Also in the letter:

■ Opposition, security experts seek answers on ICMR data leak

■ Mamaearth parent sees IPO going in the right direction

■ Infosys loses another veteran to rival tech company

Apple sounds alarm over hacking, govt orders probe

From left: Opposition leaders Mahua Moitra, Priyanka Chaturvedi, Raghav Chadha and Shashi Tharoor

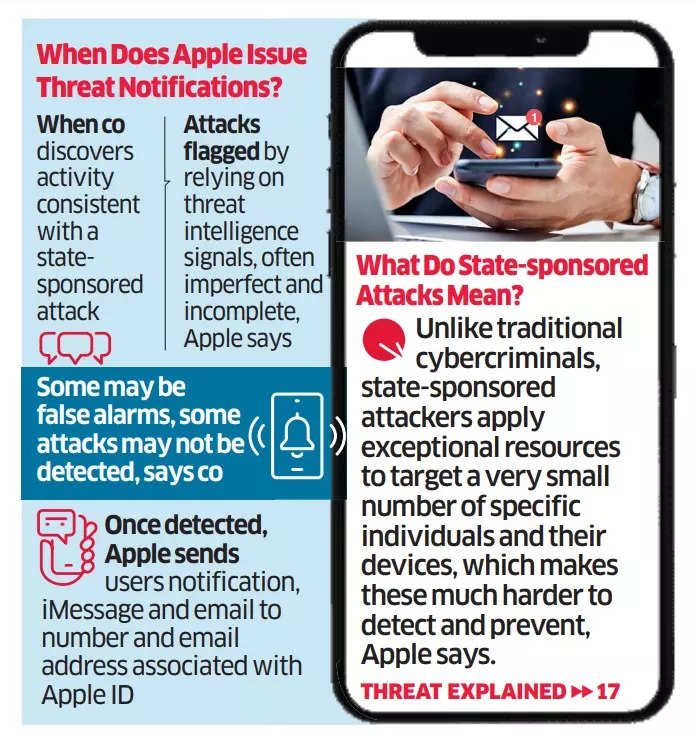

In what kicked off a political furore, Apple sent messages to several opposition party leaders and journalists warning them that their iPhones could be potential targets of an unspecified ‘state-sponsored’ privacy attack.

Government’s response: IT minister Ashwini Vaishnaw, taking to X, said on Tuesday that the Centre will investigate the matter and that it has “asked Apple to join the probe with real, accurate information on the alleged state-sponsored attacks”.

What happened? Since early Tuesday, Opposition leaders such as Trinamool Congress’ Mohua Moitra, Shiv Sena (Uddhav)’s Priyanka Chaturvedi, Samajwadi Party’s Akhilesh Yadav and the Congress’ Pawan Khera began sharing on X screenshots of Apple’s warning that they could be targets of a “state-sponsored” attack to gain remote control of their devices.

Apple probing: The iPhone maker is looking into the triggers for the threat notifications that went out to more than 20 high-profile people such as some members of parliament and their staff, geopolitical researchers and journalists. The company will examine to see how, where, and when did the alerts go out as the allegations from individuals have taken on a sensitive nature.

Read ETtech’s in-depth coverage here:

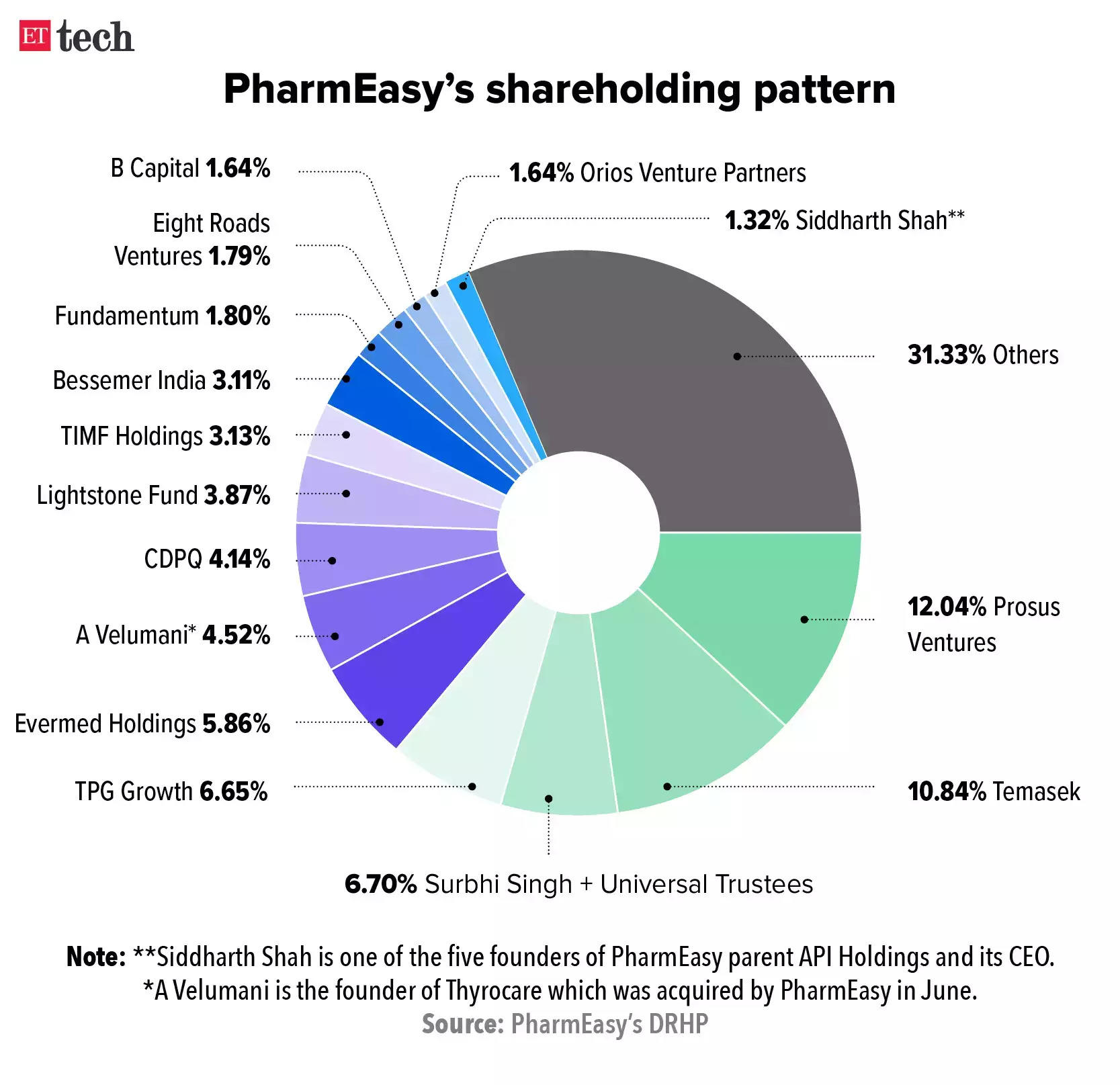

PharmEasy CEO has three-year lock-in, Pai to get 3 board seats

Siddharth Shah, founder and CEO, PharmEasy

PharmEasy has closed its Rs 3,500 crore rights issue, but it’s come with some interesting terms for both CEO Siddharth Shah and Manipal Group’s Ranjan Pai, who is investing Rs 1,300 crore in the firm.

Board games: Siddharth Shah, also a cofounder, has a three-year lock-in for his remaining stake at PharmEasy parent API Holdings, but will remain on the board of the company for the next three years, sources told us.

Rule of Three: Pai will be getting three board seats at the company for his investment, which makes him the largest shareholder in the company, with at least 15% stake. As long as he retains this holding, he will have the rights to three board seats. Both Pai and Shah are expected to work together, going forward.

Rights issue: Prosus Ventures, TPG, Temasek, Abu Dhabi’s ADQ, Amansa Capital and others have subscribed to the rights issue, investing a total of around Rs 2,200 crore. The rest is from Pai.

Shah and co: Besides Shah, Dhaval Shah, Dharmil Sheth, Harsh Parekh, and Hardik Dedhia are the other founders at the firm. Founders and founders group – which include other family members – will end up with a stake of over 15-18% in the company, including new stock options being given to the founders.

Number game: PharmEasy has clocked a cumulative Ebitda of Rs 60 crore, cofounder Dhaval Shah said in a LinkedIn post on Tuesday. ET had reported on August 30 that PharmEasy had clocked Rs 40 crore in Ebitda for the first four months of fiscal 2024. All said, the rights issue has taken place at a 90% discount to PharmEasy’s peak valuation of $5.6 billion from 2021.

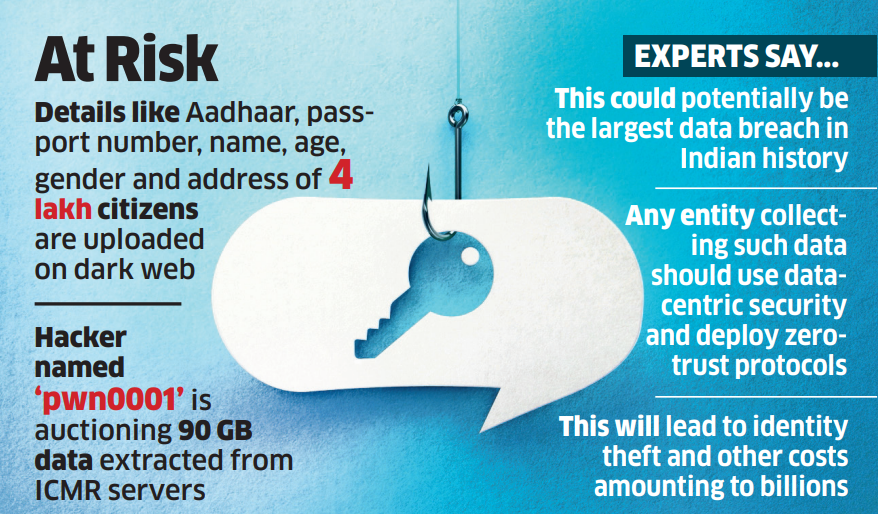

Opposition, security experts seek answers on ICMR data leak

The government is in hot water after a reported breach of personal data of nearly 81 crore Indians held by the Indian Council of Medical Research (ICMR). Opposition parties and security experts have demanded a detailed probe into what could be the largest data breach in India’s history.

What’s the news? The data theft was first discovered by American cyber security firm Resecurity on October 10. Personal details including Aadhaar number, passport number and addresses of four lakh citizens are already uploaded as sample files on the dark web by a hacker named ‘pwn0001’ who is auctioning 90 GB of data extracted by him from ICMR servers on October 9, cyber experts claimed.

Highest bidders invited: “We tried contacting the hacker who is still active and willing to sell the data to the single highest bidder. This is definitely a ransomware attack and the ICMR or the government should already be negotiating to protect this extremely sensitive data concerning national security,” said Dhiraj Gupta, cofounder, digital fraud detection firm mFilterIt. The data in the sample files was extracted from the dark web by mFilterIt.

Recap: This follows last year’s incident at the All India Institute of Medical Sciences (AIIMS) which suffered a loss of 1.3TB data containing 4 crore records in November 2022. The hackers allegedly demanded Rs 200 crore in cryptocurrency as ransom from the New Delhi hospital. Experts believe ICMR’s ransom call could go beyond Rs 1,000 crore.

Opposition’s concerns: Major opposition party All India Trinamool Congress took to X to highlight that this was not the first data breach incident from the government’s data storage infrastructure. “Why, PM Narendra Modi, are citizens left exposed and vulnerable to such data breaches when your government touts its commitment to ironclad data security?” the post read.

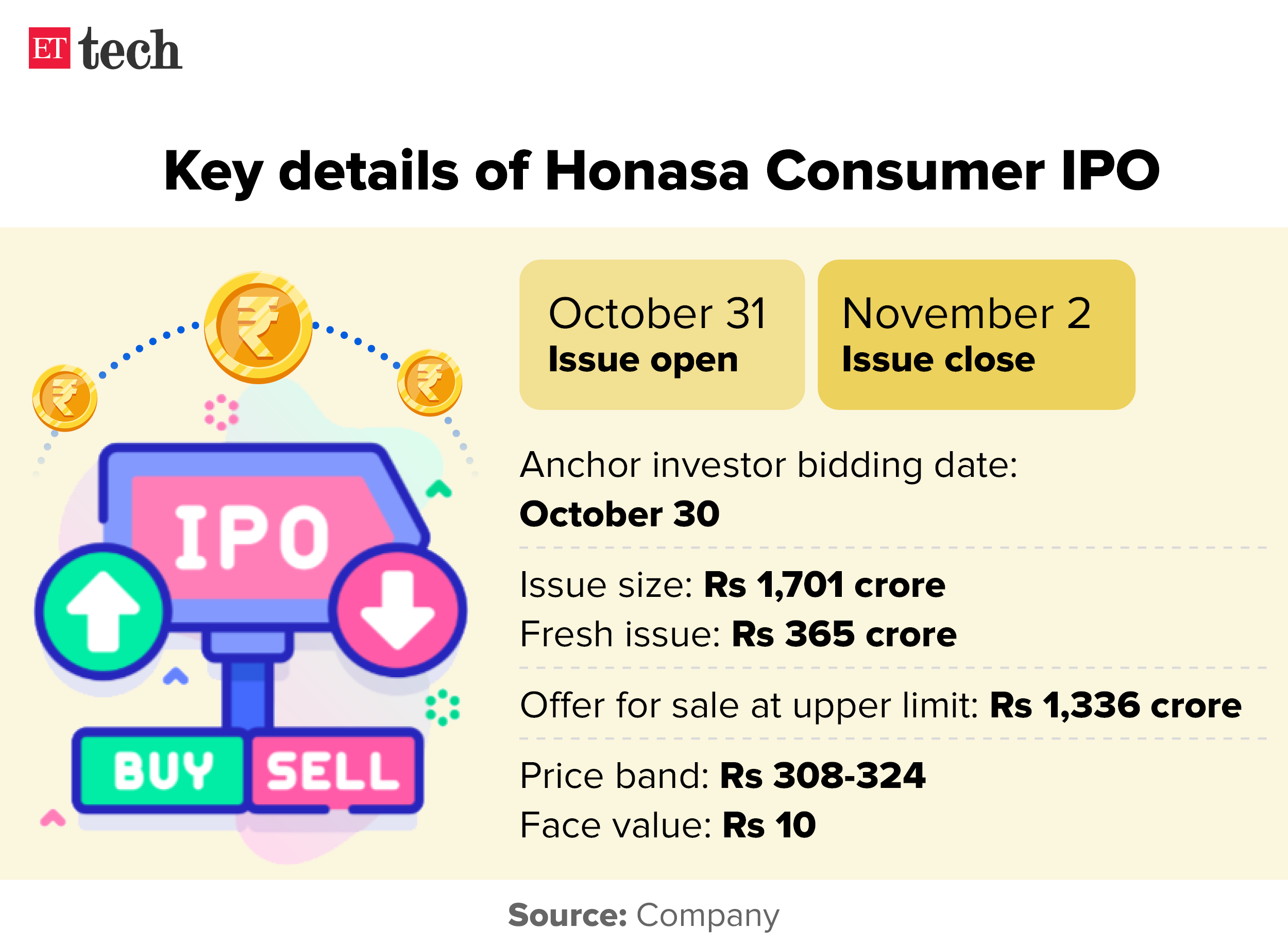

Mamaearth parent sees IPO going in the right direction

(L to R) Varun Alagh and Ghazal Alagh, cofounders, Mamaearth

“Measure the company’s stock performance in the long term” is Honasa Consumer cofounder and CEO Varun Alagh’s message to potential investors as the omnichannel retailer’s initial public offering (IPO) enters the second day of public subscription.

Quote, unquote: “The numbers should showcase in the next few days. We feel like it’s going in the right direction,” Alagh told ET in an interview. “For whatever reason, some people would have tasted bad blood, but there have been multiple IPOs where there were 70-80% listing gains,” he said, referring to the post-IPO performance of other new-age companies that went public in 2021-22.

Reaching maturity: Over time, Alagh said, the right kind of public investors who know how to guide and shape public companies in the longer term need to come on the company’s cap table with early-stage investors moving out. “For us, it wasn’t an ‘if’ but a ‘when’ conversation. We weren’t looking for a strategic investment, so in our case this was the only option for the company to go to the next level,” he added.

Shifting focus: With the company onboarding public market investors, it is planning to take a more balanced approach towards growth and profitability, having scaled at a fast pace over the last six years. “We are cognisant that we need to build sustainably and profitably. As we grow, we want to get better at improving our bottom line,” Alagh noted.

Also read | IPO-bound Honasa says its growth will build on flagship Mamaearth

Infosys loses another veteran to rival tech company

Senior-level employees continue to desert Infosys for rivals, with Rajeev Ranjan being the latest to leave India’s second-largest software services exporter after a stint of more than 24 years.

Tell me more: Ranjan was the executive vice president (EVP) and service offering head for manufacturing in India and Japan business units. He left Infosys in August to join US-based engineering firm Ness Digital Engineering as its chief operating officer (COO).

Exodus: Ranjan’s departure is part of the troubling trend of top-rung attrition at Infosys, which has lost at least eight senior management personnel in the last 12 months. Chief human resource officer Richard Lobo exited in August after a 23-year tenure at the firm. Early this year, Mohit Joshi and Ravi Kumar S, both presidents at Infosys, were hired by peers Tech Mahindra and Cognizant, as their respective CEOs.

Return to office mandate: Following large IT industry trends on reversal of work from home policy, Infosys has started calling back its employees to work from office for a minimum of ten days in a month, the software exporter’s select employees at the entry to mid-level positions have been informed.

Temple and Panchayat payments go digital in next fintech wave

The next wave of digital payments will be driven by ‘person to government’ payments moving away from cash. The National Informatics Centre (NIC), which is part of the Ministry of Electronics and IT, is building multiple apps for various utilities which can accept payments digitally and manage the books of the departments too.

What’s the news? The government is looking to digitise tax payments at the village level by deploying point of sales (PoS) terminals at village panchayats and is also trying to digitise temple donations. Digital payment major Worldline is working with the government to run pilots for digitising these payments.

Expanding use cases: A large chunk of payments which are made to the government are still done through cash. Be it tax payments in rural areas or transit payments or payments for other government services. Now under the Digital India initiative, NIC is building apps which can sit on Android POS terminals and be used to accept these payments through cards or UPI.

Other Top Stories By Our Reporters

Healthtech startup Sugar.fit secures $11 million: Sugar.fit, a healthtech startup that seeks to manage and reverse type 2 and pre-diabetes, said it has raised $11 million in a Series A funding round led by MassMutual Ventures.

Anicut Capital receives over Rs 30 crore infusion from HDFC AMC’s Fund of Funds: Anicut Capital, which makes investments through its debt and equity funds, said it has received an investment of over Rs 30 crore from HDFC Asset Management Company’s Fund of Funds, with an additional allocation expected in the near future.

Deeptech VC Java Capital announces final close of first fund: Deeptech seed investor Java Capital, which has backed firms such as aerospace startup Agnikul Cosmos and fintech BharatX, has announced the final close of its first fund, at Rs 50 crore (about $6 million).

Global Picks We Are Reading

■ We might be surprised by our reactions to generative AI (Financial Times)

■ Apple’s dark cloud might linger (The Wall Street Journal)

■ Can Rishi Sunak’s big summit save us from AI nightmare? (BBC)