Also in this letter:

- Tech IPOs need better pricing disclosures, says Sebi chief

- Swiggy in talks to invest in bike-taxi startup Rapido

- Epiq Capital makes first close of its second fund

Amazon sues ED, asks court to quash probe into Future Group deal

Amazon moved the Delhi High Court on Wednesday, seeking relief from an ongoing investigation by the Enforcement Directorate (ED) into its 2019 investment in a Future Group company.

Allegations: Accused the agency of overreach, Amazon asked the court to halt the probe and stop it from issuing summons. The ED had begun the probe last month to find out if Amazon had violated India’s foreign exchange rules while investing into Future Coupons Pvt Ltd (FCPL) in 2019.

Amazon also alleged that the ED has asked it for accounts of privileged legal opinion given to it by lawyers and law firms in India. It said it also asked it to provide a list of former employees in its legal team, and accounts of bank details and legal expenses it has incurred in India in the past 10 years.

Accusing the ED of conducting a “fishing and roving inquiry”, Amazon said such requests were beyond the agency’s powers.

A big mess: The 2019 investment has triggered more than two dozen legal cases between Amazon and Future Group in the Delhi High Court, the Supreme Court and in various tribunals, including the National Company Law Tribunal (NCLT) and the Singapore International Arbitration Centre.

The dispute has also put on hold for more than a year a deal in which Future Group agreed to sell its assets to Reliance Retail for Rs 25,000 crore. Amazon said the terms of its 2019 investment in FCPL – which owns 10% of the listed Future Retail Ltd (FRL) — bar FRL from selling any of its assets to several companies including Reliance.

Last week, the Competition Commission of India (CCI) had suspended its 2019 approval for Amazon’s investment into FCPL and fined the company Rs 200 crore.

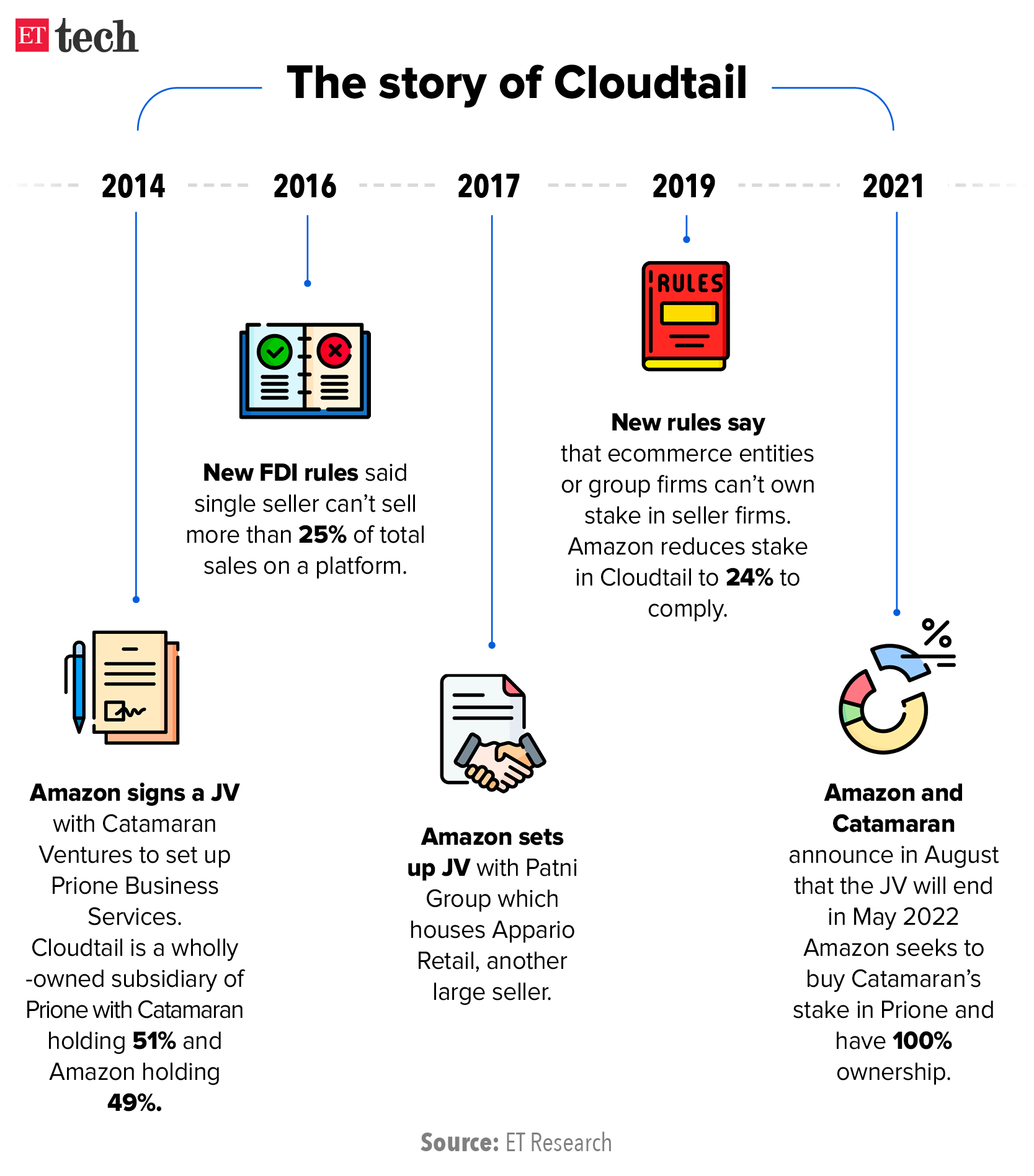

Amazon seeks Cloudtail takeover: Meanwhile, Amazon and Catamaran Ventures, the investment office of Infosys cofounder NR Narayana Murthy, said in a joint statement on Monday that the ecommerce major will acquire Catamaran’ stake in Prione, which houses Cloudtail, one of the largest sellers on Amazon In India.

The announcement comes four months after Amazon and Catamaran said they would discontinue their partnership in Prione in May 2022.

Yes, but: The deal is of course subject to regulatory approval. A source told us that Amazon has already made a filing with the Competition Commission of India (CCI).

Business goes on: The two entities said in the statement that the businesses of the joint venture would continue under the leadership of the current management. “Amazon will acquire Catamaran’s shareholding in Prione in compliance with applicable laws including all assets and liabilities…On receipt of regulatory approvals, the board of Prione and Cloudtail will take steps to complete the transaction in compliance with applicable laws,” they said.

Tech IPOs need better pricing disclosures, says Sebi chief

Sebi chairman Ajay Tyagi said on Wednesday that appropriate pricing was crucial for public issues, especially those of new-age technology companies, and that it was up to merchant bankers to follow the rules in letter and spirit. He added that the regulator would tweak the rules for new-age tech firms.

Context: His remarks come after some companies, most notably Paytm, saw their share price fall drastically from the IPO price when listing.

What he said: Tyagi urged merchant bankers to hold wider consultations for a proper balance between the issuers’ aspirations and investors’ interests. “Needless to say, Sebi will not shy away from taking required action if it finds any intermediary not adhering to its mandate,” he added.

He also listed the responsibilities of merchant bankers, such as protecting the interests of investors, conducting business with integrity, and making true and timely disclosures to investors so they are aware of the risks when making an investment decision.

Year of the IPO: The current fiscal has been a bumper year for IPOs in India. There have been 76 initial share sales as of November, raising a combined Rs 90,000 crore. The number of retail investors participating in IPOs has also skyrocketed. Retail investors have filed 5.43 crore IPO applications so far this fiscal against 3.8 crore in all of FY21.

More tightening: Tyagi’s comments come just over a month after Sebi proposed to limit the money raised from IPOs that startups can use for mergers and acquisitions (M&As), unless takeover targets are explicitly identified beforehand.

“It is proposed to prescribe a combined limit of up to 35% of the fresh issue size for deployment on such objects of inorganic growth initiatives and GCP (general corporate purpose), where the intended acquisition/strategic investment is unidentified in the objects of the offer,” Sebi said.

Tweet of the day

Swiggy in talks to invest in bike-taxi startup Rapido

Swiggy is in the final stages of talks to invest in Rapido, a bike-taxi startup based in Bengaluru, two sources told us. The potential investment from the food delivery firm is part of a larger $150-200 million funding round that Rapido is in talks to raise.

Significance: If the deal goes through, it will be Swiggy’s first bet in the mobility sector. It will enhance the company’s last-mile delivery capabilities and boost its quick commerce ambitions.

Zomato talks fell through: People aware of the development told us that Rapido was also in talks with Zomato, but those conversations fell through recently. Zomato has been on an investment spree since going public, having backed startups such as Blinkit (formerly Grofers), Shiprocket and Magicpin.

Possible synergies: “Fundamentally bike taxis and food delivery are highly complementary,” said Kunal Khatter, who heads a VC firm Advantedge and is an investor in Rapido. “As much as 80% of deliveries happen during lunch and dinner time. There is idle capacity during mornings and evenings. Bike-taxis are the opposite (busy during rush hours and relatively free during mealtimes).”

For now, though, Swiggy’s investment is a purely financial one, multiple sources told us.

Swiggy has been aggressively foraying into new categories in recent months. We have been reporting on the meteoric rise of India’s so-called quick commerce firms, led by the likes of Swiggy’s Instamart, Zepto and Blinkit, which promised deliveries in 10-20 minutes.

Swiggy’s war chest: We had reported on September 28 that Swiggy was in talks to bring on board US asset manager Invesco in what was likely to be a pre-IPO round, making the company a decacorn (worth more than $10 billion). Srisharsha Majety, Swiggy’s cofounder and CEO, told us recently that $700 million of the new funds would be used to grow for Instamart.

Epiq Capital makes first close of its second fund

Mumbai-based investment fund Epiq Capital has made the first close of $100 million for its second fund, with limited partners (LPs) such as Bollywood star Aamir Khan, cricketer Virat Kohli and entrepreneurs such as Curefit founder Mukesh Bansal joining in as sponsors, sources told us.

The fund has also increased its total size to $200 million from the $150 million that it was looking to mop up initially, which ET reported on October 5.

The decision to increase the fund size comes as domestic sponsors (LPs) are increasingly eyeing the thriving technology startup space in a record year of fundraising and IPOs for the sector.

Quote: “The fund made a first close of $100 million earlier in the month and is on track to raise the full $200 million by the next quarter…,” said a person close to the matter.

Through its first fund of $100 million, launched five years ago, Epiq invested in companies such as eyewear e-tailer Lenskart, news aggregation platform Dailyhunt, and health and fitness startup Curefit, among others.

From its second fund, it has participated in financing rounds of portfolio firms such as Park+, an app for car users, edtech startup Teachmint, and Pristyn Care, a health-tech company, all of which have raised capital recently.

Karnataka High Court reserves orders in online gaming case

The Karnataka High Court on Wednesday reserved orders after concluding hearings on petitions challenging the legal validity of the state’s new law banning online games of chance.

Senior advocate Mukul Rohatgi and others appeared for the petitioners, while Advocate General Prabhulinga Navadgi appeared for the state government.

Navadgi said that Karnataka’s legislation banning online gaming of chance, which treats these games a menace, is the only one of its kind in the country and could not be compared with similar legislation in other states. Therefore, they cannot draw references from judgements of other high courts in this case, he said.

On October 4, the Karnataka government notified the law banning online “games of chance”. Later that month the Annapoorneshwari Nagar Police in Bengaluru registered an FIR against fantasy gaming platform Dream 11 based on a complaint from a city resident who said the company was violating the new state law. After the two founders filed a petition, the court directed the police not to take coercive action against them, including arrest. This protection is still in force.

H-1B visa approvals surge to 97% in fiscal 2021

The H-1B visa approval rate for fiscal 2021 was the highest in a decade. Owing to Covid-19 restrictions, the US immigration agency had to conduct a second visa lottery to meet its quota of 85,000 visas for the year.

Details: The approval rate for H-1B visas in fiscal 2021 — from October 2020 to September this year — was 97.3%, according to data released by the US Citizenship and Immigration Services (USCIS). The agency received 398,267 petitions for initial and continuing employment, or renewals, during the period.

Why now? Immigration watchers attributed this to the high demand for tech talent in the US, as demand for digital transformation swept across sectors.

The high approval rate also reflects a shift in the approach of the US administration towards immigration under President Joe Biden.

Quote: “Biden’s fair and liberal approach towards immigration is unlike the Trump administration, which was highly restrictive in granting immigration benefits to immigrants. Under the prior administration, USCIS officers were directed to take very conservative views in approving H-1B applications. There were several instances previously wherein genuine and bona fide applications were denied in H-1B matters,” said Naresh Gehi, founder of Gehi & Associates, a US-based immigration law firm.

Other Top Stories By Our Reporters

Salesforce launches startup programme in India: Customer relationship management firm Salesforce said that it has launched the Salesforce Startup Programme in India in order to work with startups and help them scale their ventures.

AngelList announces launch of roll up vehicles for Indian startup founders: AngelList, a platform that connects angel investors with startups, said on Wednesday in a blog post on Medium that it has launched roll up vehicles (RUVs) for India.

Advent International acquires Encora Digital from Warburg Pincus: Advent International, the leading global private equity firm, has acquired a majority stake in Encora, a global digital engineering services company specialising in software product development services, according to a press statement.

Global Picks We Are Reading