Also in this letter:

- Demand for IT services will trump challenges in Q3

- Raise threshold to apply for payments bank licence: Nasscom

- Good Glamm plans marketing, analytics platform for creators

Amazon’s marketplace unit clocks 49% revenue growth in FY21

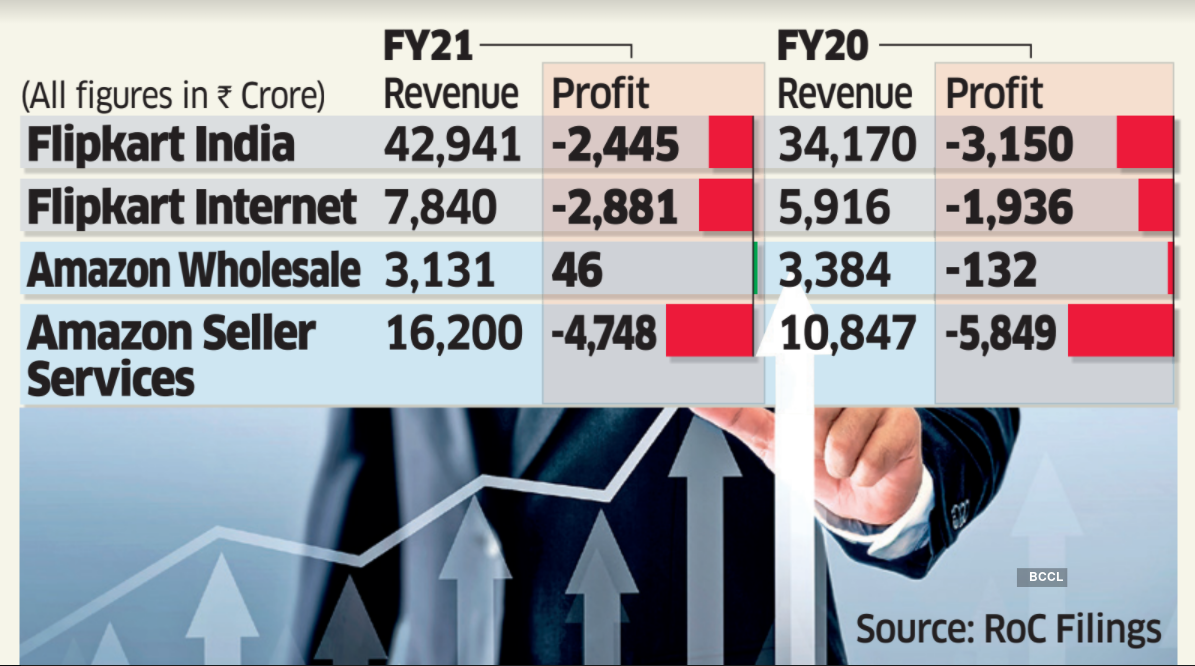

Amazon Seller Services, which runs the Amazon India marketplace, reported revenue from operations of Rs 16,200 crore in FY21, up 49% from Rs 10,847.6 crore in FY20. Losses stood at Rs 4,748 crore, down from Rs 5,849 crore in FY20. The numbers were sourced through business intelligence platform Tofler.

- Revenue from operations includes income generated through the company’s core business of selling goods and services. Total revenue also includes components such as interest income from fixed deposits and other investments.

Amazon Wholesale (India), another key unit of the US company’s local operations, reported revenue from operations of Rs 3,131 crore, down around 7% from Rs 3,384 crore in FY20— which itself was 70% lower than in FY19. It posted a net profit of Rs 46 crore in FY21 compared with a net loss of almost Rs 132 crore in FY20.

Scaling back: Amazon Wholesale has been scaling back its operations as the government has been tightening FDI rules for ecommerce companies owned by foreign firms.

The US ecommerce giant has spent well over $7 billion in India in its battle against Flipkart and others. It is embroiled in a legal battle with Future Group over a deal with Reliance Industries (RIL) and is also making significant operational changes here.

We reported last month that the company was seeking regulatory approval to acquire Catamaran Ventures’ stake in Prione Business Services, which houses Cloudtail, one of the largest sellers on its platform.

Next up, Flipkart: Flipkart India, which houses the group’s wholesale business, and Flipkart Internet, the marketplace arm, reported revenue growth of 25% and 32%, respectively, in FY21, filings sourced from Tofler showed.

Flipkart Internet clocked an operational revenue of Rs 7,840 crore for the period under review but its losses increased by 49% to Rs 2,881 crore.

Structure: Flipkart’s parent company is registered in Singapore and it operates in India through a number of units. Its core online retail business is under Flipkart Internet, and Flipkart India is the wholesale unit, which is largely involved in buying and selling goods in bulk to and from suppliers and sellers.

Flipkart Internet generates revenue through marketplace fees, which is a combination of fees it charges from sellers for providing its platform, payment gateway services, shipping, and other services. It also has other units for payments and logistics.

IT services Q3 preview: demand will trump seasonal challenges

Indian IT services leaders are expected to report strong numbers in the seasonally weak third quarter that ended December 31 due to high demand from clients.

Analysts said that Tata Consultancy Services is expected to generate traction from major deal wins in the quarter, while Infosys is expected to upgrade its guidance for the fiscal year. HCL Technologies is expected to demonstrate gains from its products business during the October-December period.

The strong outlook would be on the back of digital transformation and cloud initiatives during the quarter, said analysts.

The fact that three IT services leaders are announcing their quarterly results on January 12 is also an indicator of their confident performance in the quarter. Tier II companies are expected to outperform Tier I IT majors, they added.

“Despite companies highlighting the normal impact of furloughs, Tier I IT revenue growth should be strong, with Infosys leading revenue growth at about 4.8% QoQ (quarter on quarter) constant currency rate,” brokerage Motilal Oswal said in a note. “HCL Technologies will benefit from P&P (products and platforms) seasonality growing about 4.5% QoQ (CC), followed by Tech Mahindra, Wipro and TCS.”

- Tier I providers are expected to deliver profit growth of around 11% year on year (YoY) and 6% QoQ, according to the brokerage.

- TCS and Infosys are expected to report a profit growth of 17% and 13% YoY, respectively.

- HCL Technologies is expected to report a slight decline in profit, while Wipro is expected to report flat growth, it said.

Increase threshold to apply for payments bank licence to Rs 100 crore: Nasscom

Representatives from the technology industry have told Niti Aayog that the threshold to apply for a payments bank licence should be increased to Rs 100 crore from the Rs 20 crore as recommended by the government’s policy think tank.

Why? This should be done to deter casual or trivial applications and give consumers “an assurance that their deposits stay safe”, IT industry body Nasscom said in its feedback on a discussion paper for digital banks. The discussion paper, released in November, offered a roadmap for digital banking in India.

The Rs 100 crore entry barrier will also demonstrate that the company has the capacity to make necessary investments in technology, infrastructure, governance, and compliance, it said.

No new category: Nasscom also said that instead of creating a new licence category, any bank should be allowed to become a digital bank.

“The goal should be to set out standards that apply across the board, instead of creating a differentiated regime for just “digital banks”. After all, in the future, we envisage every bank going digital…,” Nasscom said.

It also said the RBI could revise and update existing regulations that are no longer relevant considering new digital technologies and their applications.

Tweet of the day

Good Glamm plans marketing and analytics platform for creators

The Good Glamm Group is setting up a new influencer marketing and data analytics venture called Good Creator Co and will invest Rs 200 crore in it for starters, company executives told us.

- The group has also acquired influencer and data analytics platforms Winkl and content and creator analytics company Vidooly.

“Good Creator Co will consolidate operations of its existing platforms MissMalini and Plixxo along with Winkl and Vidooly, to create what is India’s largest creator ecosystem,” cofounder Priyanka Gill said.

The four platforms are being spun off together under the umbrella of Good Creator Co, with a combined existing base of more than 250,000 influencers and reach more than 70 million users every month. Celebrity and influencers talent management and creative agency MissMalini will work together under the banner of Good Creator Co, said the executives.

Each of these four platforms works in the sphere of influencer management, marketing and analytics.

The funding will be infused to build technology platforms, and acquire and invest in complementary influencer companies and technology solutions. Good Creator Co will function independently and will look to raise further rounds of capital from external investors.

ETtech Done Deals

■ India’s largest lender, the State Bank of India, has invested $20 million in Pine Labs, the fintech startup said Tuesday without sharing any further details of the deal.

■ NewQuest Capital Partners, along with the existing investor PremjiInvest, has invested Rs 507 crore in iD Fresh Food—India’s leading fresh food startup.

■ Geniemode, a business-to-business cross-border e-commerce startup, has picked up $7 million in a Series A funding round led by Info Edge Ventures.

Theranos verdict: Key moments from the Elizabeth Holmes trial

Theranos founder Elizabeth Holmes

A jury in the US has found Theranos founder Elizabeth Holmes guilty of defrauding investors in the blood testing startup, convicting her on four of 11 counts.

Prosecutors said Holmes, 37, swindled private investors between 2010 and 2015 by convincing them that Theranos’ small machines could run a range of tests on just a single drop of blood from a finger prick.

She was convicted of investor fraud and conspiracy, but acquitted on three counts of defrauding patients who paid for tests from Theranos, and a related conspiracy charge. Holmes rose to fame after founding Theranos in 2003 at the age of 19. She attracted both high-profile wealthy investors and board members including media mogul Rupert Murdoch.

Here are the key moments from her trial.

Former Secretary of Defense testifies: Arguably the most high-profile person to take the stand, other than Holmes, was James Mattis, a retired four-star general who served as Secretary of Defense under Donald Trump and sat on Theranos’ board from 2013 to 2016. The prosecution said bringing highly credible people such as Mattis on board was one of the ways in which Holmes used “borrowed credibility” to perpetuate the fraud.

Mattis said he was interested in the device’s possible military applications because he thought it could perform the range of blood tests the company claimed it could. “I would not have been interested in it were it not,” he said.

Holmes takes the stand: One of the biggest questions around the trial was whether Holmes would take the stand in her own defence. In the end, she testified for nearly 24 hours over seven court days.

While Holmes was largely calm, even smiling at times, she became emotional at several points while talking about her ex-boyfriend Ramesh ‘Sunny’ Balwani, Theranos’ former president and COO. Balwani, who faces the same charges as Holmes and has pleaded not guilty, is set to be tried soon.

Click here for the full report.

Also Read:Elizabeth Holmes and the story of Theranos

Other Top Stories By Our Reporters

Global social commerce market to hit $1.2 trillion by 2025: India’s social commerce market will grow the fastest over this period, the Accenture report stated. The trend is being driven primarily by Gen Z and Millennial consumers, who are expected to account for 62% of the spending. (read more)

UPI transactions scale new peak in December 2021: The volume and value of monthly UPI transactions nearly doubled from January to December 2021. NPCI now expects the platform to hit 100 crore transactions per day after RBI enables UPI wallets for low-value offline transactions. (read more)

Ninjacart conducts Rs 100-crore ESOP buyback: The announcement comes days after Flipkart and Walmart invested $145 million in the company. Flipkart recently effected its own ESOP buyback worth Rs 17,000 crore—the biggest in India’s startup ecosystem. (read more)

Global Picks We Are Reading

■ The epic rise and fall of Elizabeth Holmes (NYT)

■ Private equity backs record volume of US tech deals (WSJ)

■ Google Fiber staff seek union vote, direct negotiations with Alphabet (Bloomberg)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai.