Credit: Giphy

Also in this letter:

■ Indian SaaS market hit $50-70B by 2030: report

■ Reliance arm, Sanmina team up to make electronics

■ SoftBank raises $870 million using Z Holding shares

Amazon, Future lawyers agree to talks for out-of-court settlement

Lawyers for Amazon and Future Group on Thursday agreed to initiate talks to reach an out-of-court settlement of the 18-month-old dispute, sparked by Future Group’s plan to sell its assets to Reliance Retail.

Driving the news: Amazon’s lawyer Gopal Subramanian set the conciliatory tone in the Supreme Court on Thursday morning. “We have always been willing to have a dialogue, a conversation. Let us put our heads together and find a solution,” he said.

Harish Salve, appearing for the Future Group, said in response, “Now if he has seen the light of the day and he wants to have a conversation. What prevents the big boss from Amazon calling up Mr. (Kishore) Biyani?”

What’s next? The Supreme Court said it would hear the matter again on March 15, and told the three parties— Amazon, Future Retail and its promoter Future Coupons— to thrash out a settlement.

“We will simply adjourn the matter for 10 days. Meanwhile, work out a gentlemen’s understanding,” Chief Justice N V Ramana said.

The court also said that related proceedings in the Delhi High Court and the National Company Law Appellate Tribunal (NCLAT) could go on as scheduled.

Thaw, at last: This is the first time the two parties have agreed on a conciliatory approach since October 2020, when the Singapore International Arbitration Centre (SIAC) halted the Rs 25,000-crore sale of Future Group’s assets to Reliance Retail in an emergency order.

Amazon alleges that the proposed sale violated its own 2019 agreement with FRL that barred it from selling its businesses without Amazon’s consent.

Indian SaaS market to grow 20x to $50-70 billion by 2030: report

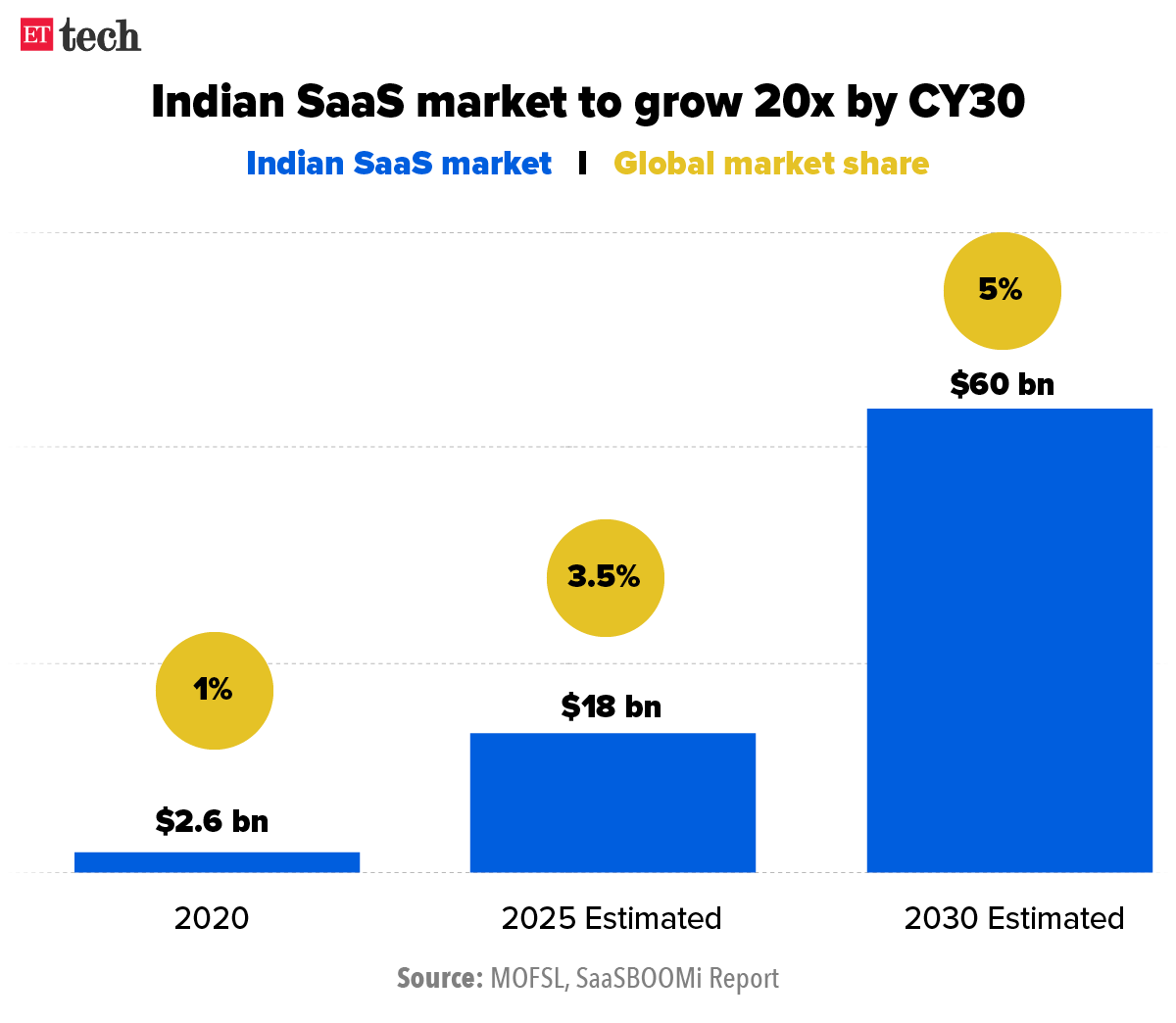

The Indian software-as-a-service (SaaS) ecosystem is expected to grow rapidly and increase its share of global SaaS to 4-5% (from about 1% at present), translating to a $50-70 billion revenue opportunity by calendar year 2030, according to a Motilal Oswal report.

The findings: India has the third-largest SaaS ecosystem globally, after the US and China, the report said.

- Within the SaaS space, it said, Indian companies are now distinguishing themselves, with a long list of firms joining the unicorn club.

- While the majority of companies focus on horizontal business software, vertical solutions and innovative Infra SaaS plays are also scaling out of India.

The report also highlighted that “there is a potential for Indian SaaS companies to scale up and be larger than Indian IT behemoths as their aspirations are to win against global software majors like SAP”.

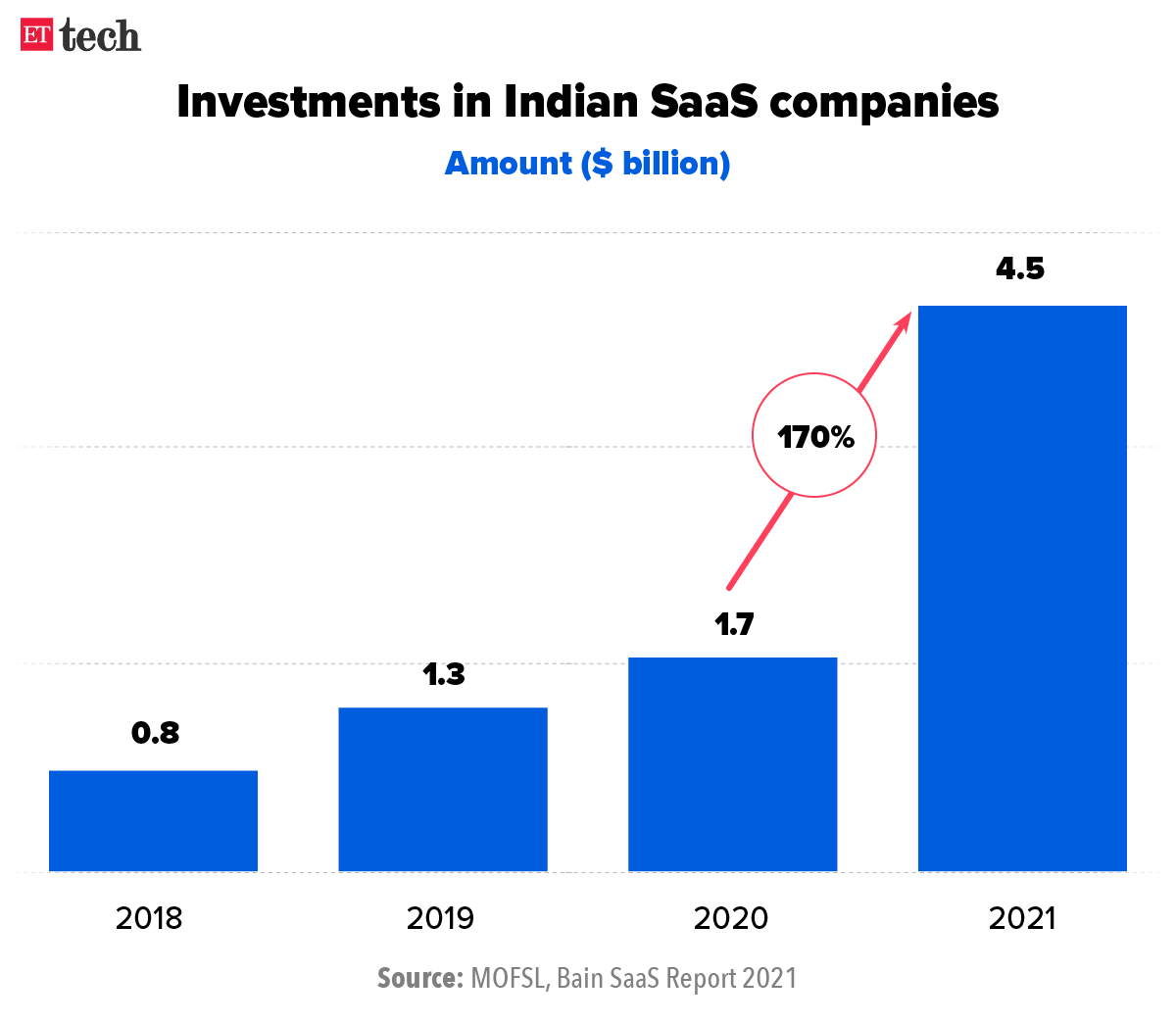

It said investments in the space shot up to $4.5 billion in 2021, a 170% increase over 2020.

Quote: “SaaS has emerged as one of the biggest disruptors in the global technology industry over the last two decades. It continues to accelerate further as the world rapidly shifts to a cloud-based environment. The Covid-19 outbreak exacerbated the push to SaaS, which offers greater flexibility, functionality, and better remote productivity,” the report said.

Reliance arm teams up with Sanmina to manufacture electronics

Reliance Strategic Business Ventures (RSBV) and Sanmina Corp, an integrated manufacturing solutions company, have entered into a joint venture (JV) for electronics manufacturing. RSBV is a wholly-owned arm of Reliance Industries.

Details: The JV has been formed through an investment in Sanmina’s Indian entity, Sanmina SCI India Pvt Ltd.

“The joint venture will create a world-class electronic manufacturing hub in India, in line with the Prime Minister’s `Make in India’ vision,” the companies said in a joint statement Thursday.

RSBVL will hold a 50.1% stake in the JV entity with Sanmina owning the remaining 49.9%. RSBVL will achieve this ownership primarily through an investment of upto Rs 1,670 crore in new shares in Sanmina’s existing Indian entity, while Sanmina will contribute its existing contract manufacturing business.

As a result of the investment, the joint venture will have more than $200 million in cash to fund growth.

SoftBank Corp raises $870 million using Z Holding shares

SoftBank Corp. has borrowed about 100 billion yen ($870 million) using Z Holdings Corp.’s shares in its first such asset-backed financing to raise funds for its business.

Tell me more: SoftBank is using about 361,440,000 shares, or 4.8%, of Z Holdings that it indirectly owns through A Holdings Corp. for stock lending, according to company spokesperson Makiko Ariyama. It received cash by lending out the Z Holdings shares, she said.

Broader strategy: The stock lending is a part of SoftBank Corp.’s attempt at diversifying its finances. Its parent, SoftBank Group Corp., has been active in tapping complex financing tools to raise funds to expand its investment portfolio of technology startups.

Other Done Deals

■ Audio streaming platform Pocket FM has raised $65 million in a funding round led by Goodwater Capital, Naver, and existing investor Tanglin Venture Partners. The company plans to use the fresh funds to strengthen its leadership position, expand into new languages, invest in AI capabilities and build a large audio creator community.

■ Instant live tutoring startup Filo has raised $23 million in a funding round led by Anthos Capital.The edtech startup plans to use the fresh capital for product development, expanding the team, tapping new categories, and scaling its tutor base across the country.

Ukraine to seek action against Russia from 50 more tech firms

Ukraine plans to urge about 50 additional tech companies, including those in gaming, esports and internet infrastructure, to take action against Russia after a slew of earlier requests, a top Ukrainian government tech official said.

Software giant Oracle Corp responded within three hours on Wednesday to a tweet from Ukraine’s Ministry of Digital Transformation calling on it to stop doing business in Russia amid the country’s invasion of Ukraine.

Call for help: Ukraine has already sought support from about 50 companies since Russia’s invasion began last week, Bornyakov said.

The outreach, which has included tweets from Vice Prime Minister Mykhailo Fedorov calling on Silicon Valley CEOs to take action, has helped bring Ukraine Starlink internet satellites from entrepreneur Elon Musk’s SpaceX and new restrictions on Russian state media by YouTube and other social media services.

Spotify closes Russia office: Spotify said it has closed its office in Russia indefinitely in response to what the audio streaming platform described as Moscow’s “unprovoked attack on Ukraine.”

It also said it has reviewed thousands of pieces of content since the start of the war, and restricted the discoverability of shows owned and operated by Russian state-affiliated media.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.