Credit: Giphy

Also in this letter:

■ Byju’s clears Aakash payments, says $800M fundraise almost done

■ Group of ministers unlikely to change 28% GST on online gaming

■ Iron Pillar plots $400 million raise to back Indian tech startups

Crypto lending platform Vauld freezes withdrawals as winter bites

Darshan Bathija, cofounder, Vauld

Crypto platform Vauld has suspended withdrawals and trading and is seeking new investors as the 2022 crypto winter takes its toll.

Driving the news: In a blog post on Monday, Vauld CEO Darshan Bathija said it was facing “financial challenges” because of volatile market conditions, financial difficulties at its key business partners, and the current market climate.

Founded in 2018 by Bathija and Sanju Kurian, Vauld provides a suite of products to crypto investors, including ‘fixed deposits’ and asset-backed lending and borrowing. It said customers have withdrawn crypto worth more than $197.7 million from the platform since June 12.

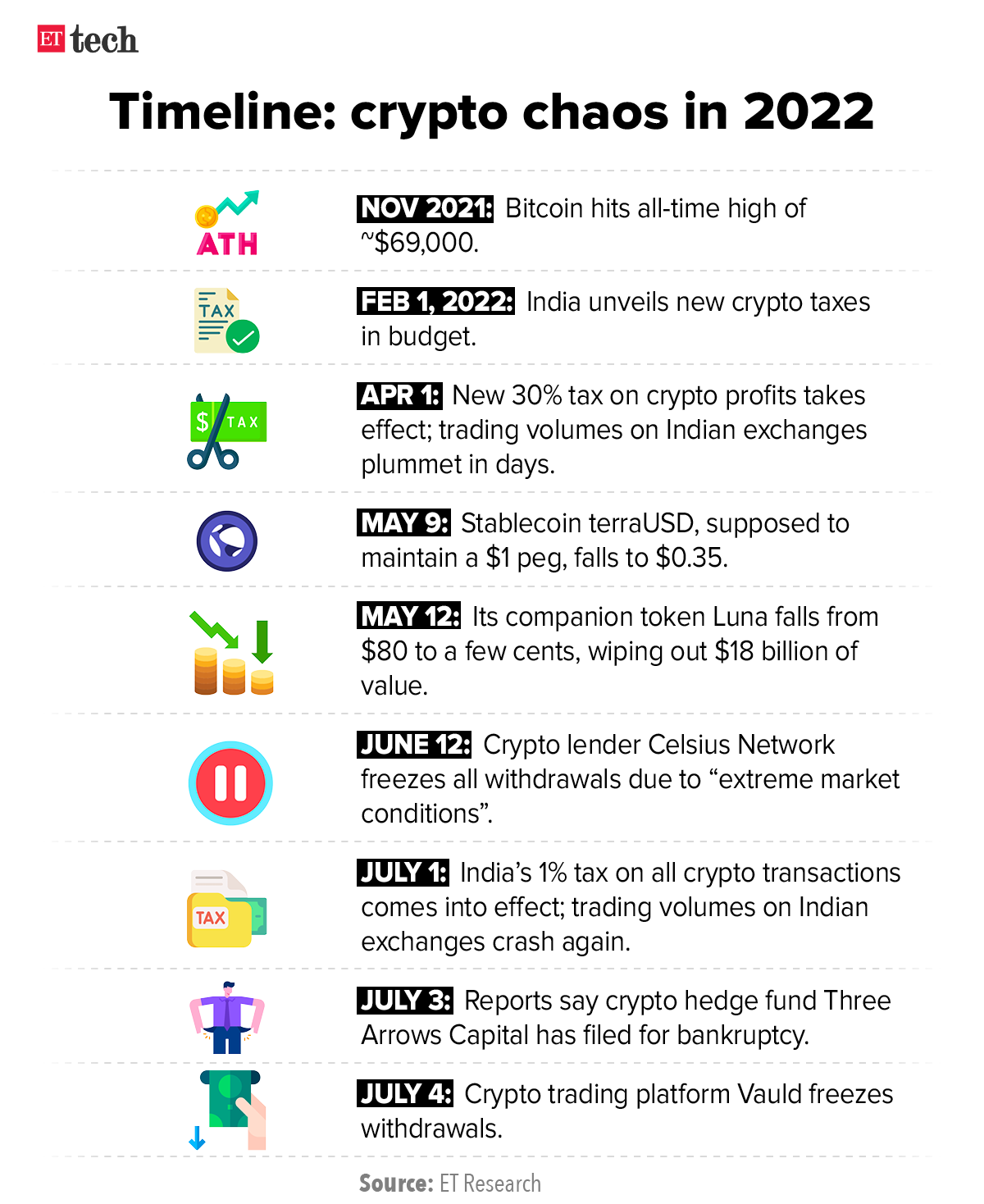

Crypto chaos: The crypto industry has been shaken by a series of collapses in recent months, including:

In June, Vauld announced it had laid off 30% of its workers, most of whom were based in India.

Seeking investors: Vauld said it had appointed legal and financial advisers, was in discussions with potential investors, and would also apply to the Singapore courts for a moratorium that would have any proceedings against it halted to give it time to carry out a restructuring.

It had raised $27 million as of July 2021 from VCs including Pantera Capital, Coinbase Ventures, CMT Digital, Gumi Cryptos, Robert Leshner, and Cadenza Capital.

Mother of all crashes: Bitcoin, the world’s largest cryptocurrency is currently trading just under $20,000, having lost around half its value since early May, and more than 70% since its all-time high of around $69,000 in November 2021.

Byju’s clears Aakash payments, says $800-million fundraise almost done

Edtech giant Byju’s said on Monday it has completed pending payments for the acquisition of Aakash Educational Service Ltd. (AESL), and received the majority of a $800-million fundraise announced in March.

Catch up quick: We reported on June 29 that Byju’s had delayed payments to Aakash, which it acquired in a cash-and-stock deal in April 2021. It was supposed to close the transaction this June but sought an extension till August, people aware of the discussions had told us.

The company is estimated to have paid around $950 million for AESL.

Statement: “Our fundraising efforts are on track and the majority of the $800 million has been already received. The balance is also expected soon. Our payments to Aakash are closed and the audited financial results are going to be announced in the next 10 days,” Byju’s said in a statement.

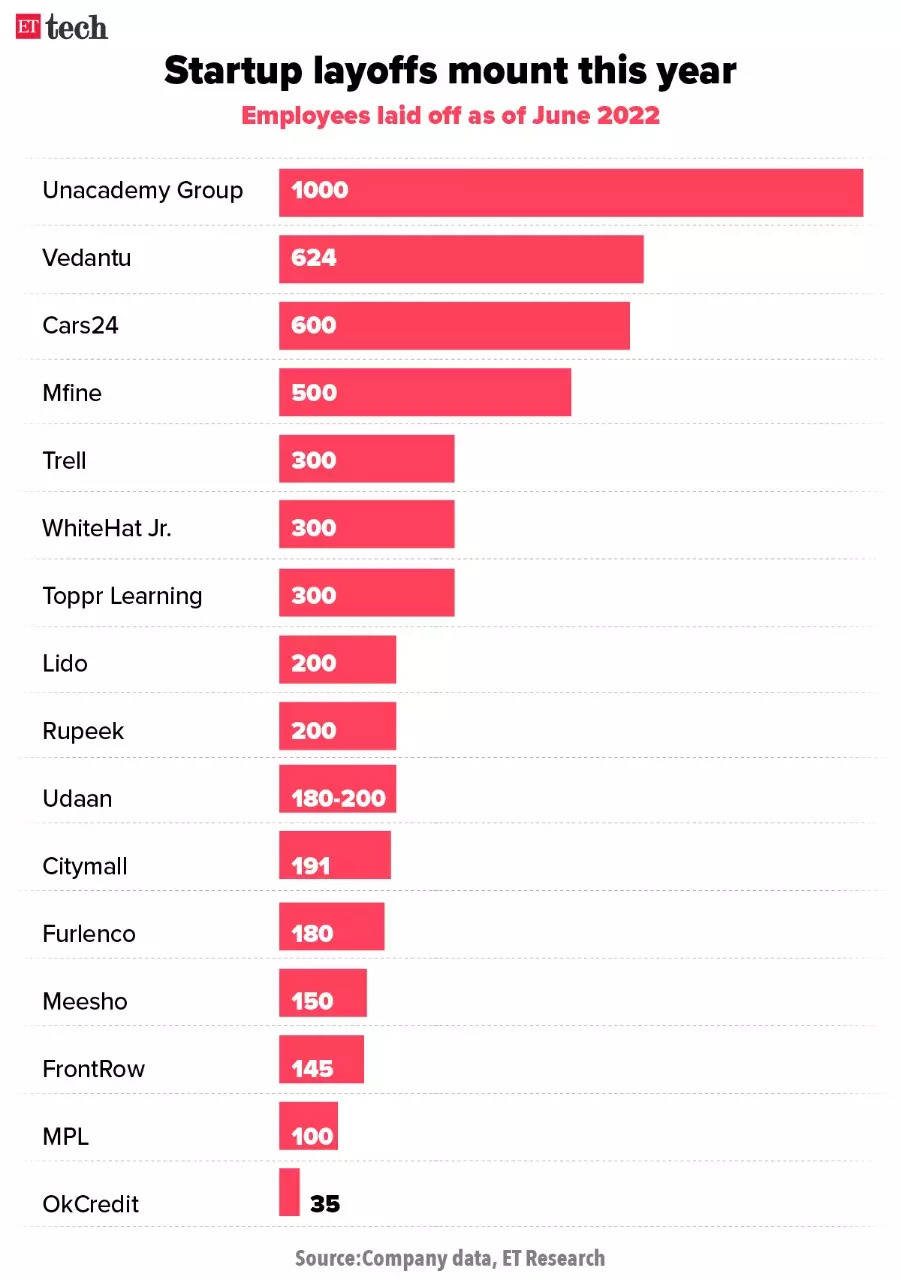

Edtech layoffs: Amid tough times for edtech firms in India, Byju’s had laid off at least 600 people – 300 from its Toppr learning platform and another 300 at coding platform WhiteHat Jr, we reported on June 29.

Other edtech companies that have laid off employees this year include Unacademy, Lido Learning, Vedantu, Frontrow and Udayy.

Many edtech firms, including Byju’s and Unacademy, have also begun venturing offline as demand for online education has been falling since the pandemic began to ebb.

Group of ministers unlikely to change 28% GST on online gaming

The group of ministers (GoM) reviewing the GST tax slabs for online gaming, horse racing and casinos is unlikely to change the 28% GST rate recommended for these services, people aware of the matter told us.

The GoM has until July 15 to review its proposals and will only review whether to tax all spending at casinos or only the amount spent on gambling.

Quote: “There is no reconsideration of the 28% for online gaming and horse races. It was not even discussed in the council meeting. It is just about casinos, following a request from Goa,” said a source.

Currently, a GST of 18% is levied on casinos, horse racing and online games involving no betting or gambling. Last week, the GST council deferred the GoM’s proposal to charge a 28% tax on all these services.

Iron Pillar plots $400 million raise to back Indian tech startups

Growth stage VC firm, Iron Pillar, is in talks to raise $400 million for its second fund to invest in emerging Indian tech startups and help them scale globally, reports Deal Street Asia.

The company, which counts the likes of Uniphore and CureFoods in its portfolio, is planning to raise the amount amid surging investments in early-stage companies from VC firms. Last month, VC giant Sequoia raised its ceiling to back more early-stage Indian startups while Bertelsmann raised a big pot of cash.

Startup hub: India is home to the world’s third-largest startup ecosystem after the US and China, with over 100 unicorns. By 2025, the country is set to have over 250 unicorns, according to a recent report by Iron Pillar, as global investors shift their focus from China owing to Beijing’s stringent rules.

Iron Pillar last raised $10 million in its second fund from Allana Group.

Tweet of the day

Gujarat, Karnataka among best states for startups, says DPIIT report

Gujarat, Karnataka and Meghalaya have been voted among the best performing states for developing the startup ecosystem in India, according to a ranking of states and union territories released by the Department for Promotion of Industry and Internal Trade (DPIIT).

The rankings are based on the initiatives taken to develop the startup ecosystem for promoting budding entrepreneurs.

Gujarat emerged as the best performer for the third consecutive year, while Kerala, Maharashtra, Odisha and Telangana were other top performers.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.