised $21 million in a round led by Pavestone Technology Fund. The funding was raised at an undisclosed valuation. The startup aims to become a unicorn within the next five years.

■ Fleet management platform Fleetx.io said it has raised $19.4 million in a funding round led by Indiamart, with existing investors IndiaQuotient and Beenext also participating. The startup said that the funds will be primarily used for hiring, improving its product, and scaling its business.

■ Pillow and sleep accessories manufacturer-to-consumer (M2C) brand Sleepsia has raised $2 million from its parent company Agile Ventures. Sleepsia will use the funding to expand its customer base in tier-II and tier-III cities.

New SEZ Act should factor in hybrid work structure, says IT industry

The IT-business process management industry is working with the government to ensure that a hybrid work structure is built into any new legislation that replaces the Special Economic Zones (SEZ) Act.

Seeking clarity: The $227-billion sector is also seeking clarity around issues such as impact of work-from-home on Income Tax exemptions under Section 10AA and expansion of the SEZ Reserve to include investments on infrastructure and employees.

Some of these clarifications, which could be amendments to existing policies, will go a long way in securing long-term commitments for the industry, officials and experts told us.

Budget announcement: Finance minister Nirmala Sitharaman said during her budget speech that the SEZ Act would be replaced with a new legislation that would help states become partners in “development of enterprise and service hubs”.

Quote: “We are very active in discussions with the government on SEZs. In fact, the clarification on hybrid work is not dependent on the new Act. We are requesting them to bring that clarification at the earliest because companies need it to prepare their long-term plans. It will give them assurance and stability to know that the option is available,” said Debjani Ghosh, president of IT industry association Nasscom.

Taxing issue: Nasscom has been seeking clarification on the tax ramifications of Section 10AA, a provision under the Income Tax Act which allows deductions for businesses established in SEZs.

China asks banks, firms to report exposure to Jack Ma’s Ant Group

Chinese authorities have told state-owned firms and banks to start a fresh round of checks on their financial exposure and other links to Ant Group Co Ltd, Bloomberg reported, citing people familiar with the matter.

Institutions were asked by many regulators, including the China Banking and Insurance Regulatory Commission, to closely examine all exposure they had to the Jack Ma-controlled fintech group, its subsidiaries and even its shareholders up to January, the report added.

Regulatory woes: Ant has been subjected to a sweeping restructuring by China after its initial public offering of $37 billion was derailed by regulators in late 2020.

Ripple effect: Chinese technology shares had their worst two-day drop since July due to renewed fears Beijing may roll out more restrictions for private enterprise.

Tencent Holdings Ltd. shares sank 5.2% on Monday, pummelled by speculation about an unspecified, impending crackdown on China’s largest social media and gaming firm that company spokesman Zhang Jun later denied. Traders pointed to everything from warnings from regulators over the weekend about scams in the metaverse to talk about yet more curbs on the gaming industry.

SoftBank likely to trim Alibaba stake: Meanwhile, SoftBank Group Corp is likely to trim its stake in Chinese ecommerce giant Alibaba, an analyst said, as the Japanese conglomerate invests in unlisted startups through its second Vision Fund and repurchases its shares. SoftBank sold 20 million Alibaba shares in the last quarter and “will need to sell more in 2022,” Jefferies analyst Atul Goyal wrote in a note.

The group will need $40 billion-45 billion of cash this year, Goyal estimates, if it maintains the current pace of investing in startups and share repurchases as part of the 1 trillion yen ($8.7 billion) programme announced in November.

Swiggy eyes $800 million IPO early next year: report

Swiggy, which is backed by SoftBank Group, has started preparations to raise at least $800 million in an initial public offering (IPO) early next year, the Nikkei reported on Tuesday, citing people familiar with the matter.

Logistics firm: Swiggy has begun adding independent directors to the board, and plans to position itself as a logistics company and not just a food delivery firm, according to the report.

Swiggy doubled its valuation to $10.7 billion after raising $700 million in a round led by asset manager Invesco on January 24, confirming what we first reported last September.

Pandemic boost: India has seen booming demand for delivery of food and grocery, especially during the pandemic. Swiggy’s grocery delivery service Instamart is now competing with the likes of Zomato-backed Blinkit and Zepto, which are luring customers with the promise of 10-minute deliveries.

Reality check for rival, peers: Swiggy’s rival Zomato had a stellar debut on the public markets last year but has since seen shares fall below the issue price after reporting tepid numbers in the third quarter.

Shares of other new-age companies such as Paytm, Policybazaar, Nykaa and Cartrade, which listed amid much fanfare last year, have also been hitting new lows every few days amid a global rout in tech stocks and the looming threat of war in Ukraine.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.